I recently spoke at the American Association of Political Consultants annual conference in Puerto Rico (h/t Keith Norman @ Premion). The topic of my talk was the political video advertising market heading into the midterm elections of 2022.

Below is a summary of a few key points. The PDF presentation is available for a deeper dive.

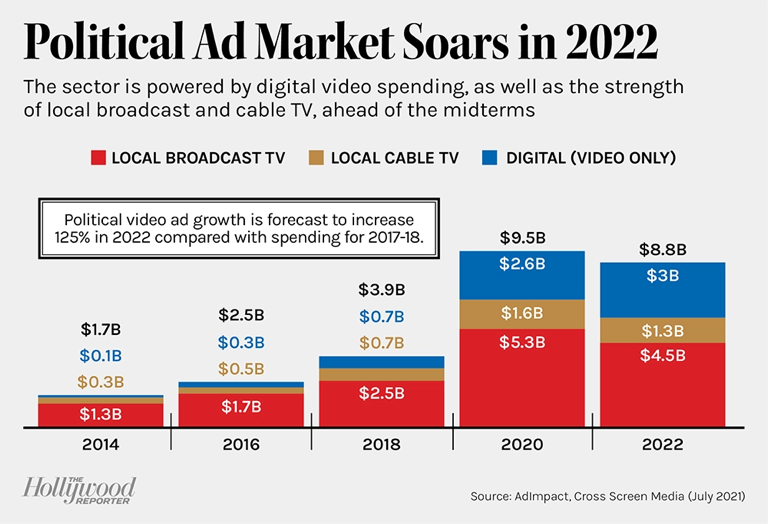

Big question #1: How large is the political video ad market expected to be in 2022?

Quick answer: $8.8B

Big question #2: How does 2022 compare to past election cycles?

Key details for political video ad spending according to AdImpact/Cross Screen Media:

1) 2022 vs. 2018 – ↑ $4.8B (↑ 125%)

2) 2022 vs. 2020 – ↓ $697M (↓ 7%)

3) ≈ 5% of the entire U.S. video ad market

4) ≈ 20% of all video ad growth is from politics

Flashback #1: Breaking Down the $9B Political Video Ad Market

Flashback #2: 55 Billion Reasons to Care About Local Video Ads

Midterm cycle political video ad spending (% growth)

1) 2014 – $1.7B

2) 2018 – $3.9B (↑ 142%)

3) 2022P – $8.8B (↑ 125%)

Presidential cycle political video ad spending (% growth):

1) 2016 – $2.5B

2) 2020 – $9.5B (↑ 283%)

