Nine big questions on TikTok:

1) How large is TikTok’s user base?

2) What does a TikTok user look like?

3) How did TikTok grow so fast?

4) How much revenue does TikTok generate?

5) How large is the short-form video ad market?

6) How much time do users spend with TikTok?

7) What impact is TikTok having on attention?

8) What makes TikTok’s algorithm so special?

9) How much does TikTok spend on content?

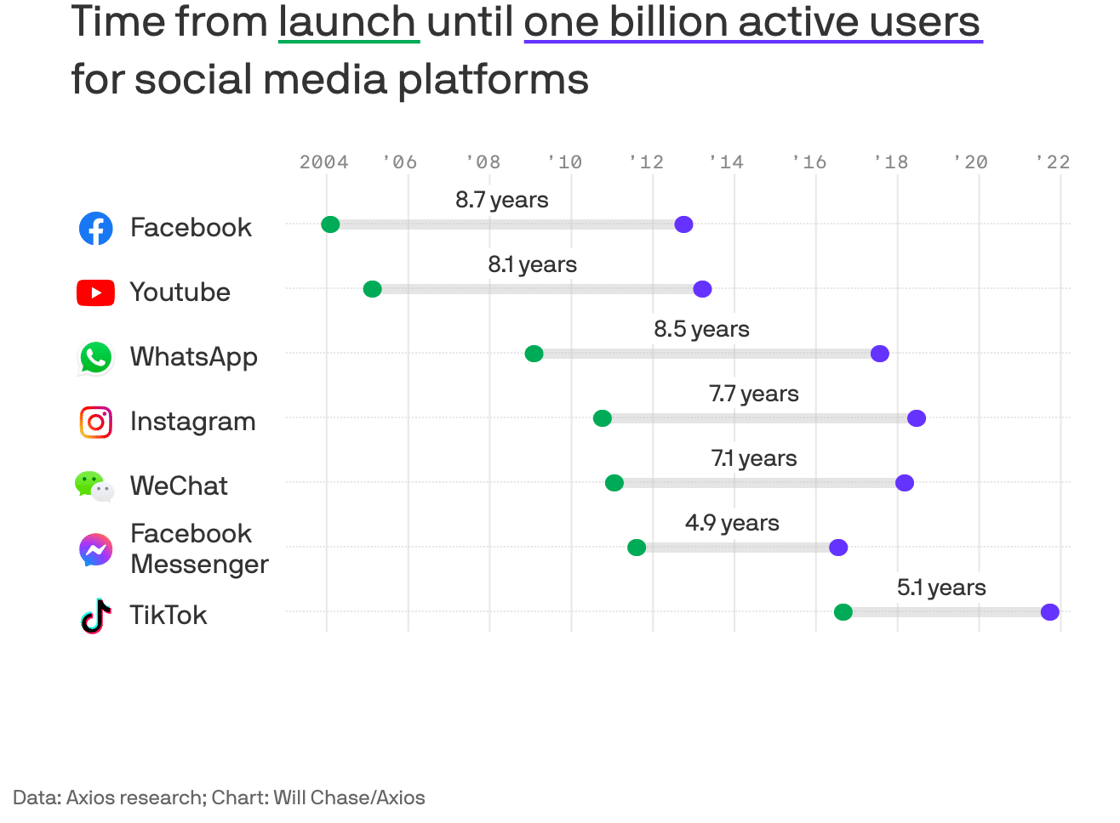

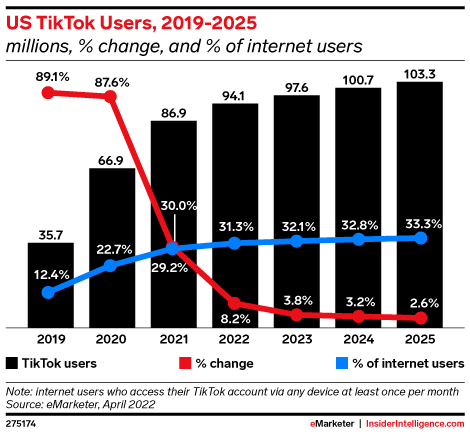

Big question #1: How large is TikTok’s user base?

Quick answer: 1B+ globally with ≈ 85M in the U.S.

