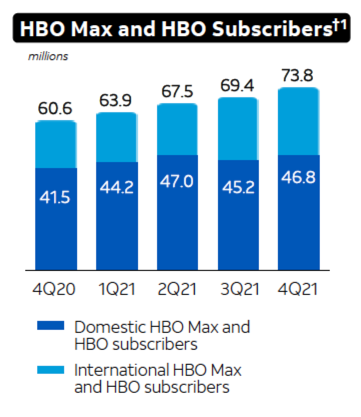

HBO Max global subscribers (YoY growth):

1) 2019 – 55M

2) 2020 – 61M (↑ 12%)

3) 2021 – 74M (↑ 21%)

HBO Max U.S. subscribers (YoY growth):

1) 2019 – 34M

2) 2020 – 42M (↑ 20%)

3) 2021 – 47M (↑ 13%)

Why this matters: HBO took a subscriber hit in Q3 but returned to growth in Q4 and has firmly positioned itself in streaming’s top tier.

Quote from Ryan Faughnder – Staff Writer @ Los Angeles Times:

“For Kilar, in the midst of a presumed lame-duck period ahead of the entertainment company’s merger with Discovery, the numbers partly vindicate WarnerMedia’s strategy of putting all of Warner Bros.’ 2021 movies on the service simultaneously with their theatrical releases.”

Dive deep: What Does HBO Max’s Launch Mean For Convergent TV?

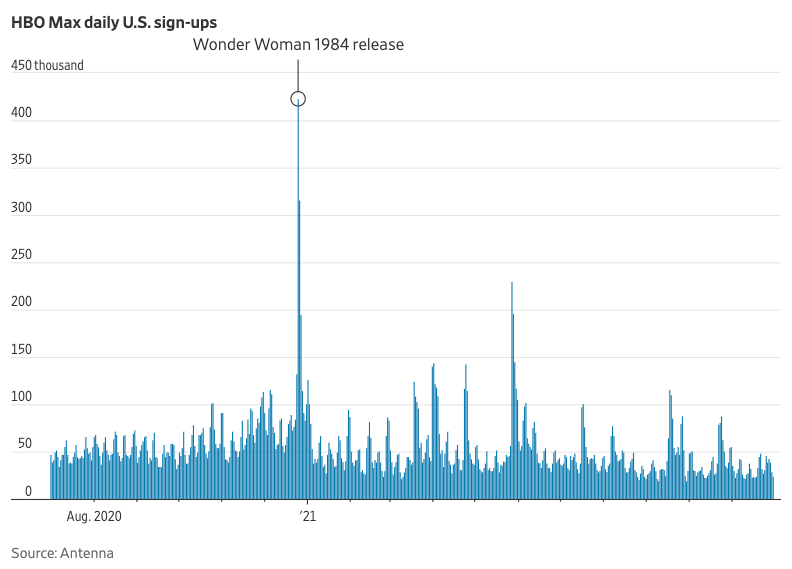

Interesting: There were multiple spikes in signups around major releases, but nothing had the same impact as Wonder Woman 1984, which drove 400K signups on Christmas Day 2020.

HBO Max U.S. average revenue per user (ARPU)(% change):

1) 2021-Q1 – $11.72

2) 2021-Q2 – $11.90 (↑ 2%)

3) 2021-Q3 – $11.82 (↓ 1%)

4) 2021-Q4 – $11.15 (↓ 6%)

Price increases announced in January 2022:

1) Netflix – ↑ 11%

2) HBO Max – ↓ 20%

Mr. Screens’ Crystal Ball: HBO Max can be more aggressive with pricing due to their ability to increase ARPU through advertising which Netflix (currently) does not offer.

Quote from Andy Forssell – GM @ HBO Max:

“Advertising is a time-tested way to reduce the cost of great entertainment and reach a wider audience.”