Four big questions re: how we watch video:

1) How much video do we watch every day?

2) Is streaming growing as a share of total TV time?

3) Are all demographic groups watching less linear TV?

4) What happens to average TV ad frequency with a growing number of zero/low TV households?

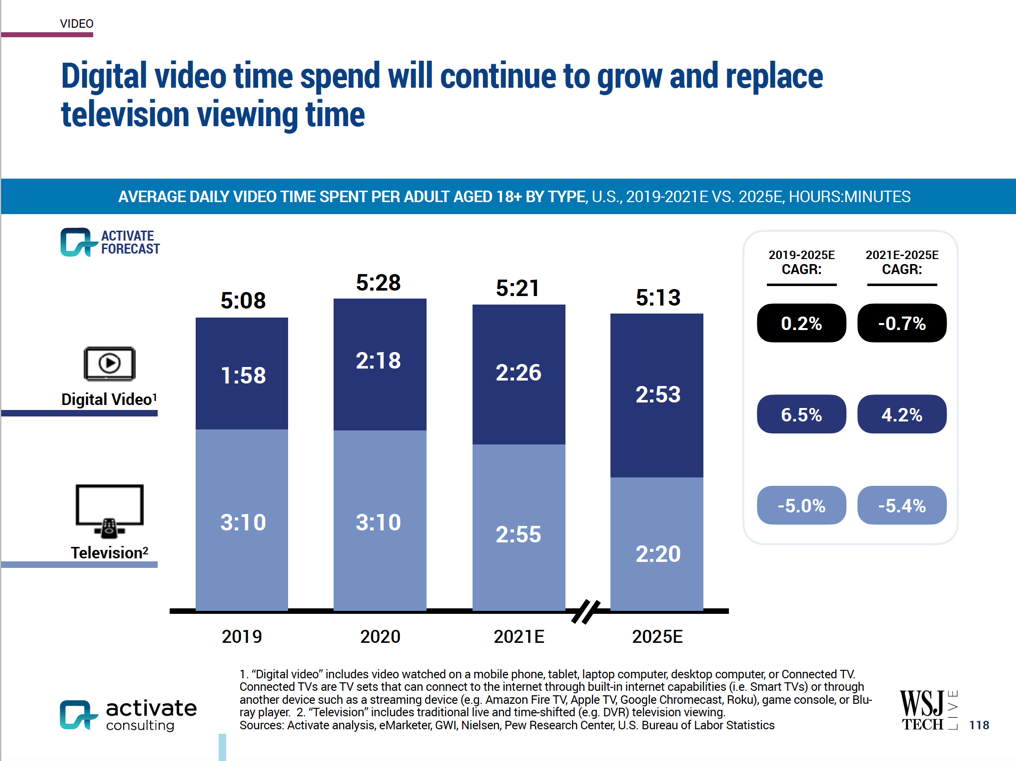

Big question #1: How much video do we watch every day?

Quick answer: 5+ hours

Average daily video time (YoY growth) according to Activate Consulting:

1) 2019 – 5h 8m

2) 2020 – 5h 28m (↑ 6%)

3) 2021 – 5h 21m (↓ 2%)

Why this matters: The total time we spend with video is not growing. The fight for attention/share between linear TV and streaming is a zero-sum game.