Flashback: TikTok Dances Its Way To 1B Monthly Users

Years after launch to reach 1B monthly users according to Axios:

1) Facebook Messenger (2011) – 4.9

2) TikTok (2017) – 5.1

3) WeChat (2011) – 7.1

4) Instagram (2011) – 7.7

5) YouTube (2005) – 8.1

6) WhatsApp (2009) – 8.5

7) Facebook (2004) – 8.7

TikTok users in the U.S. according to eMarketer:

1) 2018 – 18.8M

2) 2019 – 35.6M (↑ 89%)

3) 2020 – 66.5M (↑ 87%)

4) 2021 – 78.7M (↑ 18%)

5) 2022P – 84.9M (↑ 8%)

6) 2023P – 89.7M (↑ 6%)

7) 2024P – 93.8M (↑ 5%)

8) 2025P – 97.0M (↑ 4%)

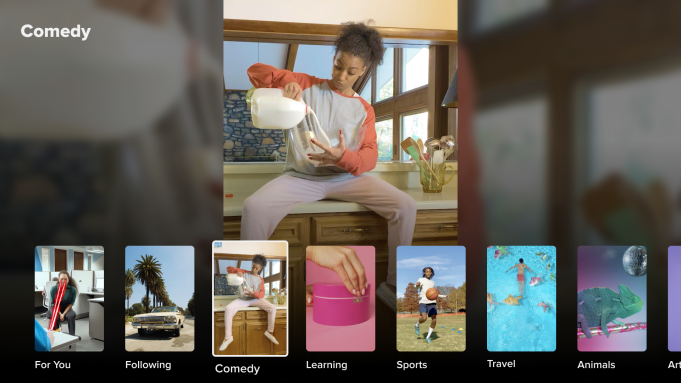

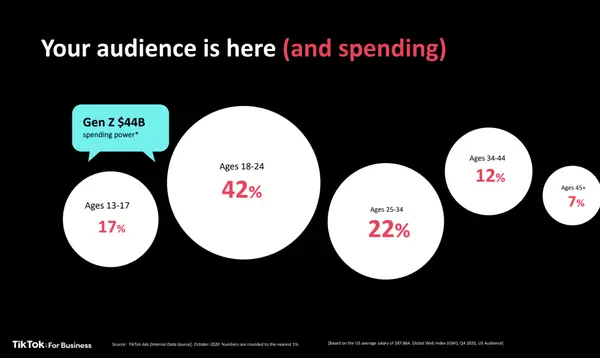

Big question #2: What does a TikTok user look like?

Share of TikTok users by age:

