I was invited to speak at the Borrell 2022 conference in Miami in March. The conference was fantastic (as always), and it was a great honor to be a part of it.

Below is a summary of a few key points. Both the video and PDF presentation are available for a deeper dive.

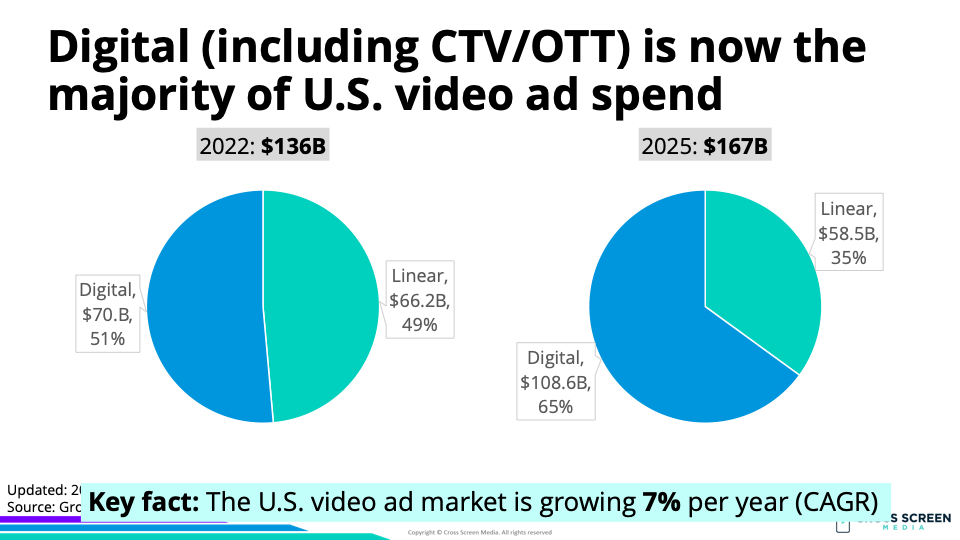

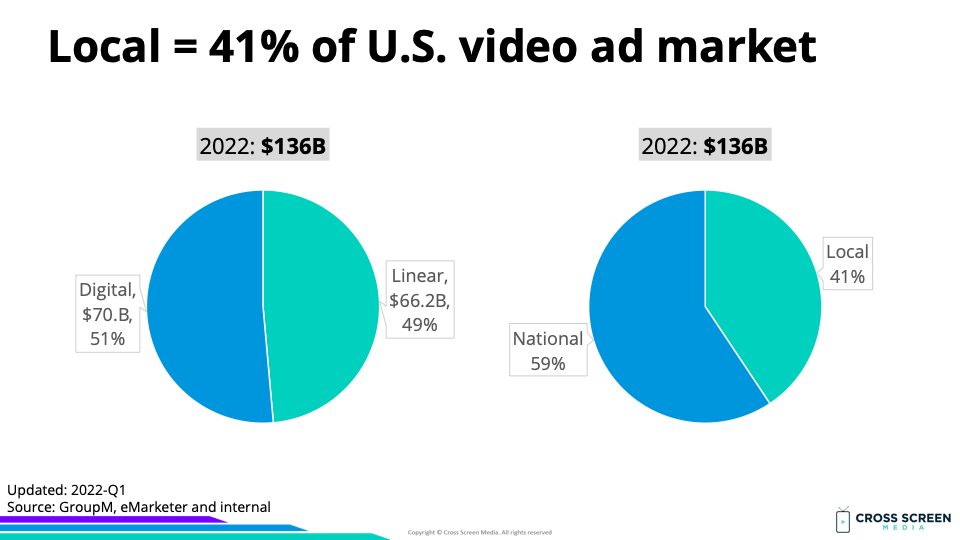

Big question #1: How large is the video ad market in the United States?