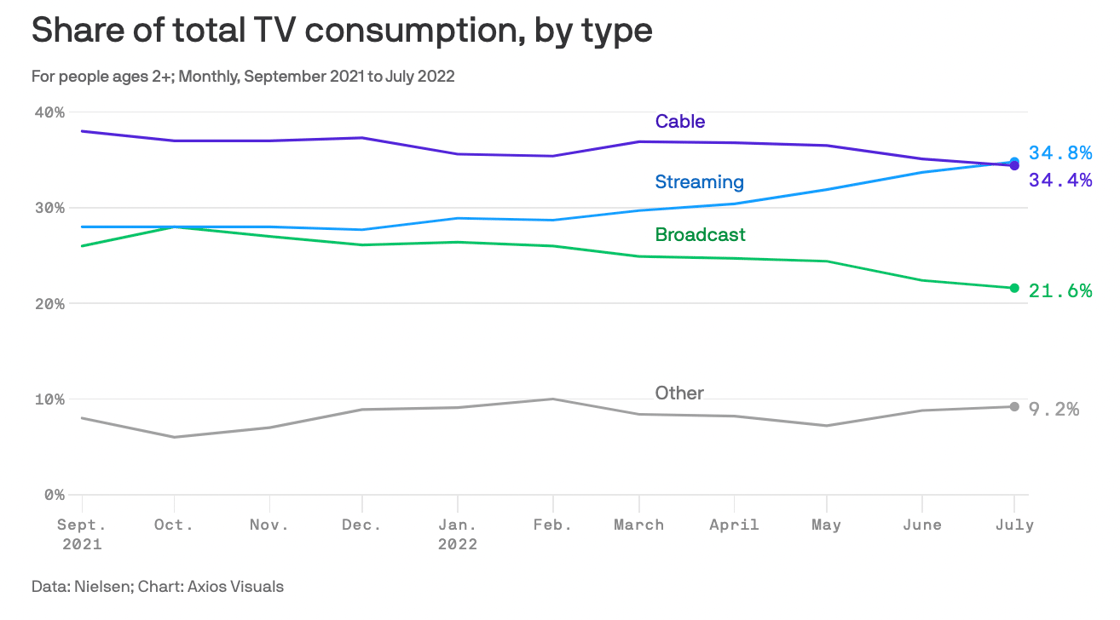

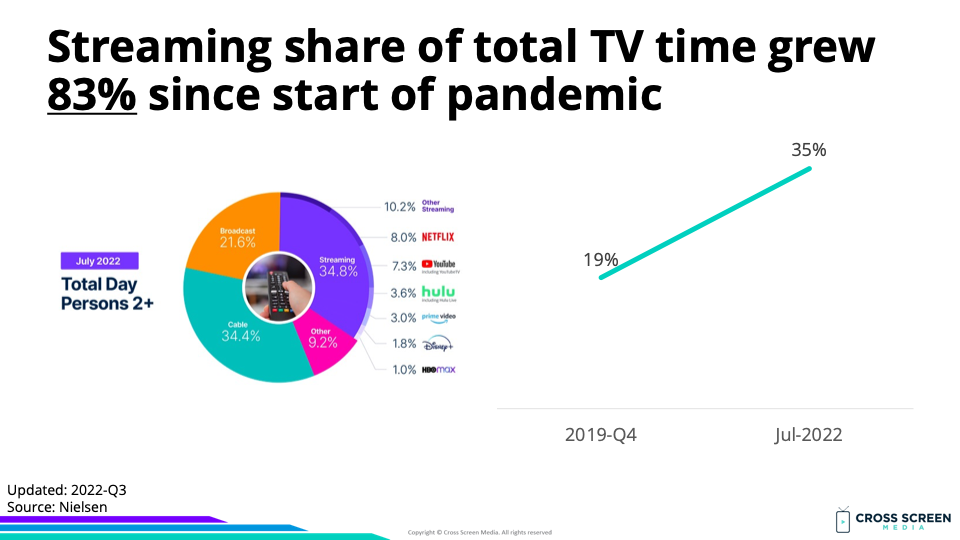

Big question #2: Is streaming growing as a share of total TV time?

