Articles

How to Reach the Elusive Cord Cutters

With Cross Screen Media’s next-generation planning tool, reaching cord cutters with precision is finally possible with targeted cross-screen campaigns at the local level that span all of our audience’s devices.

Nov 10, 2022

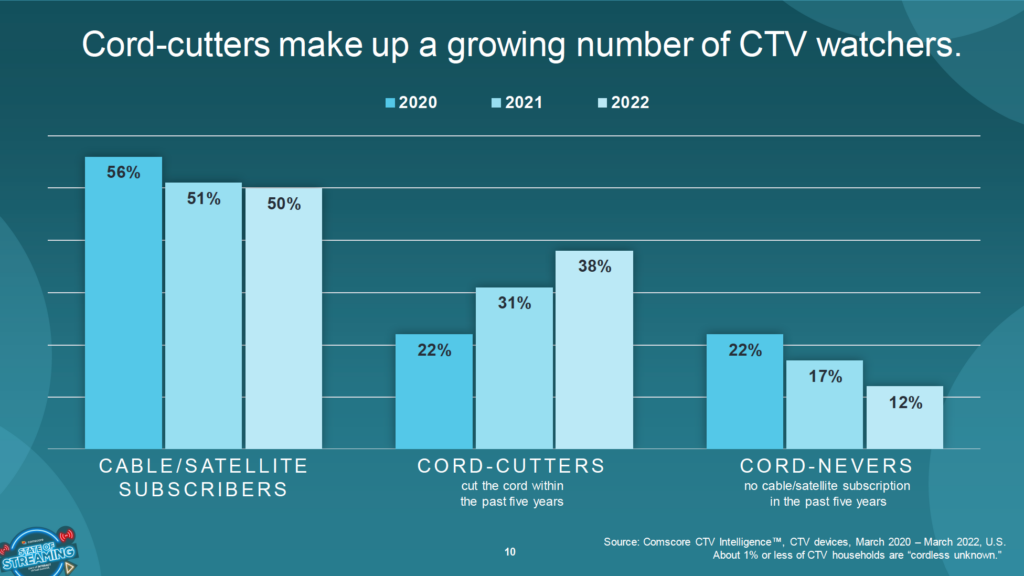

Cord cutters now account for 38% of all CTV watchers, up from 22% just two years ago. This audience, along with their “cord never” cousins, have long been a thorn in the side of advertisers looking to reach these younger, highly sought after segments. In order for advertisers to be successful reaching cord cutters, they need reliable data about this audience and about the local markets they are targeting.

To illustrate, we used our audience builder to create and examine an audience that we hypothesized would include a high percentage of cord cutters: recent shoppers of Amazon.com. We created plans across a variety of local markets, including Houston, Memphis, Denver and Phoenix, to highlight how even the same audience can vary significantly in media consumption habits. This is an audience that would be of particular interest to local retailers, and it’s one that proved to have a large percentage of cord cutters in its ranks.

Using the targeted data about our Amazon audience and our local markets, we can get a very clear picture of where to allocate our spend, where our spend differs amongst these various markets and how to optimize our spend to maximize our reach and efficiency.

Not All Screens Are Created Equal

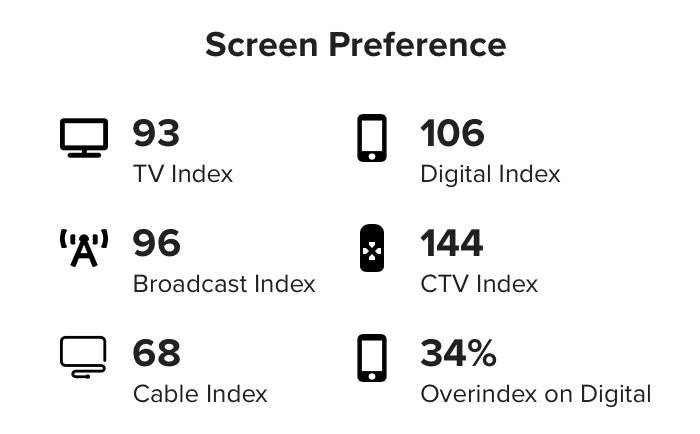

First, the planning software can validate our initial assumptions. Looking at our audience’s screen preference index, it confirms this audience’s overall tendency towards both digital and CTV and their lack of cable exposure, which is under-indexed at just 68, which is far less than the U.S. household average of 100.

We can also see that even with an audience primarily of cord cutters, broadcast and cable TV is not completely dead and we shouldn’t eliminate it entirely from our budget.

