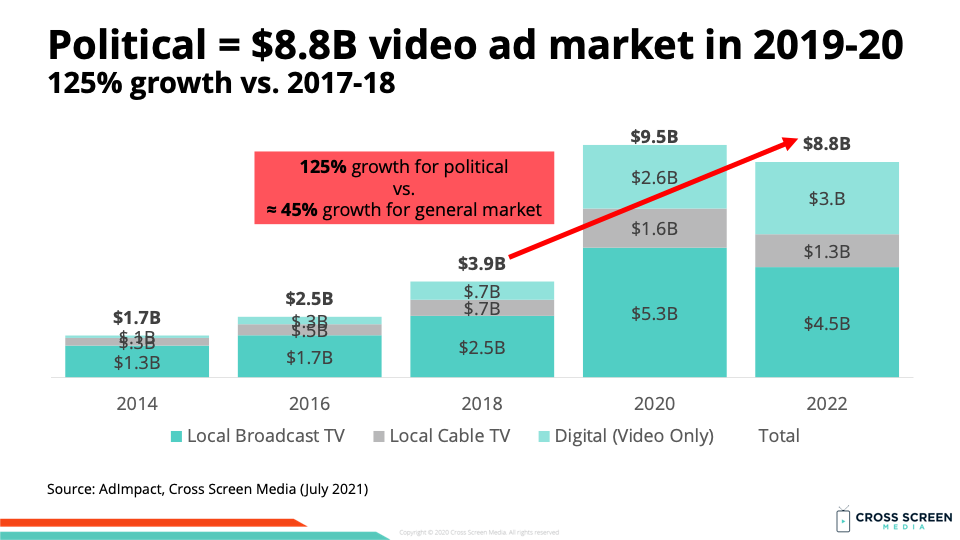

Big news #1: We project the political video ad market will reach $8.8B during the 2021-22 election cycle.

Key details for political video ad spending according to AdImpact/Cross Screen Media:

1) 2022 vs. 2018 – ↑ $4.8B (↑ 125%)

2) 2022 vs. 2020 – ↓ $697M (↓ 7%)

3) ≈ 6% of the entire U.S. video ad market

4) ≈ 18% of all video ad growth is from politics

Midterm cycle political video ad spending (% growth):

1) 2014 – $1.7B

2) 2018 – $3.9B (↑ 142%)

3) 2022P – $8.8B (↑ 125%)

Presidential cycle political video ad spending (% growth):

1) 2016 – $2.5B

2) 2020 – $9.5B (↑ 283%)

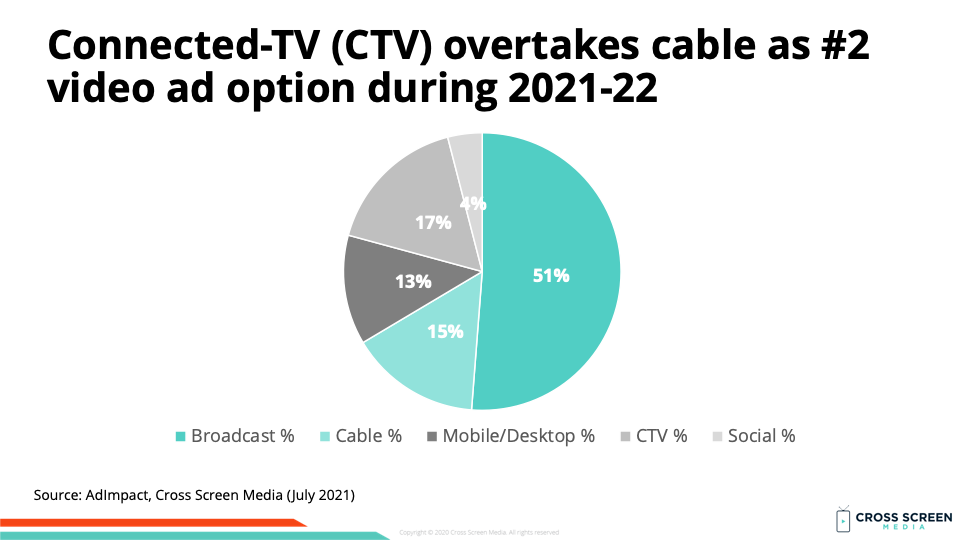

Big news #2: We are breaking out Connected-TV (CTV) for the first time in 2022.

