Six big questions re: Netflix

1) Can I still get DVDs through Netflix?

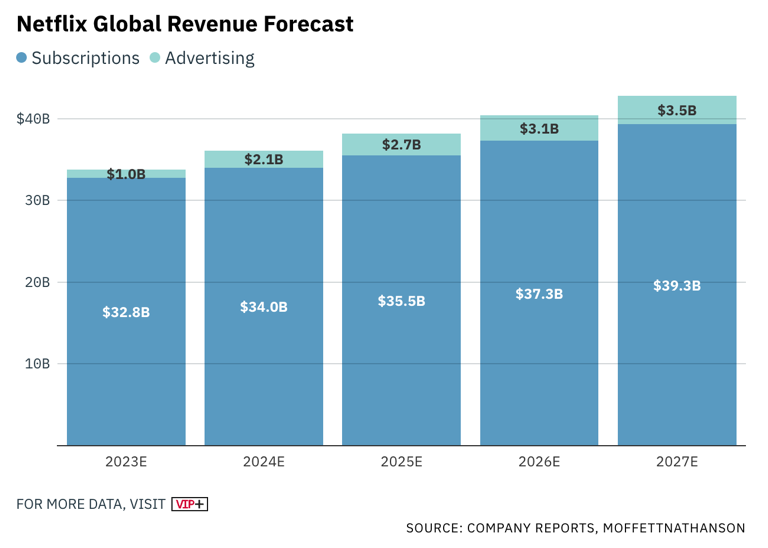

2) How much revenue is Netflix generating?

3) How many streaming subscribers does Netflix have?

4) Where is the subscriber growth coming from?

5) How much revenue do they make from each streaming subscriber?

6) What revenue is generated by each ad-supported streaming subscriber?

Big question #1: Can I still get DVDs through Netflix?

Quick answer: Yes, but they are sunsetting DVDs on September 29th after 25 years!

Quote from Marc Randolph – Co-Founder and Original CEO @ Netflix:

“Exactly 25 years ago today — on April 14th, 1998, at 8 am in the morning, Eric Meyer leaned forward, tapped a few keys on his laptop, and launched Netflix to the world.

Today, Netflix has more than 200 million of them.

Starting with a dozen people squeezed into a tiny office with dirty green carpet, Netflix now has more than 10,000 employees. It has customers in nearly every country in the world. It produces its own movies. It makes its own television shows. It’s brought the world “Netflix and Chill.” (And I promise, I never saw that last one coming).”

Big question #2: How much revenue is Netflix generating?

Netflix revenue (YoY growth):

1) 2015-Q1 – $1.6B

2) 2016-Q1 – $2.0B (↑ 24%)

3) 2017-Q1 – $2.6B (↑ 35%)

4) 2018-Q1 – $3.7B (↑ 40%)

5) 2019-Q1 – $4.5B (↑ 22%)

6) 2020-Q1 – $5.8B (↑ 28%)

7) 2021-Q1 – $7.2B (↑ 24%)

8) 2022-Q1 – $7.9B (↑ 10%)

9) 2023-Q1 – $8.2B (↑ 4%)

