Nine big questions re: Telly:

1) What is Telly?

2) How many people have signed up?

3) How will Telly recoup the cost of the television?

4) How many televisions are sold each year?

5) Which smart TV operating systems are most popular?

6) How do smart TV companies make money?

7) How large is the smart TV operating system market?

8) Why are so many companies fighting to control the smart TV operating system market?

9) What share of consumers are open to ad-supported streaming?

Big question #1: What is Telly?

Quick answer: Telly is an innovative new company offering consumers a free 55-inch smart TV in exchange for the ability (primarily) to serve advertising.

Survey data collected by Telly for ad targeting include:

1) Age

2) Gender

3) Income

Big question #2: How many people have signed up?

Quick answer: 250K signed up in the first week. Telly plans to send 500K TVs out by the end of the year.

Big question #3: How will Telly recoup the cost of the television?

Quick answer: This is the $400M question, which is how much Telly will spend to produce 500K TVs ($800 * 500K = $400M).

Why this matters: Vizio generates $29/year in advertising revenue for each household. If Telly generated similar revenue, it would take 27 years to recoup $800.

Mr. Screens’ Crystal Ball: I am extremely bullish on the concept around Telly and believe they will be able to generate far more than $29/year from each household.

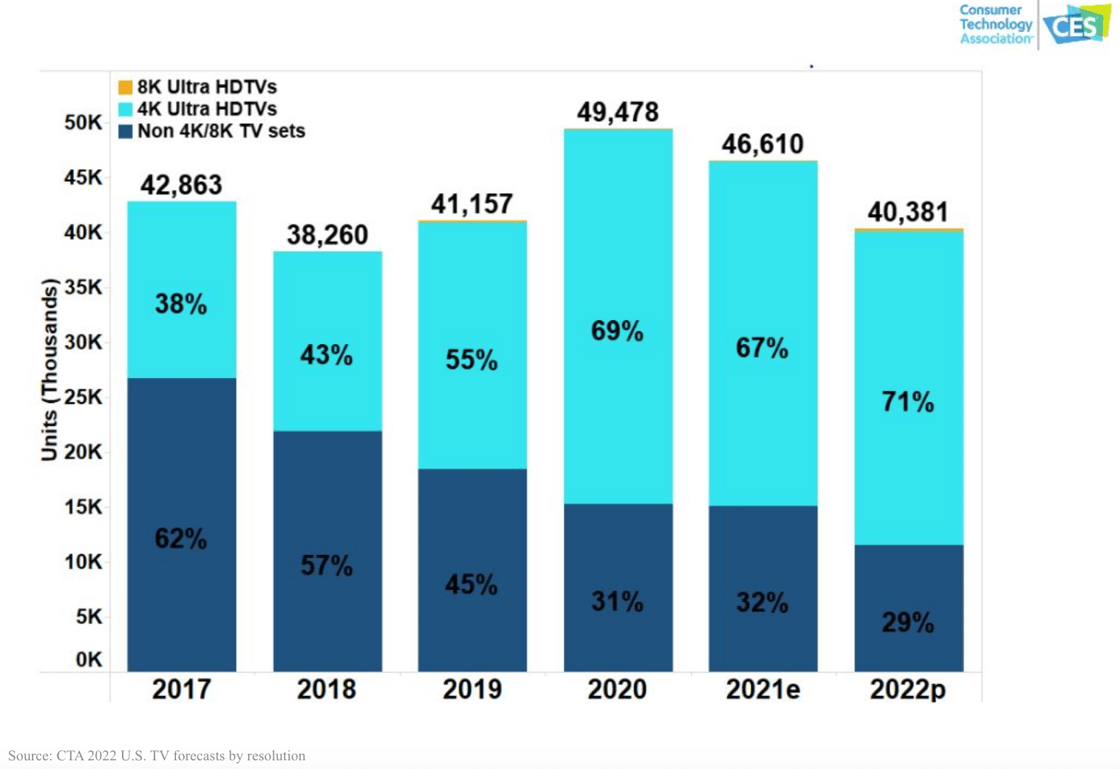

Big question #4: How many televisions are sold each year?

