Six big questions re: college football media $$$:

1) Why are teams switching conferences in college football?

2) What is the math behind Oregon and Washington moving to the Big Ten?

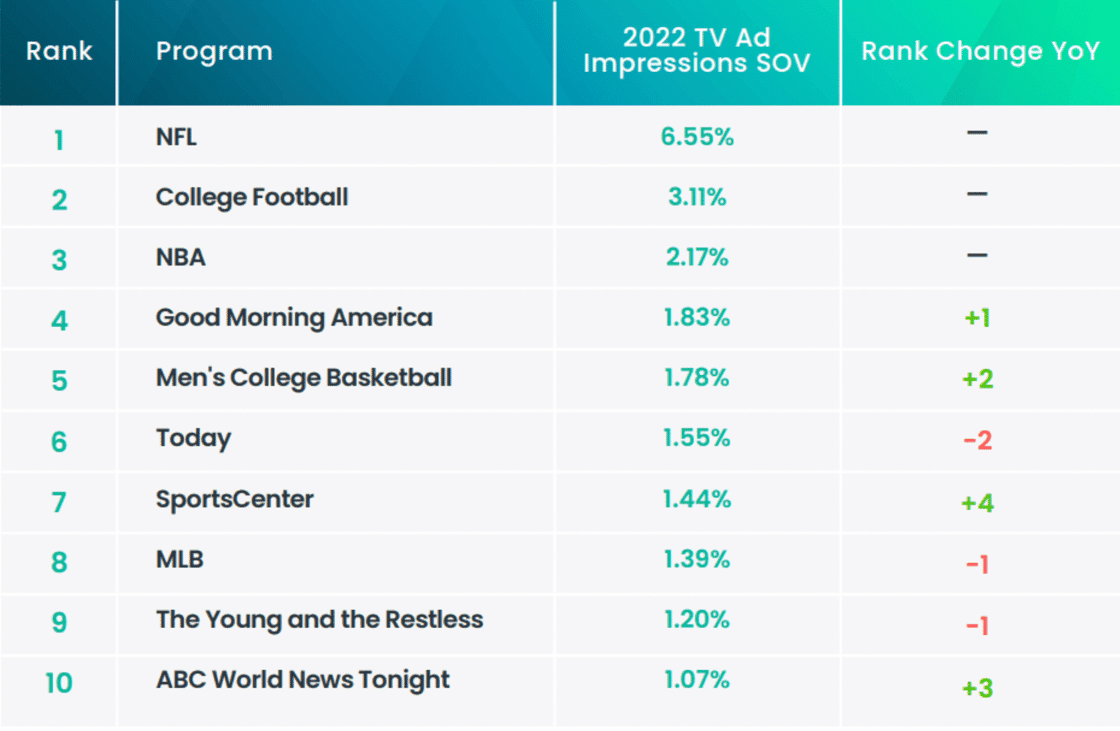

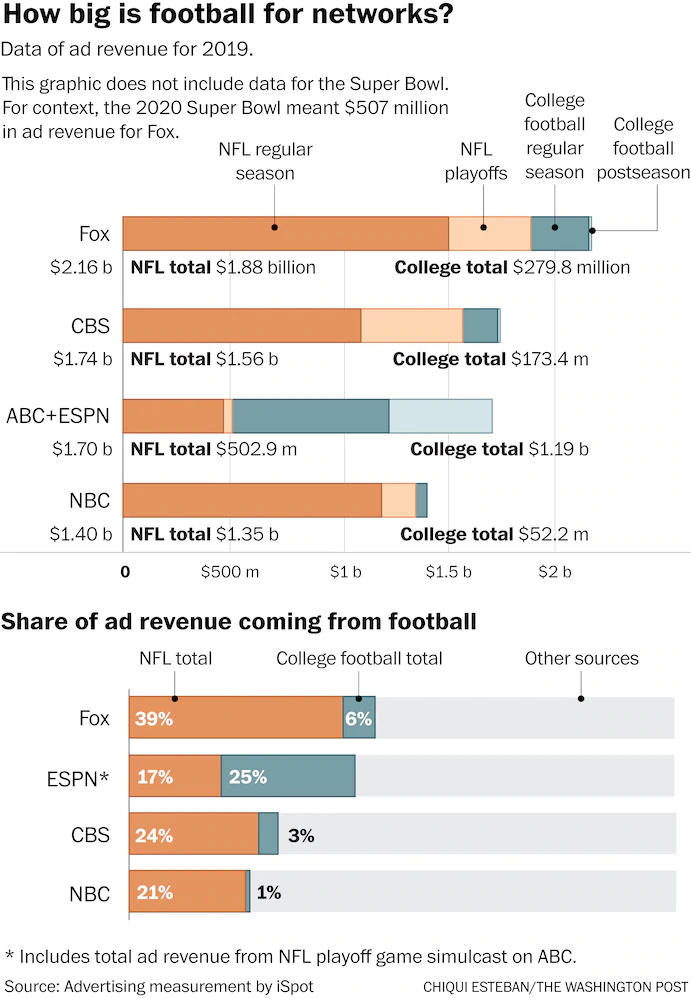

3) How important is college football to the TV networks?

