Big news #1: Disney announced a new ad-supported tier for Disney+ will launch later this year

Big news #2: Netflix may follow suit and launch an ad-supported tier at a lower price.

Quote from Spencer Neumann – Chief Financial Officer @ Netflix:

“Never say never. It’s not like we have religion against advertising, to be clear.”

Big question #1: Why would Disney+ and Netflix launch ad-supported tiers?

Quick answer: Both services are reaching saturation in the U.S. An ad-supported tier allows them to reach a new segment through a lower monthly cost.

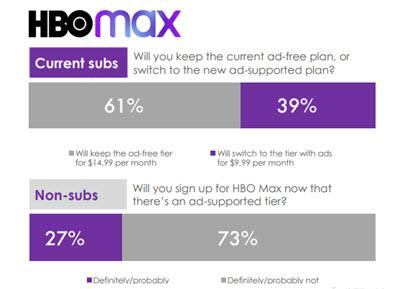

Big question #2: Won’t ad-supported plans cannibalize subscribers from higher-priced plans?

Quick answer: Not exactly. For example, 61% of existing HBO Max subscribers would stick with their current plan.

Quote from Ben Thompson – Author/Founder @ Stratechery:

“If you subscribe to the same Netflix tier you probably subscribe to today, you would never see ads. The purpose of the ads would be to expand Netflix’s geographic reach in lower income countries and to the marginal customer in saturated markets.”

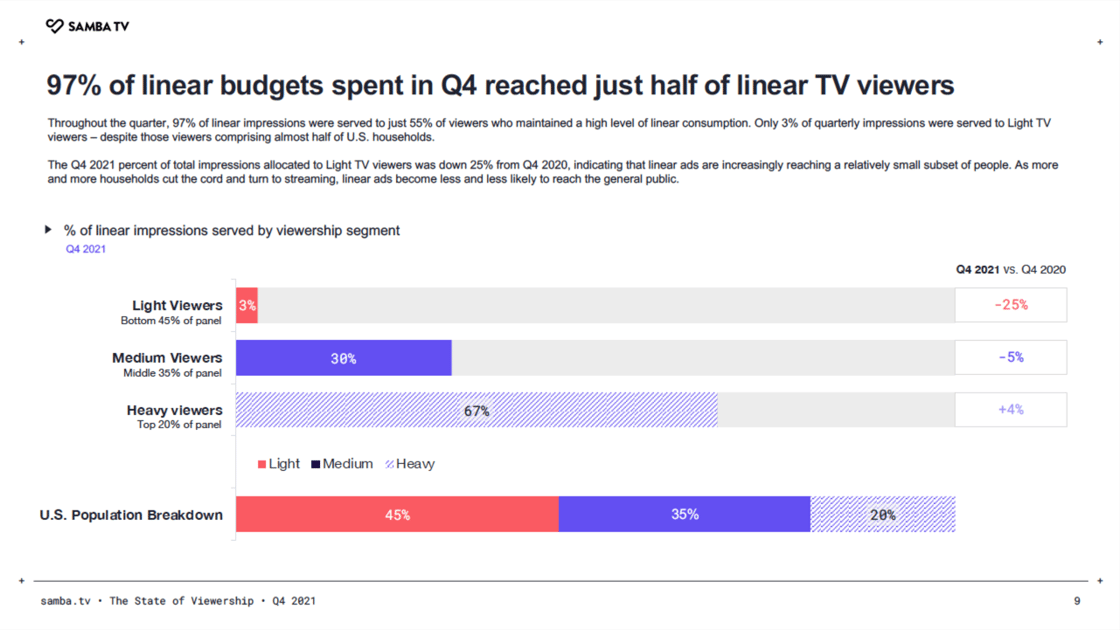

Big question #3: Will there be enough demand from advertisers?

Quick answer: Yes. A large share of consumers is difficult to reach with linear TV.

