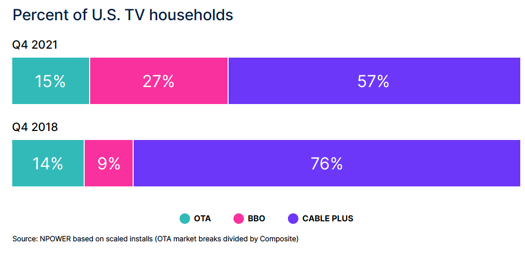

Big question #1: How do Americans receive television?

Share of U.S. TV households by source according to Nielsen:

1) Traditional pay-TV – 57%

2) Broadband-only – 27%

3) Antenna (OTA) – 15%

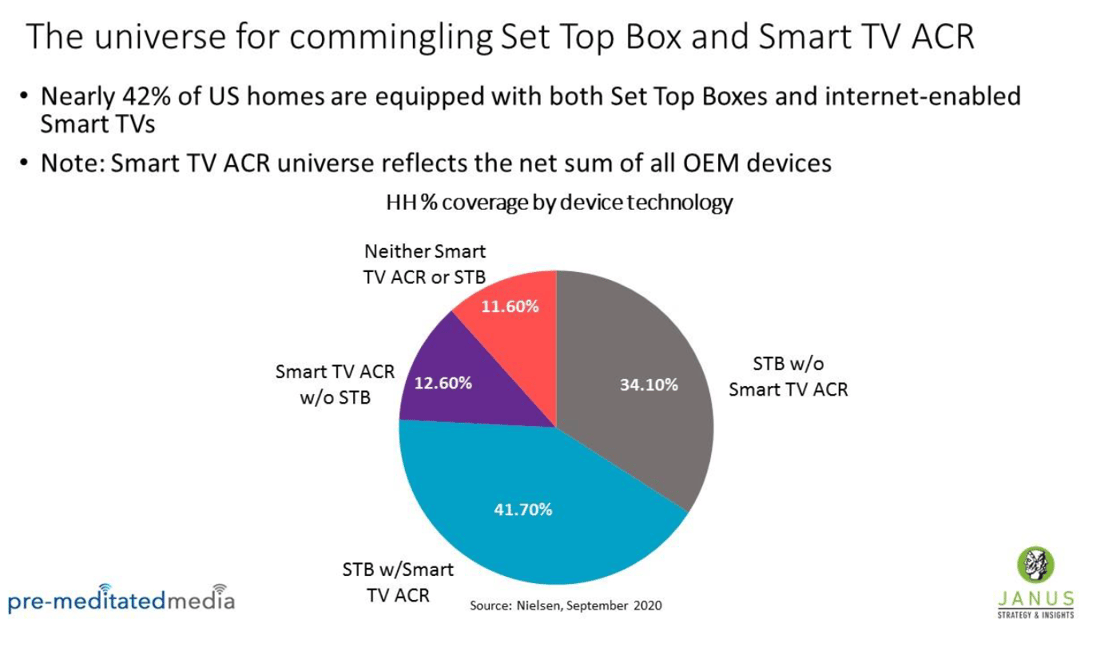

Big question #2: Does this split impact data collection for measurement?

Quick answer: Yes. These same trends are fragmenting sources available for video ad measurement.

Share of U.S. TV households by device technology according to CIMM:

1) Set-top box w/ Smart TV ACR – 42%

2) Set-top box wo/ Smart TV ACR – 34%

3) Smart TV ACR only – 13%

4) Neither set-top box or Smart TV ACR – 11%

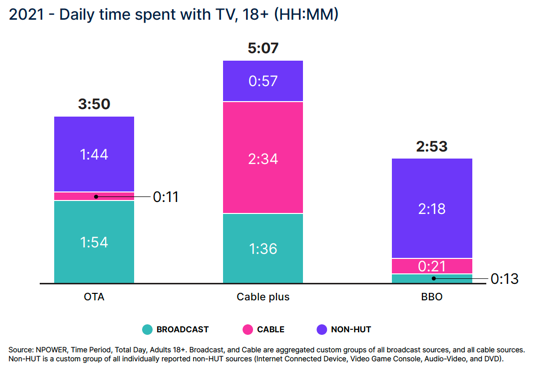

Big question #3: Does the amount of daily time spent with TV change by source?

Quick answer: Yes. Traditional pay-TV households watch 2X the amount of TV as broadband only households.

