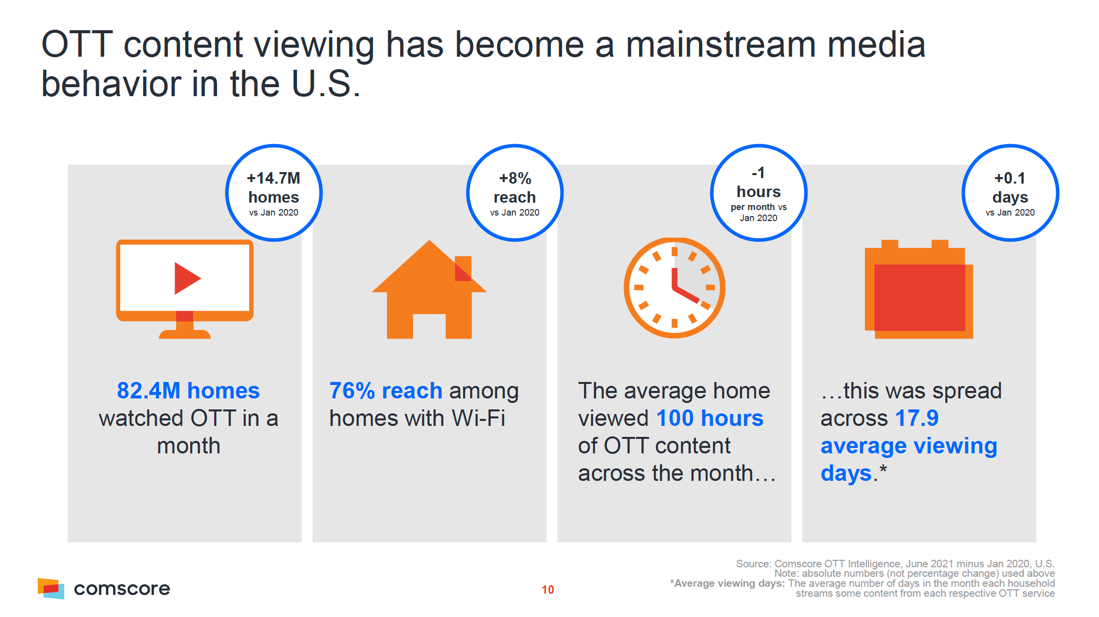

Streaming households by year (YoY growth) according to Comscore:

1) 2016 – 44.0M

2) 2017 – 50.8M (↑ 15%)

3) 2018 – 59.2M (↑ 17%)

4) 2019 – 64.0M (↑ 7%)

5) 2020 – 70.2M (↑ 10%)

6) 2021 – 82.4M (↑ 17%)

