Seven big questions re: how we watch TV:

1) Is broadcast/cable gaining ground on streaming?

2) What is the most popular starting point for watching TV?

3) How many households watch ad-supported streaming?

4) How much time do we spend with ad-supported streaming?

5) Which age groups watch the most ad-supported streaming?

6) Which streaming networks generate the most viewing time?

7) Which streaming networks account for the highest share of total TV?

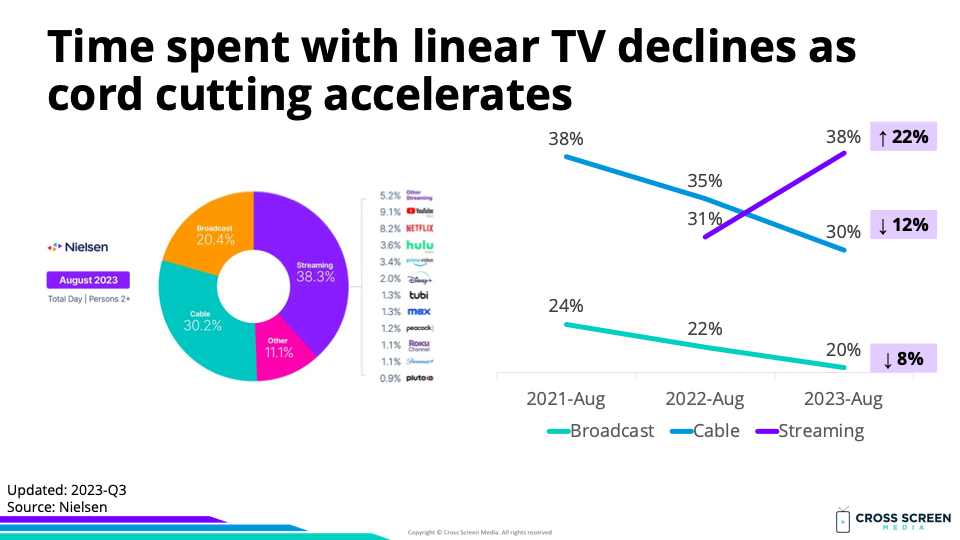

Big question #1: Is broadcast/cable gaining ground on streaming?

Share of total TV time according to Nielsen:

1) Streaming – 39%

2) Cable – 30%

3) Broadcast – 20%

4) Other – 12%

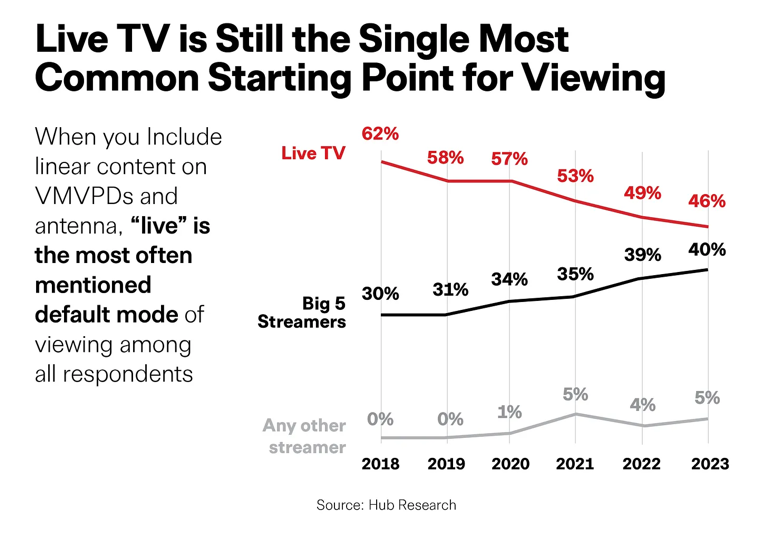

Big question #2: What is the most popular starting point for watching TV?

The most popular starting point for watching TV, according to Hub Research:

1) Live TV – 46%

2) Big 5 Streamers – 40%

3) Any other Streamer – 5%

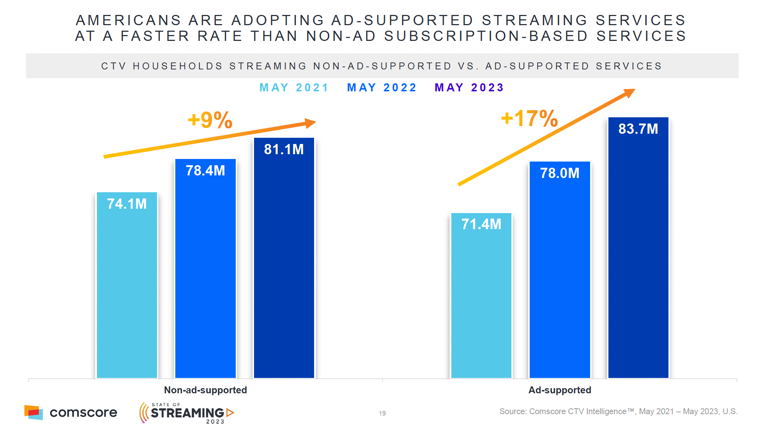

Big question #3: How many households watch ad-supported streaming?

