Eight big questions re: Disney streaming:

1) How does sports betting fit into the puzzle for ESPN?

2) Could Apple buy Disney?

3) How much revenue is Disney generating from streaming/direct-to-consumer?

4) How much money has Disney+ lost since launching in 2019?

5) How many people subscribe to Disney’s streaming services?

6) What share of Disney+ subscribers are international?

7) What share of Disney+ subscribers are ad-supported?

8) What share of total TV time do Disney+ and Hulu account for?

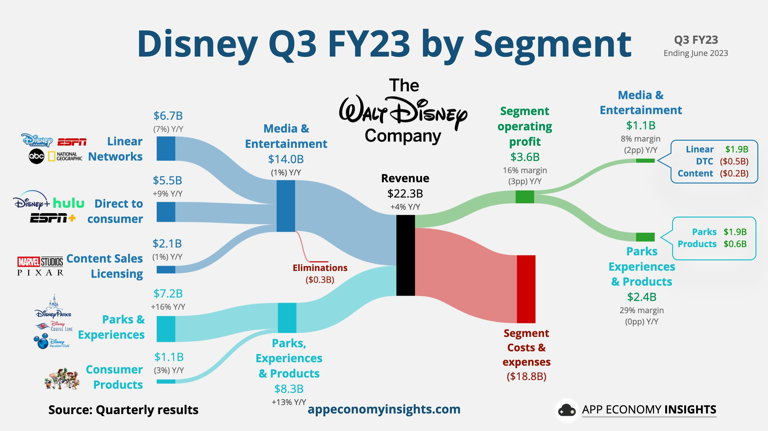

Setting the table: Linear TV networks such as ABC and ESPN account for 1/3 of Disney’s operating profits, but those are beginning to decline (↓ 23% YoY) as cord-cutting increases.

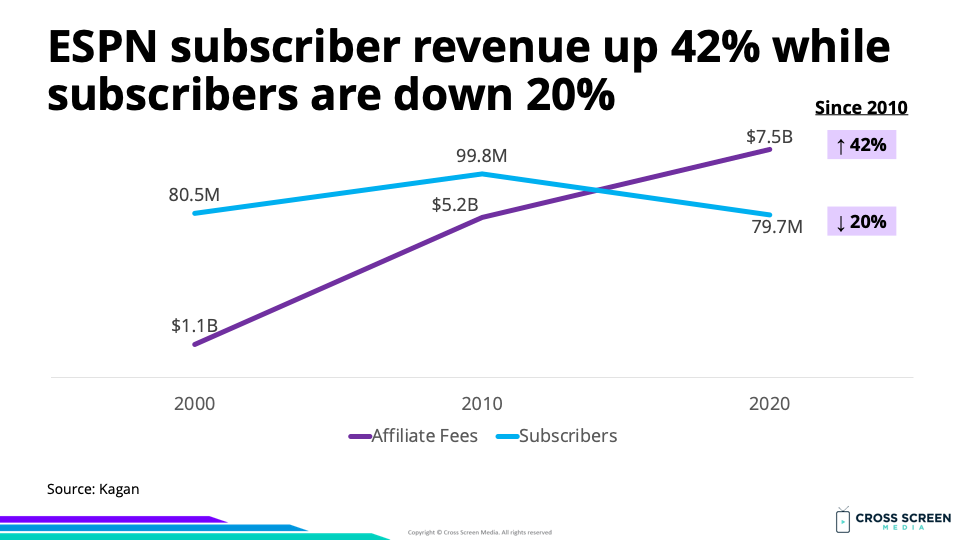

Why this matters: Since 2010, ESPN has lost 20% of its subscriber base but has been able to increase revenue by 42% through higher subscription fees (↑ 74%). Increasing cord-cutting and exploding sports rights fees are testing this model.

Big question #1: How does sports betting fit into the puzzle for ESPN?

Quick answer: ESPN signed a 10-year deal with Penn Gaming worth $2B. In recent years, ESPN has moved closer to sports betting through advertising and featuring betting lines on its shows. Partnering with Penn Gaming will allow them to increase revenue from gambling without operating a sports book itself.

Wow: Dave Portnoy bought Barstool Sports back from Penn Gaming for $1, roughly $550M less (0.0000002%) than Penn Gaming paid for it!

Big question #2: Could Apple buy Disney?

Quick answer: Unlikely due to the regulatory environment. Apple’s market cap is 18X larger than Disney’s, so the price would not be an issue!