Quick answer: 40M TVs are sold in the U.S. (250M globally). The average TV is replaced every 7 years.

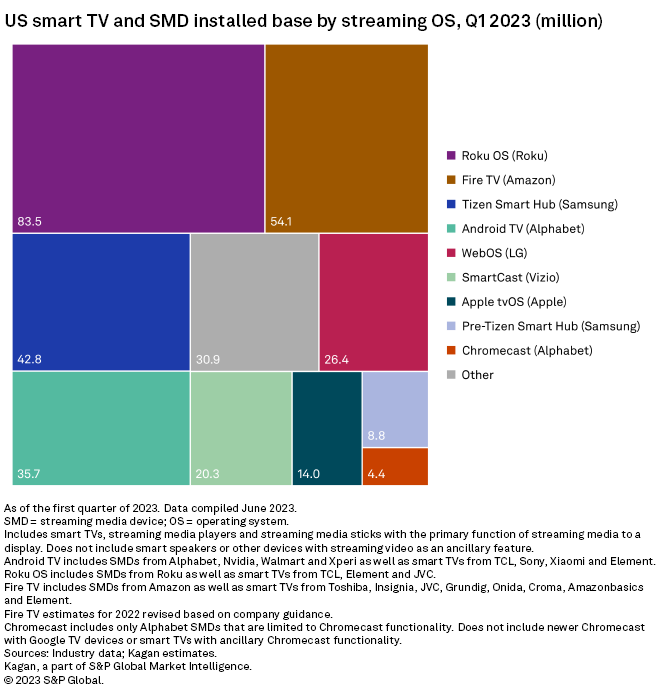

Big question #5: Which smart TV operating systems are most popular?

Share of smart TV OS install base in the United States, according to Kagan:

1) Roku OS (Roku) – 26%

2) Fire TV (Amazon) – 17%

3) Tizen Smart Hub (Samsung) – 13%

4) Android TV (Alphabet) – 11%

5) WebOS (LG) – 8%

6) SmartCast (Vizio) – 6%

7) Apple TVOS (Apple) – 4%

8) Pre-Tizen Smart Hub (Samsung) – 3%

9) Chromecast (Alphabet) – 1%

10) Others – 10%

Big question #6: How do smart TV companies make money?

Revenue sources for smart TV companies, according to nScreenMedia:

1) Advertising from FAST app

2) Advertising share with other app providers

3) Advertising on the home screen

4) Finders fee for app sign-ups

5) Licensing TV operating system to other smart TV companies

6) Billing, subscription, and management fees

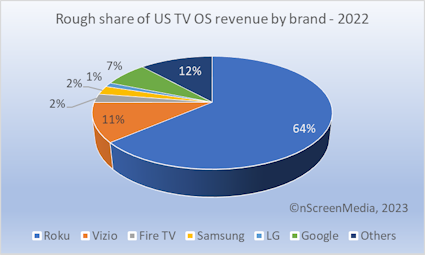

Big question #7: How large is the smart TV operating system market?

Quick answer: ≈ $4B

TV operating system revenue (% of total) according to nScreenMedia:

1) Roku – $2.7B (65%)

2) Vizio – $478M (11%)

3) Google – $250M (6%)

4) Samsung – $100M (2%)

5) Amazon – $100M (2%)

6) LG – $50M (1%)

7) Other – $500M (12%)

Big question #8: Why are so many companies fighting to control the smart TV operating system market?

Quick answer: Mobile has consolidated into two dominant players (Apple and Google), collecting 27% of all digital purchases on their devices. In 2022, Apple generated $23B in fees while Google made $13B. Combine this with a $100B TV market that will eventually be 100% streaming, and you have a massive opportunity.

