Five big questions re: how we watch TV:

1) Did broadcast/cable gain ground on streaming?

2) Are networks with both linear and streaming reaching new people?

3) Which streaming services account for the highest share of total TV?

4) If consumers could only choose one streaming service, which would it be?

5) How does media fragmentation impact reach/frequency management?

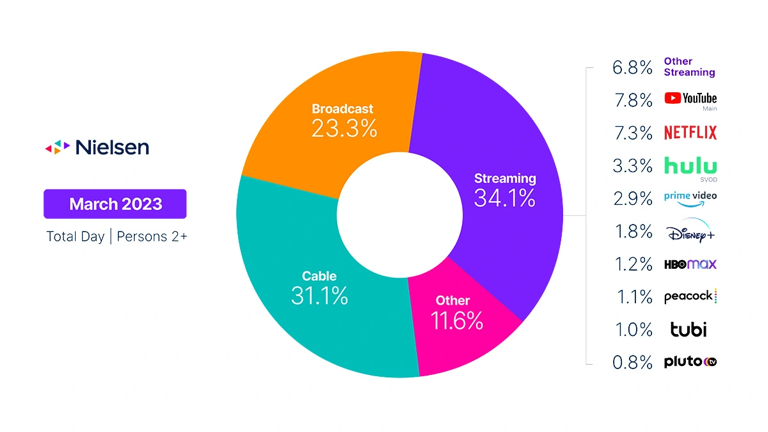

Big question #1: Did broadcast/cable gain ground on streaming?

Quick answer: Big events like March Madness shifted 0.2% of TV viewing time back to linear.

Share of total TV time according to Nielsen:

1) Streaming – 34%

2) Cable – 31%

3) Broadcast – 23%

4) Other – 12%

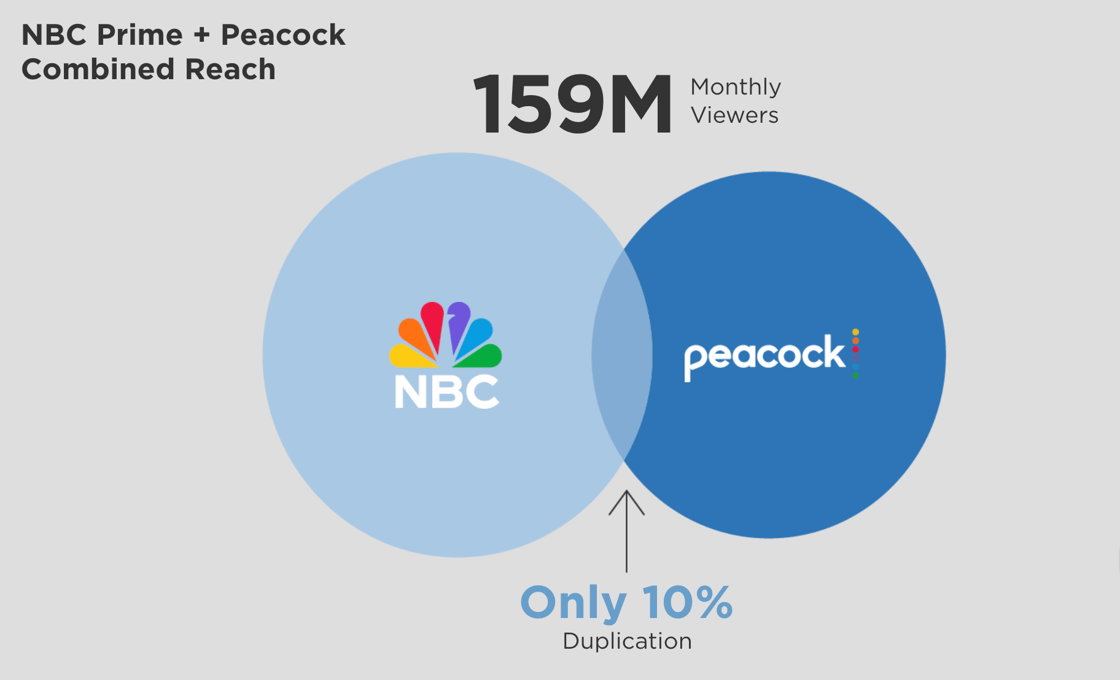

Big question #2: Are networks with both linear and streaming reaching new people?

Quick answer: Yes. There is only a 10% overlap between NBC and Peacock’s primetime audiences.

Interesting: NBCUniversal also released data for time spent by age demo and TV season.

Big question #3: Which streaming services account for the highest share of total TV?