4) How important are media rights to college athletic departments?

5) What happens in the near term?

6) What happens in the long term?

Big question #1: Why are teams switching conferences in college football?

Quick answer: More money from lucrative media rights deals. TV networks and streaming platforms place a premium on conferences with big brands that can draw large audiences. The biggest brands are grouping together to negotiate the largest media rights deals.

Quote from Amanda Christovich – Reporter @ Front Office Sports:

“A few short decades ago, TV money built the Power 5 as we know it. But by the time college football season kicks off in a few weeks, the obsessive pursuit of TV money will have driven Power 5 schools to destroy the current system altogether.”

Smart take: Andy Staples from the Athletic coined the term the “four million club” referring to games that draw 4M+ viewers.

Quick math on the four million club:

1) 1,593 televised games between 2015-19

2) 198 (12%) topped 4M+ viewers

3) 13 schools played in 10+ games

Teams with the most four million club games:

1) Alabama – 35

2) Ohio State – 31

3) Michigan – 26

4) Auburn – 17

5) Notre Dame – 17

6) Florida – 16

7) LSU – 16

8) Clemson – 15

9) Georgia – 15

10) Oklahoma – 14

Bottom line: The athletic conferences are trying to assemble a roster of the most valuable teams for TV networks and streaming companies. Geography, history, nostalgia, and rivalries have taken a back seat to the dollar.

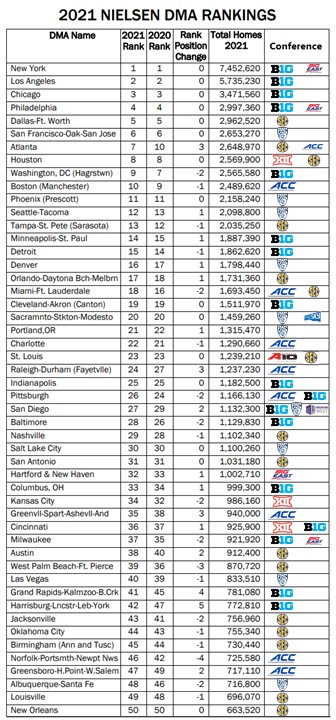

Interesting: Chris Hock and Scott Hirko created a table displaying the top 50 media markets with conference affiliations. The Big Ten has added #1 and #2 through expansion (Rutgers and USC/UCLA), and the SEC has added #5 and #8 (Texas).

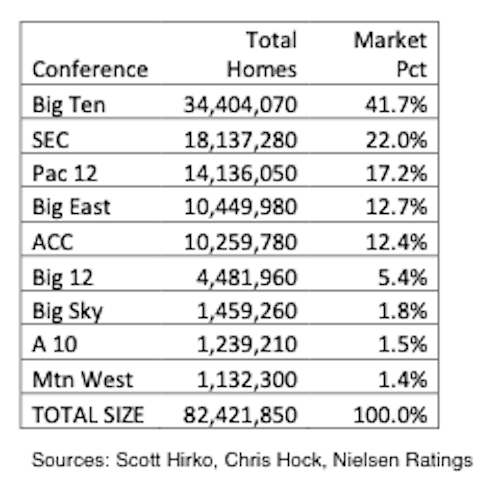

Bottom line: Big Ten country has expanded to roughly 42% of U.S. homes and nearly doubles the SEC (22%).

Big question #2: What is the math behind Oregon and Washington moving to the Big Ten?