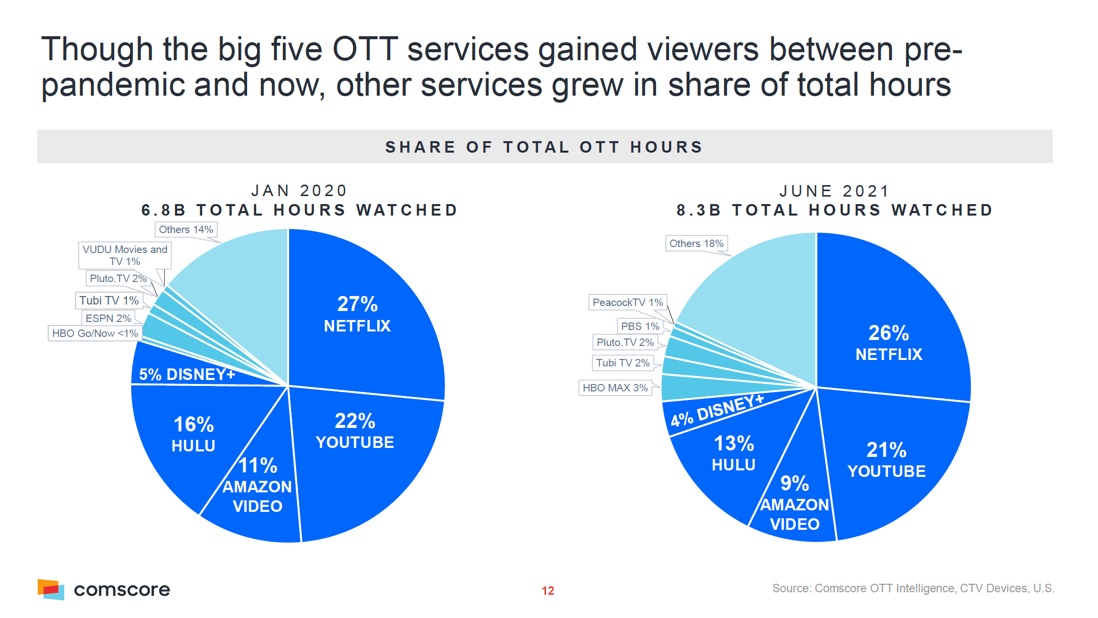

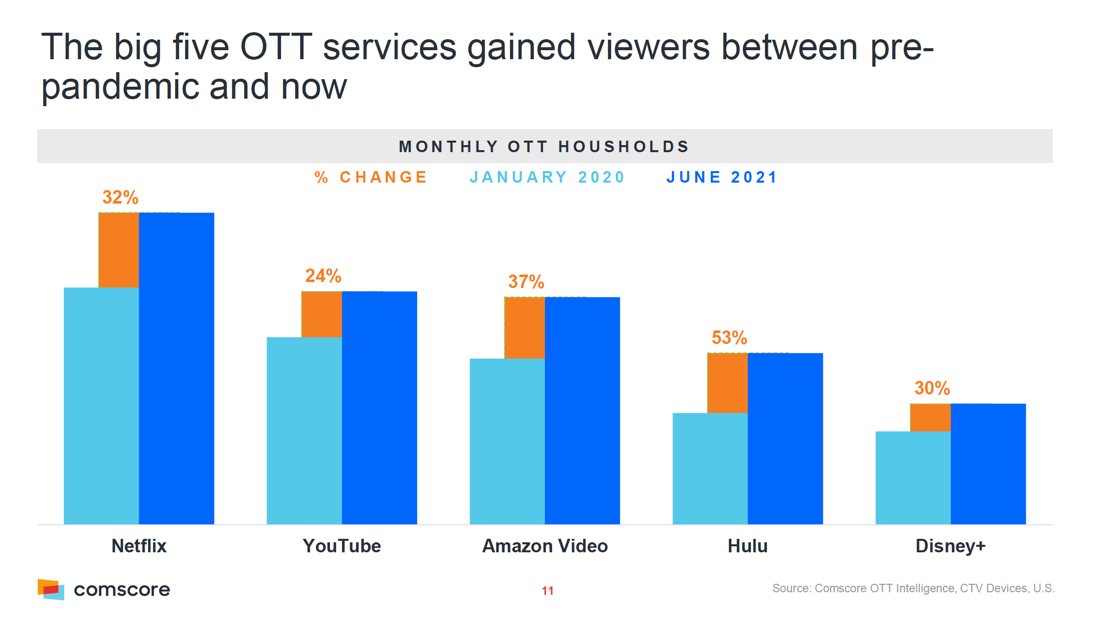

% change for streaming between Jan-20 and Jun-21:

1) Streaming hours –↑ 21%

2) Total households – ↑ 17%

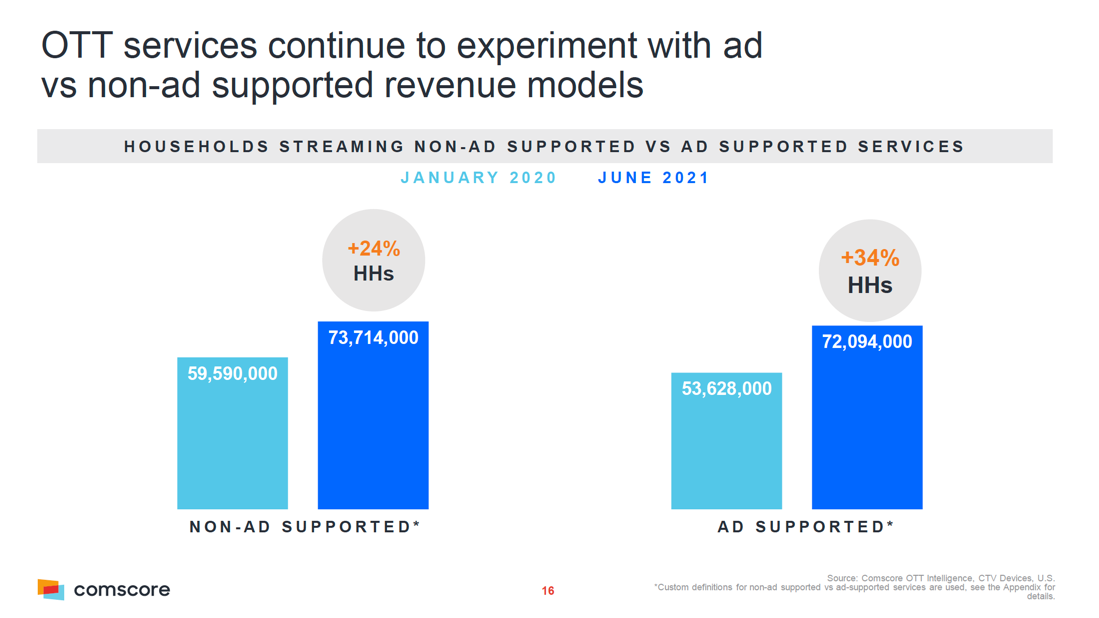

% change in reach by revenue model:

1) Ad-supported – ↑ 18.5M

2) Subscription – ↑ 14.1M

% change in reach by streaming service:

1) Hulu –↑ 53%

2) Amazon Prime Video – ↑ 37%

3) Netflix –↑ 32%

4) Disney+ –↑ 30%

5) YouTube –↑ 24%

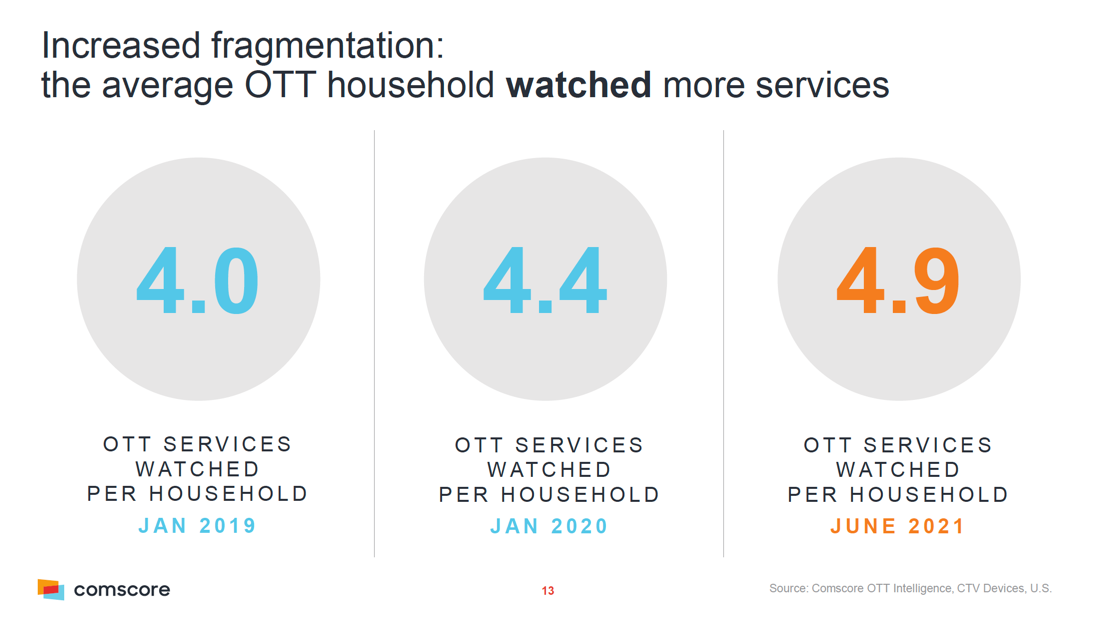

The average number of streaming services watched per household (YoY growth):

1) 2019 – 4.0

2) 2020 – 4.4 (↑ 10%)

3) 2021 – 4.9 (↑ 11%)

Quote from Laura Molen – Co-president of ad sales and partnerships @ NBCUniversal:

“We are seeing [content] consumption at about 70/30 linear to streaming, and in a couple of years, we are predicting it will be about 50/50.”