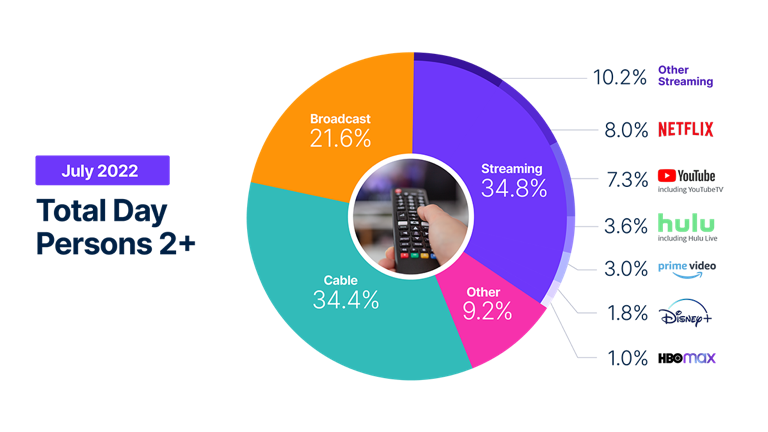

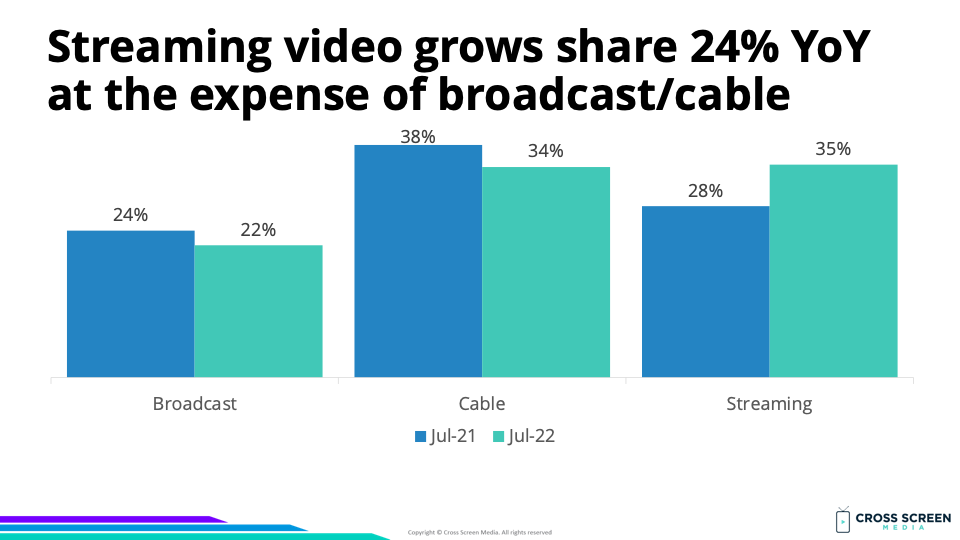

Quick answer: Yes. Streaming has grown its share by 24% (28% → 35%) over the past twelve months. For the first time in July, streaming was more popular than broadcast or cable TV.

Share of total TV time according to Nielsen:

1) Streaming – 35%

2) Cable – 34%

3) Broadcast – 22%

4) Other – 9%

Share of total TV time (video only) according to Nielsen:

1) Streaming – 38%

2) Cable – 38%

3) Broadcast – 24%

Streaming share of total TV time (YoY growth):

1) 2019-Q4 – 19%

2) 2022-Jul – 35% (↑ 83%)

YoY change in total TV time:

1) Streaming – ↑ 24%

2) Cable – ↓ 9%

3) Broadcast – ↓ 10%

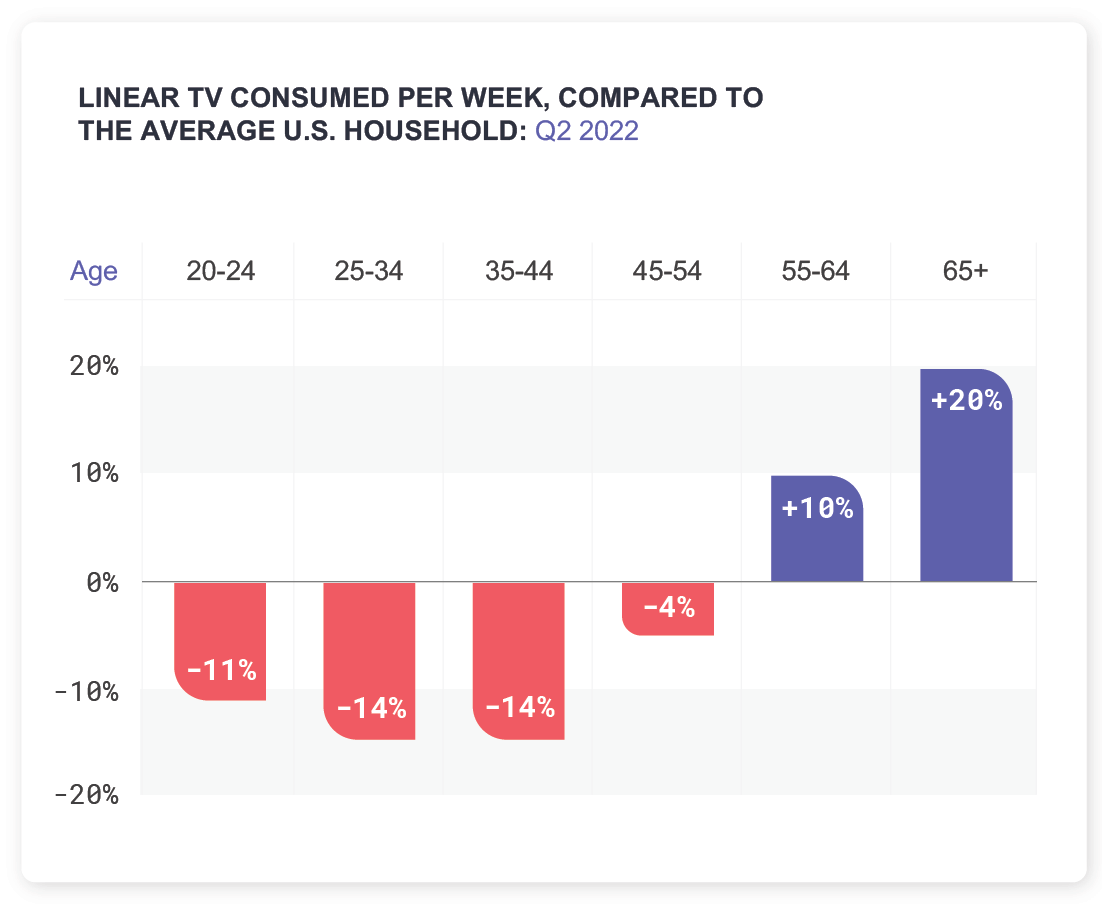

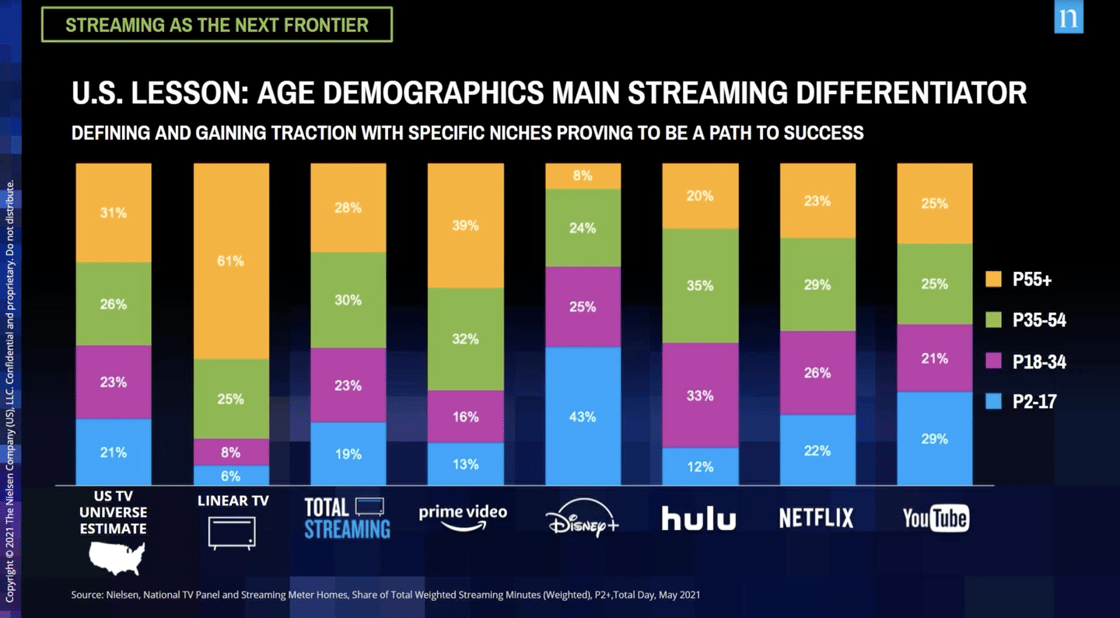

Big question #3: Are all demographic groups watching less linear TV?

Quick answer: No. Samba TV reports both 55-64 and 65+ are watching more TV vs. a year ago.

