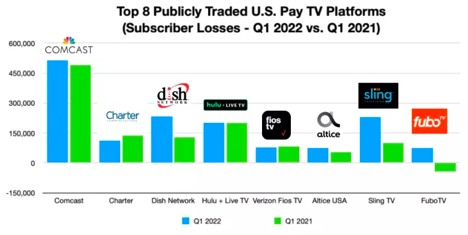

YoY change in pay-TV subscribers:

1) Traditional pay-TV – ↓ 4.7M

2) Streaming pay-TV – ↑ 939K

3) Total pay-TV – ↓ 3.7M

Total pay-TV subscriptions (YoY growth):

1) 2019-Q1 – 91.6M

2) 2020-Q1 – 87.1M (↓ 5%)

3) 2021-Q1 – 83.0M (↓ 5%)

4) 2022-Q1 – 78.7M (↓ 5%)

Traditional pay-TV subscriptions (YoY growth):

1) 2019-Q1 – 83.9M

2) 2020-Q1 – 77.5M (↓ 8%)

3) 2021-Q1 – 71.4M (↓ 8%)

4) 2022-Q1 – 66.7M (↓ 7%)

Streaming pay-TV subscriptions (YoY growth):

1) 2019-Q1 – 7.8M

2) 2020-Q1 – 9.6M (↑ 23%)

3) 2021-Q1 – 11.1M (↑ 16%)

4) 2022-Q1 – 12.0M (↑ 8%)

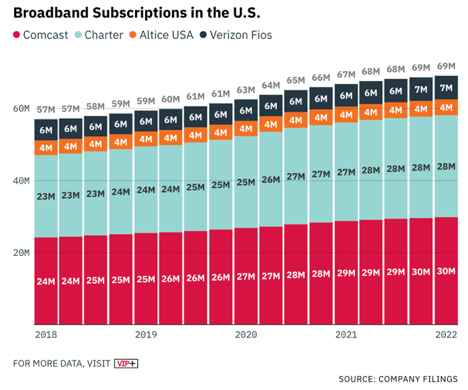

Total broadband subscriptions (YoY growth):

1) 2020-Q1 – 102.4M

2) 2021-Q1 – 107.0M (↑ 4%)

3) 2022-Q1 – 108.8M (↑ 2%)

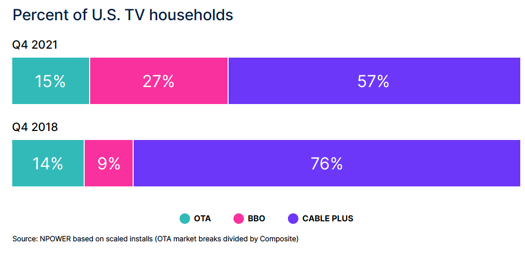

Broadband only share of TV homes according to Nielsen:

1) 2016 – 4%

2) 2018 – 9%

3) 2021 – 27%

Why this matters: Broadband service now reaches 30M more households than pay-TV. Broadband is a better business for cable/telco companies which will only grow in importance as the pay-TV universe approaches 50M households.

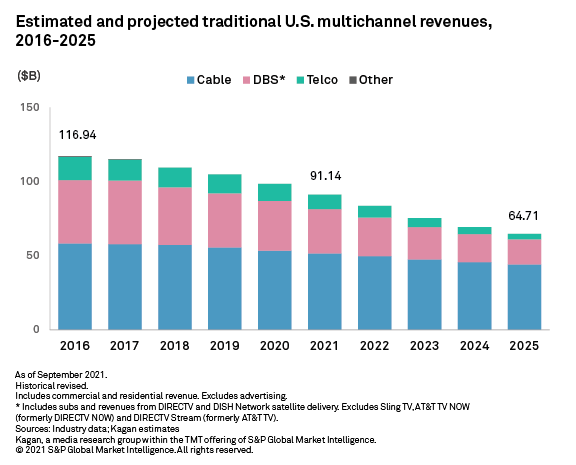

U.S. pay-TV revenue from subscriptions (% change) according to Kagan:

1) 2016 – $117B

2) 2021 – $91B (↓ 22%)

3) 2025 – $65B (↓ 29%)