Worth your time: Midterm Moolah: TV Stations Cash in on Primary Season

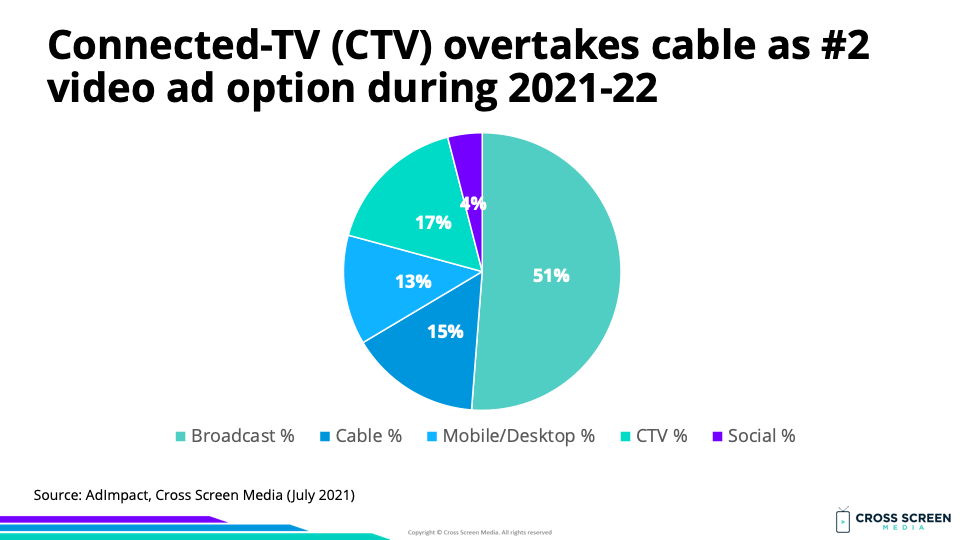

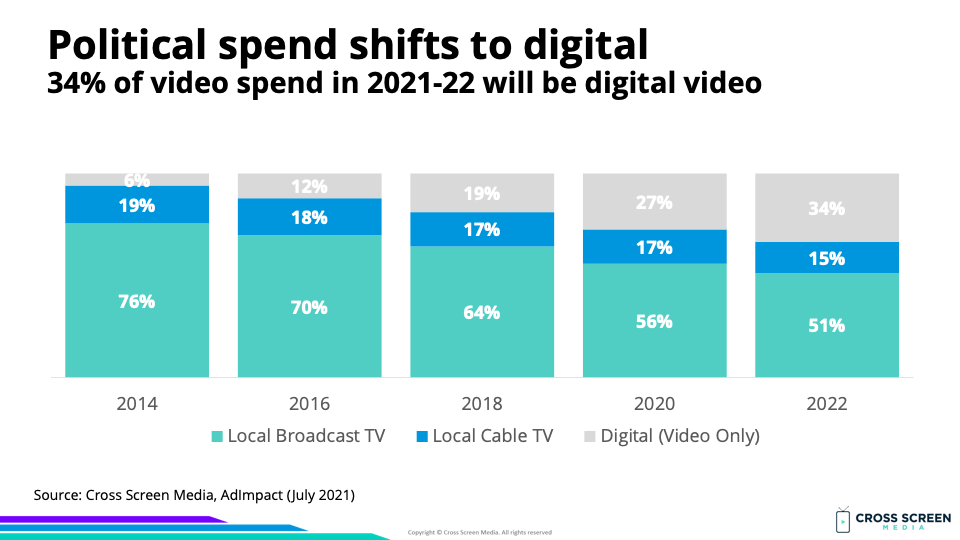

Big question #3: What is the breakdown between screen types across linear and digital video?

Share of political video ad spend by screen type:

1) Local broadcast TV – 51%

2) Connected TV (CTV) – 17%

3) Local cable TV – 15%

4) Mobile/desktop – 13%

5) Social video – 4%

Digital share (including CTV) of political video ad spend:

1) 2014 – 6%

2) 2016 – 12%

3) 2018 – 19%

4) 2020 – 27%

5) 2022P – 34%

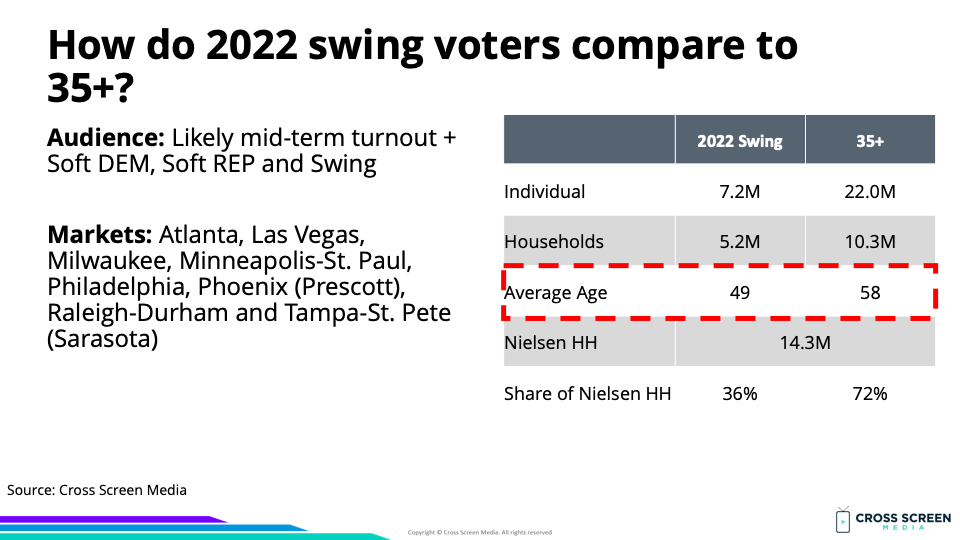

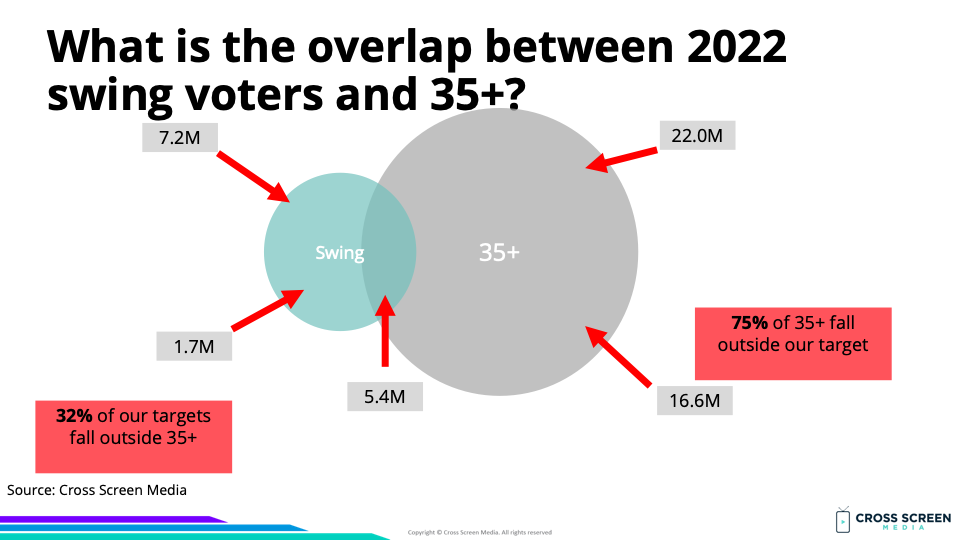

Big question #4: Why is reaching swing voters with video so hard?