1) 18-24 – 42%

2) 25-34 – 22%

3) 13-17 – 17%

4) 34-44 – 12%

5) 45+ – 7%

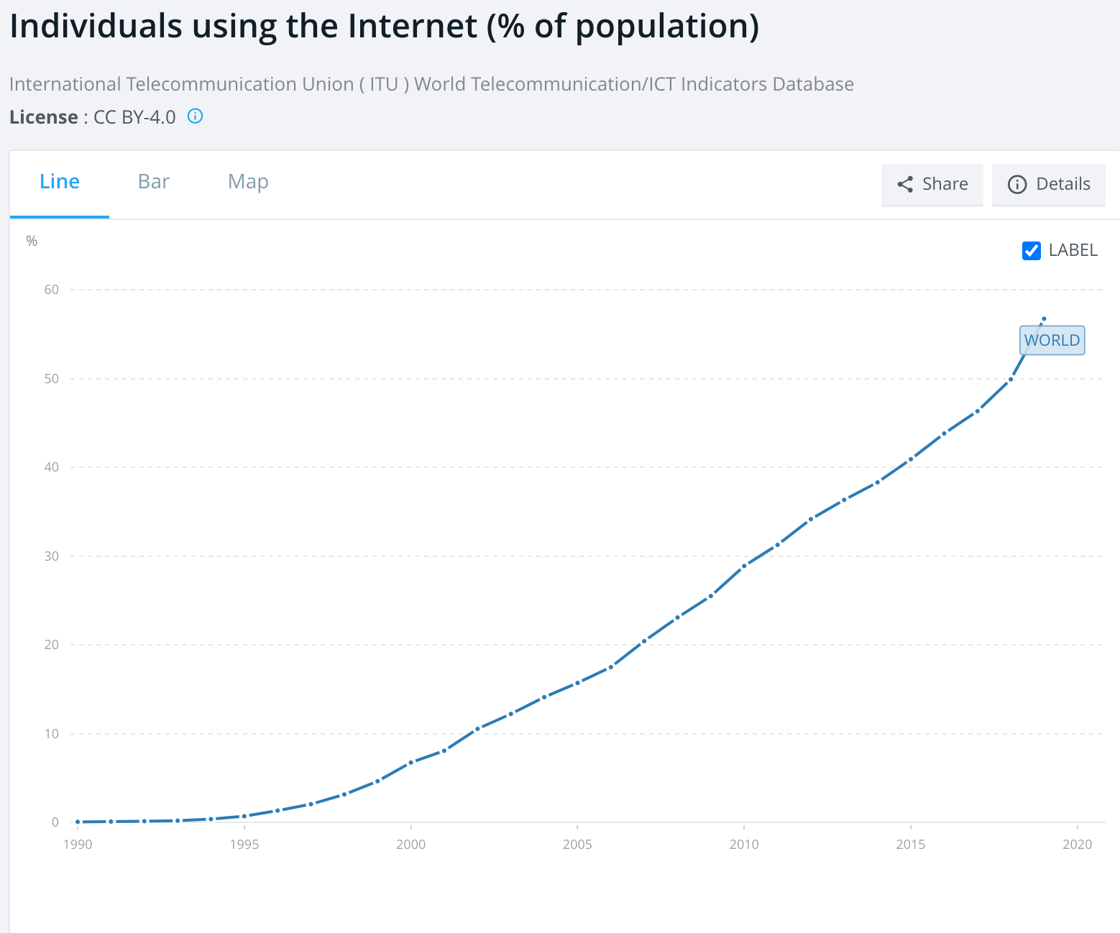

Big question #3: How did TikTok grow so fast?

Quick answer: Great product combined with a larger addressable market. For example, the share of the global population using the internet has grown 229% between the launch of Facebook (14%) and TikTok (46%).

Share of global population using the internet according to the World Bank:

1) 1990 – 0.05%

2) 1995 – 0.7%

3) 2000 – 7%

4) 2005 – 16%

5) 2010 – 29%

6) 2015 – 41%

7) 2019 – 57%

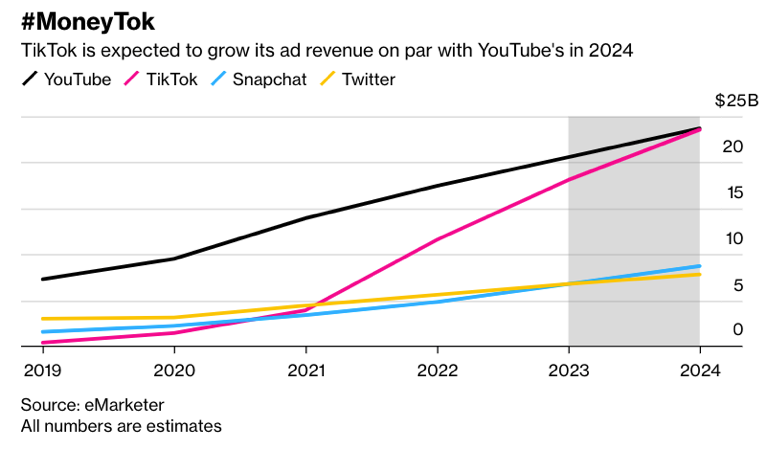

Big question #4: How much revenue does TikTok generate?

TikTok global ad revenue according to eMarketer:

1) 2019 – $340M

2) 2020 – $1.4B (↑ 315%)

3) 2021 – $3.9B (↑ 175%)

4) 2022P – $11.7B (↑ 200%)

5) 2023P – $18.0B (↑ 55%)

6) 2024P – $23.6B (↑ 31%)

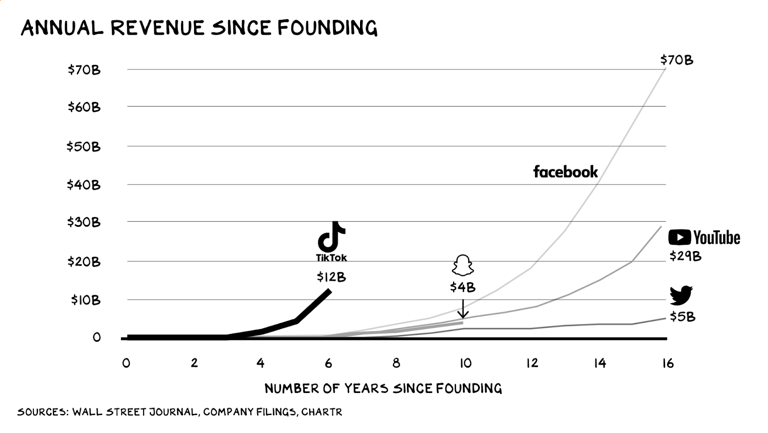

Wow #1: Scott Galloway posted this chart showing how fast TikTok scaled revenue. For example, TikTok’s revenue is larger than Twitter and Snap combined.