Share of linear TV impressions by consumption group (share of total) according to Samba TV:

1) Light TV (45%) – 3%

2) Medium TV (35%) – 30%

3) Heavy TV (20%) – 67%

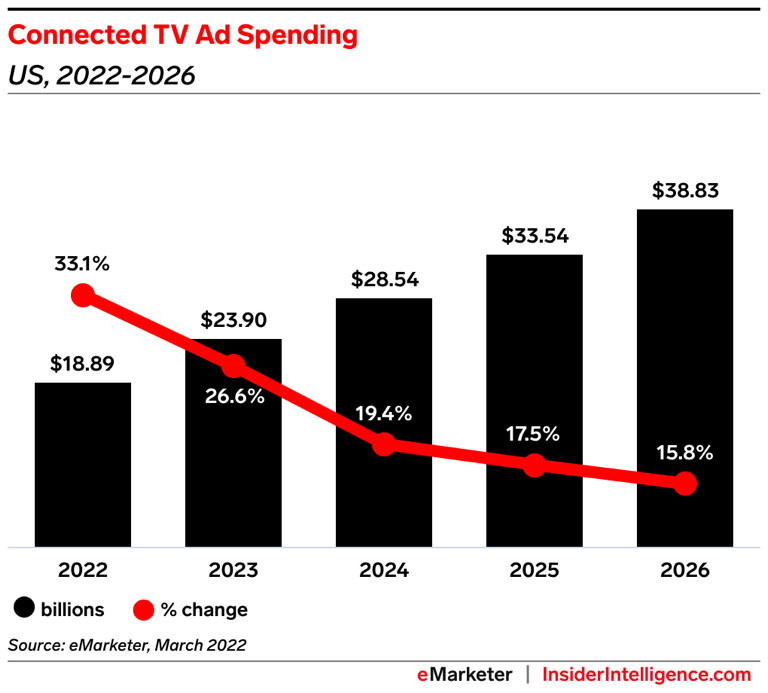

Big question #4: How large is the ad-supported streaming (AVOD/FAST) market?

Quick answer: Unclear, but we can use the CTV advertising market as a proxy.

Connected TV ad spend (YoY growth) according to eMarketer:

1) 2017 – $3B

2) 2018 – $4B (↑ 65%)

3) 2019 – $6B (↑ 48%)

4) 2020 – $9B (↑ 41%)

5) 2021 – $14B (↑ 57%)

6) 2022P – $19B (↑ 33%)

7) 2023P – $24B (↑ 27%)

8) 2024P – $29B (↑ 19%)

9) 2025P – $34B (↑ 18%)

10) 2026P – $39B (↑ 16%)