% change in reach by revenue model according to Comscore:

1) Ad-supported – ↑ 17%

2) Subscription – ↑ 9%

Big question #4: How much time do we spend with ad-supported streaming?

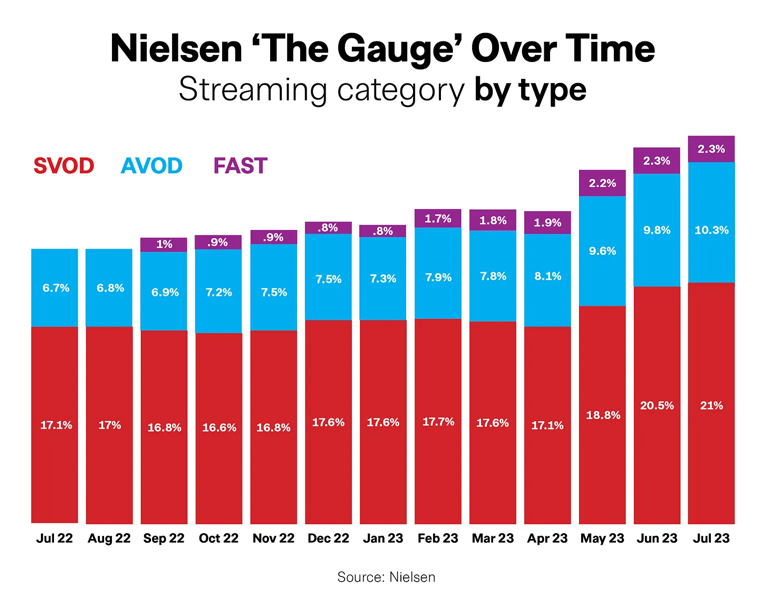

Share of total TV time by streaming type according to Entertainment Strategy Guy:

1) Subscription video-on-demand (SVOD) – 21%

2) Ad-supported video-on-demand (AVOD) – 10%

3) Free ad-supported streaming (FAST) – 2%

YoY change for total TV time by streaming type:

1) FAST – ↑ 71%

2) AVOD – ↑ 27%

3) SVOD – ↑ 19%

Big question #5: Which age groups watch the most ad-supported streaming?

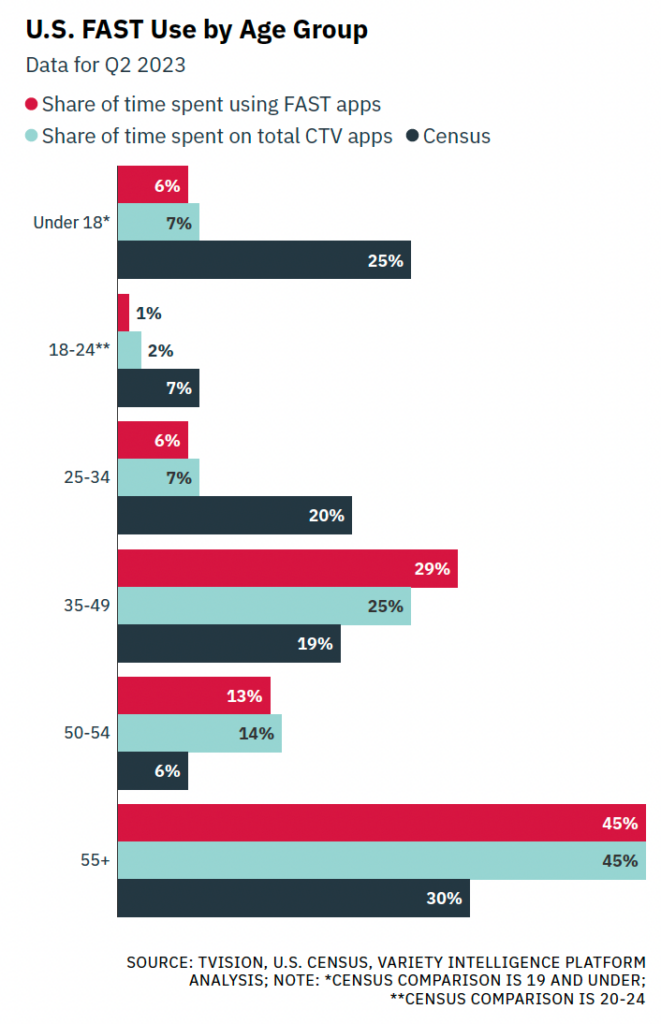

Share of free ad-supported streaming (FAST) time according to TVision:

1) 55+ – 45%

2) 35-49 – 29%

3) 50-54 – 13%

4) 25-34 – 6%

5) < 18 – 6%

6) 18-24 – 1%

Big question #6: Which streaming networks generate the most viewing time?

