Eight big questions re: cord cutting:

1) How do Americans receive television?

2) How many homes currently subscribe to a pay-TV bundle?

3) What share pay-TV subscriptions are streaming?

4) How large is the pay-TV market?

5) How does the broadband market compare to pay-TV?

6) Why is total pay-TV revenue not declining at the same rate as subscribers?

7) Which demographic groups are more likely to keep pay-TV?

8) What types of content are valued most in the pay-TV bundle?

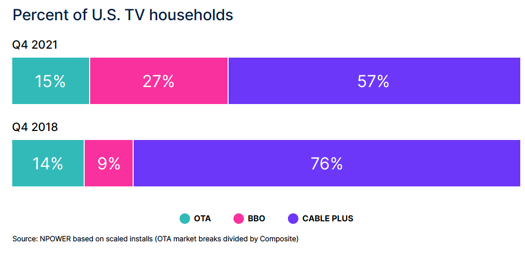

Big question #1: How do Americans receive television?

Share of U.S. TV households by source according to Nielsen:

1) Traditional pay-TV – 57%

2) Broadband-only – 27%

3) Antenna (OTA) – 15%

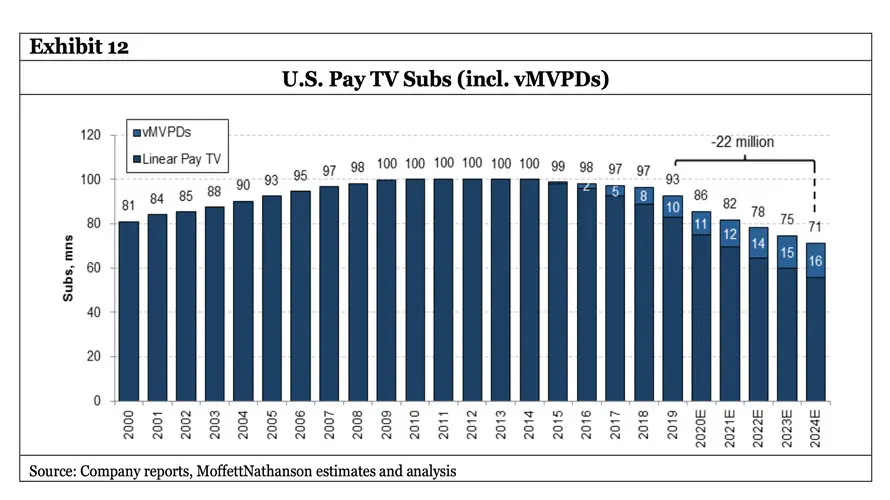

Big question #2: How many homes currently subscribe to a pay-TV bundle?

Quick answer: 78.1M

YoY change in pay-TV subscribers:

1) Traditional pay-TV – ↓ 5.7M

2) Streaming pay-TV – ↑ 1.9M

3) Total pay-TV – ↓ 3.8M

Total pay-TV subscriptions (YoY growth):

1) 2019-Q2 – 91.0M

2) 2020-Q2 – 85.9M (↓ 6%)

3) 2021-Q2 – 82.5M (↓ 5%)

4) 2022-Q2 – 78.1M (↓ 5%)

Big question #3: What share pay-TV subscriptions are streaming?

Quick answer: 17%

Streaming pay-TV subscriptions (YoY growth):

1) 2019-Q2 – 8.2M

2) 2020-Q2 – 9.9M (↑ 20%)

3) 2021-Q2 – 11.7M (↑ 18%)

4) 2022-Q2 – 13.0M (↑ 17%)

Streaming share of pay-TV subscribers:

1) 2019-Q2 – 9%

2) 2020-Q2 – 12%

3) 2021-Q2 – 14%

4) 2022-Q2 – 17%

Traditional pay-TV subscriptions (YoY growth):

1) 2019-Q2 – 82.8M

2) 2020-Q2- 76.0M (↓ 8%)

3) 2021-Q2 – 70.7M (↓ 7%)

4) 2022-Q2 – 65.0M (↓ 8%)

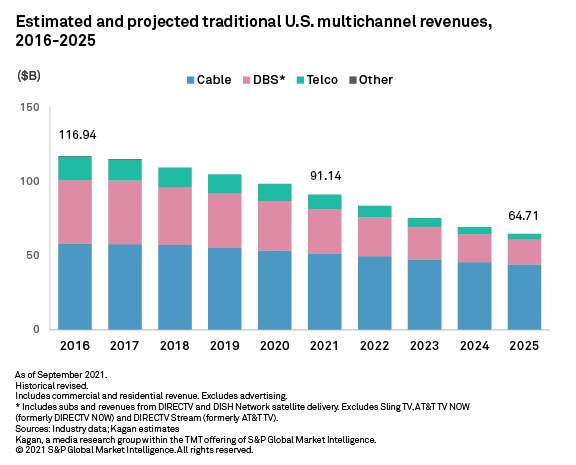

Big question #4: How large is the pay-TV market?

