Nine big questions re: WarnerBros. Discovery:

1) Why is combining Discovery+ and HBO Max a big deal?

2) When will the combined service rollout?

3) How many combined subscribers do the two services have?

4) Where is growth coming from?

5) How many ad-supported users does each service have?

6) What share of total TV/streaming time does HBO Max account for?

7) What does an HBO Max or Discovery+ consumer look like?

8) How much does WarnerBros. Discovery spend on content?

9) Is the strategy for the combined entity changing?

Big question #1: Why is combining Discovery+ and HBO Max a big deal?

Quick answer: It combines two major streaming trends (consolidation and bundles).

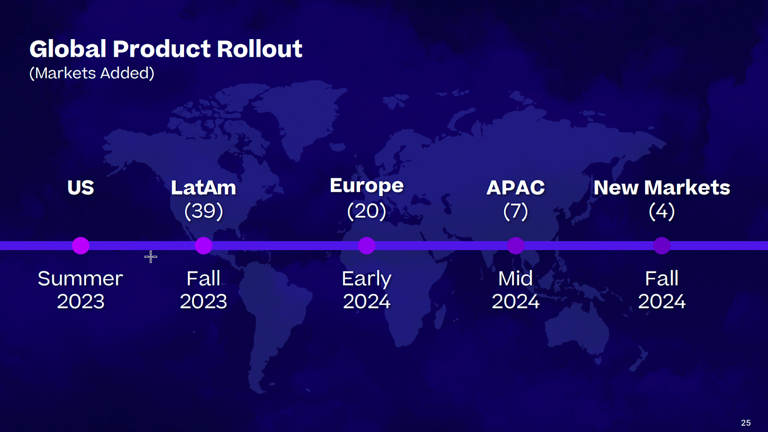

Big question #2: When will the combined service rollout?

Quick answer: Summer 2023 for the U.S.

Big question #3: How many combined subscribers do the two services have?

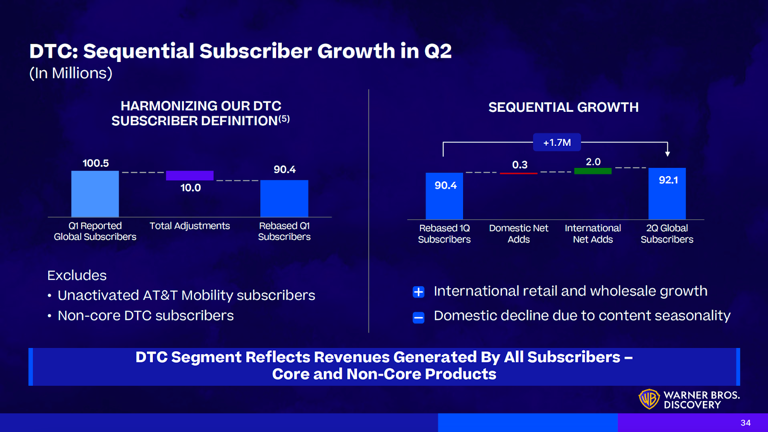

WarnerBros. Discovery streaming subscribers (QoQ growth):

1) 2022-Q1 – 90.4M

2) 2022-Q2 – 92.1M (↑ 2%)

Big question #4: Where is growth coming from?

Quick answer: International added 2.0M subscribers while the U.S. lost 300K.

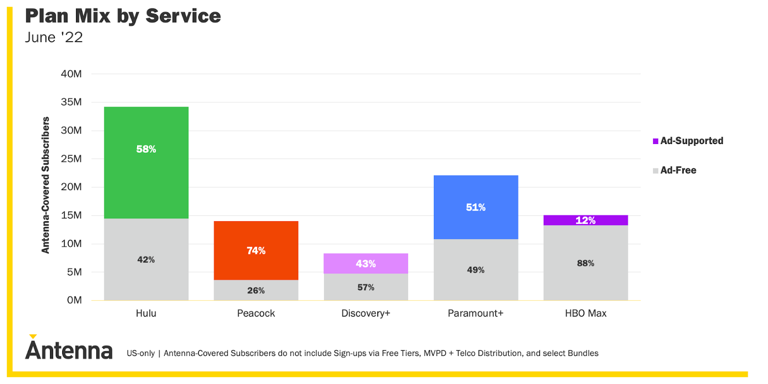

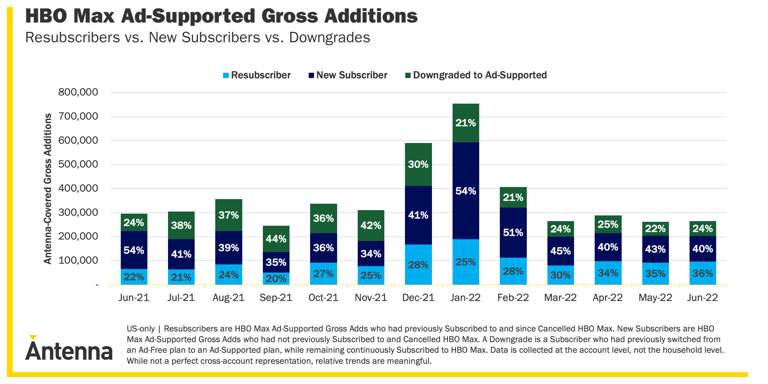

Big question #5: How many ad-supported users does each service have?