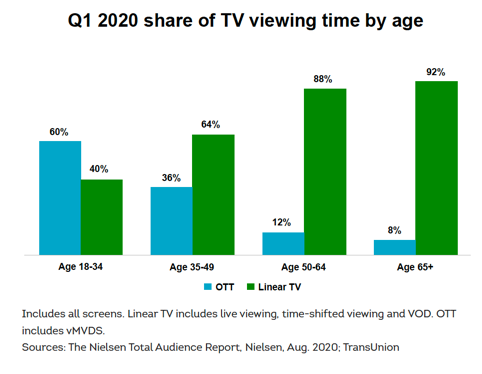

Linear share of TV viewing time in 2020 by age according to Nielsen:

1) 65+ – 92%

2) 50-64 – 88%

3) 35-49 – 64%

4) 18-34 – 40%

Wild: 55+ watches so much video that both of the following can be true simultaneously.

1) 8-12% of their video time is with streaming

2) They account for 28% of all streaming minutes

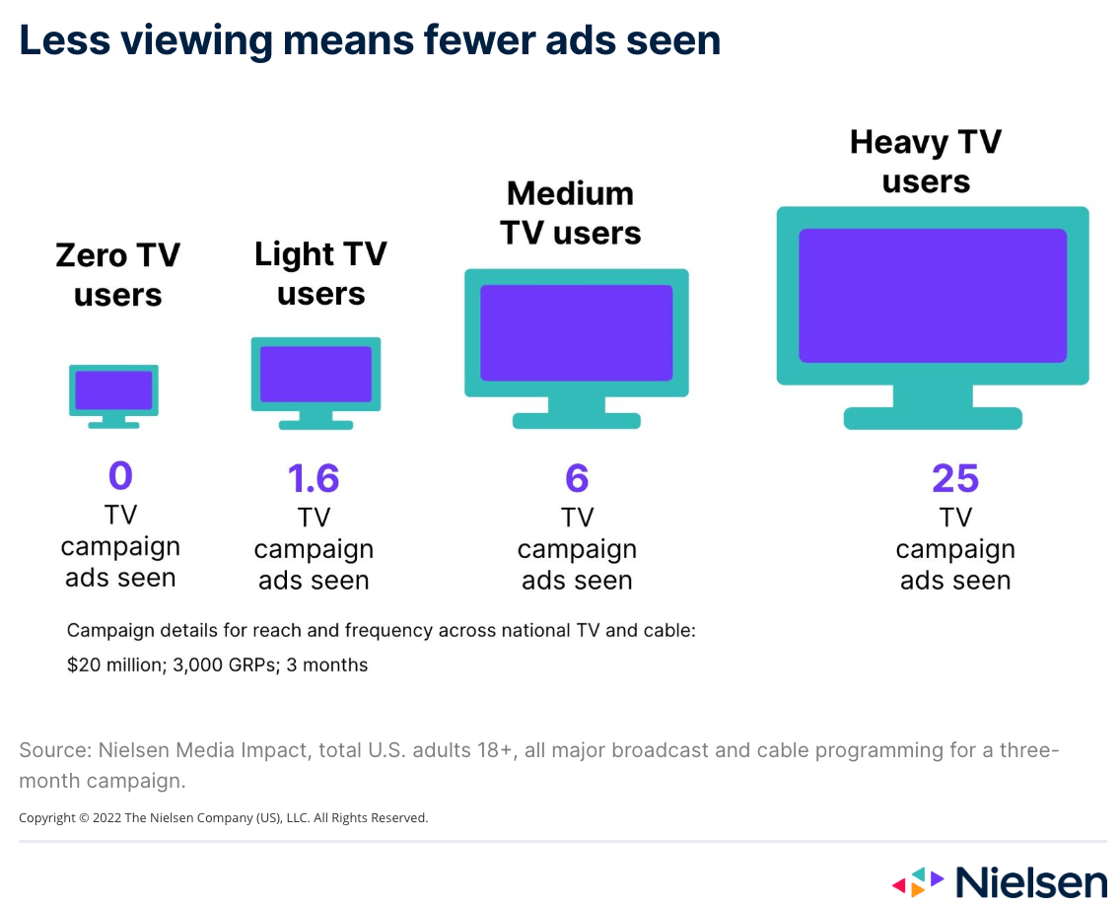

Big question #4: What happens to average TV ad frequency with a growing number of zero/low TV households?