U.S. pay-TV revenue from subscriptions (% change) according to Kagan:

1) 2016 – $117B

2) 2021 – $91B (↓ 22%)

3) 2025 – $65B (↓ 29%)

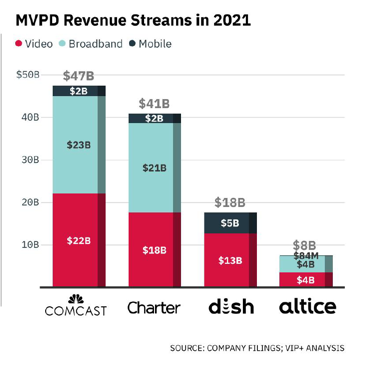

Big question #5: How does the broadband market compare to pay-TV?

Quick answer: Broadband service is now a larger (and growing) business for companies such as Charter and Comcast.

Total broadband subscriptions (YoY growth):

1) 2019-Q2 – 100.0M

2) 2020-Q2 – 103.4M (↑ 3%)

3) 2021-Q2 – 107.4M (↑ 4%)

4) 2022-Q2 – 108.7M (↑ 1%)

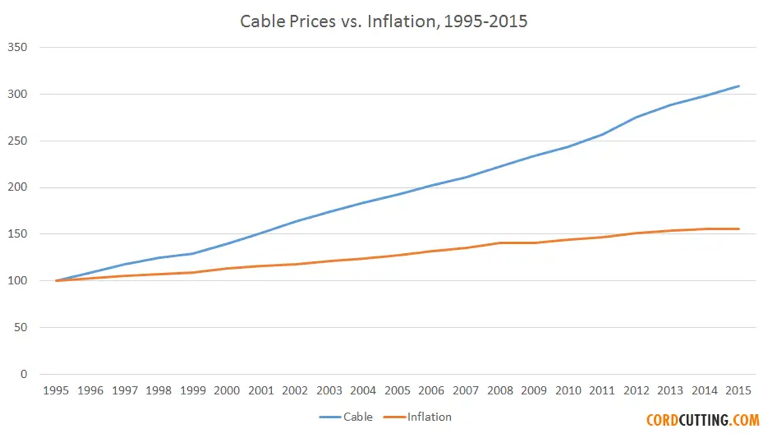

Big question #6: Why is total pay-TV revenue not declining at the same rate as subscribers?

Quick answer: As inflation and cancellations have increased, pay-TV prices have risen faster.

Annual price change between 1995-2015, according to CordCutting.com:

