Convergent TV Series

What is Disney+?

Disney parks may be struggling in the current environment, but Disney+ has (so far) been a magic carpet ride. The media giant’s ad free subscription service has more than 100 million subscribers as of March 2021 which surpasses the 60 million subscriber goal it set….for 2024.

That’s a ten-fold increase since the service launched in Nov. 2019. International markets are playing an important role in this rapid growth, including over 28 million subscribers in India alone.

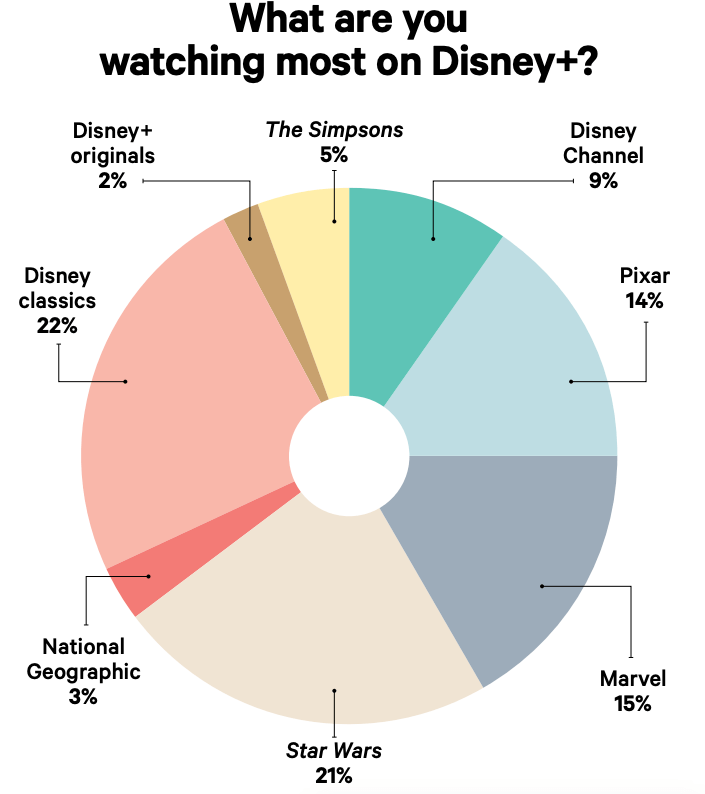

Disney+ is not limiting itself to the child-centric content that has made its parent company famous. Subscribers can watch Marvel movies, Star Wars content, The Simpsons, National Geographic, and all the other media under the massive Disney umbrella. Disney is also producing and licensing original content exclusive to Disney+, highlighted by a 641% boost in sign-ups when it released the film version of hit musical Hamilton.

That breadth of content gives Disney+ broad appeal. The option to bundle Disney+ with Disney-owned options Hulu and ESPN+ expands potential audiences for the service even more.

But Disney+ subscriptions are far from enough to replace theme park revenue lost during the pandemic. Disney would need 364 million Disney+ subscribers to compensate for the $2.2 billion drop in monthly revenue from park closures.

That tension (in addition to the high bar they have set through early success) raises the question: Will Disney+ introduce ads to drive revenue? Or will they try other tiered models, like charging extra for 4k content as competitors do?

What does the growth of Disney+ mean for convergent TV advertising today?

