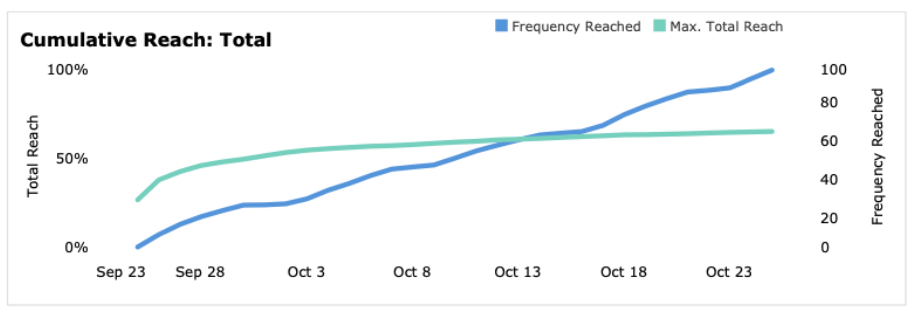

1) Reach for local advertisers is becoming a BIG problem – It is hard to break 60% reach (outside of skewed demos) with any TV platform, and finding the right mix has never been a greater challenge.

Our team tracked the reach/frequency to swing voters across key elections this fall. A continued trend was the declining reach of both broadcast and cable, but streaming still had a ceiling on the number of reachable households with ads.

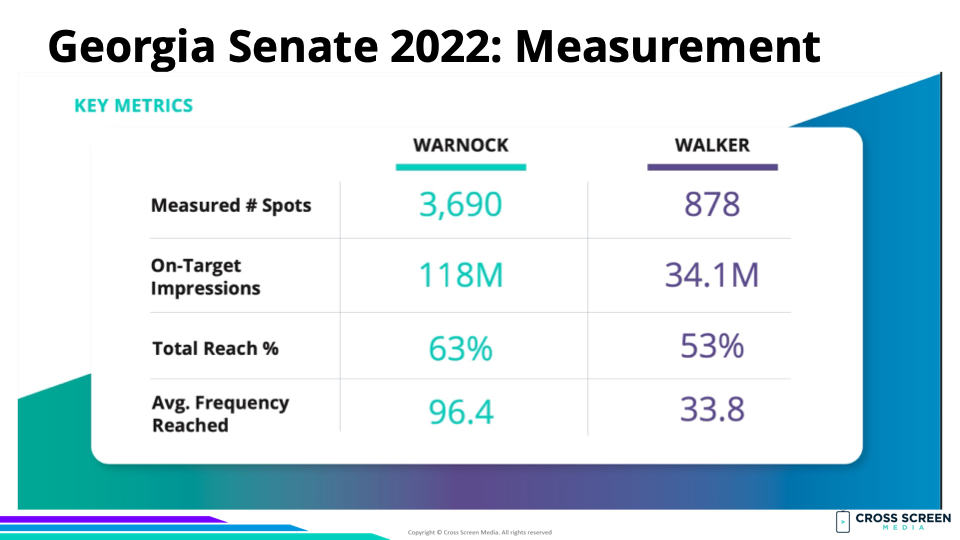

Deep dive: The Georgia Senate election provides a great example. During the final month, the Warnock campaign delivered 118M broadcast TV impressions to swing voters (1.9M HH) in the Atlanta DMA.

Problem #1: Broadcast reach maxed out at 63% (1.2M HH)

Problem #2: The average HH with at least 1 swing voter received 96 broadcast TV ads (20 per week) during that month.

Bottom line #1: This campaign spent a huge sum on broadcast TV ads and still missed 37% (700K) of targeted households. What would this reach curve look like for a normal brand spending a fraction of that amount?

Bottom line #2: Local brands will continue to need broadcast, cable, and streaming TV to reach their goals, but over-relying on any of the three will lead to lower reach and over-saturation for those who see your ads.

More: Lessons From The 2022 Georgia Senate Race

2) Growth in user-generated-content (video specifically) will begin eating into total TV time – If TikTok makes it through 2023 without being banned in the United States, then this will be obvious to everyone in the convergent TV space.

Interesting proxy: Atmosphere TV (sadly not a Screen Wars Fund portfolio company) provides a feed to bars/venues with a never-ending curated loop of user-generated video. This past summer, Lil Screens and I frequented multiple restaurants running this feed, and watching it was quite enjoyable.

Worth your time: Ben Thompson @ Stratechery posted a great interview with Eugene Wei covering this and many other topics.

More: TikTok’s Still Trending

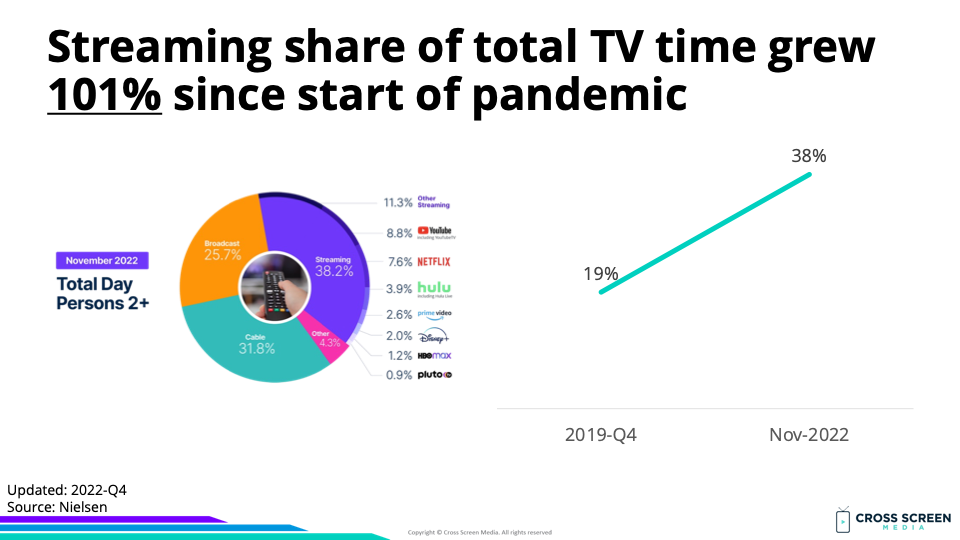

3) Streaming will eat into linear share of total TV time faster than people think – According to Nielsen, November was the highest YoY growth rate (↑ 34%) since they began releasing the Gauge report.

Why this matters: If growth for streaming is accelerating through peak NFL/college football, what happens in January when those go away?