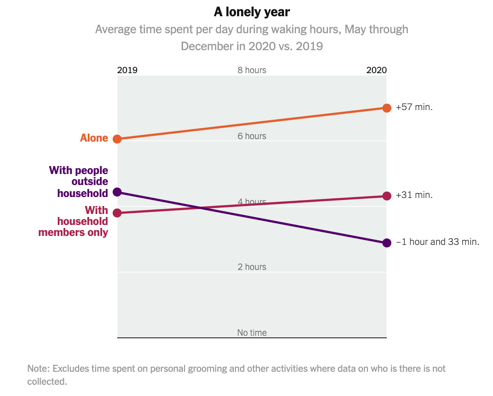

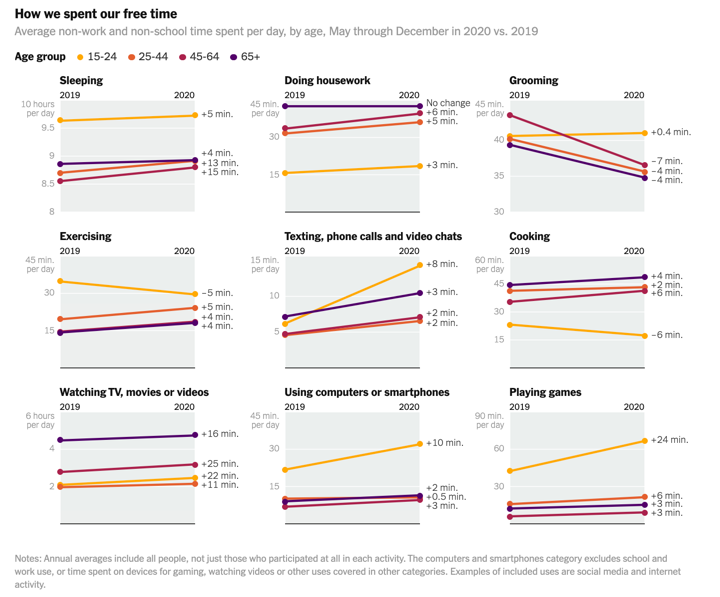

Interesting: The New York Times recently took a deep dive into how people spent their time in 2020 vs. 2019.

Time spent with others:

1) Alone – ↑ 57m

2) Same household –↑ 31m

3) Outside household –↓ 1h 33m

PSA: Perhaps exercise should have gained more time 🤣

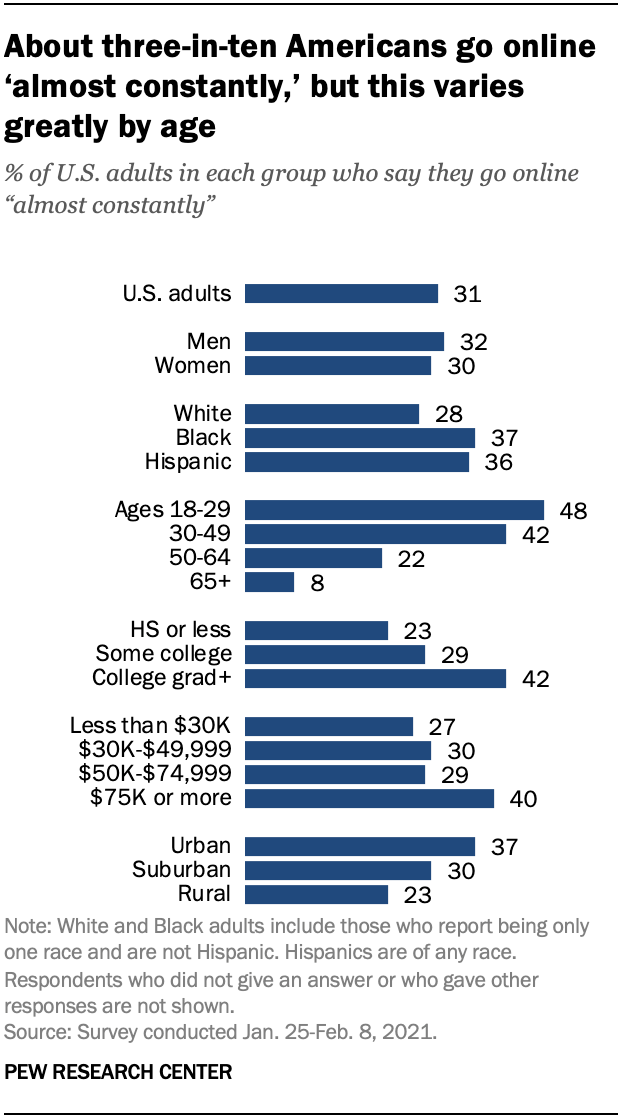

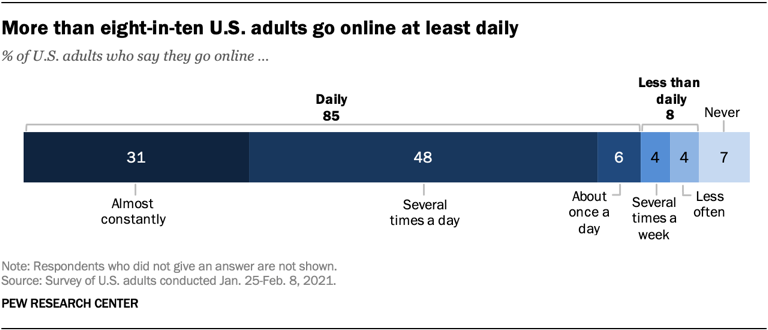

Wow: According to Pew, 31% of adults are online “almost constantly.”

Share of adults by age group online “almost constantly”:

1) 18-29 – 48%

2) 30-49 – 42%

3) 50-64 – 22%

4) 65+ – 8%