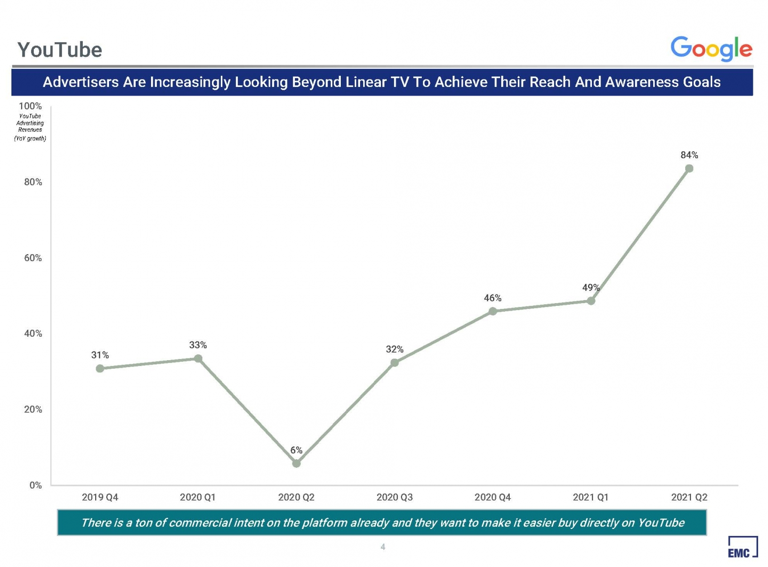

YouTube advertising revenue (YoY growth):

1) 2019-Q2 – $3.6B

2) 2020-Q2 – $3.8B (↑ 6%)

3) 2021-Q2 – $7.0B (↑ 84%)

Big question #1: What drove YoY growth in revenue for YouTube?

Quick answer: A rapidly increasing CTV user base and higher CPMs (↑ 108% YoY).

YouTube users in the U.S. on CTV (% change):

1) Mar-20 – 100M

2) Dec-20 – 120M (↑ 20%)

Share of YouTube ads on CTV according to The Information:

1) 2019 – 12%

2) 2020 – 40%

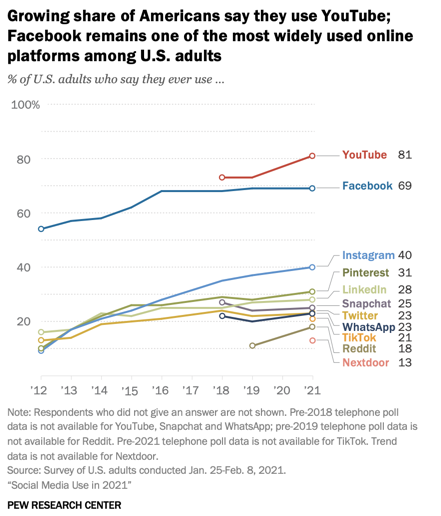

Share of U.S. adults who use YouTube according to Pew:

1) 2018 – 73%

2) 2021 – 81%

Big question #2: What items limit YouTube’s ability to cut into the $70B TV ad market?

Missing items from YouTube ad offering according to AdAge:

1) Measurement (beyond YouTube)

2) Frequency management (beyond YouTube)

3) Targeting (beyond YouTube data)

Quote from anonymous media buying executive:

“We know that the marketplace for TV is challenging, at best. And in order to really transfer dollars over from linear cable to something like YouTube, you need to understand, ‘Am I getting the same efficiency? Am I getting the same value? Am I getting the same audience?’”

YouTube’s share of U.S. video ad market according to eMarketer / Cross Screen Media:

1) 2019 – 4%

2) 2020 – 4%

3) 2021P – 5%

4) 2022P – 6%

5) 2023P – 6%