.gif?width=960&upscale=true&name=giphy%20(11).gif)

Six big questions re: how often we cancel streaming services:

1) What is churn?

2) How many subscribers cancel their service each month?

3) Why is reducing churn so important?

4) Which streaming services have the lowest churn rate?

5) How does the churn rate for streaming compare to other industries?

6) How does churn impact a customer’s lifetime value to a streaming service?

Big question #1: What is churn?

Quick answer: Churn is the percentage of streaming subscribers that cancel.

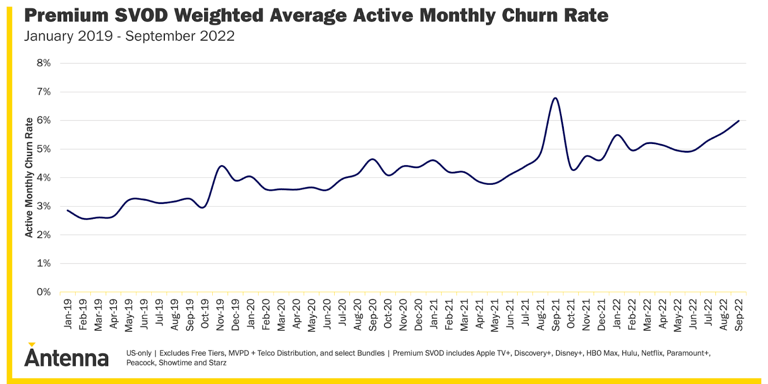

Big question #2: How many subscribers cancel their service each month?

Average monthly churn rate through September (YoY growth) according to Antenna:

1) 2019 – 3.2%

2) 2020 – 4.0% (↑ 25%)

3) 2021 – 4.5% (↑ 13%)

4) 2022 – 5.8% (↑ 29%)

Big question #3: Why is reducing churn so important?

Quick answer: It takes five to ten months for streaming services to break even after they pay $50+ to get new customers (CAC).

Quote from Doug Shapiro – Former Chief Strategy Officer @ Turner Broadcasting:

“Although none of the streamers disclose it, churn may be the industry’s biggest problem…

Stubbornly high churn may render streaming permanently unprofitable for some streamers, even at scale. Although streaming is currently unprofitable for the big media companies, most expect it will become profitable as the business matures. If churn stays high this may prove wrong.”

Flashback #1: Antenna Breaks Down Streaming Between the Lines

Flashback #2: Does More Content Actually Mean Less Churn?

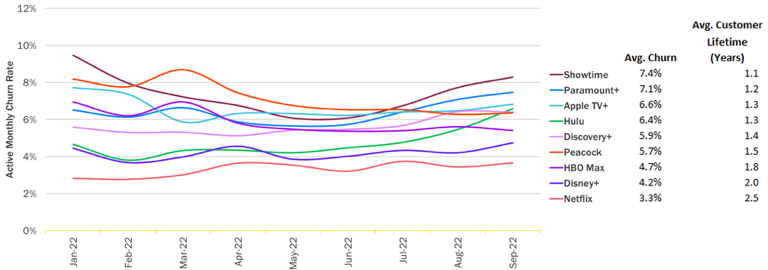

Big question #4: Which streaming services have the lowest churn rate?

Average monthly churn rate in 2022 by streaming service:

1) Netflix – 3.3%

2) Disney+ – 4.2%

3) HBO Max – 4.7%

4) Peacock – 5.7%

5) Average – 5.8%

6) Discovery+ – 5.9%

7) Hulu – 6.4%

8) Apple TV+ – 6.6%

9) Paramount+ – 7.1%

10) Showtime – 7.4%

Quick math for industry average churn:

1) Monthly churn – 15.6%

2) Customer lifetime – 6 months

3) Monthly subscription fee – ≈ $9

4) Lifetime value (LTV) – $59

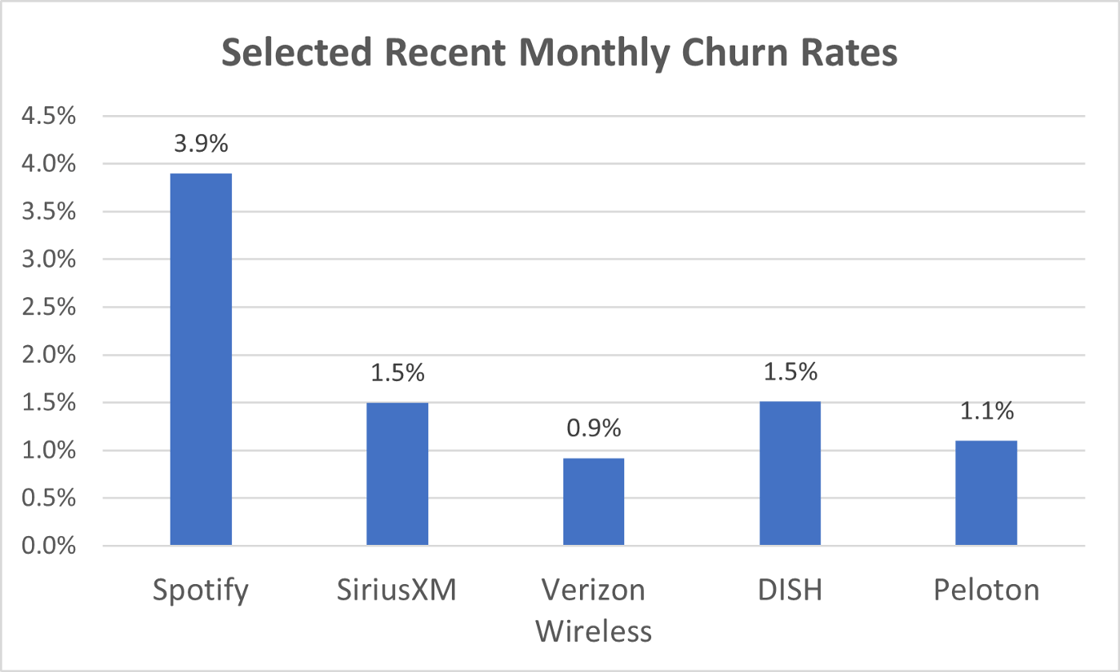

Big question #5: How does the churn rate for streaming compare to other industries?

Quick answer: It is much higher.

Churn rate by industry:

1) Wireless phone service (Verizon) – 0.9%

2) Digital fitness (Peloton) – 1.1%

3) Satellite TV (DISH) – 1.5%

4) Satellite radio (SiriusXM) – 1.5%

5) Streaming radio (Spotify) – 3.9%

6) Streaming video (average) – 15.6%

Why this matters: The average customer lifetime for wireless phone service is 111 months, while streaming video is only 6 months.

Quote from Doug Shapiro – Former Chief Strategy Officer @ Turner Broadcasting:

“It happened because of much lower “switching costs,” the costs to cease using a product or service. One of the defining characteristics of the Internet is that it has shifted power to consumers, in the form of greater competition (as it has reduced entry barriers), easier price discovery and lower switching costs. Streaming is no different. But while it has long been clear that streaming has much lower switching costs than traditional pay TV, it was impossible to predict with precision how this would effect churn. Turns out that it effects it a lot.”

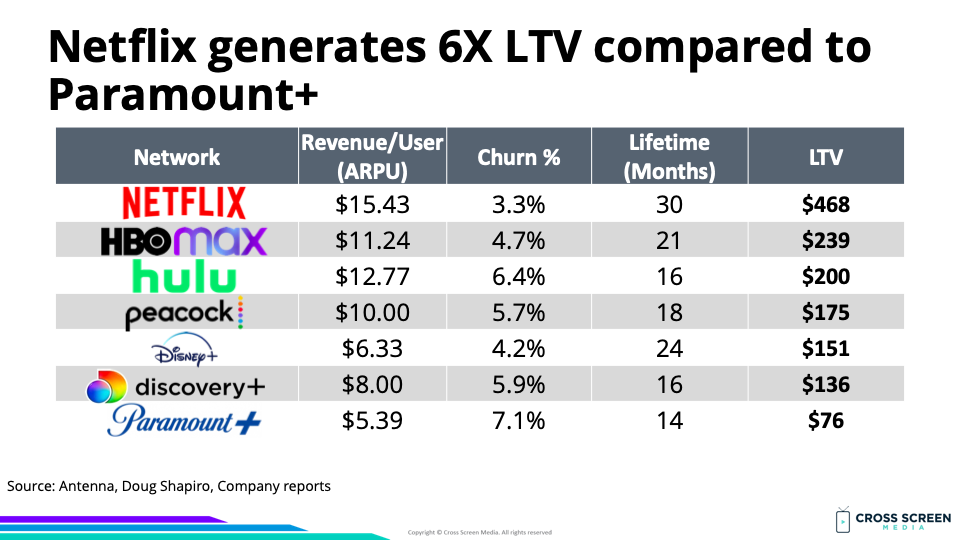

Big question #6: How does churn impact a customer’s lifetime value to a streaming service?

Quick answer: Higher churn leads to lower lifetime values.

More revenue → more content → more customers → lower churn → more revenue

Lifetime value (LTV) for various streaming services:

1) Netflix – $468

2) HBO Max – $239

3) Hulu – $200

4) Peacock – $175

5) Disney+ – $151

6) Discovery+ – $136

7) Paramount+ – $76