Seven big questions re: the streaming decade:

1) How much time are we spending with streaming TV?

2) How many streaming TV devices are in the U.S.?

3) How large is the streaming TV ad market?

4) Why are advertisers shifting their budget to streaming TV?

5) Where is money coming from for streaming TV spend?

6) Do buyers plan linear or streaming TV first?

7) What are the top challenges for buying streaming TV advertising?

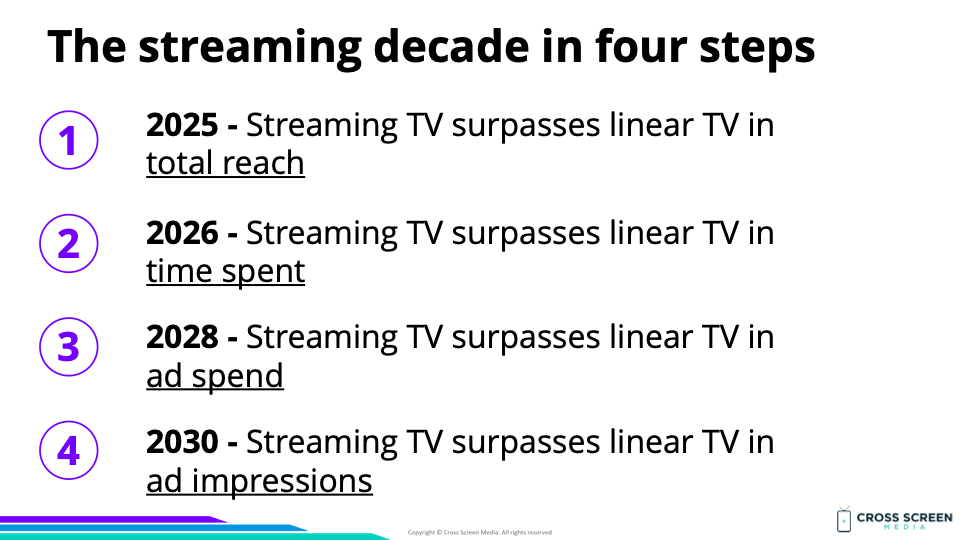

Setting the table: We are in the midst of a shift in consumption/advertising from linear TV to streaming. This shift will take over a decade to play out and will occur in the following four steps.

The streaming decade in four steps:

1) 2025 – Streaming TV surpasses linear TV in total reach

2) 2026 – Streaming TV surpasses linear TV in time spent

3) 2028 – Streaming TV surpasses linear TV in ad spend

4) 2030 – Streaming TV surpasses linear TV in ad impressions

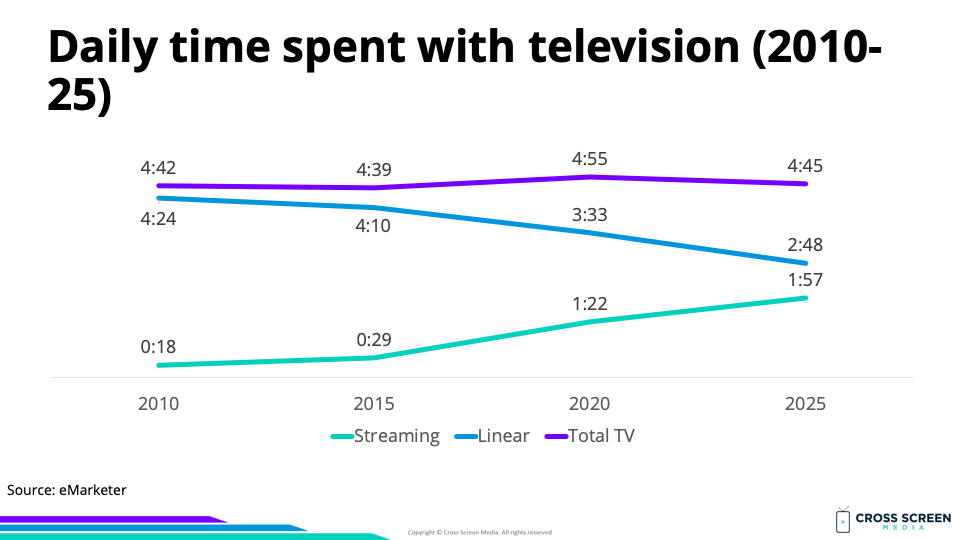

Big question #1: How much time are we spending with streaming TV?