Ad-supported share of subscriber base according to Antenna:

1) Discovery+ – 43%

2) HBO Max – 12%

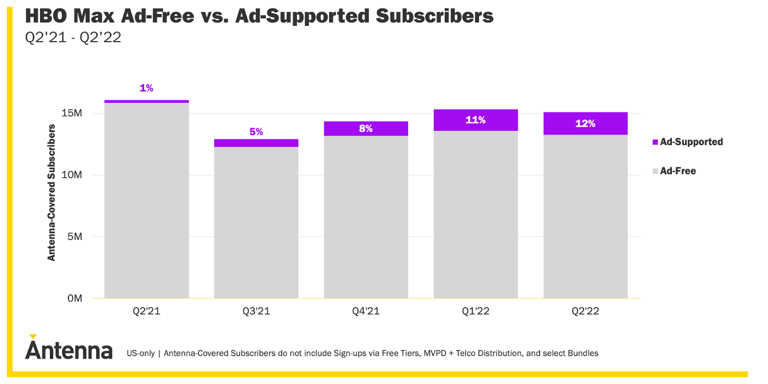

FYI: Ad-supported accounted for only 1% of the HBO Max user base in 2021-Q2.

Source of HBO Max ad-supported sign-ups:

1) New subscriber – 44%

2) Downgrade – 29%

3) Resubscriber – 27%

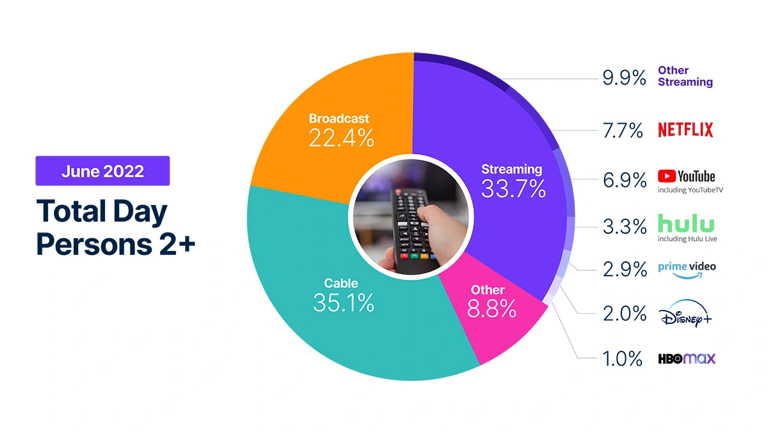

Big question #6: What share of total TV/streaming time does HBO Max account for?

Quick answer: HBO Max accounts for 1% of total TV time and 3% of streaming TV time.

Big question #7: What does an HBO Max or Discovery+ consumer look like?

Interesting: HBO Max skews more male and older (40+) with movies and younger (Gen Z) with series, according to Julia Alexander and Parrot Analytics.

Podcast: Julia Alexander on the Impact of Ad-Supported Streaming

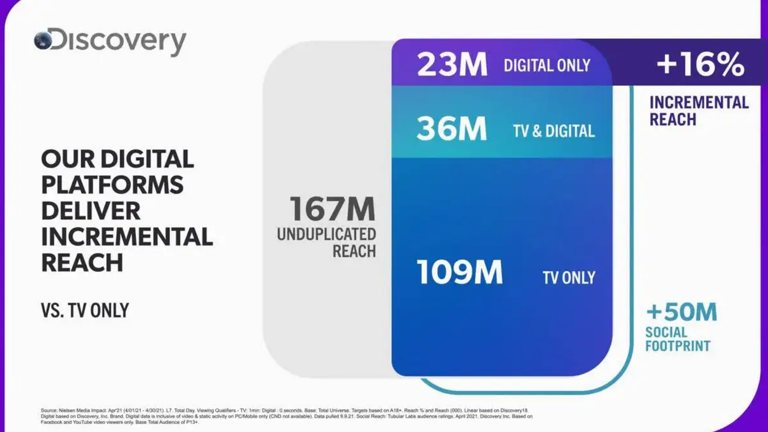

Discovery viewer share by screen (of total):

1) TV only – 109M (65%)

2) TV + Digital – 36M (21%)

3) Digital only – 23M (14%)

Big question #8: How much does WarnerBros. Discovery spend on content?