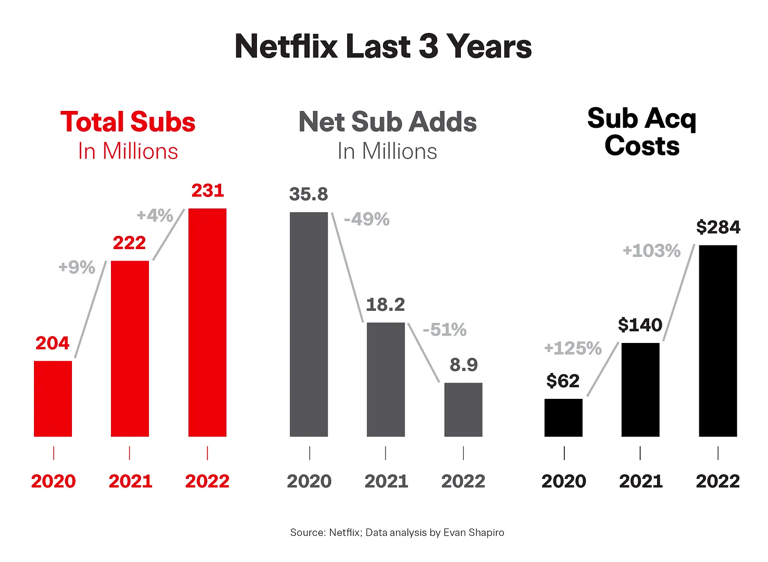

Big question #3: How many streaming subscribers does Netflix have?

Netflix subscribers (YoY growth):

1) 2015-Q1 – 62.3M

2) 2016-Q1 – 81.5M (↑ 31%)

3) 2017-Q1 – 94.4M (↑ 16%)

4) 2018-Q1 – 118.9M (↑ 26%)

5) 2019-Q1 – 148.9M (↑ 25%)

6) 2020-Q1 – 182.9M (↑ 23%)

7) 2021-Q1 – 207.6M (↑ 14%)

8) 2022-Q1 – 221.6M (↑ 7%)

9) 2023-Q1 – 232.5M (↑ 5%)

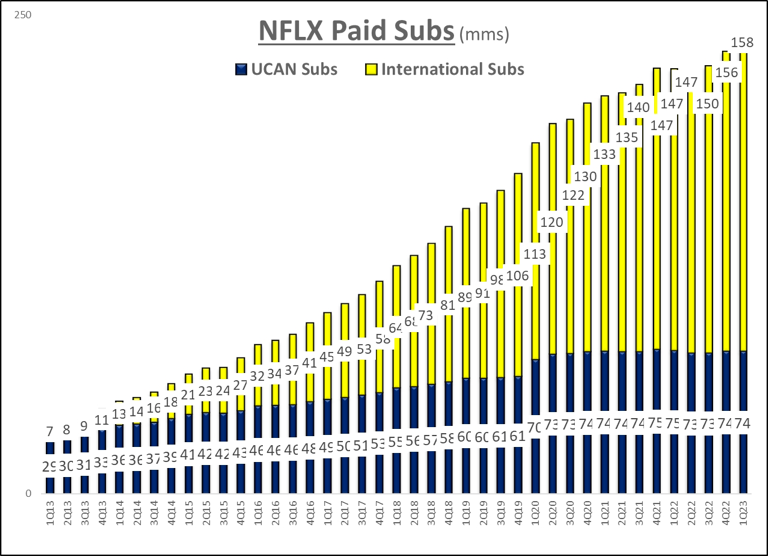

Big question #4: Where is the subscriber growth coming from?

Netflix subscriber growth (% of total):

1) International – 1.7M (94%)

2) U.S./Canada – 100K (6%)

3) Total – 1.8M

Netflix subscribers (% of total):

1) International – 158.1M (68%)

2) U.S./Canada – 74.4M (32%)

3) Total – 232.5M

Big question #5: How much revenue do they make from each streaming subscriber?

Monthly ARPU for Netflix in U.S./Canada (YoY growth):

1) 2019-Q1 – $11.45

2) 2020-Q1 – $13.09 (↑ 14%)

3) 2021-Q1 – $14.25 (↑ 9%)

4) 2022-Q1 – $14.91 (↑ 5%)

5) 2023-Q1 – $16.18 (↑ 9%)

