Big news: The IAB released a report on the digital video market last week to kick off the NewFronts.

Big question #1: What are the NewFronts?

Quick answer: Digital content companies promote upcoming content to advertisers at the NewFronts. Think the digital version of the Upfronts.

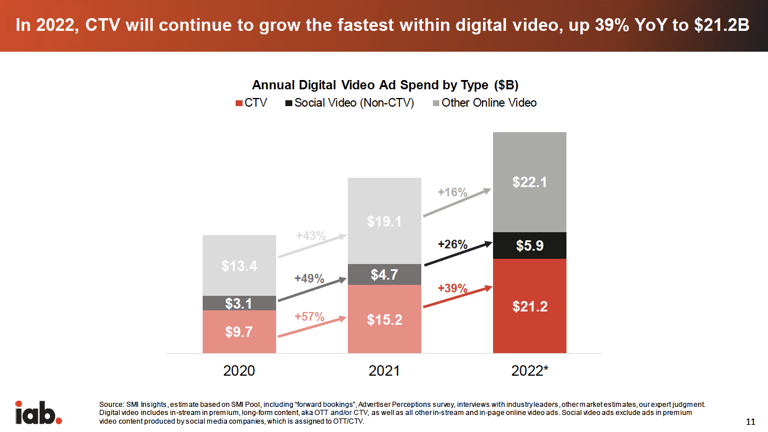

Big question #2: How large is the video ad market in the U.S.?

Digital video ad spend according to the IAB:

1) 2020 – $26B

2) 2021 – $39B (↑ 49%)

3) 2022P – $49B (↑ 26%)

Big question #3: Which video ad format is growing fastest?

Quick answer: Connected TV (CTV).

YoY growth rate for connected TV ad spend:

1) 2021 – ↑ 57%

2) 2022P – ↑ 39%

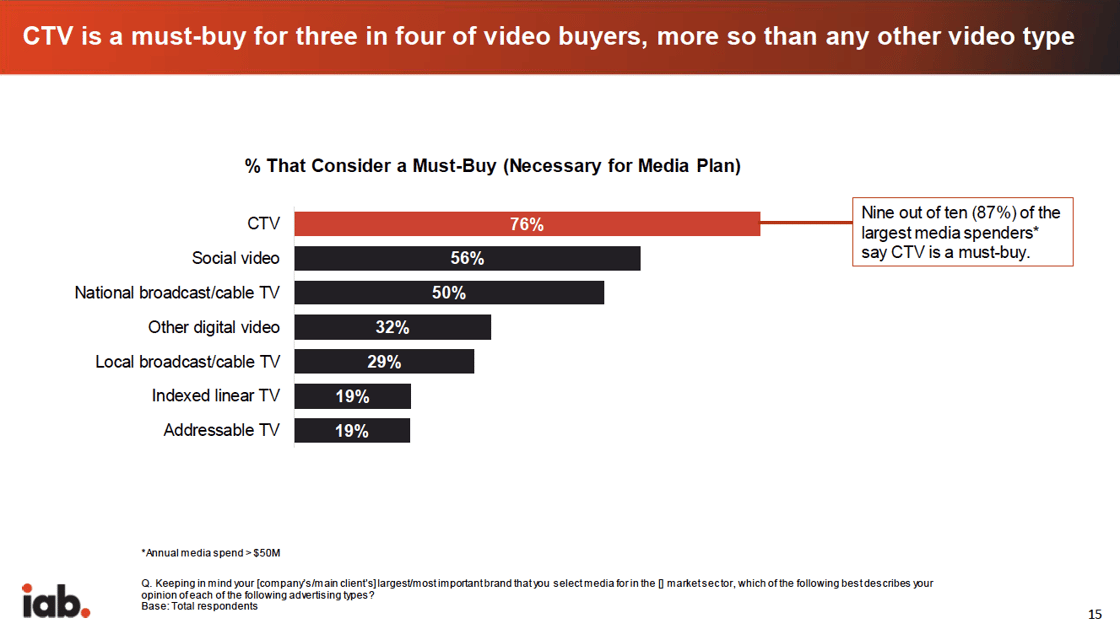

Share that consider each video ad format a must-buy:

1) CTV – 76%

2) Social video – 56%

3) National linear – 50%

4) Other digital video – 32%

5) Local linear – 29%

6) Indexed linear – 19%

7) Addressable TV – 19%

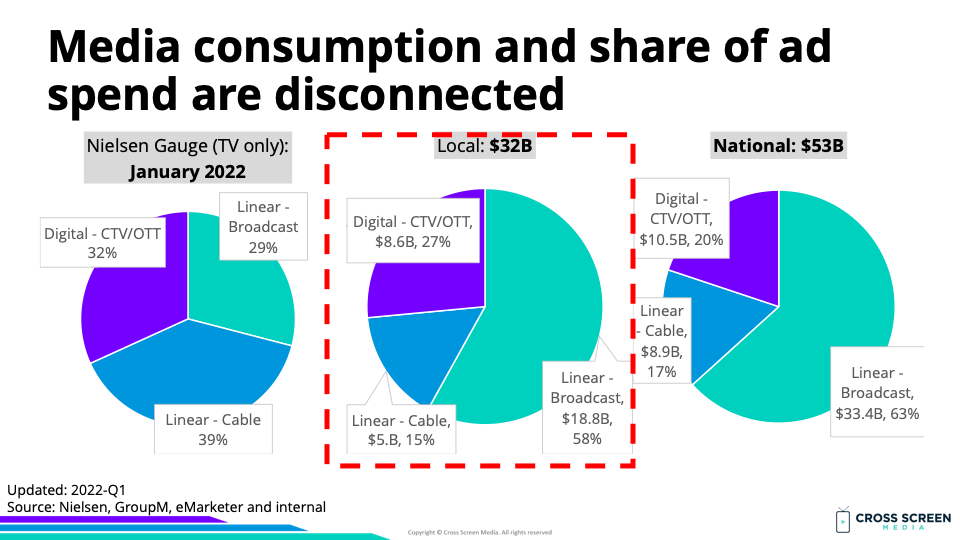

Big question #4: 4. Does ad spend for CTV line up with consumption?

Quick answer: No. CTV is still underbought compared to its reach and time spent. Part of this can be explained by the fact a higher share of streaming is ad-free (≈ 60%) than linear TV (≈ 20%).