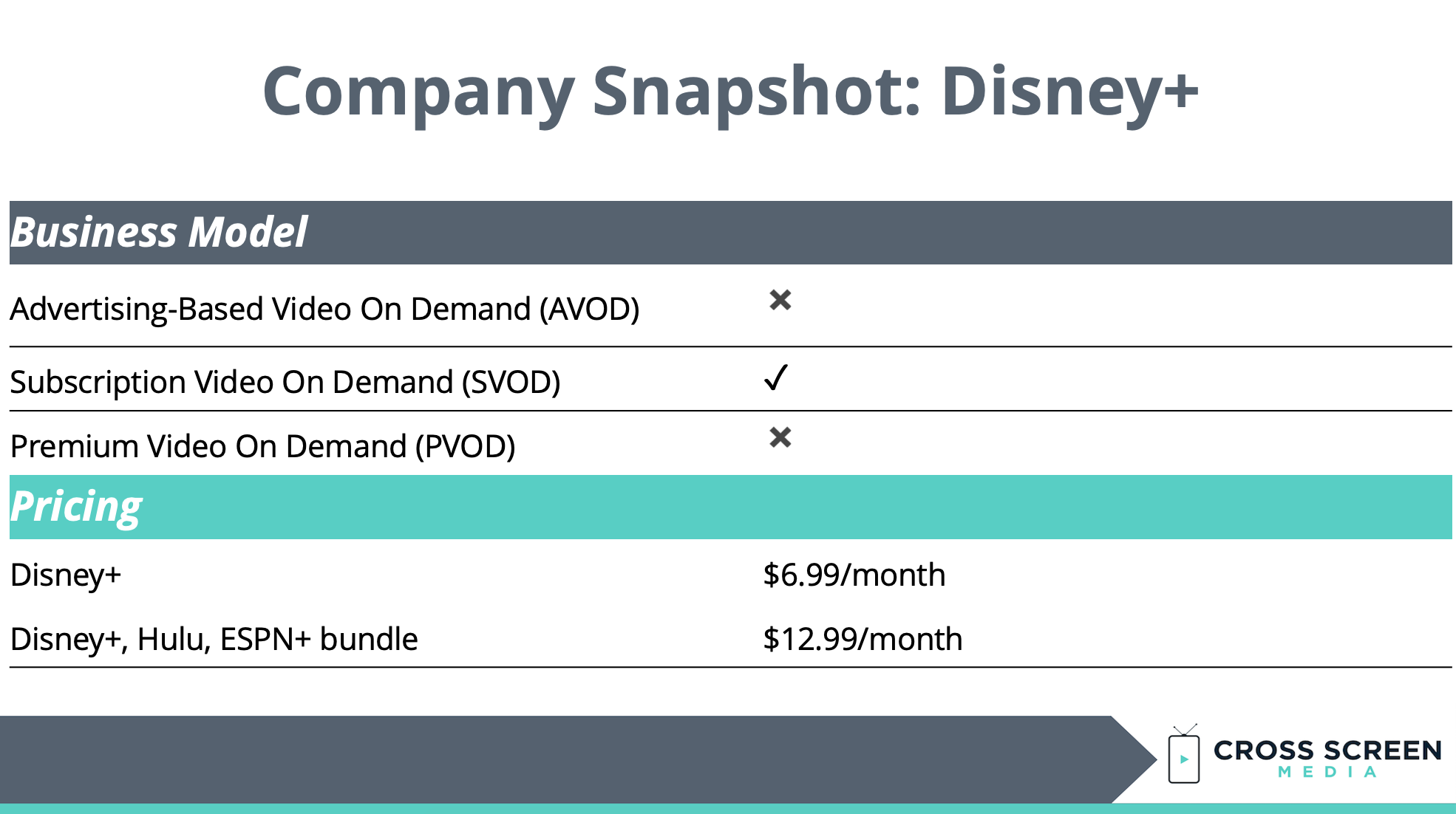

Disney+ doesn’t currently run ads. On the surface, that might sound like a missed revenue opportunity. But the bigger picture shows deliberate logic behind this decision.

Disney+ can be purchased as part of a cost-saving bundle with ESPN+ and Hulu, which both offer ad-supported tiers. This comes with several advantages.

Increased revenue per subscriber.

Broader appeal than each service has on its own.

Disney can use Disney+ customer data to improve ad targeting on the other services, which makes them even more appealing to advertisers seeking brand safe content.

The bundle is close in price to Netflix, bringing Disney more into head-to-head competition for consumer streaming dollars with the ad-free option. Keeping ads off Disney+ may help Disney maintain subscribers who otherwise avoid ad-supported services.

What does Disney+’s strong growth mean for convergent TV advertising in the future?

Disney+ is, in itself, an advertising and engagement strategy for the rest of the Disney ecosystem. The wide world of Disney includes Disney’s theme parks, merchandise, live shows, TV, box office releases, and more — all on top of Disney’s other streaming services.

Disney+ consumer data also improves targeting for advertisers on Hulu, ESPN+, and Disney’s successful linear TV channels.

These synergies make Disney+ a different animal than other streaming players. In trying to understand the revenue strategy of Disney+, it’s important to look at it as a piece of something much larger, where subscriber growth may be prioritized over direct revenue for the foreseeable future.

So, will Disney+ run an ad-supported version any time soon? Unlikely.

We’ll keep this page updated with new developments; check back for the latest on Disney+’s magical ride.

Read the rest of our Convergent TV blog series here!