U.S. video ad market (% change):

1) 2022 – $136B

2) 2025 – $167B (↑ 23%)

Digital share of U.S video ad market:

1) 2022 – 51%

2) 2025 – 65%

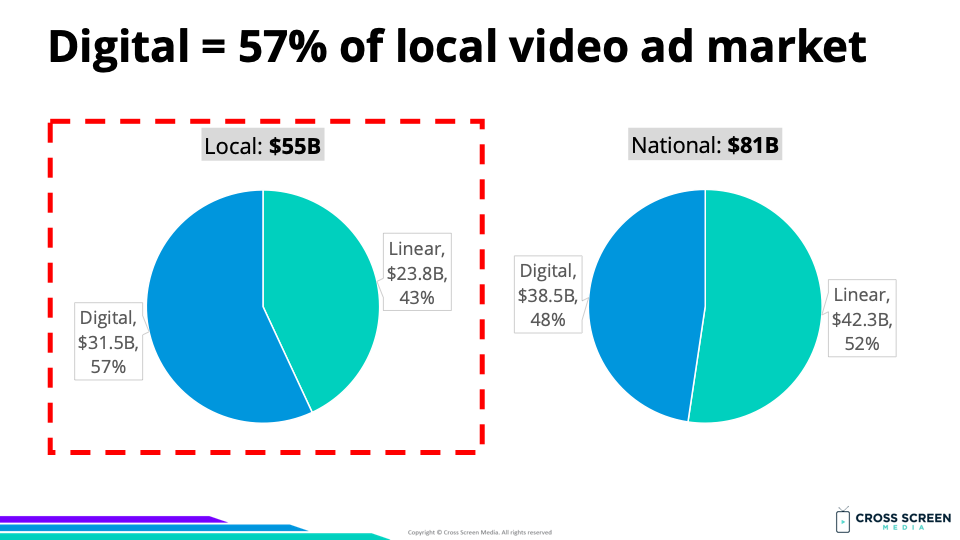

Big question #2: How large is the local video ad market in the United States?

U.S. video ad market (% of total) by geographic targeting:

1) National – $81B (59%)

2) Local – $55B (41%)

Why this matters: The local video ad market is larger ($55B) than most people understand. It is more fragmented than the national ad market, with 210 individual markets and 800X the number of advertisers.

Digital share of U.S. video ad market by geographic targeting:

1) Local – 57%

2) National – 48%

Why this matters: This makes sense when you consider how important digital’s ability to target by geography (zip codes, distance from a location, etc.) is to local advertisers and has little value to national advertisers.