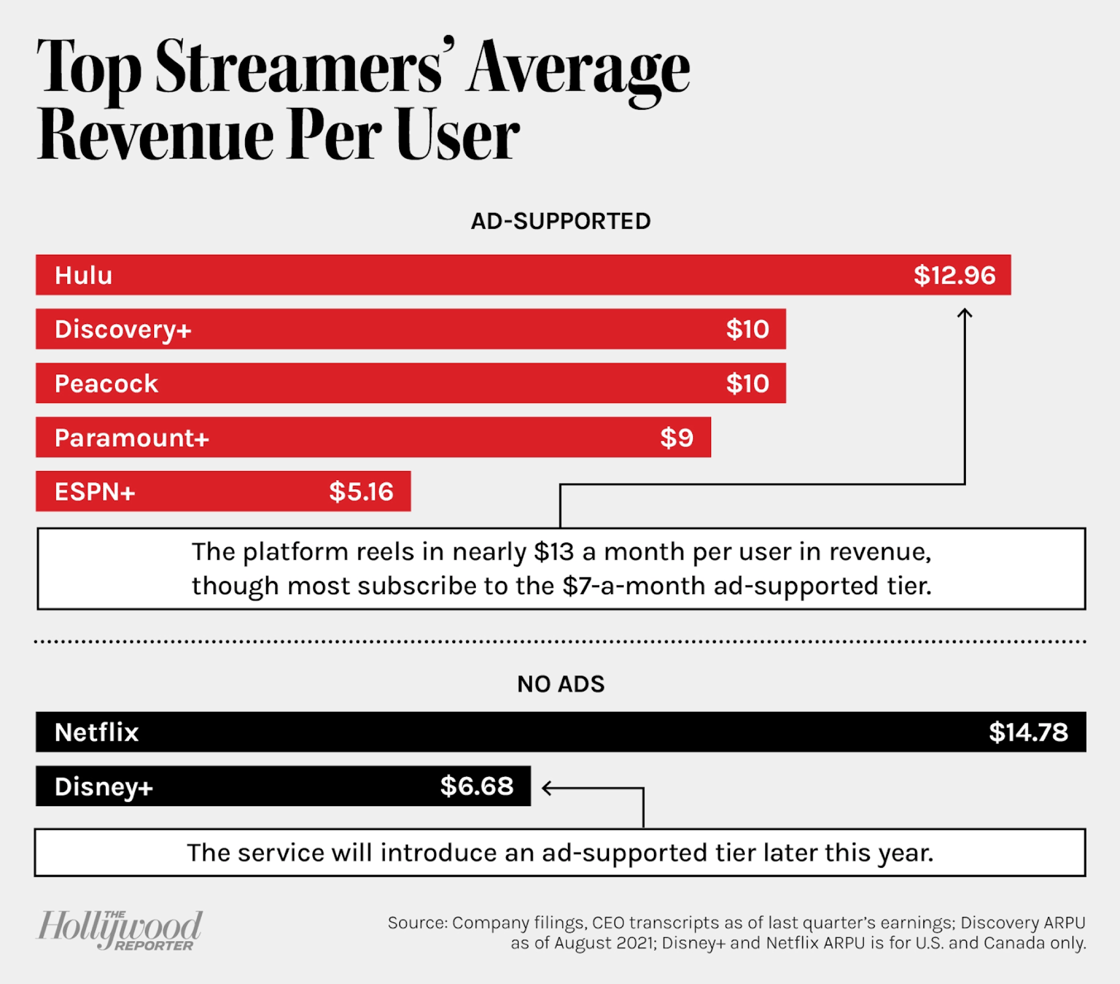

Big question #5: Who are the major players in ad-supported streaming?

Current:

1) Hulu

2) YouTube

3) Roku

4) Pluto TV

5) Tubi

New arrivals:

1) WarnerBros Discovery

2) Hulu w/ Disney+

3) Pluto TV w/ Paramount+

4) Peacock

5) Amazon

6) Netflix???

