Nine big questions re: ad-supported streaming:

1) How many U.S. consumers watch ad-supported streaming?

2) What share of total TV time comes from streaming?

3) What share of streaming subscribers are on ad-supported plans?

4) What share of streaming time is ad-supported?

5) How large is the ad-supported streaming market?

6) What share of the total TV ad market comes from streaming?

7) What share of total TV ad impressions comes from streaming?

8) Who are the major players in ad-supported streaming?

9) How do networks increase ad-supported revenue?

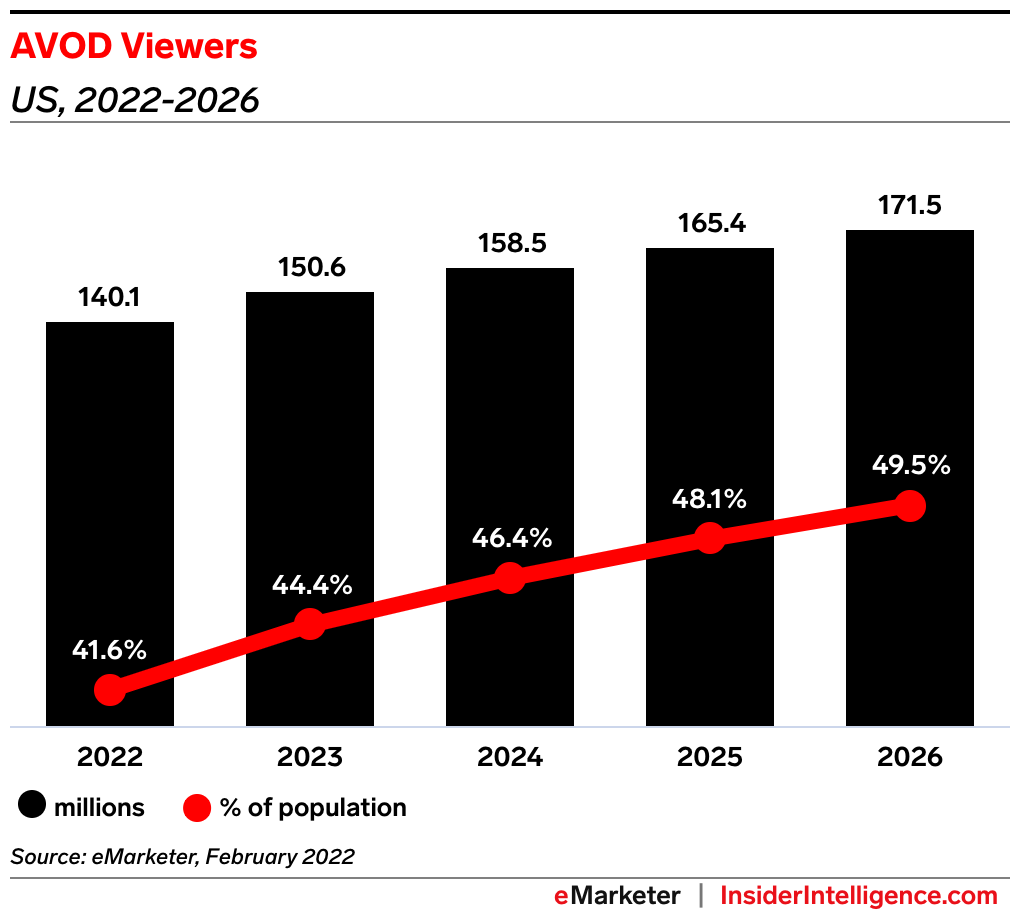

Big question #1: How many U.S. consumers watch ad-supported streaming?

Ad-supported streaming viewers (YoY growth) according to eMarketer:

1) 2018 – 60M

2) 2019 – 84M (↑ 39%)

3) 2020 – 106M (↑ 31%)

4) 2021 – 129M (↑ 18%)

5) 2022P – 140M (↑ 9%)

6) 2023P – 151M (↑ 7%)

7) 2024P – 159M (↑ 5%)

8) 2025P – 165M (↑ 4%)

9) 2026P – 171M (↑ 4%)

Share of U.S. HH with streaming devices according to Leichtman Research Group:

1) 2012 – 38%

2) 2020 – 80%

3) 2022 – 87%

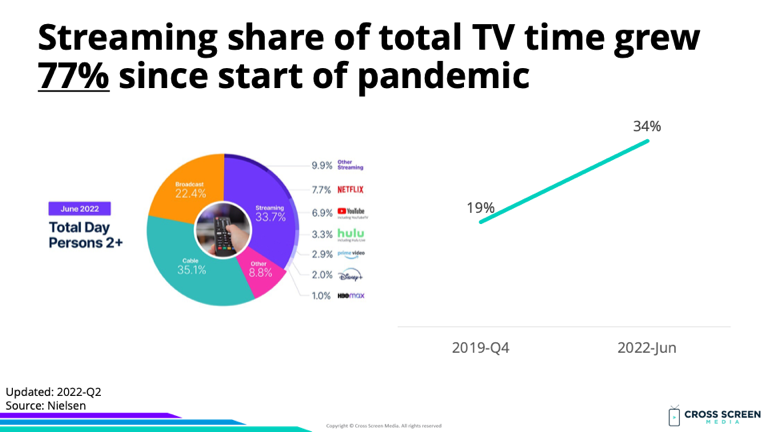

Big question #2: What share of total TV time comes from streaming?

Streaming share of total TV time (YoY growth):

1) 2019-Q4 – 19%

2) 2022-Jun – 34% (↑ 77%)

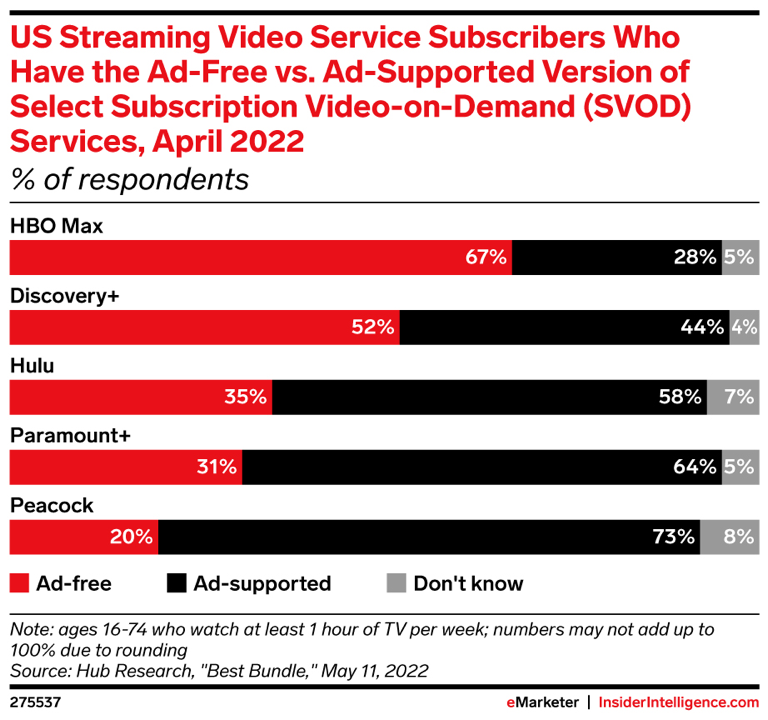

Share of subscribers on ad-supported plans according to Hub Research Group:

1) Peacock – 73%

2) Paramount+ – 64%

3) Hulu – 58%

4) Discovery+ – 44%

5) HBO Max – 28%

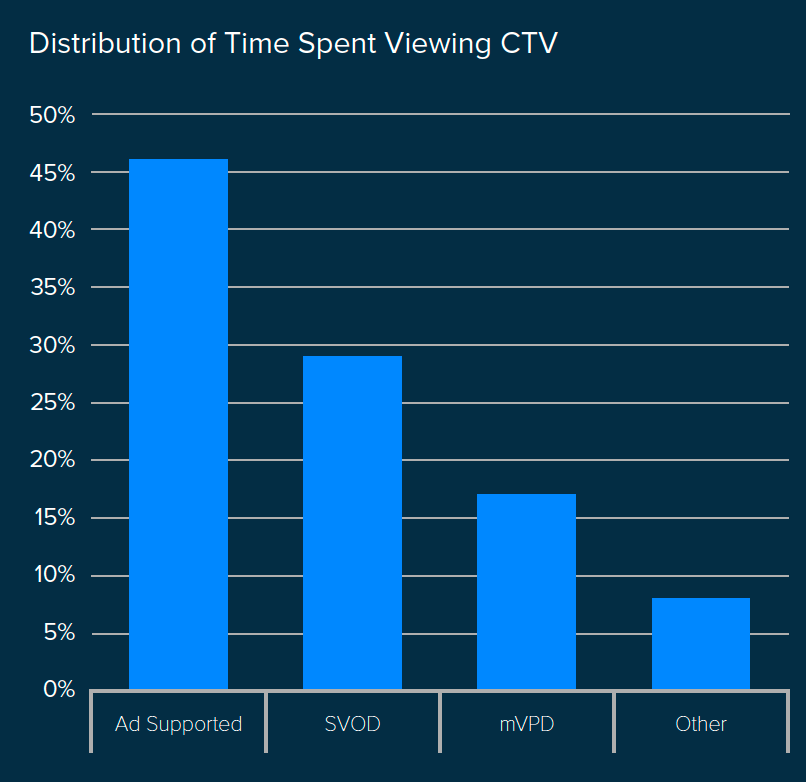

Big question #4: What share of streaming time is ad-supported?

Share of streaming time according to TVision:

1) Ad-supported – 46%

2) SVOD – 29%

3) Pay-TV – 17%

4) Other – 8%

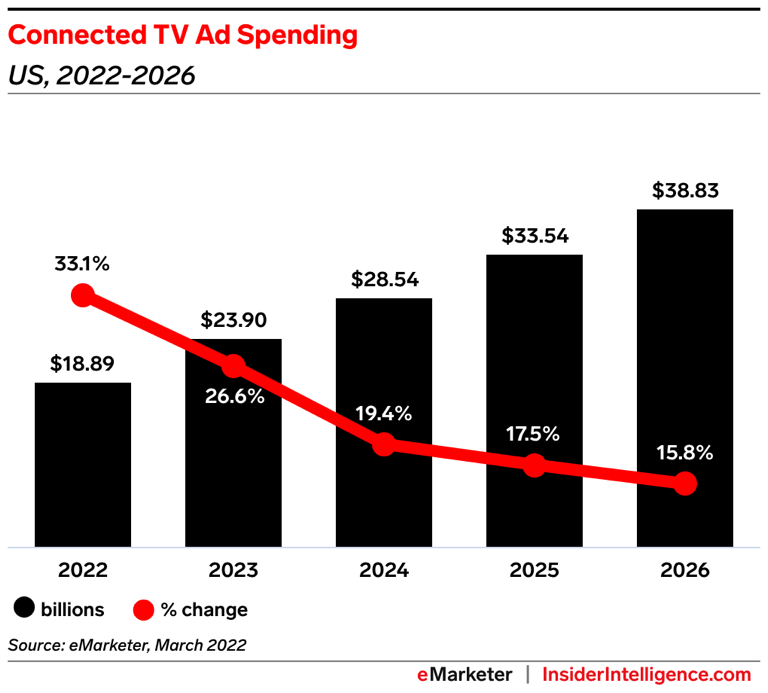

Big question #5: How large is the ad-supported streaming market?

Connected TV ad spend (YoY growth) according to eMarketer:

1) 2017 – $3B

2) 2018 – $4B (↑ 65%)

3) 2019 – $6B (↑ 48%)

4) 2020 – $9B (↑ 41%)

5) 2021 – $14B (↑ 57%)

6) 2022P – $19B (↑ 33%)

7) 2023P – $24B (↑ 27%)

8) 2024P – $29B (↑ 19%)

9) 2025P – $34B (↑ 18%)

10) 2026P – $39B (↑ 16%)

Big question #6: What share of the total TV ad market comes from streaming?

Connected TV share of total TV advertising:

1) 2020 – 13%

2) 2021 – 19%

3) 2022 – 22%

4) 2023 – 29%

5) 2024 – 31%

6) 2025 – 37%

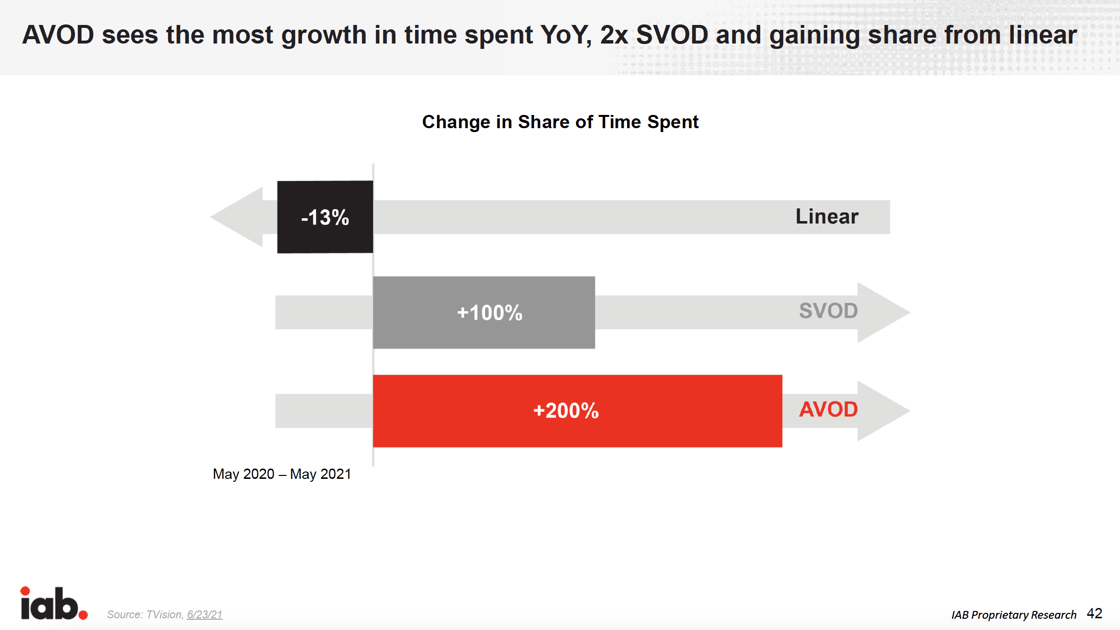

YoY growth rate in time spent according to the IAB:

1) Streaming (ad-supported) – ↑ 200%

2) Streaming (ad-free) – ↑ 100%

3) Linear TV – ↓ 13%

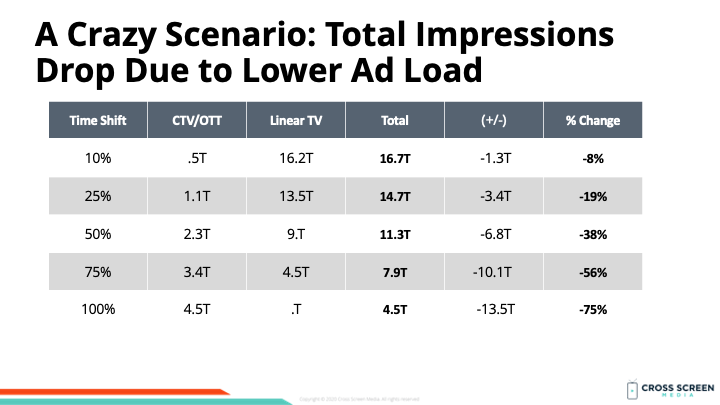

Big question #7: What share of total TV ad impressions comes from streaming?

Quick answer: ≈ 5%

Wow: If ≈ 25% of total TV time has shifted from linear to streaming, total TV ad impressions will drop by 19% (↓ 3.4T). We covered this topic @ RampUp NYC in 2019. Growing this market requires better ads that marketers are willing to pay more for.

Video: Building the Right Cross-Screen Media Mix | RampUp NY 2019 Conference

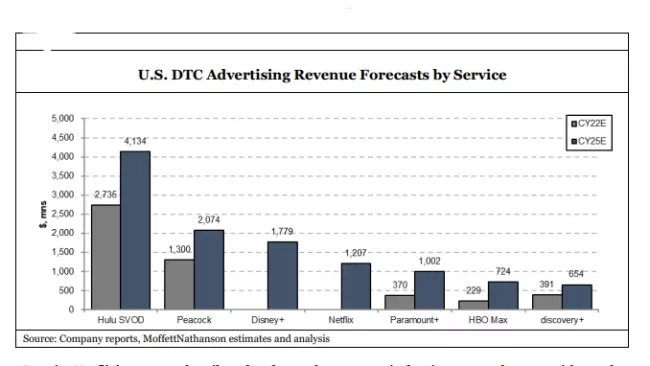

Big question #8: Who are the major players in ad-supported streaming?

Advertising revenue estimate in 2025 according to MoffettNathanson:

1) Hulu – $4.1B

2) Peacock – $2.1B

3) Disney+ – $1.8B

4) Netflix – $1.2B

5) Paramount+ – $1.0B

6) HBO Max – $724M

7) Discovery+ – $654M

Big question #9: How do networks increase ad-supported revenue?

Four ways a platform can increase ad revenue according to Eric Seufert:

1) Increase ad load

2) Increase users

3) Increase time spent/user

4) Increase value to the marketer, leading to higher ad prices

Outstanding questions:

1) Why do total TV ad impressions drop as streaming gains share of TV time?

2) What share of Netflix/Disney+ subscribers choose the ad-supported plan?