Quick answer: 1h 51m per day.

Daily time spent with streaming TV according to eMarketer:

1) 2010 – 0h 18m

2) 2015 – 0h 29m

3) 2020 – 1h 22m

4) 2025P – 1h 57m

Big question #2: How many streaming TV devices are in the U.S.?

Quick answer: 345M

Share of streaming TV devices ( % of total) in the U.S. according to S&P Capital IQ:

1) Smart TVs – 225M (65%)

2) Streaming sticks – 86M (25%)

3) Streaming media players – 34M (10%)

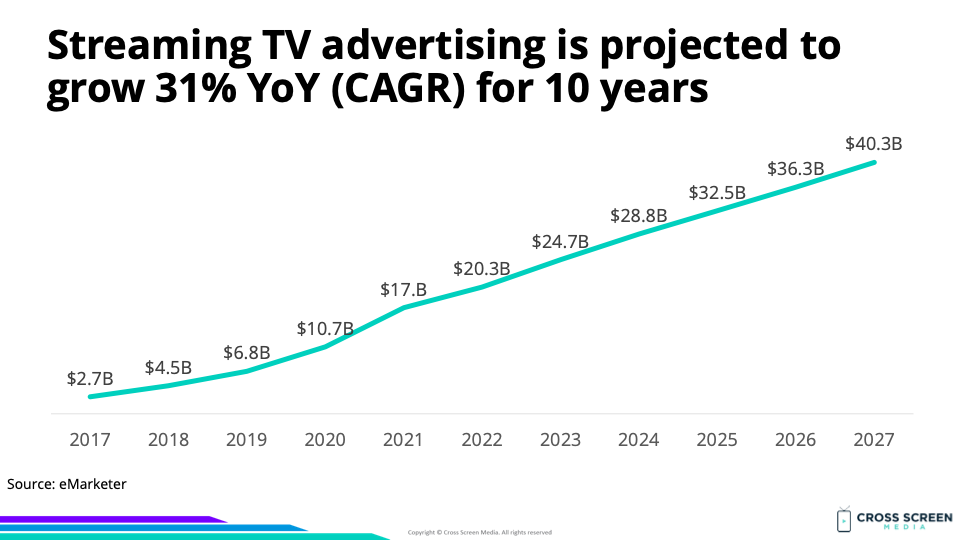

Big question #3: How large is the streaming TV ad market?

Quick answer: $25B in 2023.

Streaming TV advertising (YoY growth) according to eMarketer:

1) 2017 – $2.7B

2) 2018 – $4.5B (↑ 66%)

3) 2019 – $6.8B (↑ 51%)

4) 2020 – $10.7B (↑ 57%)

5) 2021 – $17.0B (↑ 58%)

6) 2022 – $20.3B (↑ 20%)

7) 2023P – $24.7B (↑ 22%)

8) 2024P – $28.8B (↑ 17%)

9) 2025P – $32.5B (↑ 13%)

10) 2026P – $36.3B (↑ 11%)

11) 2027P – $40.3B (↑ 11%)