1) Pay-TV – ↑ 6%

2) Inflation – ↑ 2%

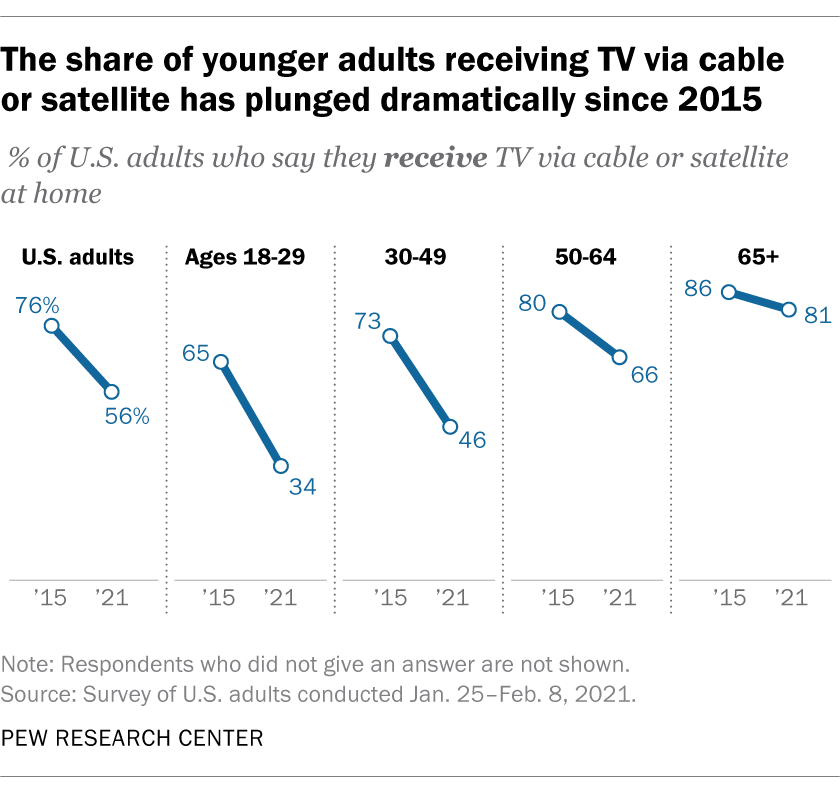

Big question #7: Which demographic groups are more likely to keep pay-TV?

Share of adults that forgo traditional pay-TV according to Pew:

1) 18-29 – 66%

2) 30-49 – 54%

3) 18+ – 44%

4) 50-64 – 34%

5) 65+ – 19%

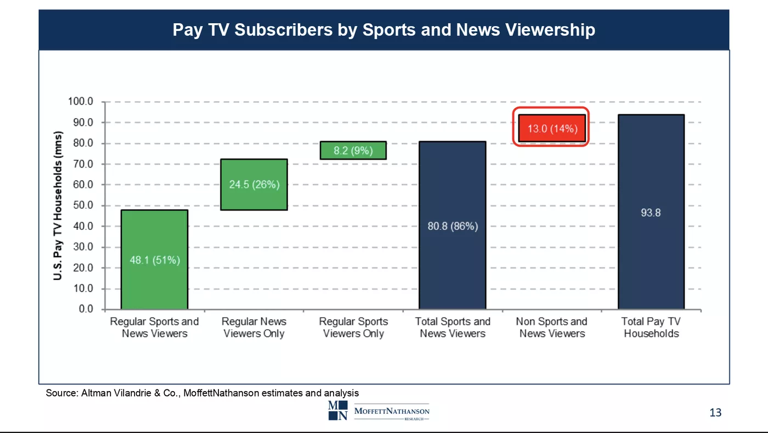

Big question #8: What types of content are valued most in the pay-TV bundle?

Quick answer: 51% of pay-TV subscribers are regular sports and news viewers.

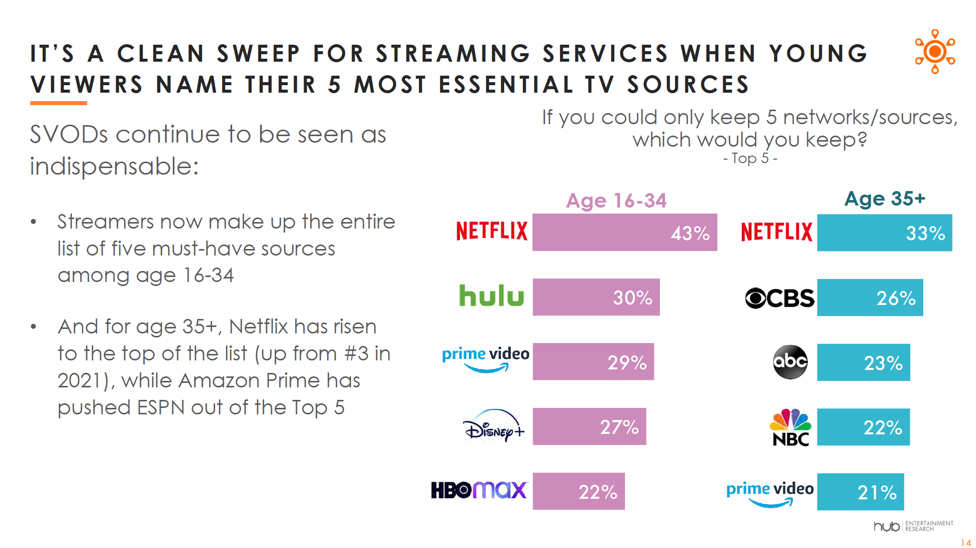

Bad sign: No cable network is in the top 5 most essential TV sources.