Four big questions re: the sports + streaming:

1) Why was last week’s NFL Thursday Night Football on Amazon Prime so important to the future of sports + streaming?

2) How many viewers tuned into the broadcast vs. expectations?

3) How did this compare to previous games?

4) How much are advertisers paying for ad spots?

Big question #1: Why was last week’s NFL Thursday Night Football on Amazon Prime so important to the future of sports + streaming?

Quick answer: Amazon is paying $1.0B annually to air NFL Thursday Night Football exclusively (outside of home markets) on Amazon Prime. This is a massive test of whether streaming can deliver a similar reach to linear TV.

Flashback: The NFL’s Streaming Future

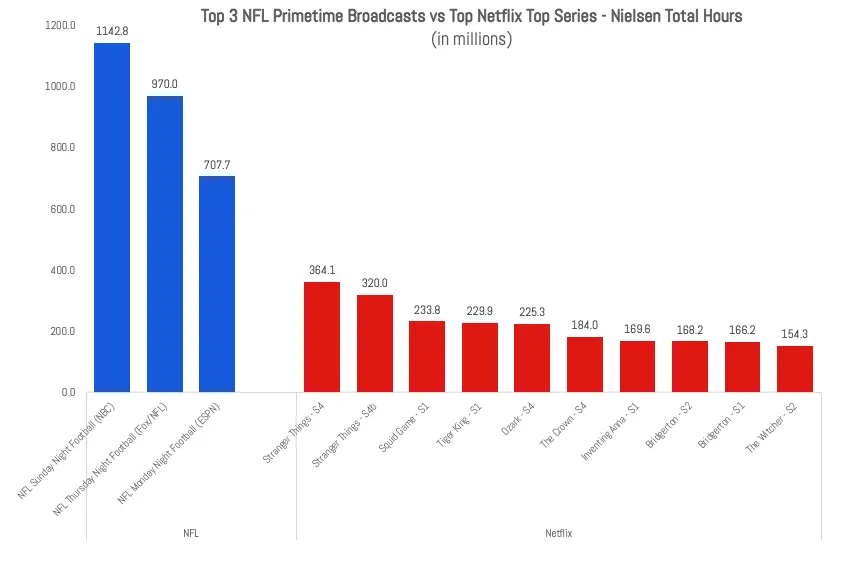

Wow: Each NFL window was viewed 2-4X as much as Stranger Things Season 4 over 17 weeks.

Quote from Fred Gaudelli – Executive Producer @ Amazon:

“I was at ESPN when we had our first NFL game. You know what the NFL did for ESPN. It put it on a rocket to the moon that is still in orbit. Amazon is a huge company, a hugely successful company. But the NFL can take you places that most other entities can’t.”

Big question #2: How many viewers tuned into the broadcast vs. expectations?

Viewership for 2022 Thursday Night Football Week 2:

1) Expectation – 12.5M

2) Actual – 13.0M

3) Peak – 14.6M (10:45 – 10:59PM EST)

Big question #3: How did this compare to previous games?

Viewership for NFL Thursday Night Football Week 2 (YoY growth):

1) 2021 (NFL Network) – 9M

2) 2022 (Amazon Prime + KTTV/KHSB) – 13M (↑ 47%)

Average age for NFL Thursday Night Football:

1) 2021 – 53

2) 2022 – 46

Viewership for NFL Thursday Night Football Week 2 by source (% of total):

1) Streaming (Amazon Prime) – 11.8M (91%)

2) Broadcast in Los Angeles (Fox-KTTV) – 602K (5%)

3) Broadcast in Kansas City (NBC-KSHB) – 550K (4%)

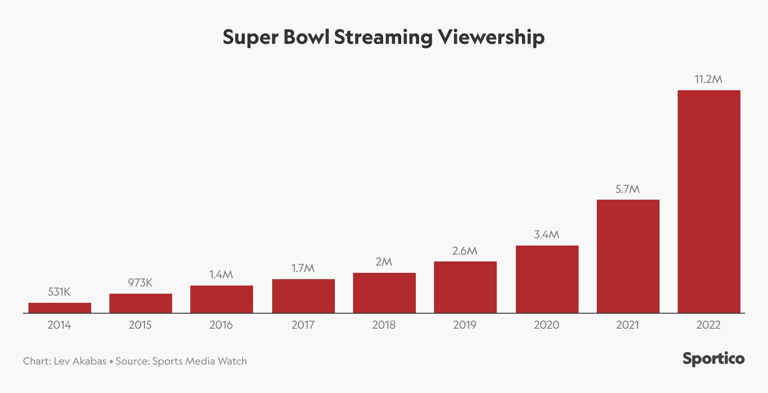

Streaming only viewership for NFL games:

1) 2022 TNF Week 2 (Amazon Prime) – 11.8M

2) 2022 Super Bowl (Peacock) – 11.2M

Bottom line #1: This is huge. Live sports are the last holdout in the shift to streaming. More people streamed a Thursday night game with 13M total viewers compared to the Super Bowl, which drew 112M.

Bottom line #2: The shift to streaming is happening faster than even I (a streaming bull) would have anticipated.

Quote from Julia Alexander – Director of Strategy @ Parrot Analytics:

“A big part of the Amazon win. Not the entire win; Amazon wants to be a major player in the media space and prove that it can use its tech capabilities to be a major distributor within the future of sports.”

Big question #4: How much are advertisers paying for ad spots?

Cost per 30-second spot (% change) during NFL Thursday Night Football according to Standard Media Index:

1) 2021 (Fox) – $635K

2) 2022 (Amazon Prime) – $550K (↓ 13%)