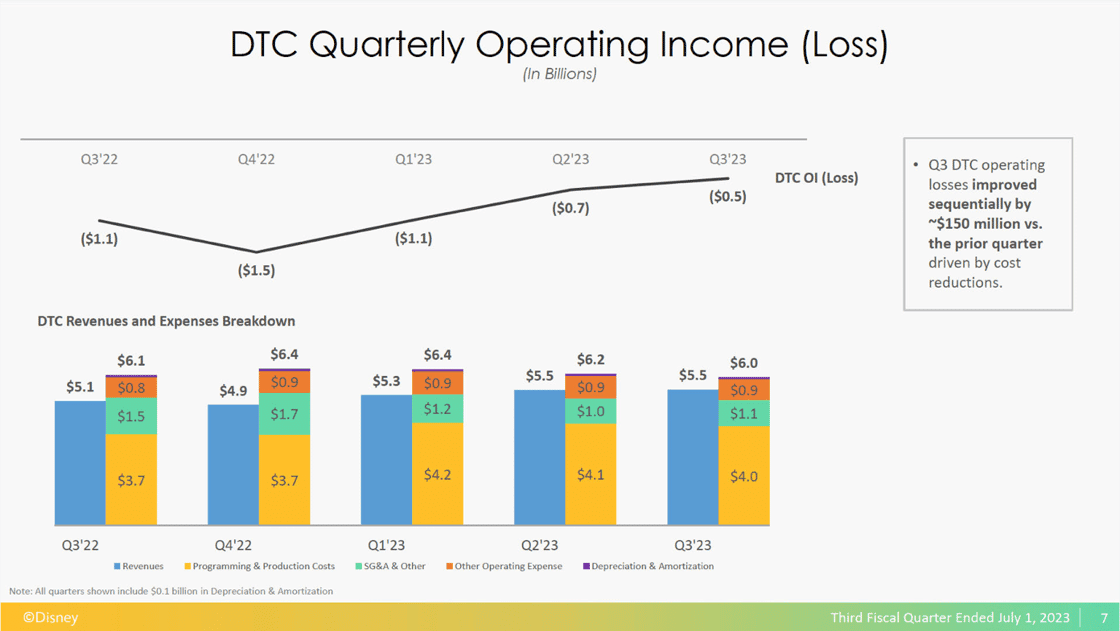

Big question #3: How much revenue is Disney generating from streaming/direct-to-consumer?

Disney streaming/DTC revenue (YoY growth):

1) 2022-Q2 – $5.1B

2) 2023-Q2 – $5.5B (↑ 8%)

Bottom line: Disney+’s goal is to be profitable by September 2024, which drives decisions like the second price increase ($8 → $11 → $14) in 10 months.

Disney streaming/DTC profit (YoY growth):

1) 2022-Q2 – ($1.1B)

2) 2023-Q2 – ($500M) (↑ 55%)

Big question #4: How much money has Disney+ lost since launching in 2019?