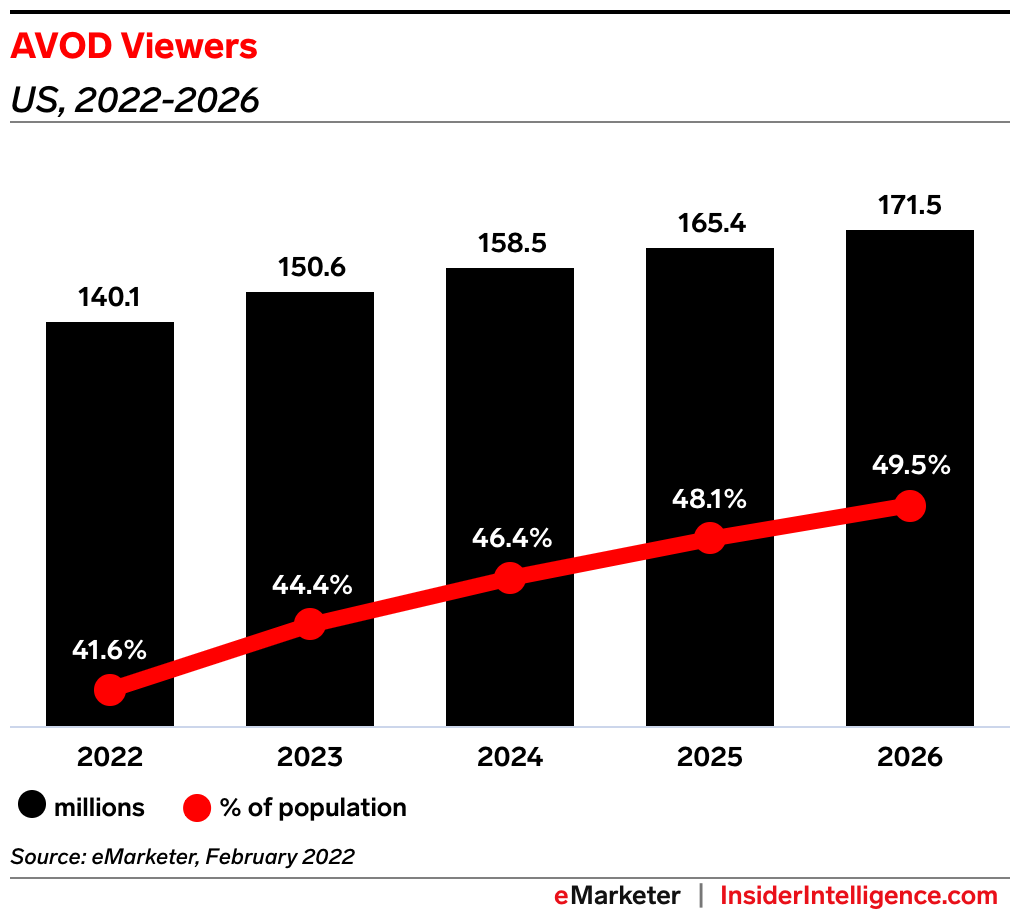

Big question #6: How many people in the U.S. watch ad-supported streaming?

Ad-supported streaming viewers (YoY growth) according to eMarketer:

1) 2018 – 60M

2) 2019 – 84M (↑ 39%)

3) 2020 – 106M (↑ 31%)

4) 2021 – 129M (↑ 18%)

5) 2022P – 140M (↑ 9%)

6) 2023P – 151M (↑ 7%)

7) 2024P – 159M (↑ 5%)

8) 2025P – 165M (↑ 4%)

9) 2026P – 171M (↑ 4%)

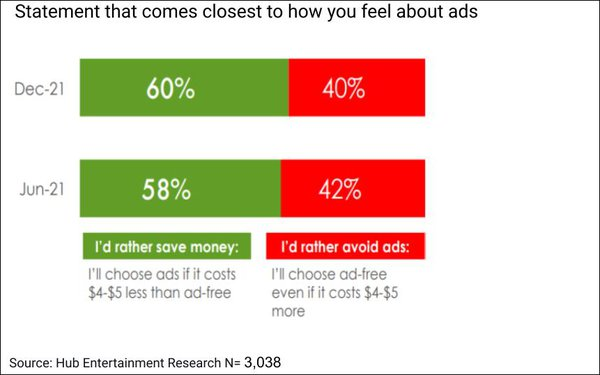

Big question #7: Why would consumers choose an ad-supported plan?

Quick answer: Lower cost. 60% would choose ad-supported plans if the monthly price were $4 – $5 less.

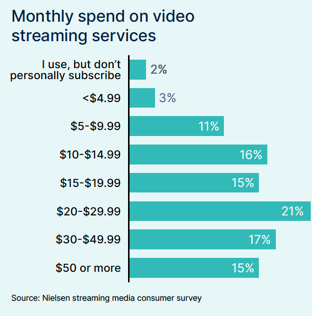

Why this matters: 53% of streaming households are already paying $20+ per month. Each streamer is banking on higher prices to offset increased content costs.

Flashback: Who’s Going To Pay For All These Shows?

Outstanding questions:

1) What is an acceptable ad load for consumers in streaming?

2) Are marketers willing to pay higher CPMs for streaming advertising that is targeted and/or measurable?

3) Can an ad-supported service without subscriptions support high production original programming?