Big question #5: How large is the short-form video ad market?

Social video ad spending (YoY growth) according to eMarketer:

1) 2017 – $5.8B

2) 2018 – $8.5B (↑ 47%)

3) 2019 – $11.3B (↑ 33%)

4) 2020 – $15.3B (↑ 35%)

5) 2021 – $24.0B (↑ 58%)

6) 2022P – $34.0B (↑ 42%)

7) 2023P – $42.8B (↑ 26%)

8) 2024P – $49.3B (↑ 15%)

9) 2025P – $53.7B (↑ 9%)

10) 2026P – $56.6B (↑ 5%)

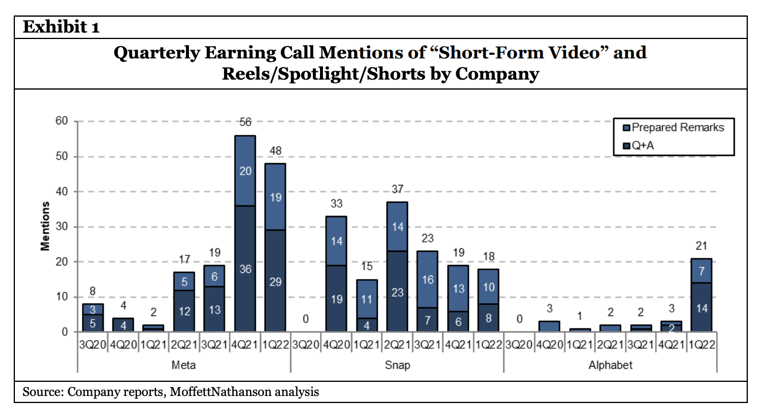

Bottom line: TikTok has been top of mind for Meta, with 100+ mentions over their past two earnings calls!

Big question #6: How much time do users spend with TikTok?

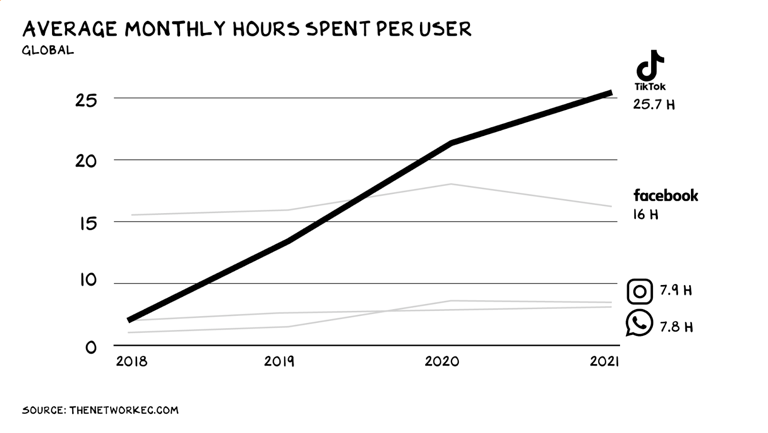

Average monthly time spent per user according to Scott Galloway:

1) TikTok – 25.7h

2) Facebook + Instagram – 23.9h

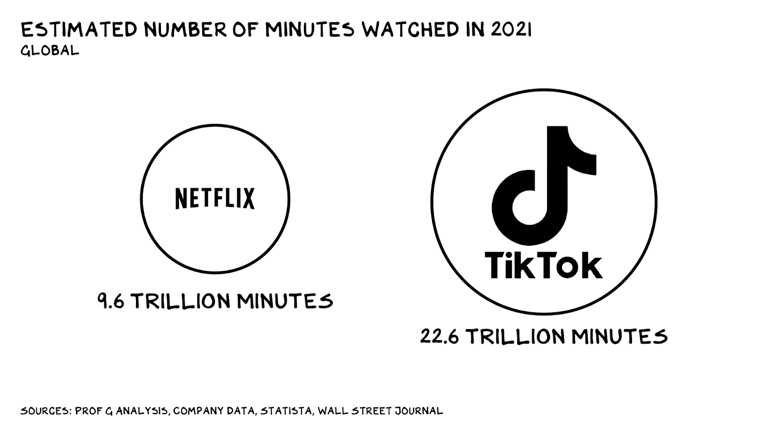

Wow #2: TikTok generates ≈ 135% more minutes of viewing than Netflix.