Daily time spent with TV by source:

1) Traditional pay-TV – 5h 7m

2) Antenna (OTA) – 3h 50m

3) Broadband-only – 2h 53m

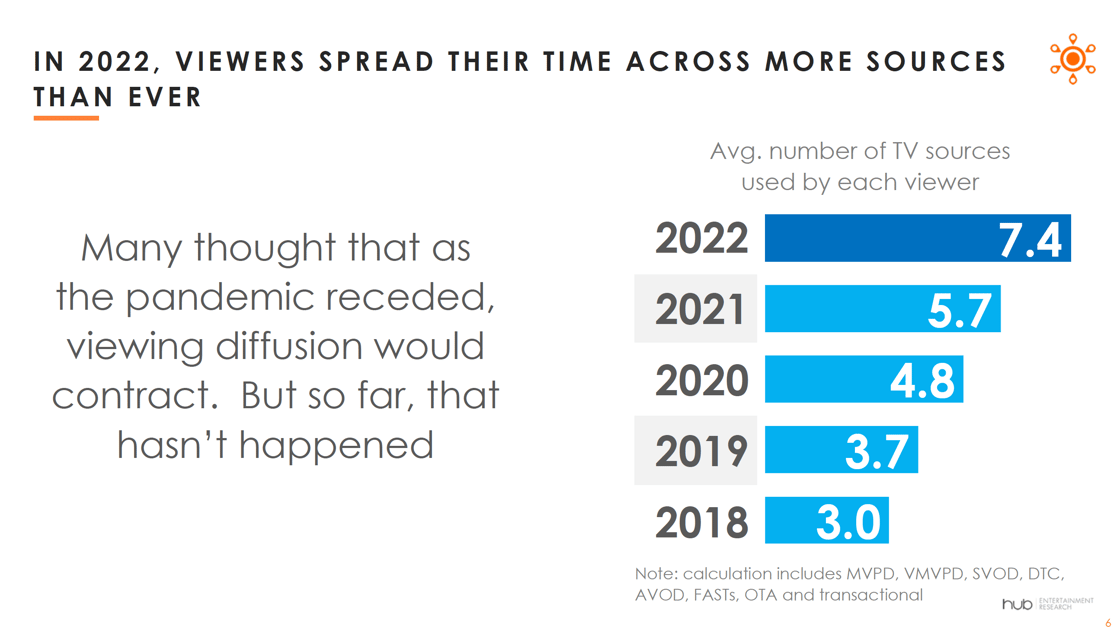

Big question #4: How many different services do people use to watch TV?

Average number of TV sources (YoY growth) according to HUB Entertainment Research:

1) 2018 – 3.0

2) 2019 – 3.7 (↑ 23%)

3) 2020 – 4.8 (↑ 30%)

4) 2021 – 5.7 (↑ 19%)

5) 2022 – 7.4 (↑ 30%)

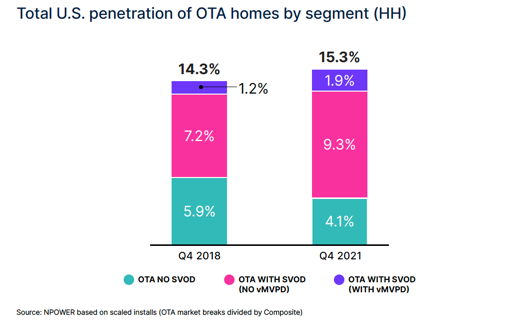

Big question #5: Do antenna (OTA) homes also use streaming?

Quick answer: Yes. 73% of antenna (OTA) homes have some form of streaming.

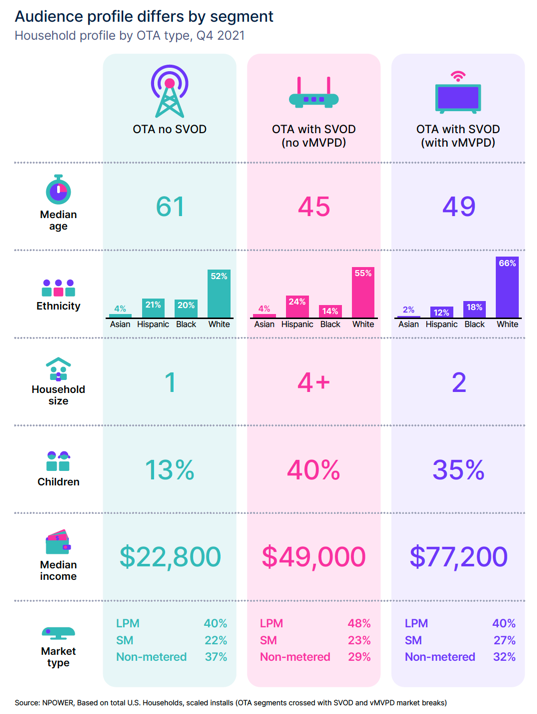

Big question #6: Do OTA households differ by age/income?

Quick answer: Yes. OTA households without streaming are 12+ years older with a 54% lower average income.

Big question #7: Does the share of over OTA homes differ by market?

Quick answer: Yes. A household in Albuquerque (31%) is 4X more likely to be OTA than in Boston (8%).

Why this matters: Local is complicated/fragmented. The same target consumes video content differently by the market, which requires a unique media plan for each.

.png?width=1120&upscale=true&name=55%20Billion%20Reasons%20to%20Care%20About%20Local%20Video%20Ads%20(1).png)