Share of total TV time (streaming only):

1) YouTube – 8%

2) Netflix – 7%

3) Hulu – 3%

4) Amazon Prime – 3%

5) Disney+ – 2%

6) HBO Max – 1%

7) Peacock – 1%

8) Tubi – 1%

9) PlutoTV – 1%

10) Other – 7%

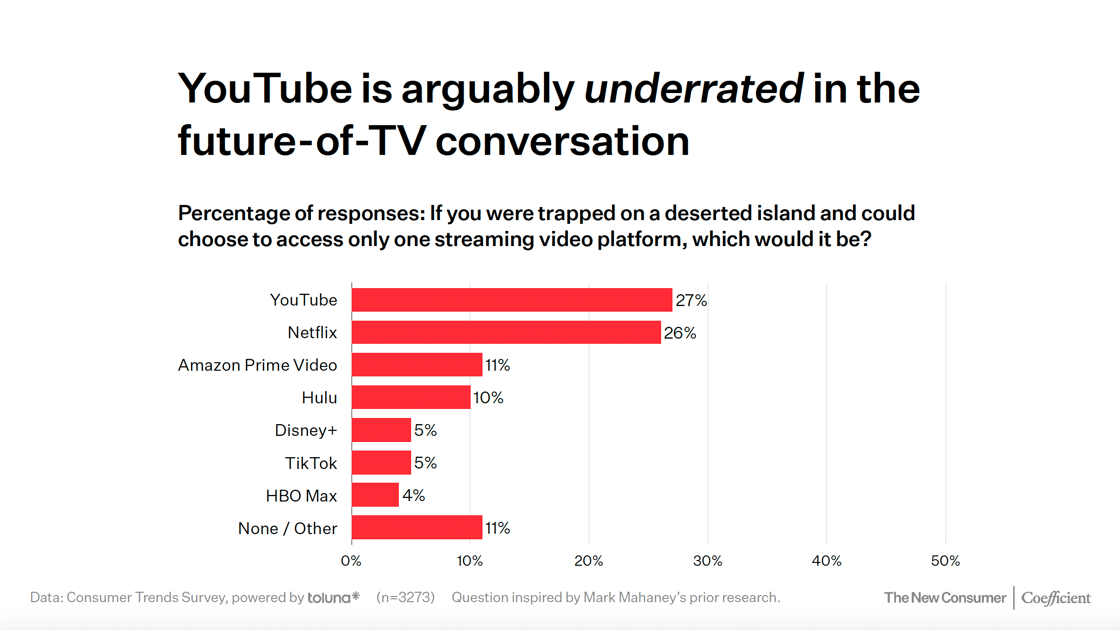

Big question #4: If consumers could only choose one streaming service, which would it be?

If trapped on a desert island, which streaming service would you choose:

1) YouTube – 27%

2) Netflix – 26%

3) Amazon Prime – 11%

4) Hulu – 10%

5) Disney+ – 5%

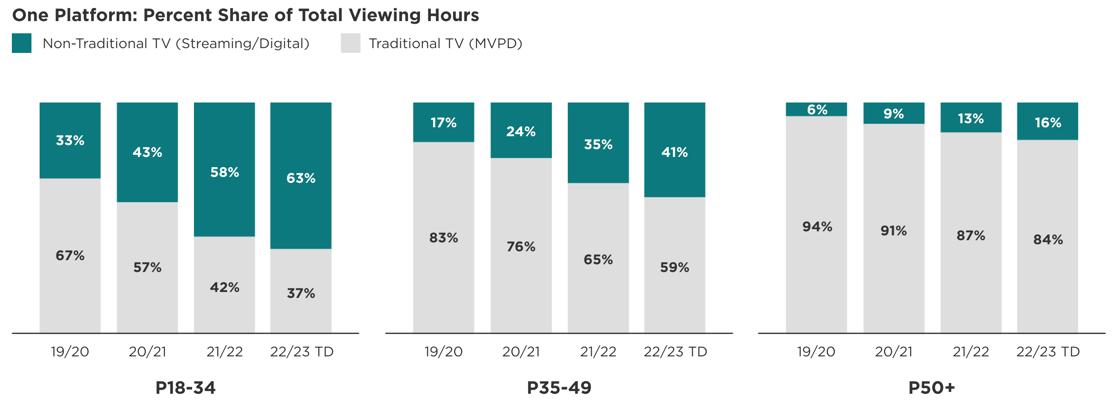

Big question #5: How does media fragmentation impact reach/frequency management?

Quick answer: It is becoming difficult to manage reach and frequency as time spent with video fragments.

Quote from Brian Wieser – Principal @ Madison and Wall:

“The big issue for me is that pay TV penetration continues to fall at a dramatic pace, and is poised to decline below 50% in the United States probably towards the end next year (down from more like 90% at the beginning of the last decade). This is leading to a severe erosion of the potential for traditional television to satisfy reach-based media goals within any reasonable range of cost (i.e. a marketer can buy the first or second decile of reach in a campaign relatively inexpensively, but each percentage point of reach becomes dramatically more expensive, rising at a much faster rate than CPM inflation).”

Screen Wars Podcast: Brian Wieser on the Dynamics of Media Buying

Why this matters: As marketers buy more spots to achieve GRP goals, linear is experiencing a similar problem as streaming (repeat ads, etc.).

Quote from Howard Shimmel – Head of Strategy @ datafuelX:

“While we know that advertising frequency is a challenge in connected TV (CTV), with consumers getting the same ad over and over, the issue of frequency in linear is a growing and equally large problem.

For advertisers, this is a particular concern, as reach for a given linear campaign at a given GRP shrinks while frequency expands.

The challenge that publishers and advertisers face — which will worsen in the future — is how to manage reach and frequency across platforms where most consumers are reachable by both linear and addressable.”

Screen Wars Podcast: Howard Shimmel on Next Steps for Cross-Platform Measurement

.png?width=1120&upscale=true&name=ScreenWars%20Series%20Banner%20-%20Howard%20Shimmel(1).png)