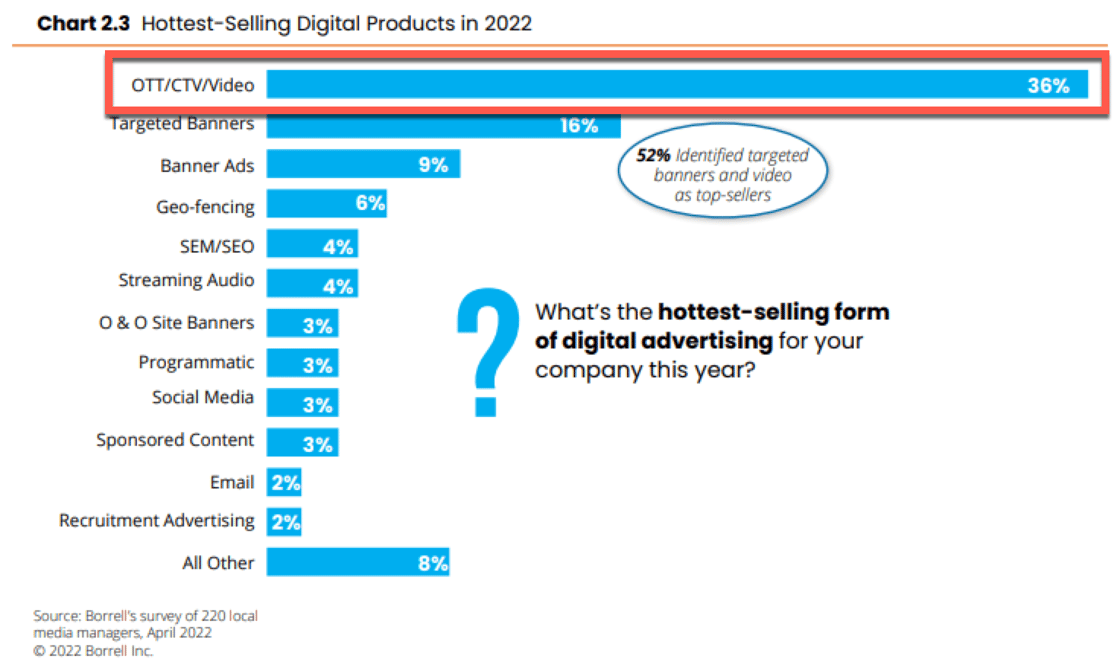

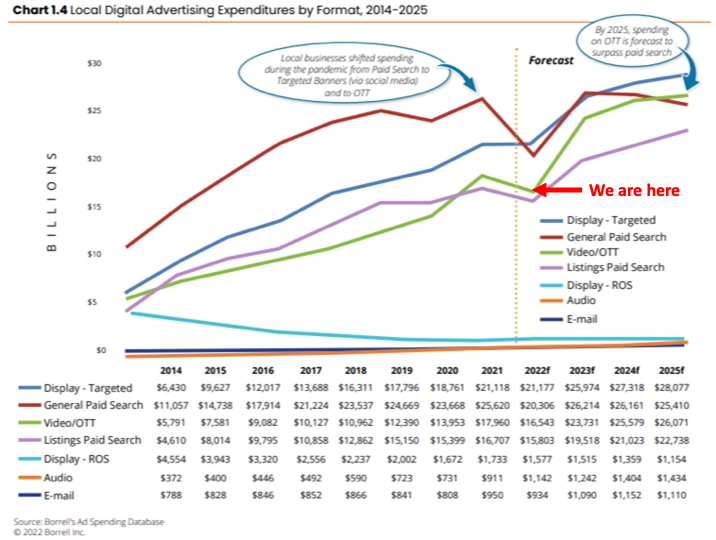

PSA #1: This lines up with data from Borrell that shows CTV/OTT as the most-in-demand digital product in 2022.

PSA #2: CTV/OTT is early in its growth curve with local advertisers.

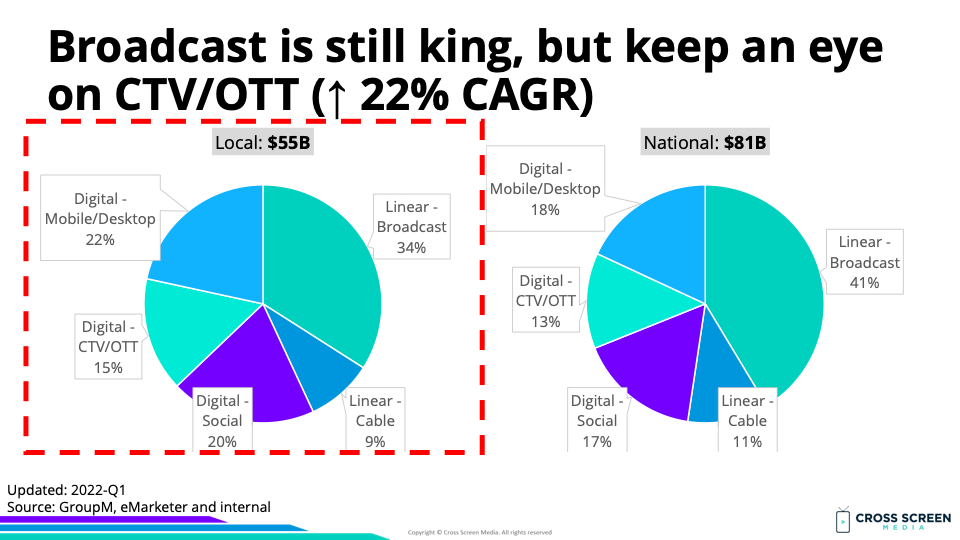

U.S. local video ad market (% of total) by screen type:

U.S. local video ad market (% of total) by screen type:

1) Broadcast – $19B (34%)

2) Mobile/Desktop – $12B (22%)

3) Social Video – $11B (20%)

4) CTV/OTT – $9B (15%)

5) Cable – $5B (9%)

