Nine big questions re: bundles and churn:

1) How do bundles work?

2) Why are bundles coming back?

3) Who is bundling?

4) What is churn?

5) How many subscribers cancel their service each month?

6) Why is reducing churn so important?

7) Which streaming services have the lowest churn rate?

8) How does the churn rate for streaming compare to other industries?

9) How does churn impact a customer’s lifetime value to a streaming service?

Big question #1: How do bundles work?

Quick answer: Similar to cable, consumers pay one price for multiple streamers. Unlike cable, the consumer still logs into each app (Hulu, Max, etc.) to watch each streamer’s content and cancel anytime.

Big question #2: Why are bundles coming back?

Quick answer: Bundles are re-emerging to reduce cancellations (churn) among streamers. Consumers benefit from lower prices (≈ 30%) and consolidated billing, which makes bundles attractive.

Quote from George Loewenstein – Professor of economics and psychology @ Carnegie Mellon University:

“It may be less painful paying for a group of things because you don’t know how much they cost individually.”

Quote from Peter Kafka – Chief Correspondent covering media and technology @ Business Insider:

“Unless you work at a Big TV company, you don’t want the bundle to come back! It was a terrible way to pay for and watch TV, and when it was around, most of you complained about it.

For those of you who weren’t around or don’t remember: The old-timey TV bundle was a take-it-or-leave-it package, sold to you by your local cable monopoly (which you likely hated). Never watched sports? Didn’t matter — you were paying for ESPN, anyway. Never watched old movies? You still paid for TCM. Not into Rupert Murdoch’s politics? You paid up for Fox News, regardless.

But it was worse than that. The old-timey bundle was also a prerequisite for some things you might want, like HBO or Showtime. Your local cable monopoly would sell you those channels only once you’d already subscribed to the basic bundle. And good luck unsubscribing to any of this stuff whenever you decided you were done with it — like you can with a single click for a streamer. The cable industry was infamous for making it hard to leave.”

Video: Are We Going Back To Cable? Understanding The Future Of Streaming Bundles

Big question #3: Who is bundling?

Existing bundles include:

1) Disney+, Hulu, and ESPN+

2) Disney+, Hulu, and Max

3) Peacock Premium, Apple TV+, and Netflix Basic (through Comcast)

4) Paramount+ and Showtime

5) Max and Netflix Basic (through Verizon)

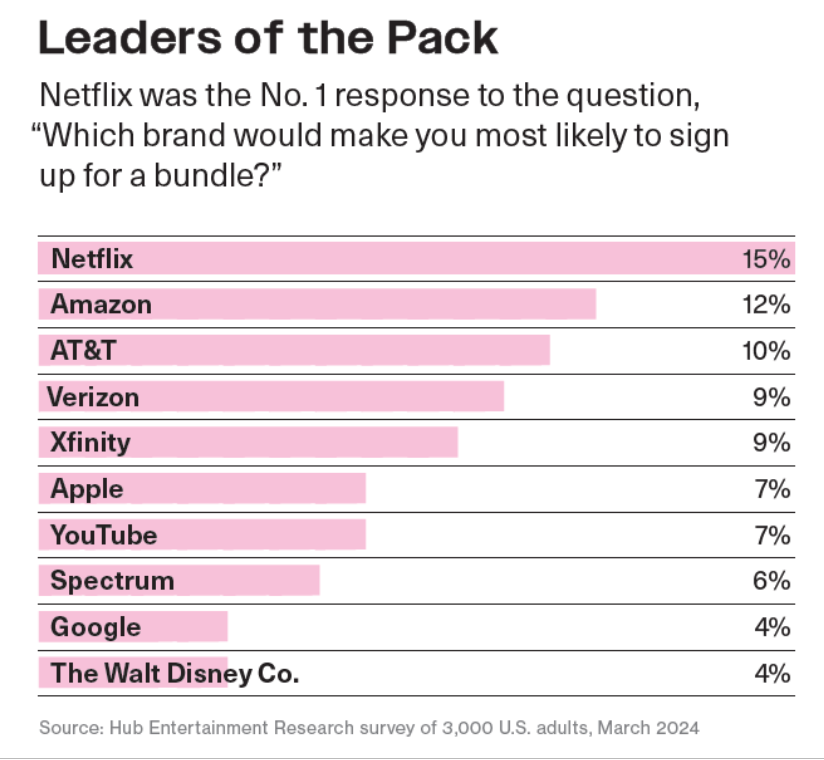

The brands most likely to make you sign up for a bundle, according to Hub Entertainment Research:

1) Netflix – 15%

2) Amazon – 12%

3) AT&T – 10%

4) Verizon – 9%

5) Xfinity – 9%

Big question #4: What is churn?

Quick answer: Churn is the percentage of streaming subscribers that cancel.

Flashback: Why Streaming Churn Matters

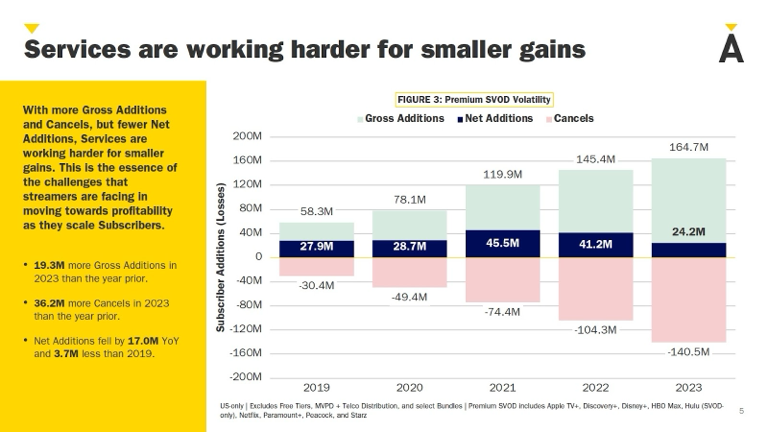

Big question #5: How many subscribers cancel their service each month?

Average monthly churn rate (YoY growth) according to Antenna:

1) 2019 – 3.2%

2) 2020 – 4.0% (↑ 25%)

3) 2021 – 4.5% (↑ 13%)

4) 2022 – 5.8% (↑ 29%)

5) 2023 – 5.5% (↓ 5%)

Big question #6: Why is reducing churn so important?

Quick answer: Streaming services take five to ten months to break even after they pay $50+ to acquire new customers (CAC).

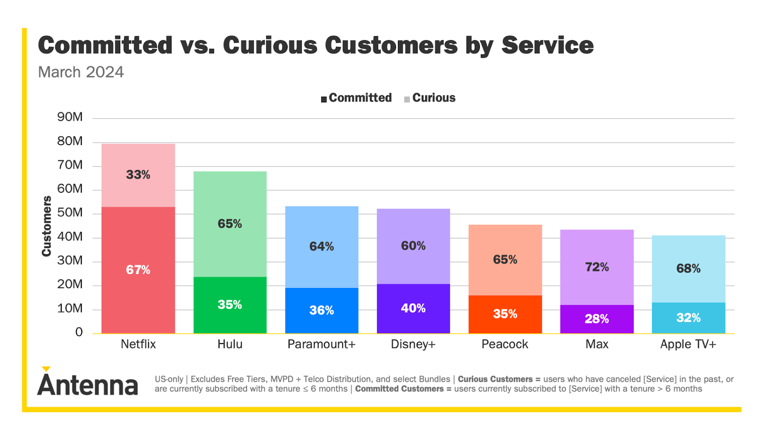

Interesting: Antenna created a value for “curious” customers, who are most at risk for churn. A curious customer is someone who has subscribed to a streaming service for less than six months.