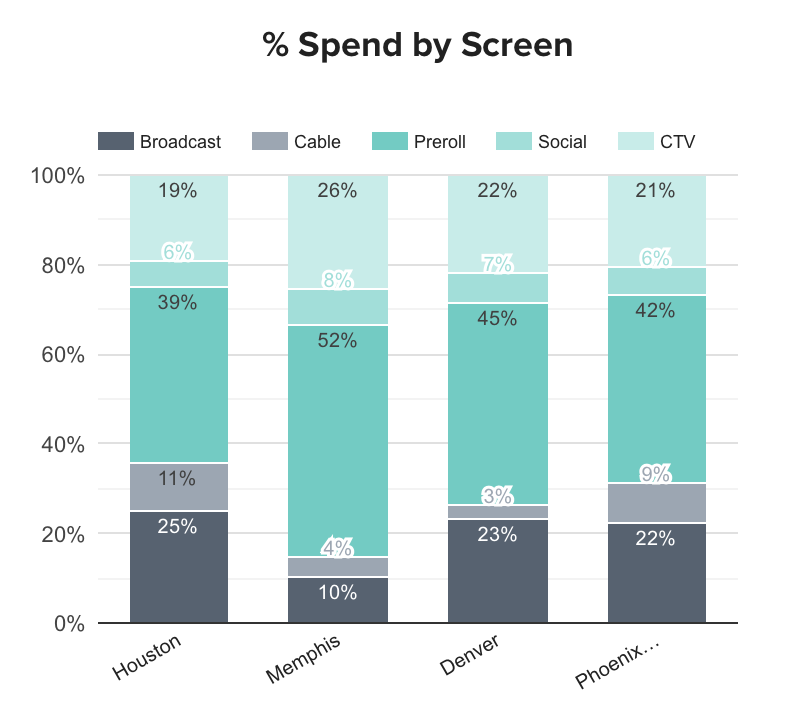

In fact, in DMAs like Houston, up to 36% of our budget is best spent with a combination of broadcast and cable. A vast majority of our Amazon audience is indeed not reachable via these traditional means, but traditional TV lives on as a critical element of many media plans.  On the flip side, it’s also interesting to note that our Amazon audience is not exclusively reachable via digital channels either. Even in our best market for digital video, Memphis, only two-thirds of our budget is best spent on that medium. In order to effectively reach cord cutters, we’re going to need a comprehensive cross-screen campaign, the kind that Cross Screen Media helps advertisers discover every day.

On the flip side, it’s also interesting to note that our Amazon audience is not exclusively reachable via digital channels either. Even in our best market for digital video, Memphis, only two-thirds of our budget is best spent on that medium. In order to effectively reach cord cutters, we’re going to need a comprehensive cross-screen campaign, the kind that Cross Screen Media helps advertisers discover every day.

Allocating Spend Efficiently

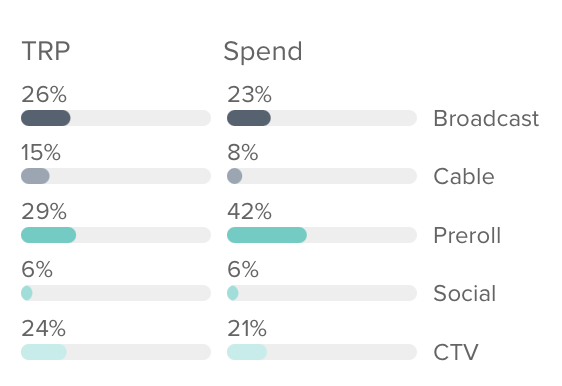

Our planning optimizer shows us the optimal budget to reach our Amazon shoppers and it’s truly a cross-screen solution. The plan includes almost equal amounts of broadcast, preroll and Connected TV. Both Cable TV and social media, however, came in at just a fraction of the overall plan, just 8% and 6% of the total spend respectively.