Quick answer: The same ad buy reaches heavy TV viewers 25 times while only 2 times for a light TV viewer.

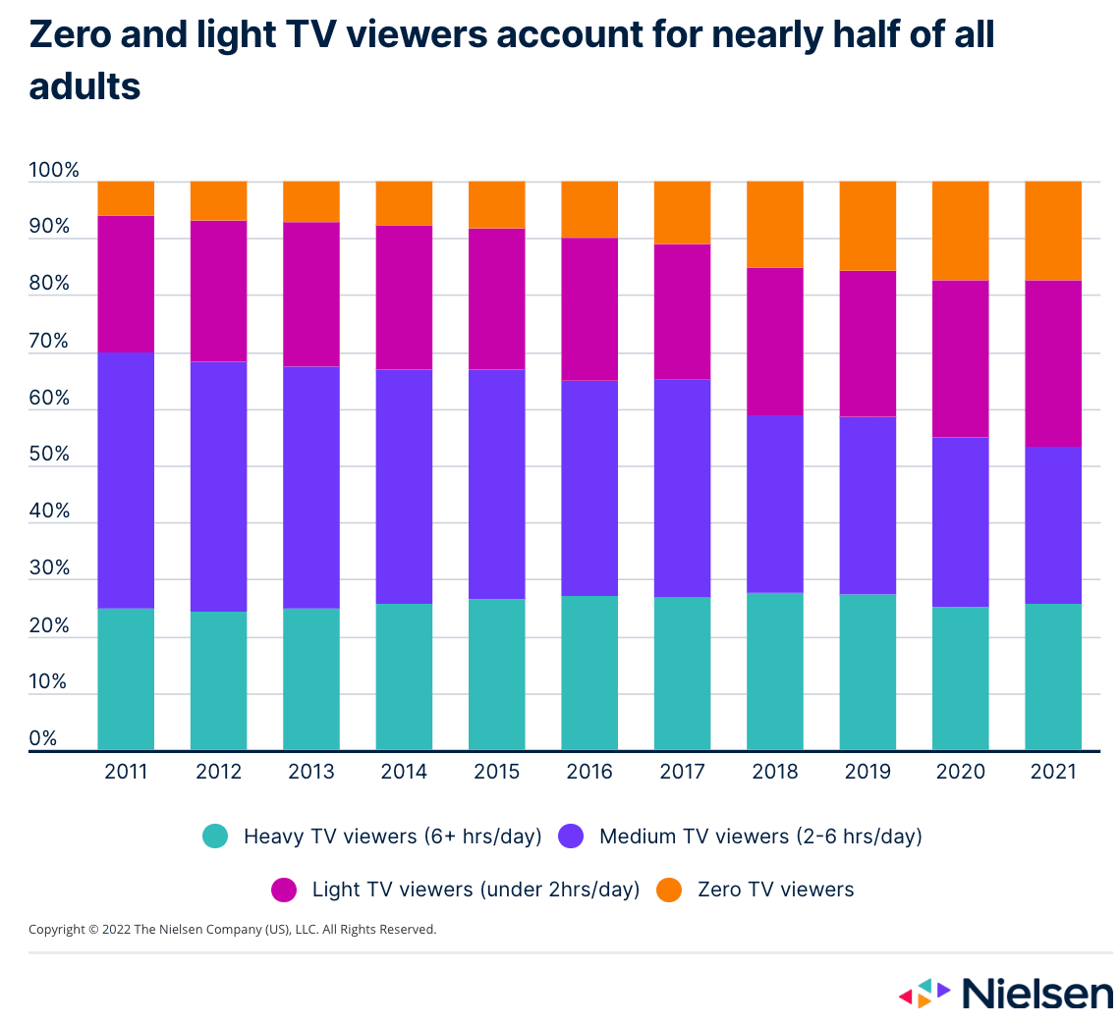

Why this matters: In 2021, 47% of all households were light or zero TV viewers.

Share of adults by TV consumption according to Nielsen:

1) Light TV – 29%

2) Medium TV – 27%

3) Heavy TV – 26%

4) Zero TV – 18%

Share of TV viewers in light/zero consumption bucket:

1) 2011 – 30%

2) 2021 – 47%