Estimated U.S. content spend for WarnerBros. Discovery (YoY growth) according to Wells Fargo:

1) 2019 – $19.8B

2) 2020 – $18.0B (↓ 9%)

3) 2021 – $20.7B (↑ 15%)

4) 2022P – $22.4B (↑ 8%)

5) 2023P – $24.0B (↑ 7%)

6) 2024P – $25.2B (↑ 5%)

7) 2025P – $26.2B (↑ 4%)

Big question #9: Is the strategy for the combined entity changing?

Quick answer: Yes. In short, they are moving away from a “win at all costs” mindset with streaming and focusing on maintaining their cash flow-producing assets (linear TV, movies, etc.).

Quote from Lightshed Partners:

“Streaming is still in the early days as linear TV fades at an accelerating rate. WBD stepping back from their streaming ambitions is not an indictment of streaming’s future nor the long-term TAM of streaming. Rather, it is the harsh reality that WBD has no choice. As their huge basic cable network portfolio erodes at an accelerating rate along with the rest of the legacy media industry, WBD needs to find new ways of generating cash, even if that means sacrificing their future strategically.”

Why this matters: The cost of producing streaming content and acquiring subscribers has risen to a point where profitability is challenging in the near term. A company that survives will either play for the future (streaming subscribers, etc.) or protect its current cash cows (linear TV subscription fees, etc.). Splitting the difference is most likely a losing strategy.

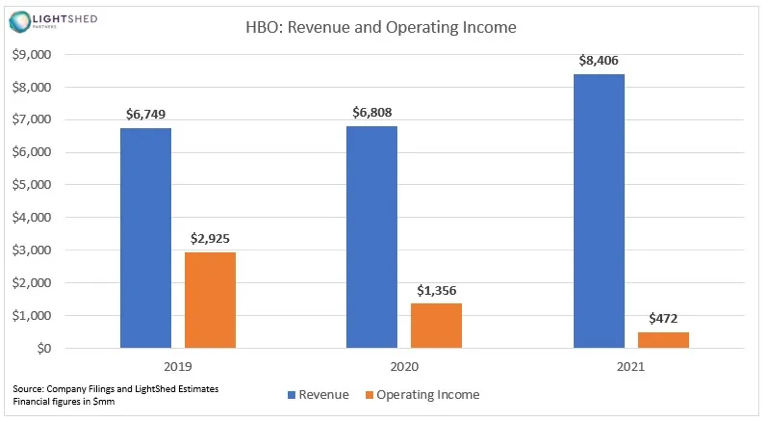

Change in HBO revenue vs. profit between 2019-21, according to Lightshed Partners:

1) Revenue – ↑ 25%

2) Profit – ↓ 84%

Worth your time: WarnerBros. Discovery’s “No Mas” as Cash Outweighs Streaming

Podcast: Rich Greenfield on Streaming’s Road Ahead

Quote from David Zaslav – CEO @ WarnerBros. Discovery:

“But the number – the number on the corner of JB’s desk and mine is the breakeven and the $1 billion. If we do that – I don’t really care what the number is. We are not in the business of trying to pick up every sub. We want to make sure we get paid. We get paid fairly. We have very high-quality content in many markets, we should be paid more because we are providing dramatically better content and more robust content and higher quality content. If the number is 122 and we are making over $1 billion, that is the number for us. We are going to grow subs significantly, but we want to run – we want to drive profitability and free cash flow.”

Quote from Entertainment Strategy Guy:

“Partly, David Zaslav has looked at the streaming prize and didn’t see a prize to be won at all costs. Zaslav knows streaming is the future, but it’s a lower margin and potentially lower revenue future. He wants to make as much money from linear as he can, while boosting the margins on streaming in the meantime. I would also add he has a pretty rough balance sheet (with $50 billion in debt and earnings that are shrinking, not growing) and pretty high expectations (from the board he convinced to buy WarnerBros.) so he has a lot of work to do.”

“Moreover, I generally believe the “death of linear TV” is exaggerated, and Zaslav is trying to balance the transition between mediums while maximizing revenues. If his bet is right—say linear TV takes 20 years to “die” or a combination of vMVPDs/FASTS replace a good chunk of that revenue—then he has the right strategy.”

Worth your time: WarnerBros. Discovery Sets a New Direction…Kind Of

Outstanding questions:

1) Will enough customers find value in HBO Max and Discovery+ for a combined offering to succeed?

2) What other streaming services will join forces?