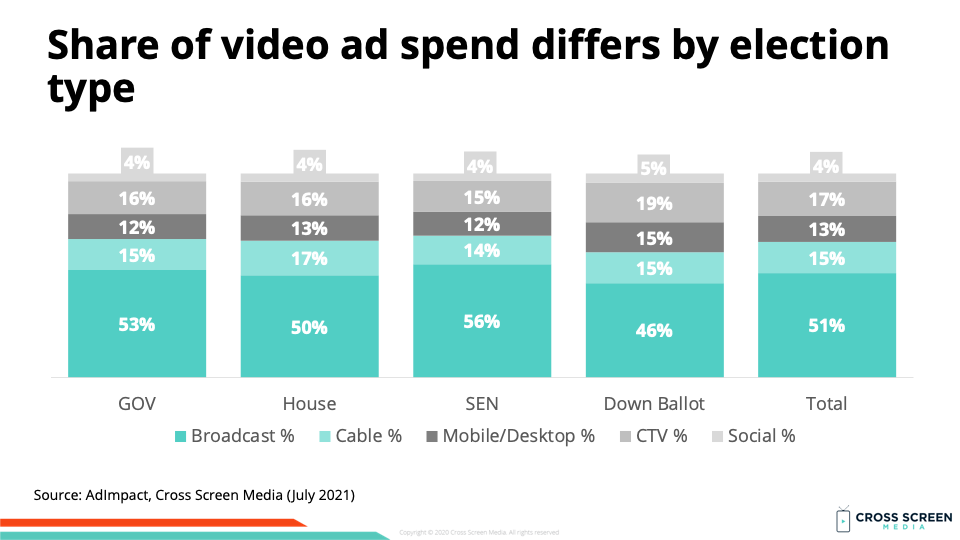

Share of political video ad spend by screen type:

1) Local broadcast TV – 51%

2) Connected-TV (CTV) – 17%

3) Local cable TV – 15%

4) Mobile/desktop – 13%

5) Social video – 4%

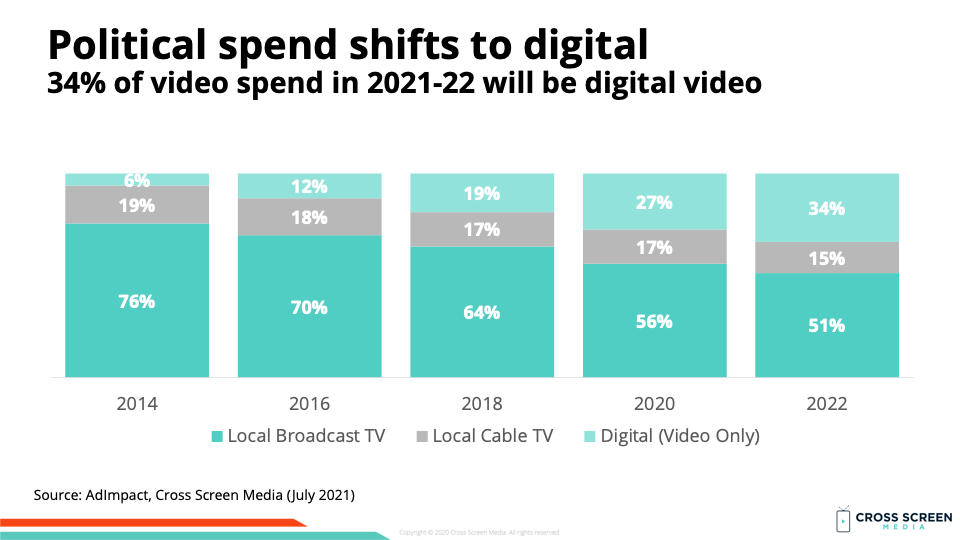

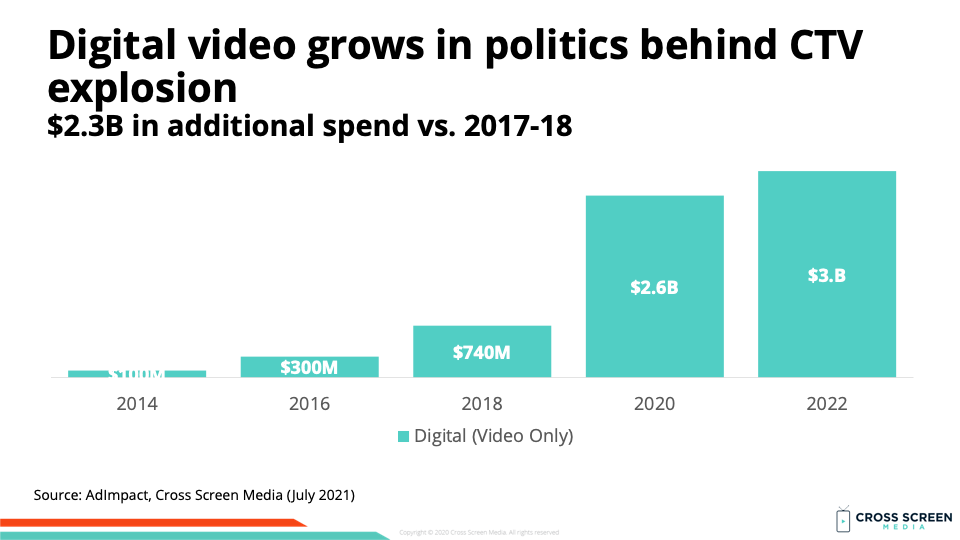

Digital share (including CTV) of political video ad spend:

1) 2014 – 6%

2) 2016 – 12%

3) 2018 – 19%

4) 2020 – 27%

5) 2022P – 34%

Why this matters: We predict CTV has now become the #2 screen type behind local broadcast TV.