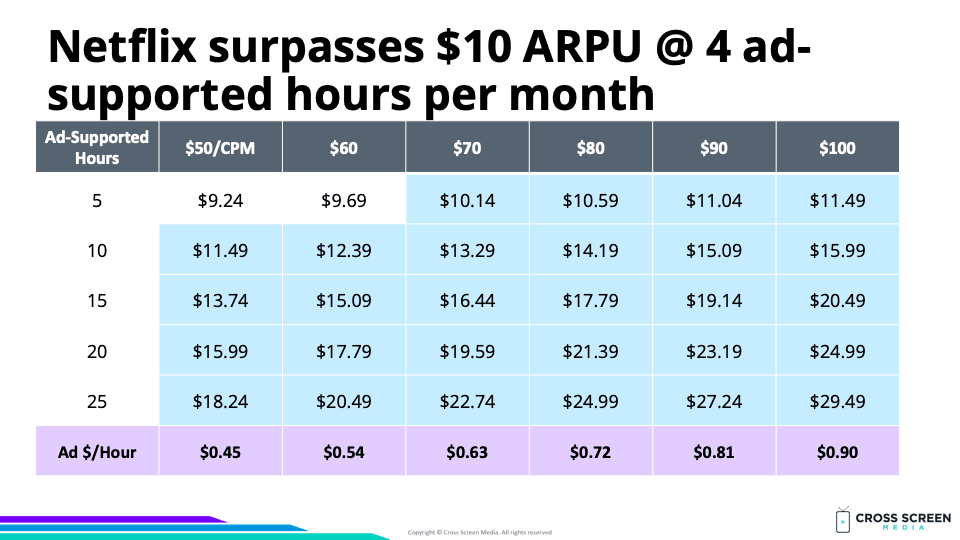

Big question #6: What revenue is generated by each ad-supported streaming subscriber?

Quick answer: $8.50 ($6.99 + $1.51).

Solid start: Our model below projected $3.00/month in ad revenue, and they are 50% of the way there.

Quick math on the advertising model for Netflix:

1) Ad minutes/hour – 4.5

2) 30s spots/hour – 9

3) CPM $ – ≈ $80

4) $/spot – $0.08

5) Ad revenue/hour – $0.72

6) ARPU > $9.99 @ 4.2 hours ($6.99 + $3.00 = $9.99)

Flashback: The Coming Netflix Ad Machine

Quote from Michael Nathanson – Analyst @ MoffettNathanson:

“I was reading the Wall Street Journal summary of their articles. They’re like, “Oh, fortunately, not very many people left their plans to go to advertising because then they’ll be cannibalized.” It’s like, has anyone looked at Hulu? It is much more profitable to have people on an ad tier.

And I think this is probably a bit of a cultural shift. It was so ingrained that “We don’t do advertising”, and they broke through that to do advertising. And now, they need to break through, in my estimation, to prefer advertising. They should want as many people as possible seeing ads on their platform. And yeah, to your point, if you go back to those 2000 earnings calls, Hastings said something like “No, this Blockbuster price war is great because we’re going to obliterate the stores.” And it was insane, but it worked out. It’s the same thing here. Do the same thing, obliterate linear TV once and for all. It’s a big opportunity, and they just need to embrace it and go for it.”

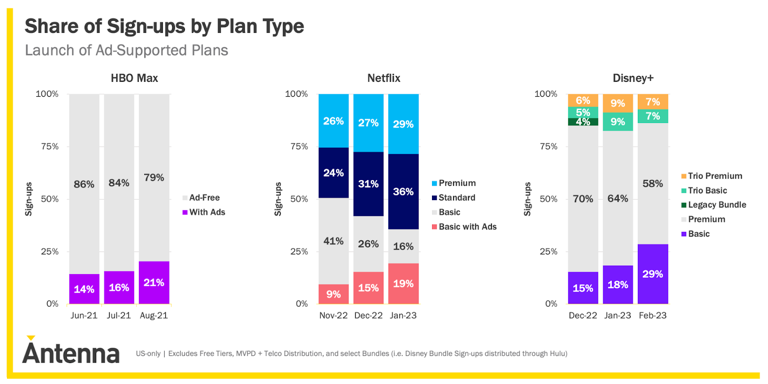

PSA: As of January, ad-supported plans accounted for 19% of signups, up from 9% in November.