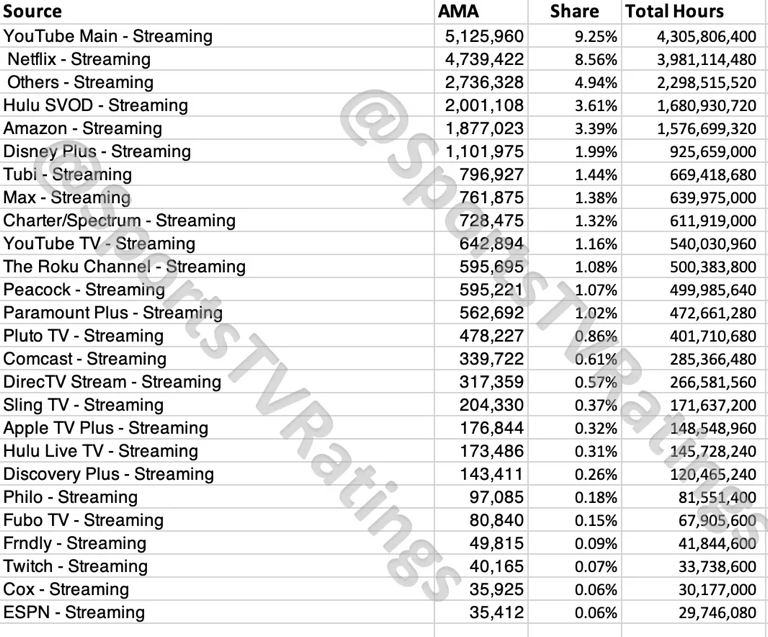

Total monthly hours of viewing time according to SportsTVRatings:

1) YouTube (ad-supported) – 4.3B

2) Netflix – 4.0B

3) Hulu – 2.3B

4) Amazon – 1.6B

5) Disney+ – 926M

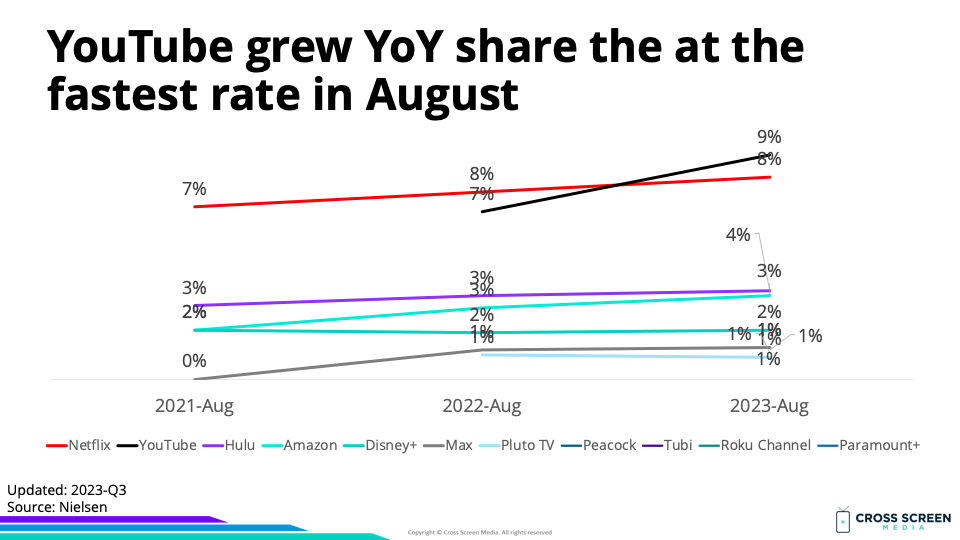

Big question #7: Which streaming networks account for the highest share of total TV?

Share of total TV time (streaming only):

1) YouTube – 9%

2) Netflix – 8%

3) Hulu – 4%

4) Amazon Prime – 3%

5) Disney+ – 2%

6) Tubi – 1%

7) HBO Max – 1%

8) Peacock – 1%

9) Roku Channel – 1%

10) Paramount+ – 1%

11) PlutoTV – 1%

12) Other – 5%