6) Total – $55B

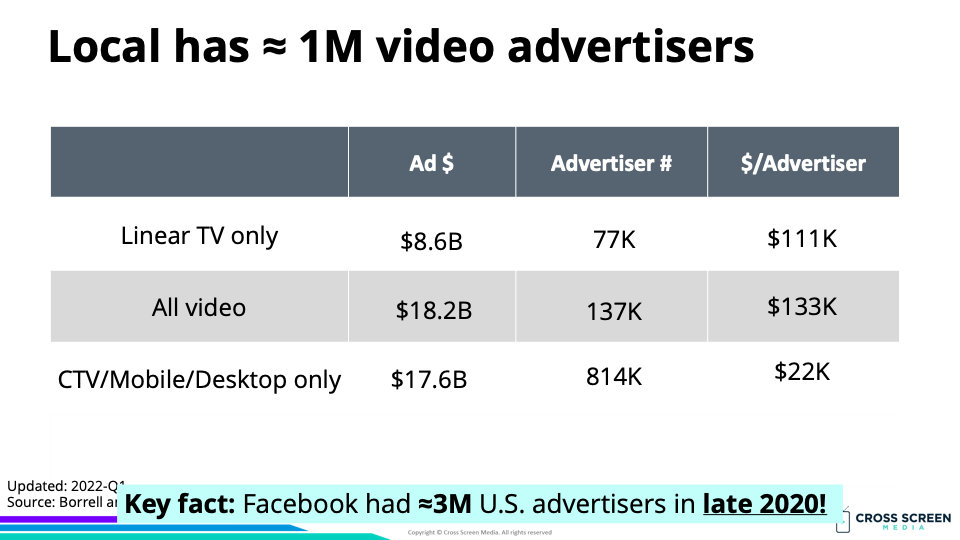

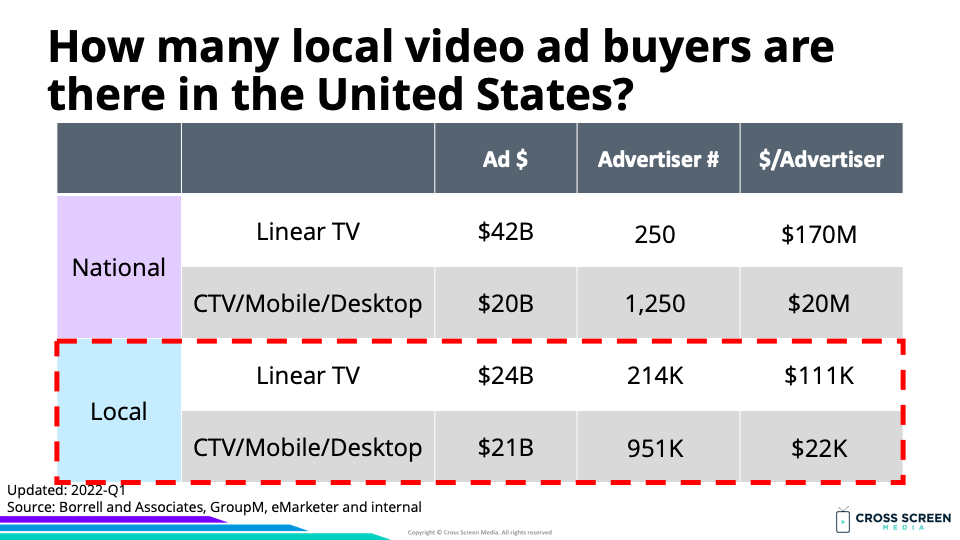

Big question #3: How many local video ad buyers are in the United States?

Estimated number of video ad buyers:

1) Local Digital – 951K

2) Local Linear – 214K

3) National Digital – 1.3K

4) National Linear – 250

Annual video ad spend per advertiser:

1) National Linear – $170M

2) National Digital – $20M

3) Local Linear – $111K

4) Local Digital – $22K

Why this matters #1: The local video ad market is the next battleground for convergent TV. Winning this space will require an offering built specifically for local advertisers. The same ad stack built for national advertisers with an annual video ad spend of $50M+ will not work for local advertisers spending $43K.

Why this matters #2: This is the exact problem we are solving at Cross Screen Media. Our vision is a single video ad platform allowing local advertisers to plan, activate and measure all forms of video advertising across every granular geography.

Estimated number of local video ad buyers (% of total):

1) Digital only – 814K (79%)

2) All video – 137K (13%)

3) Linear only – 77K (8%)

.png?width=1120&upscale=true&name=55%20Billion%20Reasons%20to%20Care%20About%20Local%20Video%20Ads%20(1).png)