Eight big questions re: ESPN:

1) Why is ESPN important to the TV ecosystem?

2) How does ESPN make money?

3) How many households subscribe to ESPN?

4) How has ESPN grown revenue while losing subscribers?

5) When will ESPN go direct-to-consumer?

6) Why is the dispute with Charter a big deal?

7) What share of pay-TV households watch ESPN?

8) How much does ESPN pay to sports leagues?

Setting the table: A carriage dispute between ESPN and Charter resulted in 15M pay-TV households losing ESPN for 11 days.

Quote from Alex Weprin – Media and Business Writer @ The Hollywood Reporter:

“10 years ago, Charter’s threat to leave its old TV business behind would have been laughable, with its still-rich profits and 10s of millions of subscribers. But it isn’t now, much to the chagrin of the entertainment companies reliant on cable TV’s billions of dollars in annual cash flow.”

Big question #1: Why is ESPN important to the TV ecosystem?

Quick answer: ESPN is (currently) available only through a pay-TV bundle. Due to this exclusive relationship, they charge a premium to pay-TV companies (Charter, etc.).

Big question #2: How does ESPN make money?

Source of 2022 revenue for ESPN (% of total) according to Kagan:

1) Subscriber fees – $7.7B (76%)

2) Advertising – $2.1B (21%)

3) Other – $248M (2%)

3) Total – $10.1B

Big question #3: How many households subscribe to ESPN?

Quick answer: 71M. Down 29% from the peak in 2011 (100M).

ESPN subscribers (% growth) according to Kagan:

1) 1980 – 7.3M

2) 1990 – 57.3M (↑ 682%)

3) 2000 – 80.5M (↑ 40%)

4) 2010 – 99.8M (↑ 24%)

5) 2020 – 79.7M (↓ 20%)

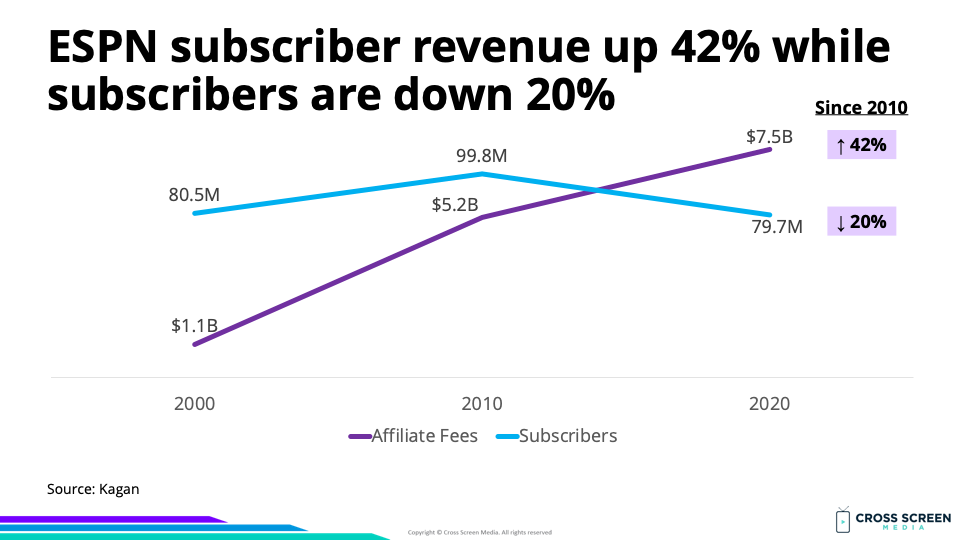

Big question #4: How has ESPN grown revenue while losing subscribers?

Quick answer: Subscriber fees have risen faster than cord-cutting.

Why this matters: Since 2010, ESPN has lost 20% of its subscriber base but has been able to increase revenue by 42% through higher subscription fees (↑ 74%). Increasing cord-cutting and exploding sports rights fees are testing this model.

Big question #5: When will ESPN go direct-to-consumer?

Quick answer: As cable drops below 50M households, ESPN wants to launch a direct-to-consumer (DTC) version of the channel. Without the direct option, 70M+ subscribers would not be able to subscribe.

Bottom line: The challenge for Disney/ESPN is getting the timing right. Launching a direct option will allow pay-TV companies to remove ESPN from their basic tiers, causing an immediate drop in revenue since only people who consistently watch ESPN (<20%) will subscribe independently.

Quote from Jimmy Pitaro – Chairman @ ESPN:

“We’re going to get to a point where we take our entire network, our flagship programming, and make it available direct to consumer. That’s a ‘when,’ not an ‘if’….We’re only going to do it when it makes sense for our business and for our bottom line.”

Quick math for ESPN DTC, according to Andrew Marchand:

1) ESPN currently makes ≈ $750M per month (75M * $10) in subscriber fees

2) 25M will leave pay-TV ecosystem (50M remain) before ESPN launches DTC

3) DTC will need to make up for a loss of $250M per month (25M * $10)

4) 12.5M need to pay $20 per month

Big question #6: Why is the dispute with Charter a big deal?

Quick answer: Charter is the #2 pay-TV provider (14.7M HH), accounting for 20% of all pay-TV subscribers. They pay Disney $2.2B yearly in subscriber fees and roughly $1.6B for ESPN alone. Most subscribers likely would not have signed up for another service (YouTube TV, etc.) to keep ESPN.

Bottom line: YouTube TV and Hulu + Live TV gained < 150K incremental subscribers during the standoff. If we assume 100% of those came from Charter, then missing key events such as the U.S. Open and College football kickoff led 1% of their subscribers to move elsewhere.

Interesting: Charter’s willingness to leave the video business entirely and concentrate on broadband was one of their key negotiating points. For example, video does not appear anywhere on their list of top pricing packages.

Quote from Craig Moffett – Partner and Senior Analyst @ MoffetNathanson:

“The truth is, they don’t make very much money on video. It’s hard to negotiate with a counterparty that has nothing to lose.”

Video: Charter agrees to pay Disney a wholesale fee, ending the 11-day dispute

Big question #7: What share of pay-TV households watch ESPN?

Quick answer: Less than 20% of pay-TV households watch ESPN for 3+ hours each month. Just 1% watch 12+ hours per month.

Why this matters: ESPN is the most expensive channel at $9.42 per month compared to $0.49 for the average channel.

Big question #8: How much does ESPN pay to sports leagues?

Quick answer: $9B per year.

Wow: Since 2010, sports rights have grown 8% per year (CAGR)

Quote from Ben Thompson – Author/Founder @ Stratechery:

“The biggest long-term question, though, has to be around sports itself. Sports leagues could extract ever higher rights fees from ESPN because ESPN could extract ever higher affiliate fees from cable TV providers; if the latter is broken than the former is as well.”

More: This Cable Company Stopped Marketing TV to Its Customers. Here’s What Happened.