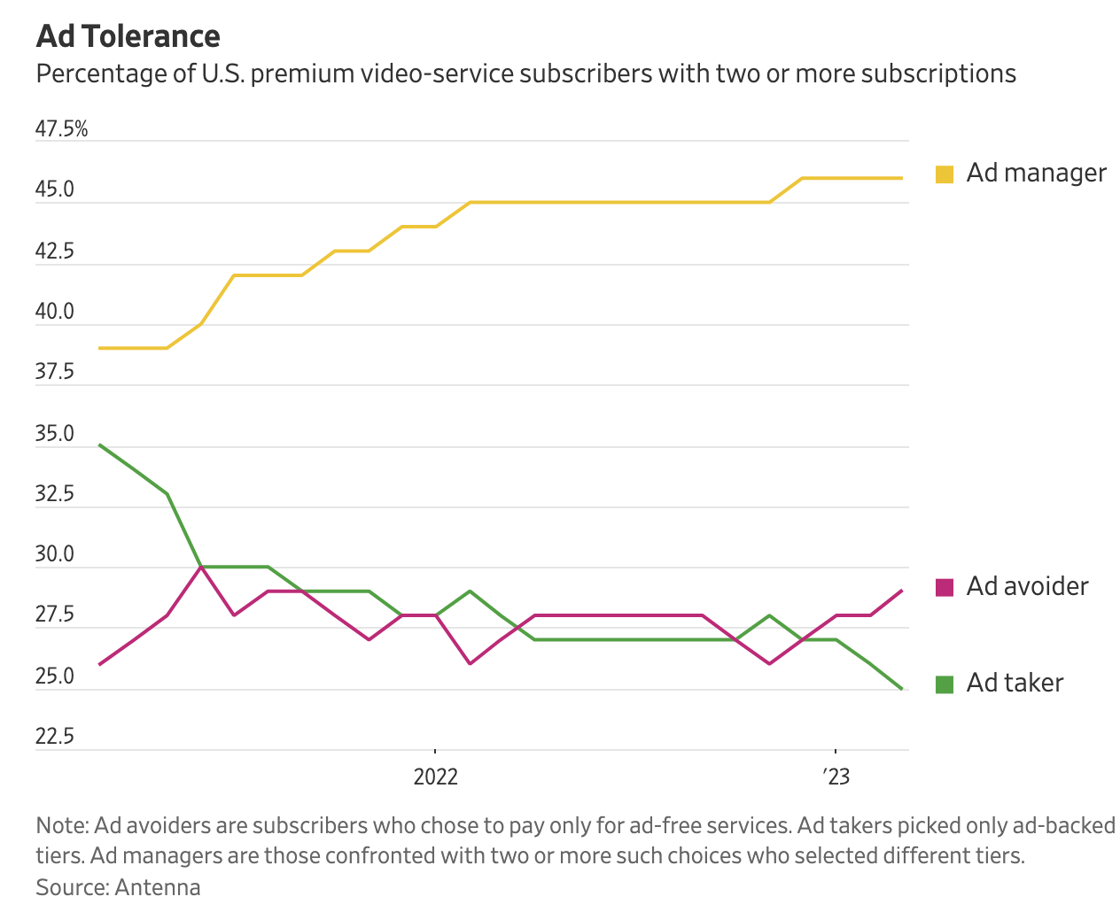

Big question #9: What share of consumers are open to ad-supported streaming?

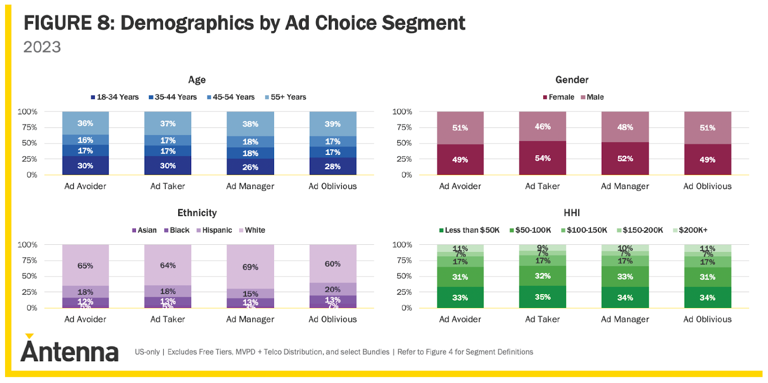

Ad tolerance share according to Antenna:

1) Ad manager (mix and match) – 46%

2) Ad avoider (always ad-free) – 29%

3) Ad taker (always ad-supported) – 25%

Dive deep: Antenna broke out these ad tolerance groups by age, gender, ethnicity, and household income.