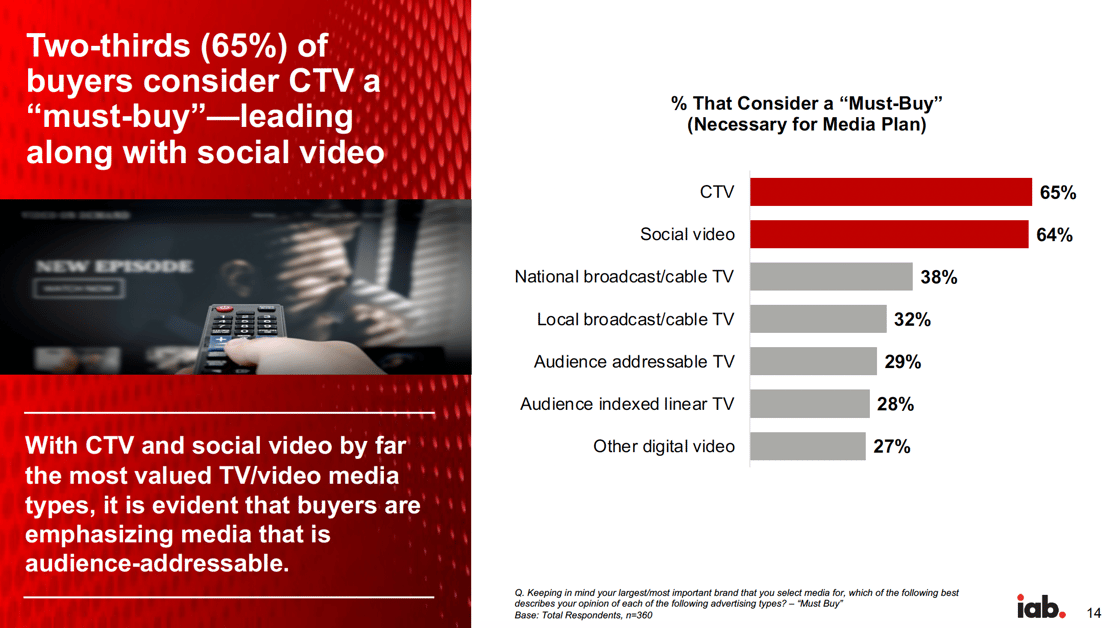

Share that considers each video ad format a must-buy:

1) CTV – 65%

2) Social video – 64%

3) National linear TV – 38%

4) Local linear TV – 32%

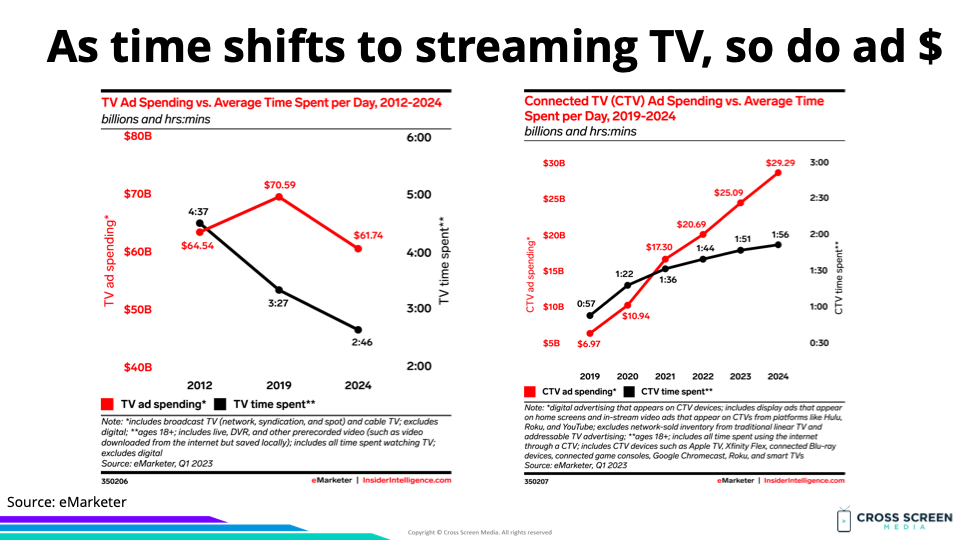

Bottom line: Advertisers will follow eyeballs. As time spent shifts from linear TV to streaming, so will ad $.

