Four big questions re: YouTube:

1) How much advertising revenue did YouTube generate last year?

2) Why did advertising revenue growth decelerate?

3) What share of total TV time does YouTube account for?

4) What share of total TV time does YouTube TV account for?

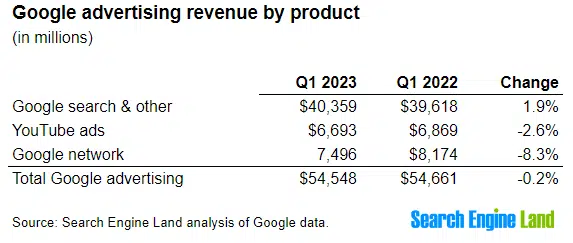

Big question #1: How much advertising revenue did YouTube generate last year?

YouTube advertising revenue (YoY growth):

1) 2019-Q1 – $3.0B

2) 2020-Q1 – $4.0B (↑ 33%)

3) 2021-Q1 – $6.0B (↑ 49%)

4) 2022-Q1 – $6.9B (↑ 14%)

5) 2023-Q1 – $6.7B (↓ 3%)

Big question #2: Why did advertising revenue growth decelerate?

Quick answer: Unclear. The overall economic environment impacts all networks, but YouTube is losing a greater budget share.

Interesting question: Why is ad revenue for YouTube declining while it is growing for Meta?

Note: As Brian Wieser recently pointed out on our podcast, comparing YouTube to other networks is difficult since they don’t break out their US or USCAN revenue.

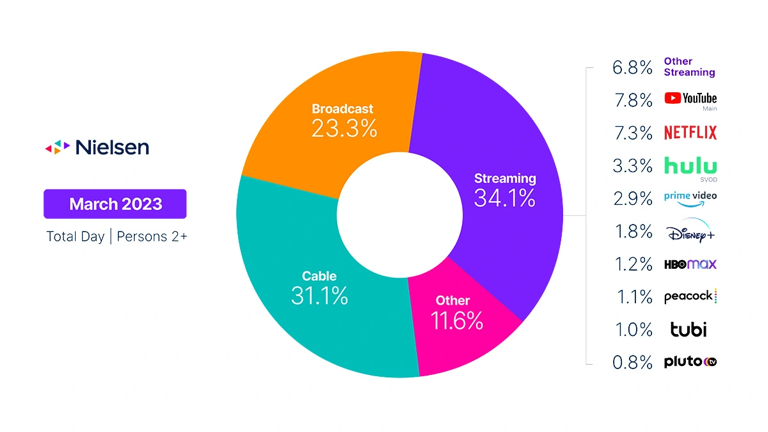

Big question #3: What share of total TV time does YouTube account for?

Quick answer: YouTube accounts for 8% of total TV time and 23% of streaming TV time.

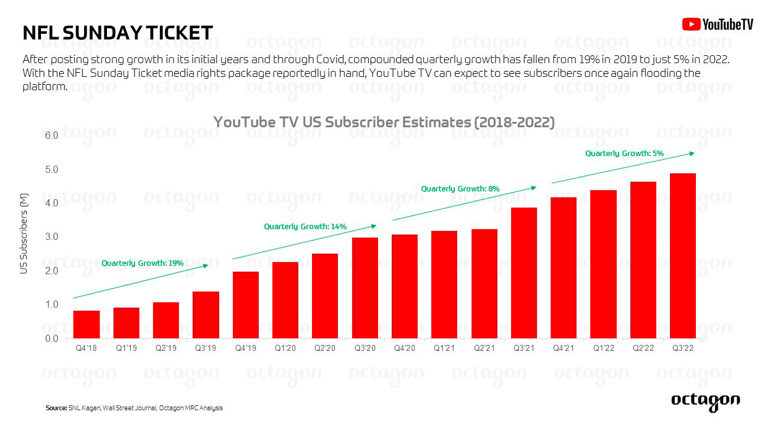

Big question #4: What share of total TV time does YouTube TV account for?

Quick answer: YouTube TV accounts for 1.2% of total TV time.

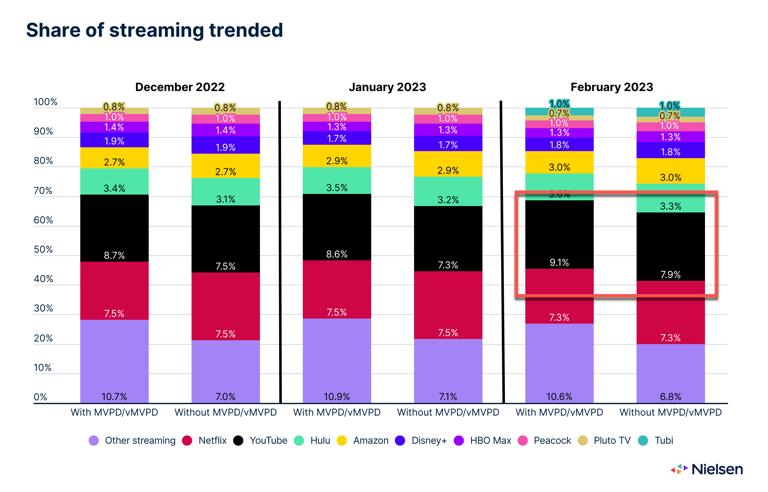

Remember: Nielsen made a methodology change with the February data. Streaming of broadcast/cable content was previously double-counted by Nielsen. The February data removes it from streaming and only counts it as broadcast/cable.

Why this matters: Only ≈ 2% of all TV households and 7% of all pay-TV households subscribe to YouTube TV.