Challenge #1: The actual audience (swing voters) consumes video content differently than our primary demo (35+).

Average age of audience:

1) 2022 swing voter – 49

2) Average adult – 51

3) 35+ demo – 58

Why this matters: Most TV advertising in politics is still planned/measured against a 35+ demo.

Challenge #2: Using a traditional demo for planning/measurement leads us to miss 32% of our target audience, while 75% of the demo is not our target.

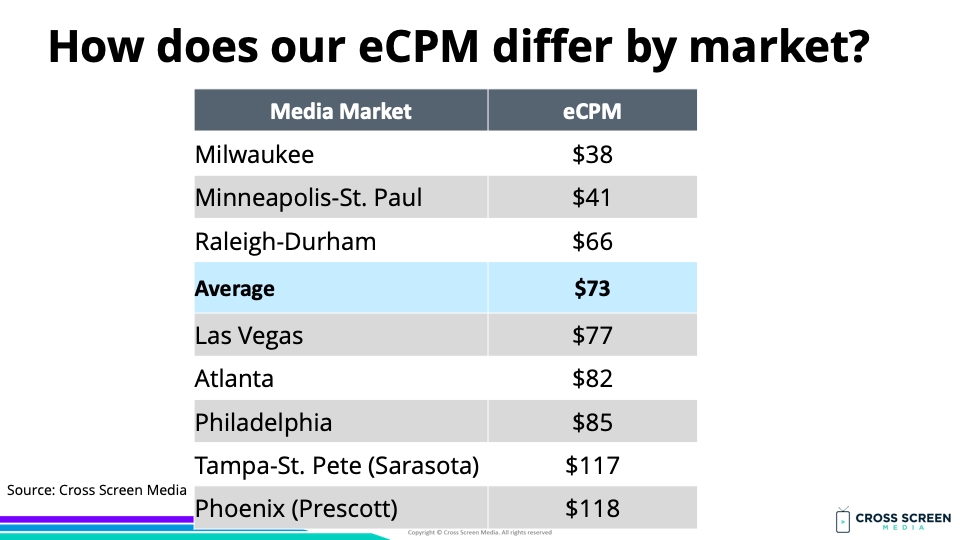

Challenge #3: Local video ad pricing and media consumption are different by market, leading to variance in eCPMs for the same audience.

Big question #5: What is the solution?

Quick answer: Planning, activation, and measurement against audiences at the local level. Each market should have a unique/allocation and plan.

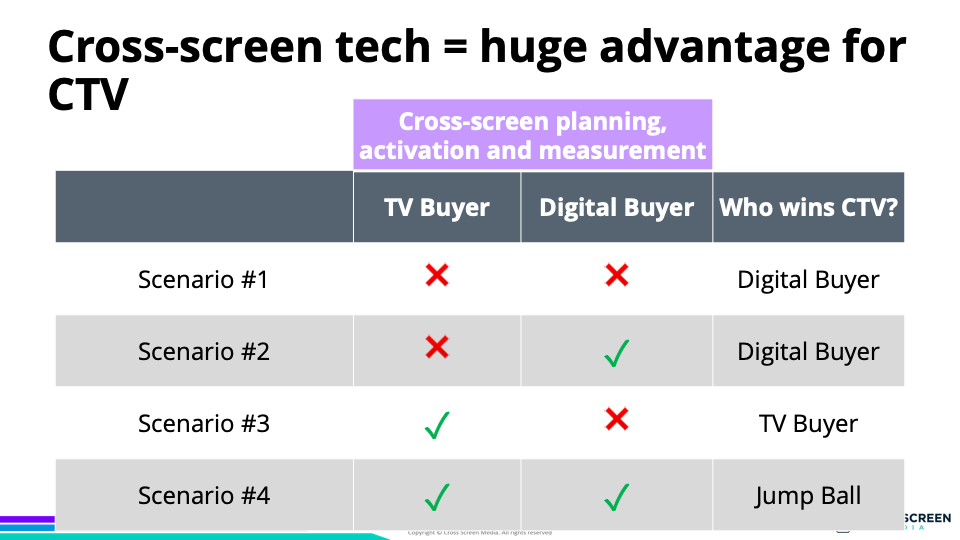

Big question #6: Who will win the battle for CTV dollars?

Quick answer: In the fight for CTV ad dollars, the group which adopts cross-screen planning, activation, and measurement will have an advantage.

.png?width=1120&upscale=true&name=9%20Billion%20Reasons%20to%20Care%20About%20Political%20Video%20Ads%20(1).png)