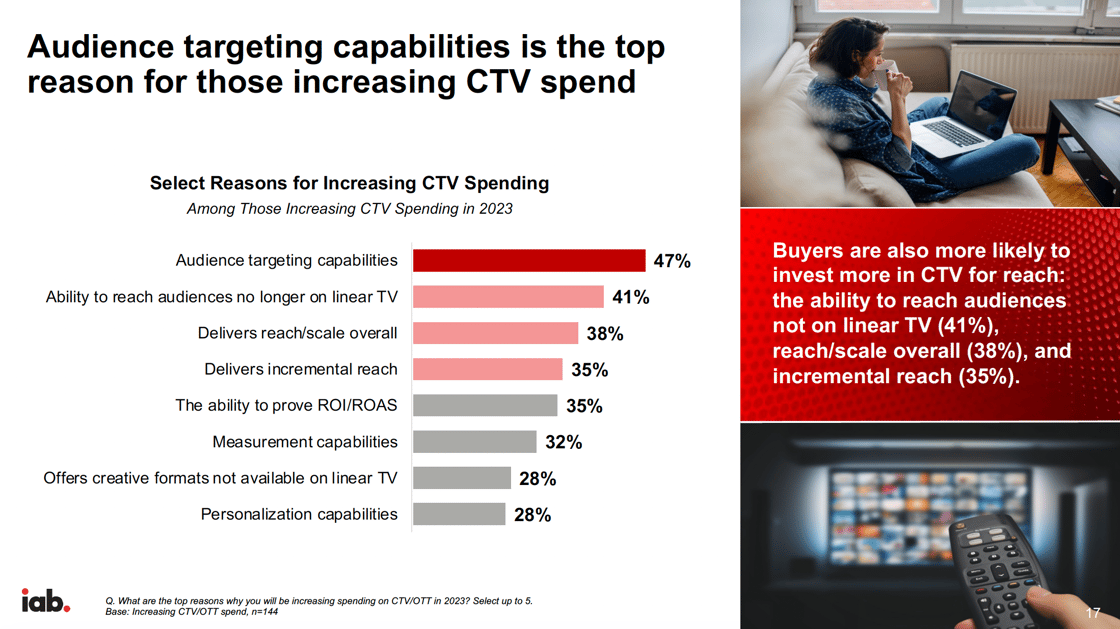

Big question #4: Why are advertisers shifting their budget to streaming TV?

Top reasons for increasing streaming TV ad spend according to the IAB:

1) Audience targeting – 47%

2) Reach non-TV audiences – 41%

3) Overall reach/scale – 38%

4) Incremental reach overall – 35%

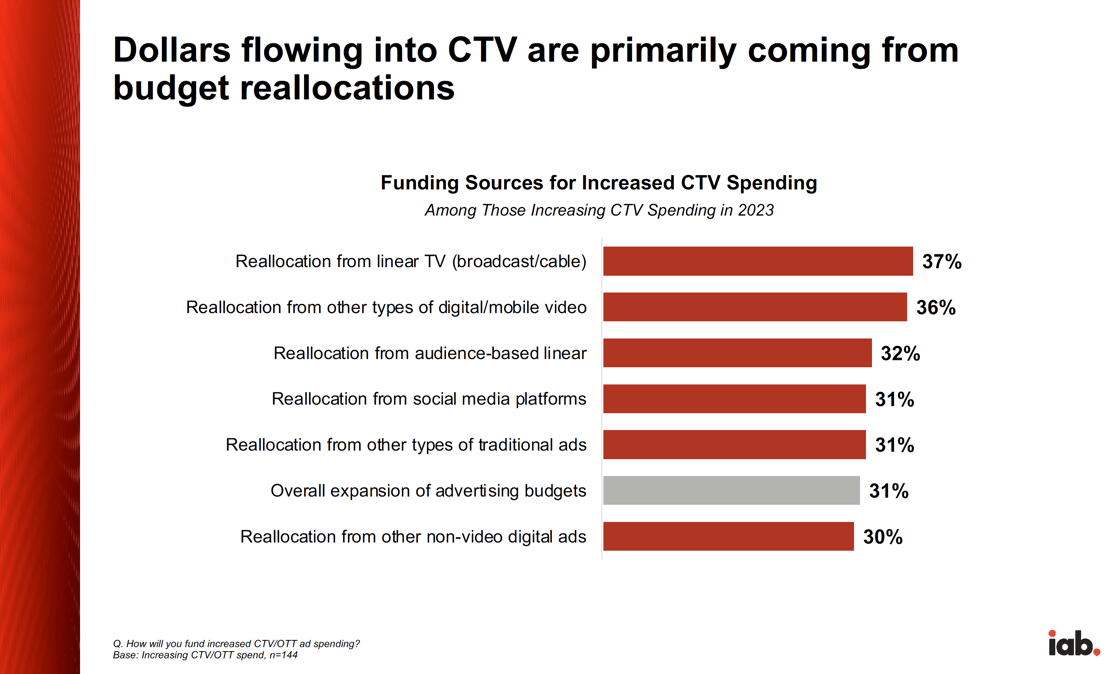

Big question #5: Where is money coming from for streaming TV spend

Quick answer: 37% plan to shift funds away from linear TV.

Big question #6: Do buyers plan linear or streaming TV first?

Quick answer: 51% plan linear first.

Which video ad format do buyers plan first according to Advertiser Perceptions:

1) Linear TV – 51%

2) Linear + Streaming TV together – 34%

3) Streaming TV – 15%

Quote from Nathan Hugenberger – Chief Technology Officer @ Known:

“CTV sort of lives in that middle ground, that Goldilocks world, and I think some advertisers may bring to it their legacy biases and their particular bent on things. Some people are bringing to this a legacy of thinking about TV and video in a very sort of old-school television way, and some people are coming to CTV and thinking about digital and thinking about performance where they’re expecting that click and [being] easy to measure using last-touch [attribution] and very simplistic methods.”

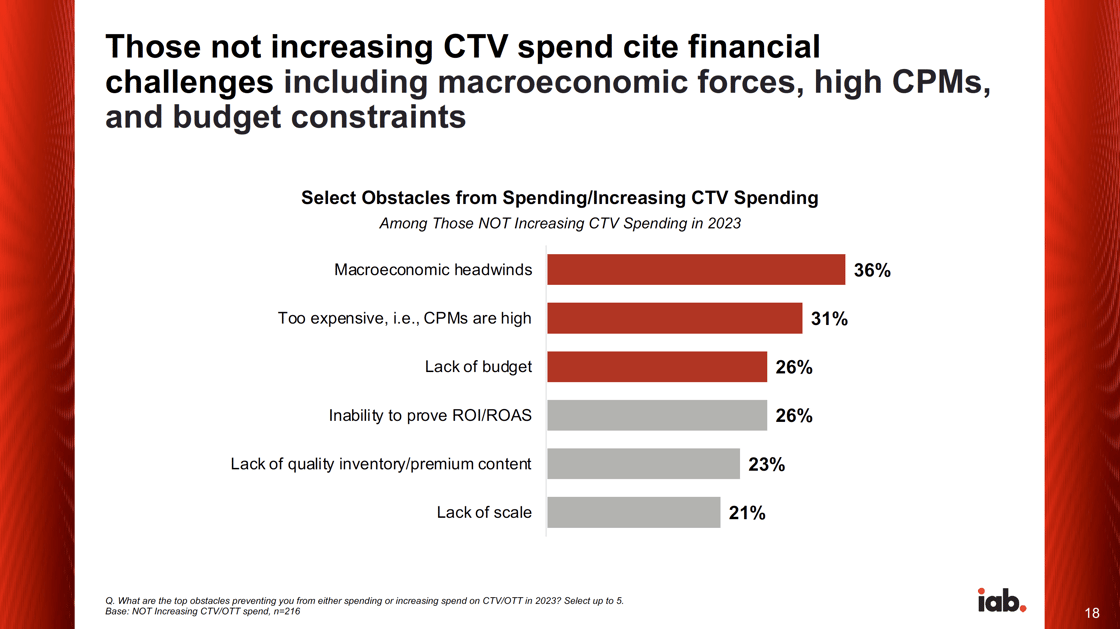

Big question #7: What are the top challenges for buying streaming TV advertising?

Top challenges for buying streaming TV advertising:

1) Macroeconomic headwinds – 36%

2) Too expensive – 31%

3) Lack of budget – 26%