Recommended Allocation of Spend Why Cross Screen Solutions Matter

Why Cross Screen Solutions Matter

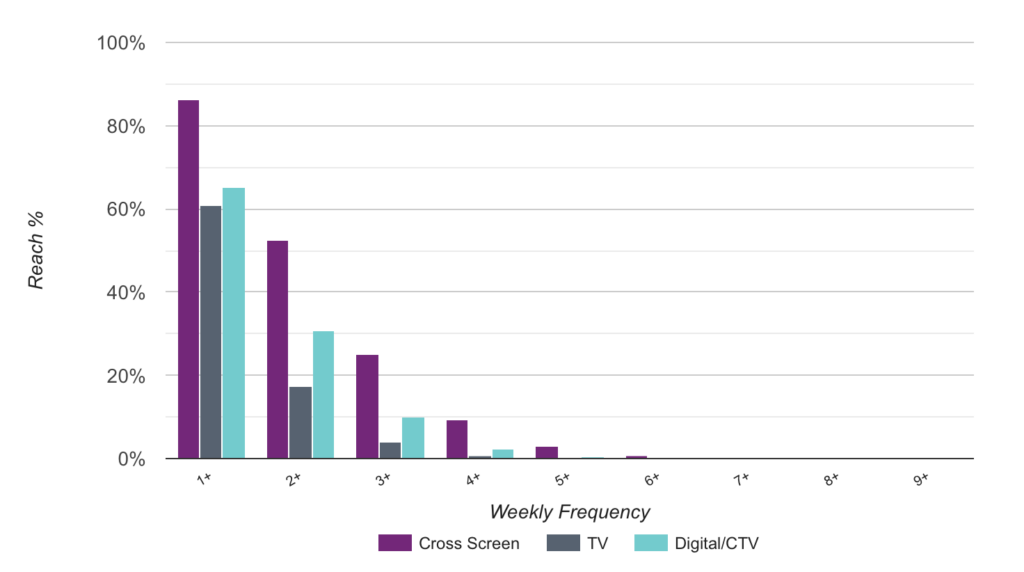

The next important takeaway is that our cross-screen reach is far higher than TV or digital campaigns alone within the same budget. In fact, for our audience, it’s almost impossible to reach them more than three times without using cross-screen campaigns.

This is the kind of data that advertisers crave, and it’s what sets winning agencies apart from their peers. Using this data, we can see that even for a single impression, TV and digital struggles to reach just 60% of our audience, while a cross-screen solution reaches over 85% of our cord cutters right out of the gate. A full 25% of our audience would have been missed had we not used the planning software and built this plan on the local level

Why Local Markets Matter

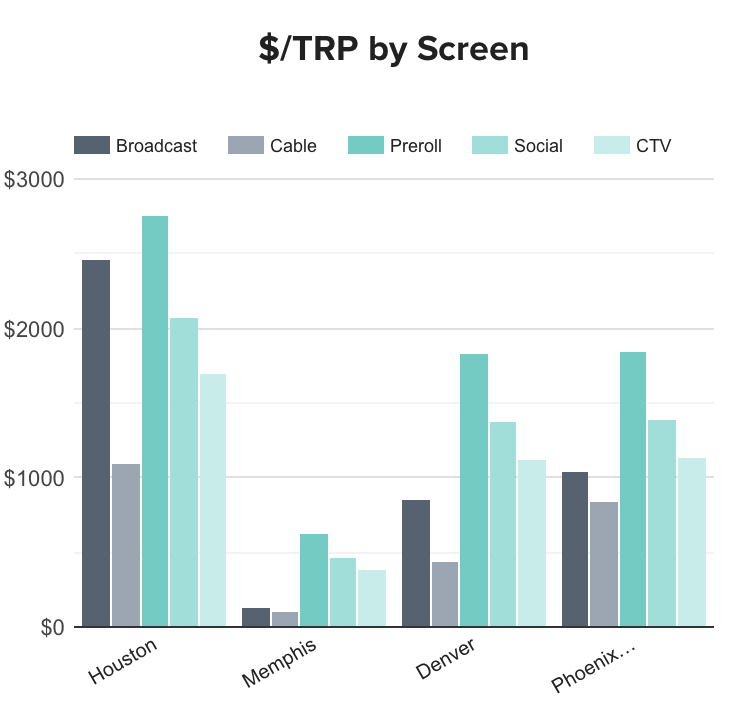

When targeting cord cutters, it’s also important to remember that local markets vary greatly. It’s impossible to create one plan to rule them all. In our example, we can see that costs vary widely between our four sample markets. The cost per TRP is an order of magnitude higher in Houston than it is in Memphis, while Cable TV in Phoenix is twice the price of Denver to reach our Amazon shoppers.

Conclusion

As you can see, Cross Screen Media offers a powerful tool when it comes to reaching the elusive cord-cutting audience. The traditional assumptions regarding this group have proven to be incorrect. Audiences with a high cord cutter percentage can still have broadcast and cable TV exposure, and they are far from being 100% digital as well.

The winning combination for this audience is two-fold. First, advertisers must use a targeted cross-screen approach. And second, advertisers must factor in local market conditions. Using the kinds of data Cross Screen Media can provide in both areas, advertisers can finally get the complete picture of their audience, and allocate their resources accordingly to maximize reach and optimize frequency.