Streamers with the largest share of curious customers, according to Antenna:

1) Max – 72%

2) Apple TV+ – 68%

3) Peacock – 65%

4) Hulu – 65%

5) Paramount+ 64%

6) Disney+ – 60%

7) Netflix – 33%

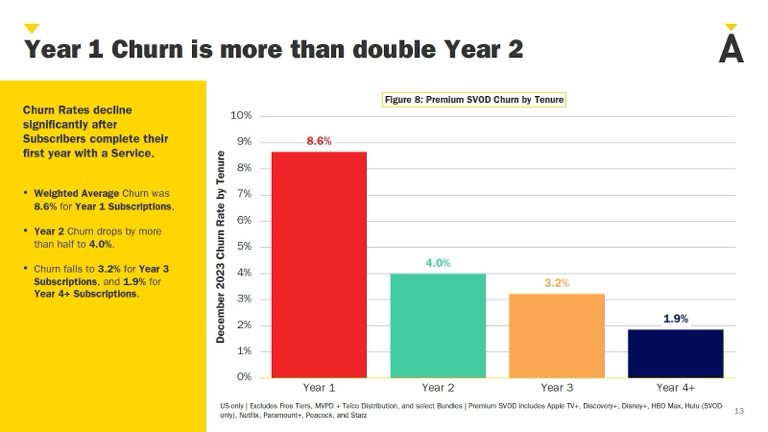

Why this matters: Customers are 2X as likely to cancel during their first year.

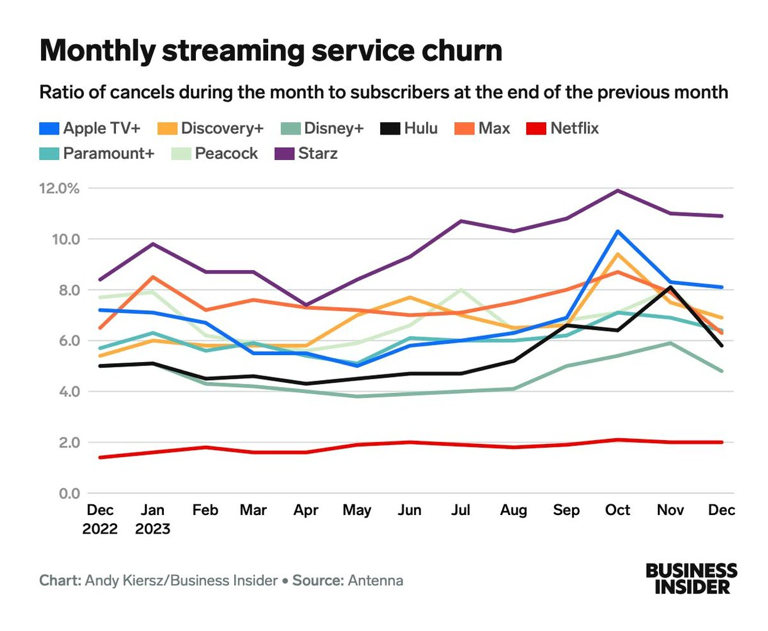

Big question #7: Which streaming services have the lowest churn rate?

Average monthly churn rate in 2023 by streaming service:

1) Netflix – 1.8%

2) Disney+ – 4.5%

3) Hulu – 5.0%

4) Average – 5.5%

5) Paramount+ – 6.0%

6) Discovery+ – 6.6%

7) Peacock – 6.7%

8) Apple TV+ – 6.7%

9) Max+ – 7.4%

10) Starz – 9.2%

Big question #8: How does the churn rate for streaming compare to other industries?

Churn rate by industry:

1) Wireless phone service (Verizon) – 0.9%

2) Digital fitness (Peloton) – 1.1%

3) Satellite TV (DISH) – 1.5%

4) Satellite radio (SiriusXM) – 1.5%

5) Streaming radio (Spotify) – 3.9%

6) Streaming video (average) – 5.5%

Big question #9: How does churn impact a customer’s lifetime value to a streaming service?

Quick answer: Higher churn leads to lower lifetime values.

More revenue → more content → more customers → lower churn → more revenue

Quick math for industry average churn:

1) Monthly churn – 5.5%

2) Customer lifetime – 18 months

3) Monthly subscription fee – ≈ $9

4) Lifetime value (LTV) – $168