Seven big questions re: Netflix:

1) How much revenue is Netflix generating?

2) How many streaming subscribers does Netflix have?

3) Where is the subscriber growth coming from?

4) How much revenue do they make from each streaming subscriber?

5) How many ad-supported users does Netflix have?

6) What is Netflix’s share of streaming viewership?

7) Does Netflix have live sports yet?

Setting the table: 2023 was a monster year for Netflix. The gap between Netflix and its competition is growing.

A few 2023 highlights for Netflix:

1) Added ≈ 30M subscribers worldwide (roughly 1 Peacock)

2) Launched ad tier and grew it to 23M active users

3) Generated $5B of profit and $7B of free cash flow

4) #1 original show for 48 weeks (out of 52)

5) #1 acquired show for 44 weeks

6) #1 streaming movie for 41 weeks

Great read from Alex Weprin: Netflix Is the King of Streaming. Is It a Benevolent Dictator?

Screen Wars Podcast #36: Hollywood Reporter’s Alex Weprin on the Future of Ads in Streaming

.png?width=1120&upscale=true&name=ScreenWars%20Series%20Banner%20-%20Alex%20Weprin(3).png)

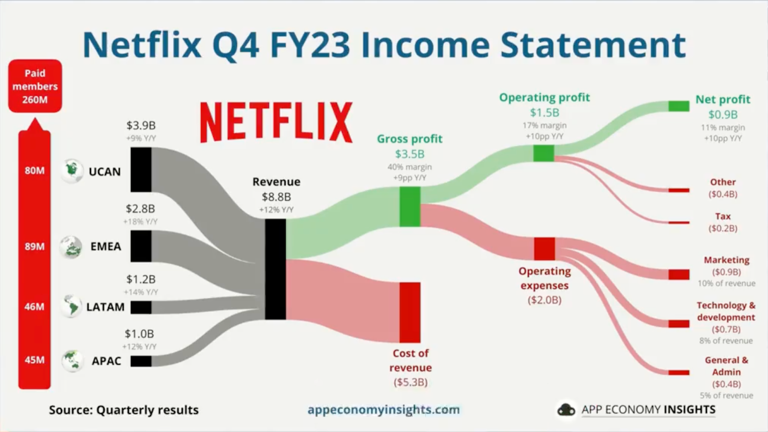

Big question #1: How much revenue is Netflix generating?

Netflix revenue (YoY growth):

1) 2015 – $6.8B

2) 2016 – $8.8B (↑ 30%)

3) 2017 – $11.7B (↑ 32%)

4) 2018 – $15.8B (↑ 35%)

5) 2019 – $20.2B (↑ 28%)

6) 2020 – $25.0B (↑ 24%)

7) 2021 – $29.7B (↑ 19%)

8) 2022 – $31.6B (↑ 6%)

9) 2023 – $33.7B (↑ 7%)

Netflix profit (YoY growth):

1) 2022 – $4.5B

2) 2023 – $5.4B (↑ 20%)

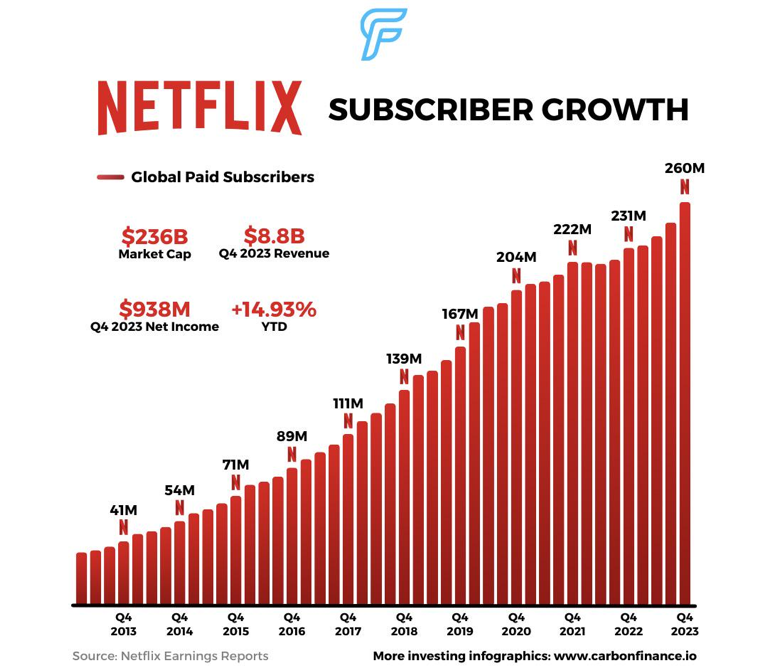

Big question #2: How many streaming subscribers does Netflix have?

Netflix subscribers (YoY growth):

1) 2007 – 7.5M

2) 2008 – 9.4M (↑ 26%)

3) 2009 – 12.3M (↑ 31%)

4) 2010 – 20.0M (↑ 63%)

5) 2011 – 23.5M (↑ 18%)

6) 2012 – 33.3M (↑ 41%)

7) 2013 – 44.4M (↑ 33%)

8) 2014 – 57.4M (↑ 29%)

9) 2015 – 74.8M (↑ 30%)

10) 2016 – 93.8M (↑ 25%)

11) 2017 – 110.6M (↑ 18%)

12) 2018 – 139.3M (↑ 26%)

13) 2019 – 167.1M (↑ 20%)

14) 2020 – 203.7M (↑ 22%)

15) 2021 – 221.8M (↑ 9%)

16) 2022 – 230.8M (↑ 4%)

17) 2023 – 260.3M (↑ 13%)