Quick answer: $11B

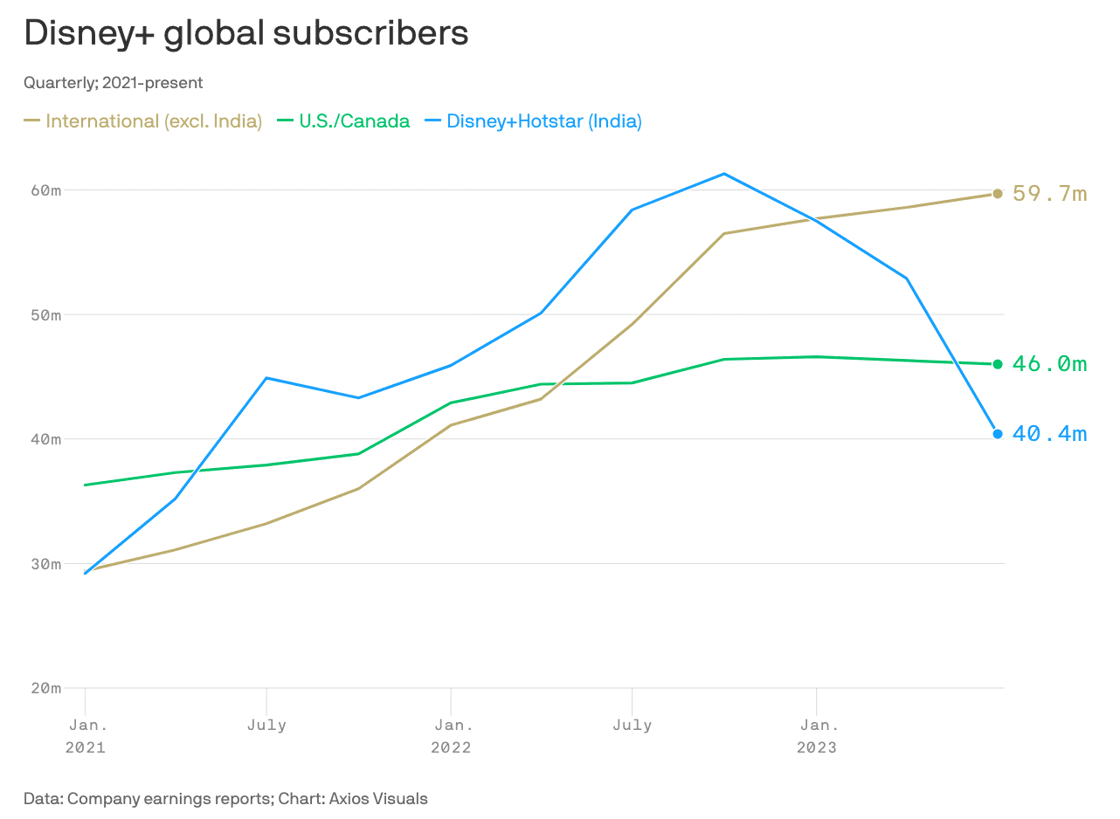

Big question #5: How many people subscribe to Disney’s streaming services?

Disney+ subscribers (YoY growth):

1) 2020-Q2 – 57.5M

2) 2021-Q2 – 116.0M (↑ 102%)

3) 2022-Q2 – 152.1M (↑ 31%)

4) 2023-Q2 – 146.1M (↓ 4%)

Disney streaming subscribers by platform (% of total):

1) Disney+ – 146.1M (67%)

2) Hulu – 48.3M (22%)

3) ESPN+ – 25.2M (11%)

4) Total – 219.6M

Total Disney streaming subscribers (YoY growth):

1) 2020-Q2 – 101.5M

2) 2021-Q2 – 173.7M (↑ 71%)

3) 2022-Q2 – 222.1M (↑ 27%)

4) 2023-Q2 – 219.6M (↓ 1%)

Big question #6: What share of Disney+ subscribers are international?

Share of Disney+ subscribers outside U.S./Canada:

1) 2021-Q2 – 67%

2) 2022-Q2 – 71%

3) 2023-Q2 – 69%

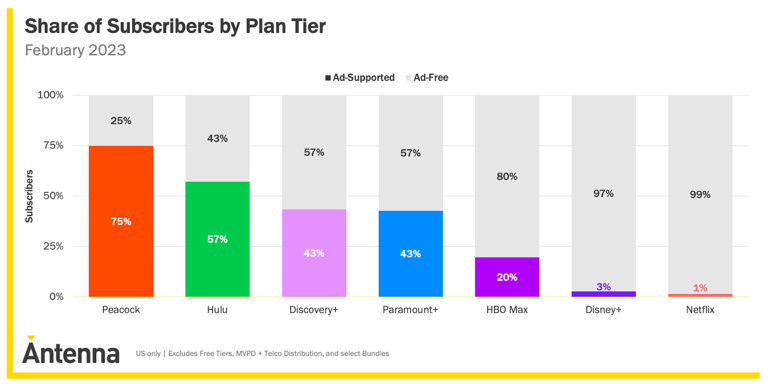

Big question #7: What share of Disney+ subscribers are ad-supported?

Quick answer: ≈ 2% (3.3M)

Bottom line: Disney did not increase its ad-supported tier prices for either Disney+ or Hulu, providing another indication that ad-supported subscriptions bring in higher revenue per user (ARPU). The long-term goal is a balance that resembles Hulu (50%+ w/ ads).

Quote from Bob Iger – CEO @ Disney:

“We’re obviously trying with our pricing strategy to migrate more subs to the advertiser-supported tier.”

Big question #8: What share of total TV time do Disney+ and Hulu account for?

Quick answer: Hulu and Disney+ account for 6% of total TV time and 15% of streaming TV time.

.png?width=1120&upscale=true&name=27B3.8-JUN2023E(Disney).png)