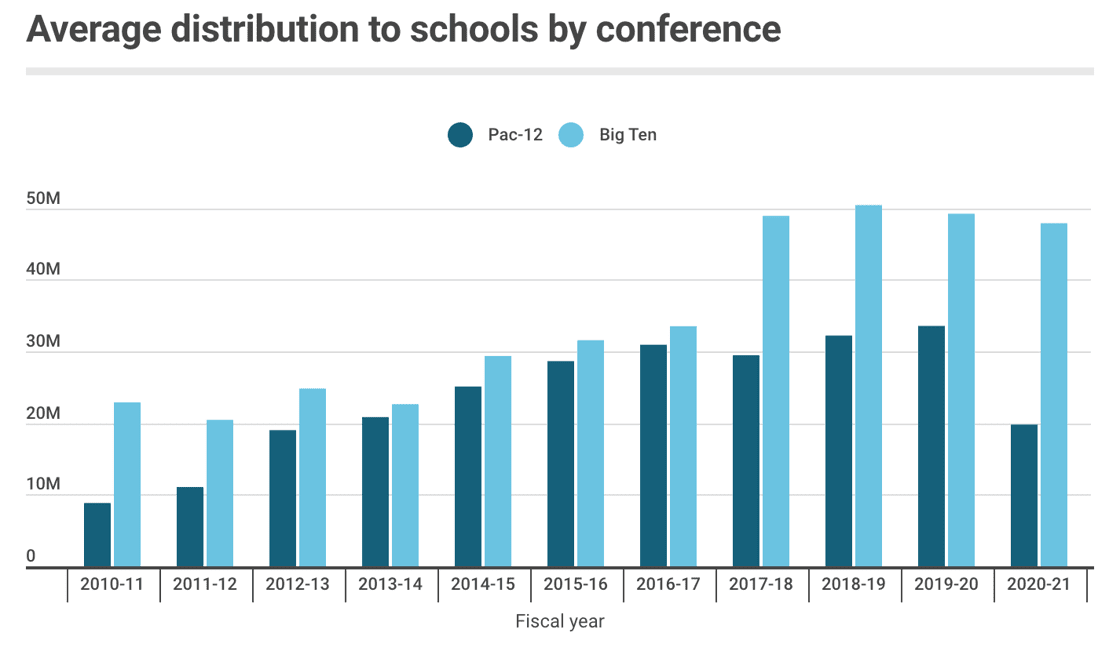

Quick answer: More money. Even before last year’s monster media rights deal, the Big Ten distributed 62% more revenue to member schools than the Pac-12.

Revenue distribution per school according to The Los Angeles Times:

1) Big Ten – $54.3M

2) Pac-12 – $33.6M

Bottom line: Oregon and Washington agreed to take a ≈ 67% lower share (initially) from the Big Ten (≈ $45M vs. $75M). Even with this haircut, they are still better off than a full share from the Pac-12.

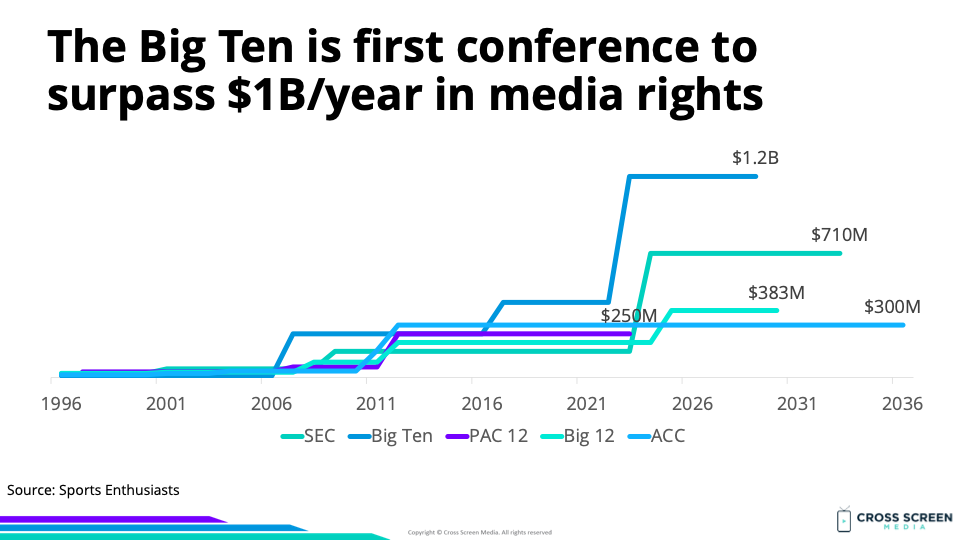

Flashback #1: College Football Goes BIG with Media Rights

Big question #3: How important is college football to the TV networks?

Quick answer: College football accounts for 3% of all linear TV ad impressions.

NCAA football advertising revenue by network (% of total) according to iSpot:

1) ABC/ESPN – $1.2B (25%)

2) Fox – $280M (6%)

3) CBS – $173M (3%)

4) NBC – $52M (1%)

Flashback #2: Is Conference Realignment The Right Play Call?

Quote from Matthew Dixon – Author @ Sports Enthusiasts:

“While money is the primary driving force for realignment, there are a few other factors at play when it comes to realignment and TV contracts. How we watch television is the biggest change over the last three decades of realignment. The idea of streaming was probably not even thought about in 1996 but the times have changed. In 2013, about 100 million US households subscribed to some type of traditional, paid TV package. That number is projected to be only 60 million by the end of 2023 – a 40% drop in a decade.”

Big question #4: How important are media rights to college athletic departments?

Quick answer: As of 2019, approximately 34% of athletic department revenue came from media deals, which have grown 3X in some cases (Big Ten).

Source of revenue for Power Five athletic departments, according to Axios:

1) Media rights – 34%

2) Ticket revenue – 20%

3) Government/Institution – 5%

4) Student fees – 2%

5) Other (licensing, etc.) – 39%

Big question #5: What happens in the near term?

Quick answer: More dominoes will fall. Notre Dame, Florida State, Clemson, and Miami are top targets for the SEC and BIG Ten. California, Stanford, Washington State, and Oregon must find a new home.

Big question #6: What happens in the long term?

Mr. Screens’ Crystal Ball: A super conference where the Big Ten and SEC essentially act like the AFC and NFC do for the NFL.

More #1: College football viewer’s guide: Streamers, services, best prices to watch the 2023 season

More #2: College Football’s Inevitable Conclusion? Two 20-Team Megaconferences