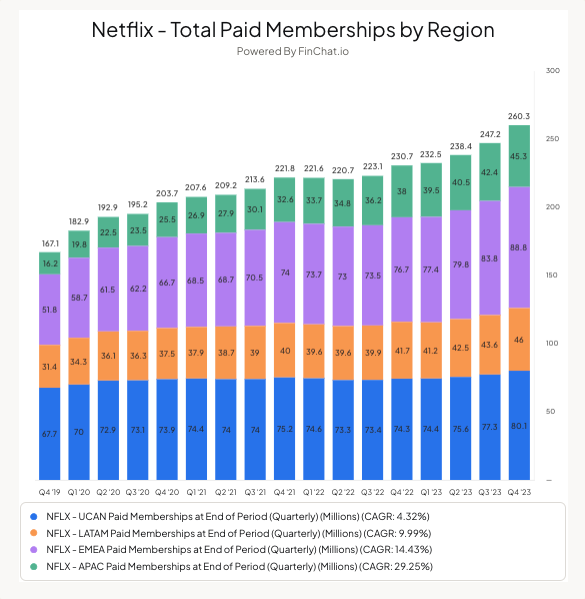

Big question #3: Where is the subscriber growth coming from?Netflix subscriber growth (% of total):

1) International – 10.3M (79%)

2) U.S./Canada – 2.8M (21%)

3) Total – 13.1M

Netflix subscribers (% of total):

1) International – 180.2M (69%)

2) U.S./Canada – 80.1M (31%)

3) Total – 260.3M

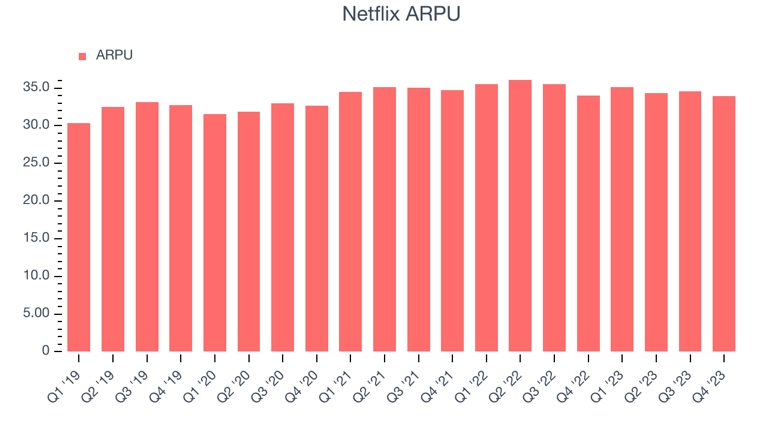

Big question #4: How much revenue do they make from each streaming subscriber?

Monthly ARPU for Netflix in the U.S./Canada (YoY growth):

1) 2019-Q4 – $13.22

2) 2020-Q4 – $13.51 (↑ 2%)

3) 2021-Q4 – $14.78 (↑ 9%)

4) 2022-Q4 – $16.23 (↑ 10%)

5) 2023-Q4 – $16.64 (↑ 3%)

Big question #5: How many ad-supported users does Netflix have?

Netflix ad-supported active users:

1) 2023-May – 5M

2) 2023-Aug – 10M

3) 2023-Oct – 15M

4) 2023-Dec – 23M

Big question #6: What is Netflix’s share of streaming viewership?

Quick answer: Netflix accounts for 8% of total TV time and 21% of streaming TV time.

.png?width=1120&upscale=true&name=27B3.8-DEC2023E(Netflix).png)

Big question #7: Does Netflix have live sports yet?

Quick answer: No major sports (NFL, NBA, etc.) yet, but they did acquire the rights for WWE Raw over the next 10 years.

Key details for the Netflix/WWE Raw deal:

1) $5B over 10 years ($500M per year)

2) 1.5M viewers per week on USA Network

3) Airs 52 weeks per year

4) 3 hours per show

5) 156 live hours per year

6) $3.2M in license fees per hour of content

Why this matters #1: Recently, they have aired one-off events such as the Netflix Cup, Chris Rock’s stand-up, and the Love Is Blind reunion. WWE Raw will be the first live event to air consistently on Netflix.

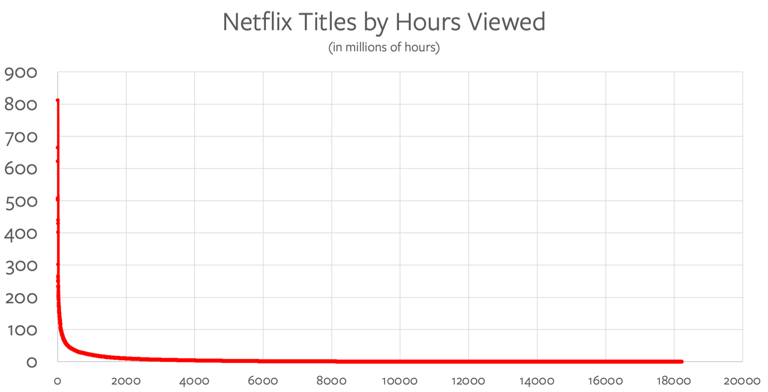

Why this matters #2: WWE Raw will bring a massive audience to Netflix. It should rank in the top 0.5% (200M+ hours/year) for all of Netflix’s programming.

Netflix titles grouped by total hours of viewing time (2023-1H) according to Michael Mulvihill:

1) 0 -1M – 57%

2) 1M – 5M –23%

3) 5M – 10M – 8%

4) 10M – 25M – 7%

5) 25M – 50M – 3%

6) 50M – 100M – 1%

7) 100M+ – 0.5%

Podcast: A Wild Week at Netflix: Stuber’s Out, WWE Is In, and Subs Are Up