Quote from Darren Herman – Operating Partner @ Bain Capital:

“The most interesting insight that I have regarding TikTok is that it does not steal my minutes from social media but rather it steals them from consuming other video or content, inclusive of television. Tiktok usually complements or replaces the time when I’m sitting in front of the television.”

PSA: Sign up for Darren’s outstanding newsletter, Operating Partner.

Quote from Troy Young – Adviser/Investor + Former Global President @ Hearst Magazines:

“Consumers are spending an average of 52 minutes daily on the platform. This doesn’t mean they won’t read professional media or watch dramas on Netflix. But it’s 52 minutes taken from somewhere else. More importantly, it’s a new media habit. The simple notion that an increasing amount of time is spent on short form video by a growing class of amateur and semi-professional creators should trigger some reflection on the shape of future media and how digital media companies compete. The humble web page has a tough job ahead.”

Screen Wars Podcast: Troy Young on Lean Media Companies and the Shift Towards Creator Models

Quote from Casey Neistat – Co-Founder @ Beme:

“While YouTube remains “by far the greatest place for self expression” because it accommodates many types and lengths of user-generated content, he said the attention TikTok draws has the net effect of eroding the viewership of YouTube and other platforms. Plus, short-format videos mark a fundamental change in the content users want.”

Big question #7: What impact is TikTok having on attention?

Quick answer: It is getting even shorter.

Quote from Erin Weaver – Senior Director of Audience Development @ Group Nine:

“You get roughly two seconds to get people’s attention now. On Facebook, it used to be 10. On YouTube it was 30 seconds.”

Big question #8: What makes TikTok’s algorithm so special?

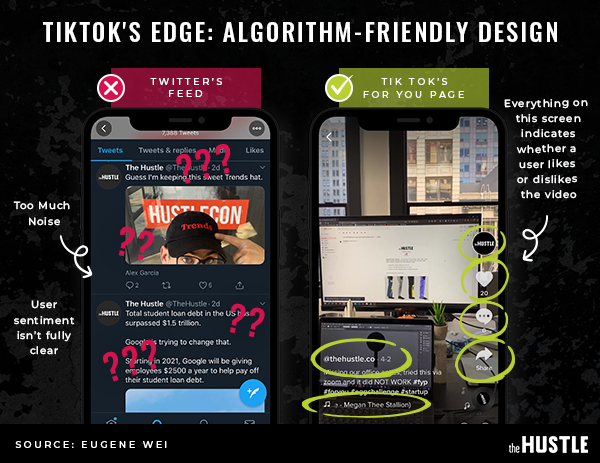

Quick answer: Eugene Wei and The Hustle posted this graphic breaking down how TikTok’s simple user interface delivers a ton of data about user preferences powering their recommendation engine (algorithms, etc.).

Quick math on “micro signals” powering TikTok’s recommendation engine according to Scott Galloway:

1) 11m average user session

2) 25s average video length

3) 26 videos watched per session

Bottom line: In 11 minutes, TikTok can get feedback on 26 different videos from each user. Compare that to a platform like Netflix running 60-minute scripted shows. TikTok gets feedback on 150+ pieces of content for every 1 that Netflix does.

Quote from Scott Galloway – Professor @ NYU Stern School of Business:

“That’s 26 “episodes” per session, with each episode generating multiple microsignals: whether you scrolled past a video, paused it, re-watched it, liked it, commented on it, shared it, and followed the creator, plus how long you watched before moving on. That’s hundreds of signals. Sweet crude like the world has never seen, ready to be algorithmically refined into rocket fuel.”

Big question #9: How much does TikTok spend on content?

Quick answer: $200M or ≈ 1% of the amount that Netflix spends!

Outstanding questions:

1) Will pressure from governments (United States, India, etc.) slow TikTok’s growth?

2) Can TikTok become what Facebook Watch meant to be, combining social-like recommendation engines with CTV-specific content (16×9 vs. 9×16)?

3) Can TikTok build a self-serve ad juggernaut like Meta/Google?

4) How should we value ads with such short bursts of attention?

More #1: Why I’m Still Worried About TikTok

More #2: How TikTok Reads Your Mind

.png?width=1120&upscale=true&name=Social%20Network%20Video%20Ad%20Spending%20(4).png)