Big question #1: Why are political buyers adopting CTV so rapidly?

Key reasons for political adoption of CTV:

1) Addressability and measurement

2) High impact creative

3) Unique reach from voters with little/no linear TV consumption

Wow: The political video ad market is growing (CAGR) at a rate of 23% compared to 10% for the general video ad market!

Big question #2: Does this share differ by election type?

Quick answer: Yes. U.S. Senate elections will spend the largest share of their video ad budget on linear TV (70%) while down ballot races will spend the lowest (61%).

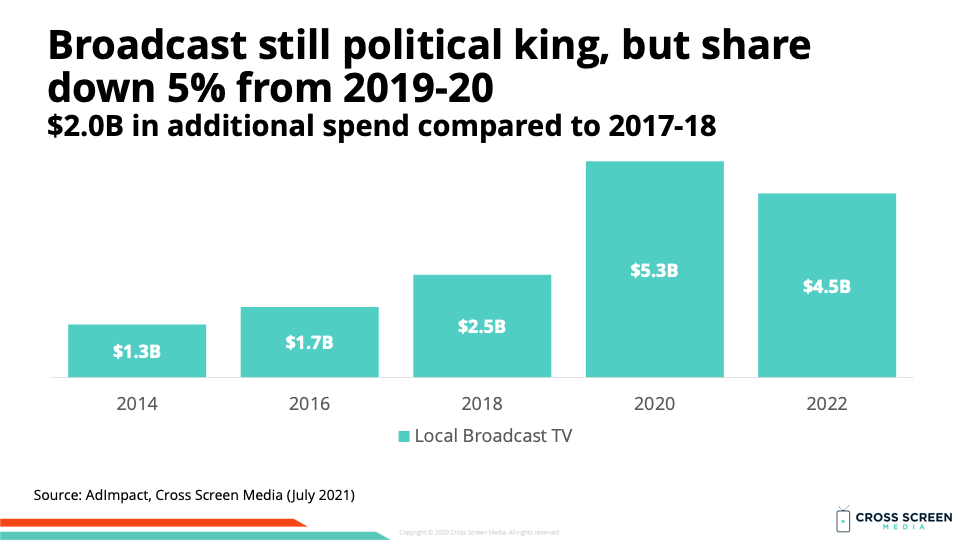

Local broadcast TV spend (% growth):

1) 2014 – $1.3B

2) 2016 – $1.7B (↑ 33%)

3) 2018 – $2.5B (↑ 46%)

4) 2020 – $5.3B (↑ 110%)

5) 2022P – $4.5B (↓ 15%)

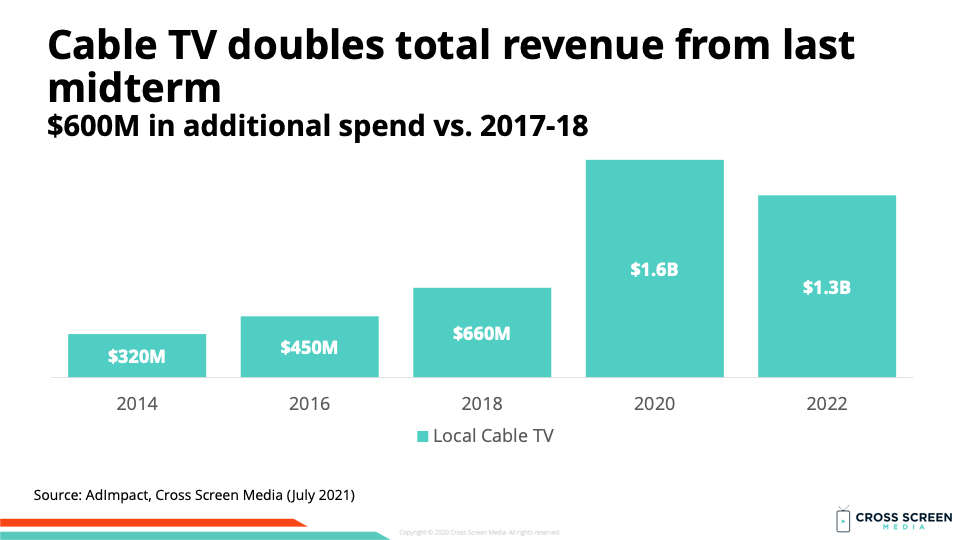

Local cable TV spend (% growth):

1) 2014 – $320M

2) 2016 – $450M (↑ 41%)

3) 2018 – $660M (↑ 47%)

4) 2020 – $1.6B (↑ 142%)

5) 2022P – $1.3B (↓ 16%)

Digital video (including CTV) spend (% growth):

1) 2014 – $100M

2) 2016 – $300M (↑ 200%)

3) 2018 – $740M (↑ 147%)

4) 2020 – $2.6B (↑ 251%)

5) 2022P – $3.0B (↑ 14%)

Big question #3: Do you want to sell more political ads in 2022? If yes, then download our FREE 12-page report, and let’s get started!