Six big questions re: YouTube:

1) Why were advertisers angry with YouTube?

2) Did the scandal impact YouTube’s revenue?

3) What share of total TV time does YouTube account for?

4) What share of total TV time does YouTube TV account for?

5) What share of total YouTube time is on CTV?

6) How much would YouTube be worth as a standalone company?

Big question #1: Why were advertisers angry with YouTube?

Quick answer: The Wall Street Journal reported in June that ads for 1,100+ brands ran on low-quality non-YouTube inventory.

Quote from Allison Schiff – Managing Editor @ AdExchanger:

“Its scandal du jour, as reported by The Wall Street Journal, is brought to you by Adalytics, an advertising analytics firm that published a meticulously researched report earlier this week demonstrating that the majority of YouTube ad campaigns – around 80% – allegedly run not on YouTube proper but rather on low-quality third-party sites in YouTube’s version of an audience network.”

Impacted brands according to Adalytics:

1) Johnson & Johnson

2) American Express

3) Samsung

4) Sephora

5) Macy’s

6) Disney+

How this happened, according to Allison Schiff:

1) Measurement companies don’t have access to YouTube ad data

2) No third-party tracking pixels on YouTube ads

3) Google chooses which data to “share” with its measurement partners

Why this matters: YouTube’s ad business (🚀) continues to underperform its share of total TV time (🚀🚀🚀). Several reasons exist, which we have discussed in the past, but part of ad buyer apprehension revolves around the intersection of user-generated content with a lack of transparency.

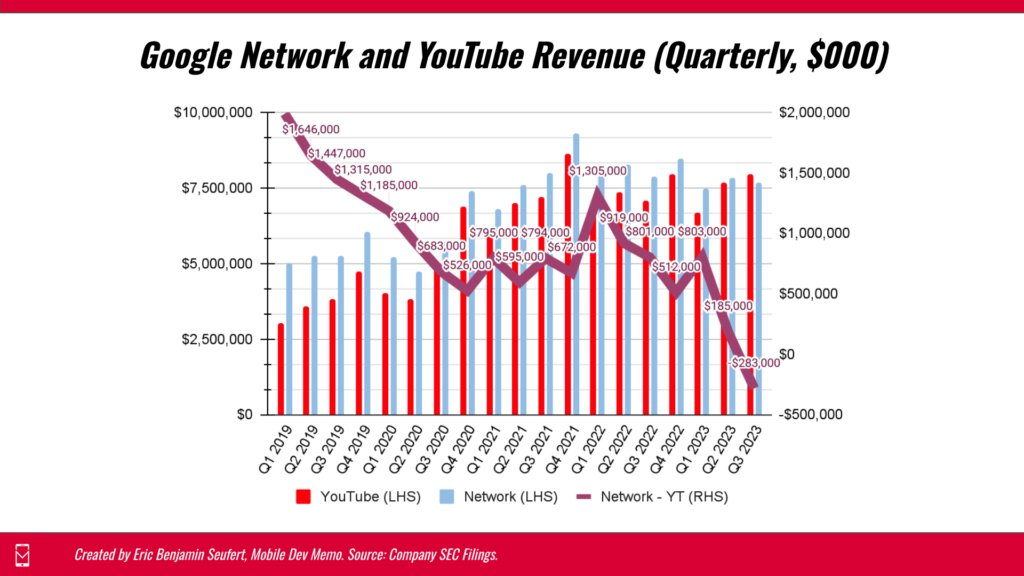

Big question #2: Did the scandal impact YouTube’s revenue?

Quick answer: No. After declining last year, revenue grew 12% YoY.

YouTube advertising revenue (YoY growth):

1) 2019-Q3 – $3.8B

2) 2020-Q3 – $5.0B (↑ 32%)

3) 2021-Q3 – $7.2B (↑ 43%)

4) 2022-Q3 – $7.1B (↓ 2%)

5) 2023-Q3 – $8.0B (↑ 12%)

Big question #3: What share of total TV time does YouTube account for?

Quick answer: YouTube accounts for 9% of total TV time and 24% of streaming TV time.

.png?width=1120&upscale=true&name=27B3.8-SEP2023E(YouTube).png)

Big question #4: What share of total TV time does YouTube TV account for?

Quick answer: YouTube TV accounts for 1.7% of total TV time.

Big question #5: What share of total YouTube time is on CTV?

Quick answer: 45%

Bull case for YouTube: Share of total TV time grew 30% YoY.

Bear case for YouTube: Ad revenue grew 12%. Consumption is growing ≈ 2.5X faster than advertising revenue.

Why this matters: Although CTV advertising is a hot market, YouTube is not fully exploiting it.

Quote from Mike Shields – Founder @ Shields Strategic Consulting:

“My theory, which I’ve talked about before, is TV Truther Syndrome. This is where brands and media sellers deny that YouTube is a factor in the TV market, and particularly on TV screens. I’m just back from the terrific Beet Retreat in San Juan, which featured two days of impressive ‘real talk’ about TV advertising’s many challenges and opportunities. Yet there was a strong undercurrent of the syndrome. Again and again we hear that the only real premium video is found in sitcoms and dramas, and that all the research tells us that the mindset when someone watches ‘short form’ (a phrase that was uttered with great disgust) is just different, which ruins ad receptivity. “There is absolutely nothing like the TV experience, the greatest ad vehicle ever created” – more than one attendee said.”

Big question #6: How much would YouTube be worth as a standalone company?

Quick answer: According to Laura Martin (a friend of SOTS), YouTube would be worth $400B as a standalone company!

Podcast: Needham & Company’s Laura Martin on the Keys to Value In the TV Market

More #1: YouTube is Trying to Walled Garden TV

More #2: Google reportedly violates its own standards in third-party ad deals 80% of the time

More #3: What Google and YouTube’s alleged ad scandal says about the industry