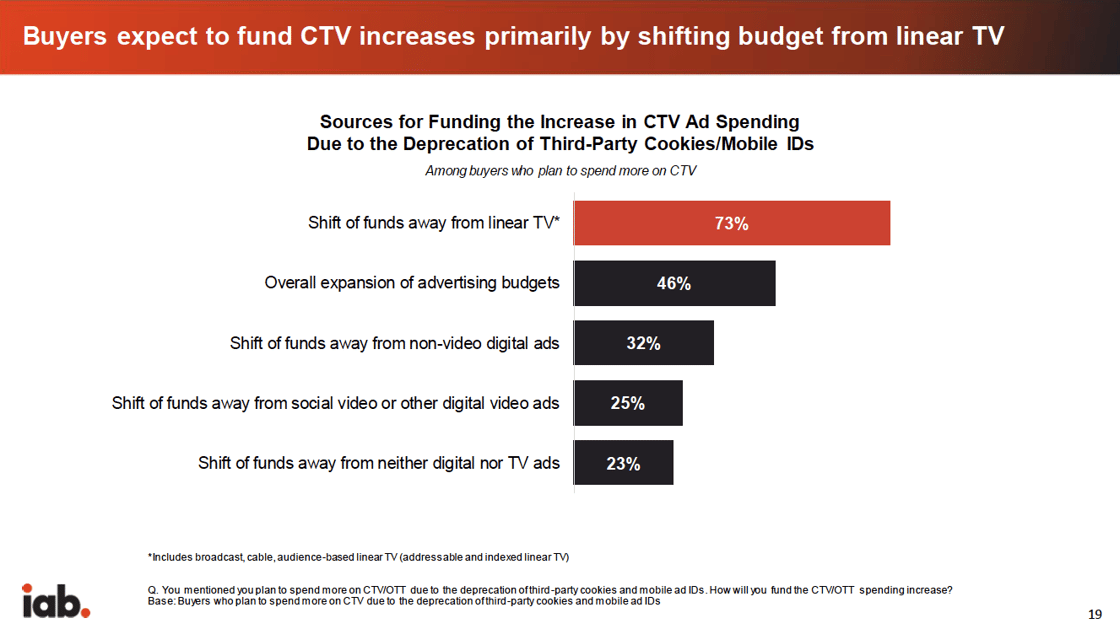

Big question #5: Where is money coming from for CTV spend?

Quick answer: 73% plan to shift funds away from linear TV.

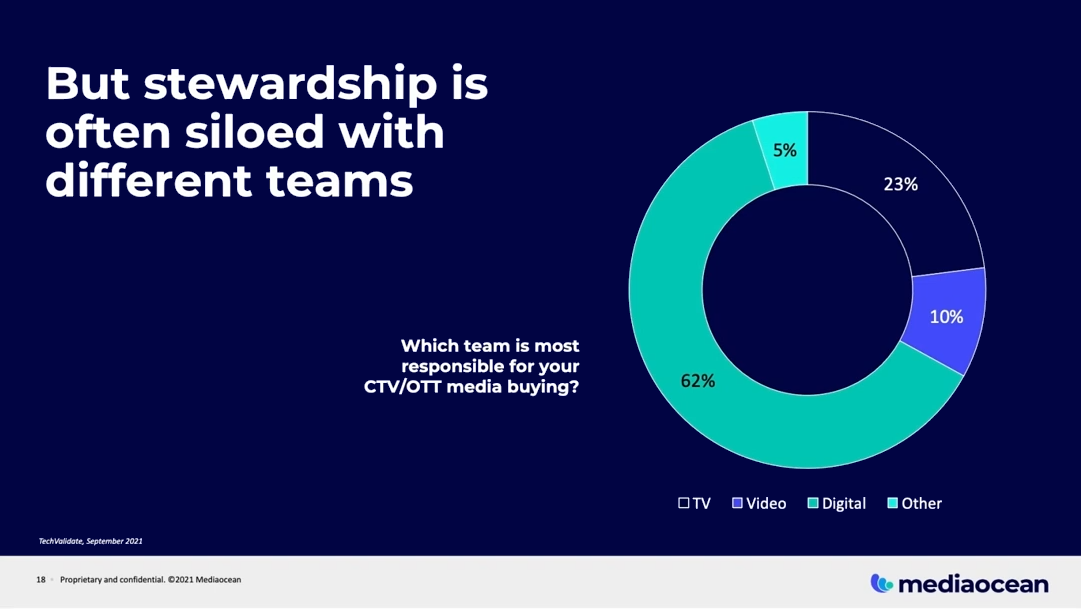

Big question #6: Who currently buys CTV advertising?

Team most responsible for buying CTV advertising according to Mediaocean:

1) Digital – 62%

2) Linear – 23%

3) Video – 10%

4) Other – 5%

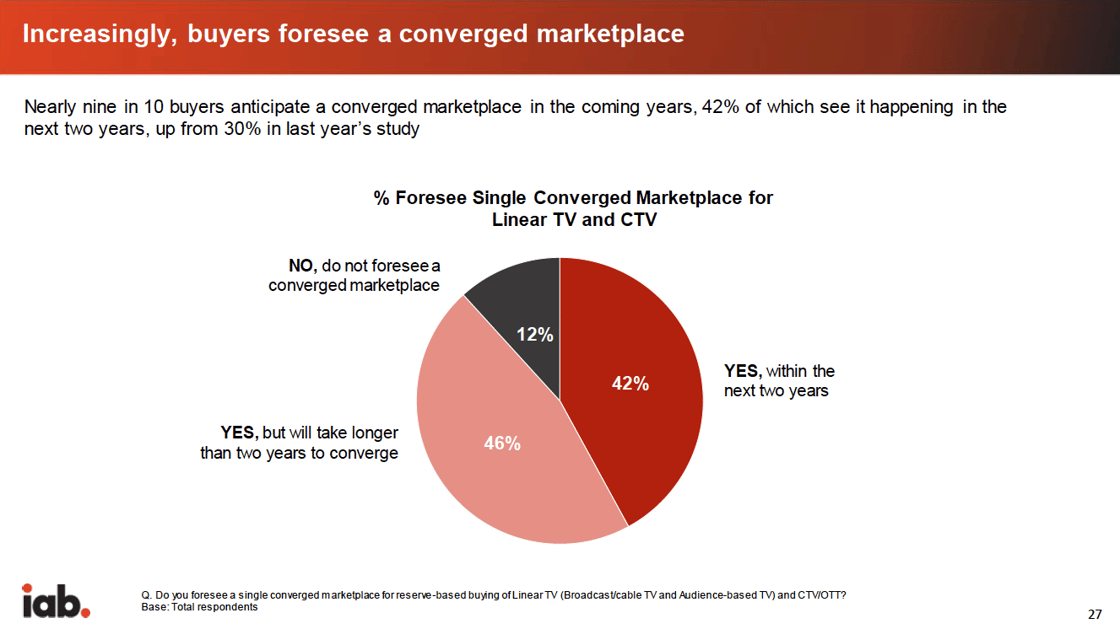

Big question #7: What does the future look like?

Quick answer: Converged teams planning/buying linear TV and CTV together.

Share that foresees a converged marketplace for linear TV and CTV:

1) Yes (2+ years) – 46%

2) Yes (<2 years) – 42%

3) No – 12%

Flashback: CTV Leads Digital Ad Growth

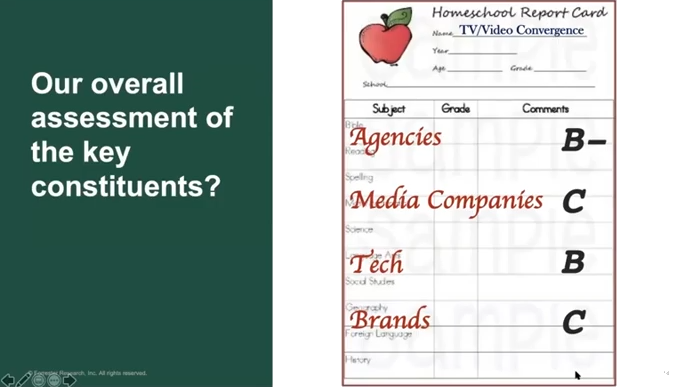

Big question #8: What progress are we making towards convergent TV?

Report card for TV/video convergence according to Joanna O’Connell:

1) Tech – B

2) Agencies – B-

3) Media companies – C

4) Brands – C

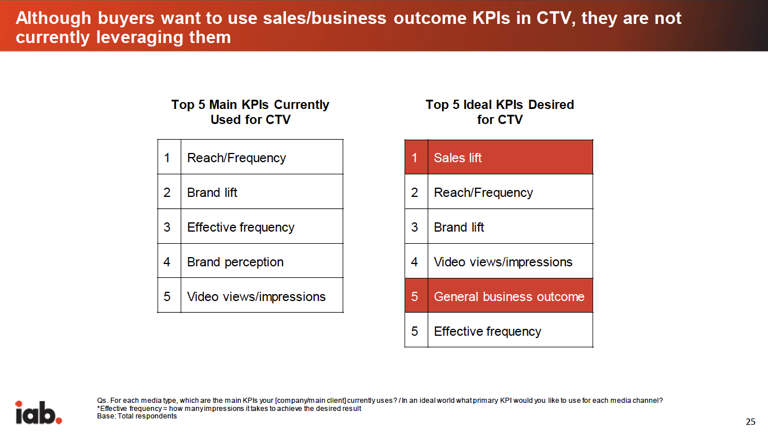

Big question #9: What are the most important KPIs for CTV advertising?

Top KPIs currently used for CTV:

1) Reach/frequency

2) Brand lift

3) Effective frequency

4) Brand perception

5) Video views/impressions