Big news: Streaming rights for the Indian Premier League (IPL) cricket will be moving from Disney’s Hotstar to Viacom18.

Big question #1: What is Viacom18?

Quick answer: A joint venture between Network18 (51%) and Paramount (49%).

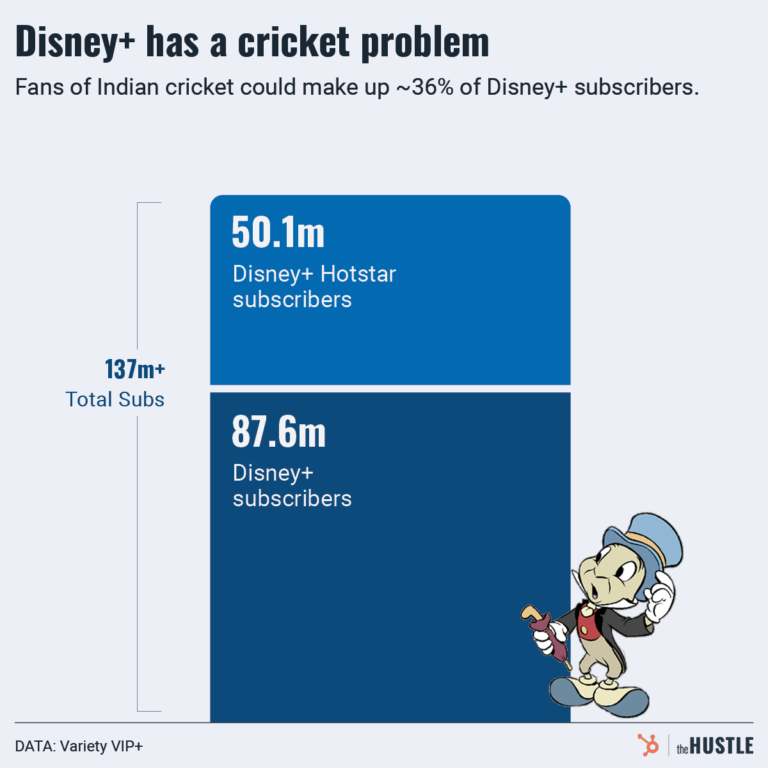

Why this matters #1: India’s Hotstar accounts for 36% of all Disney+ subscribers. Analysts are projecting that 20M Hotstar subscribers could cancel due to the loss of cricket.

Quote from Brandon Katz – Senior TV Industry Reporter @ The Wrap:

“Talk about a sticky wicket. The Walt Disney Company, which has had TV and streaming rights to cricket’s Indian Premier League, just came up with only half those rights in a new five-year deal that could have a very big impact on the entertainment giant’s future.”

Big question #2: How important are media rights to Disney+ growth in India?

Quick answer: Cricket is the most popular sport in India, with 124M fans accounting for 90% of the 136M who like any sport.

Key details for new IPL media rights deal:

1) Begins in 2023 and runs through 2027

2) 5 years total

3) ≈ $6B total

4) $1.2B per year

5) 410 matches per year

Future IPL media rights by network according to The BBC:

1) Streaming (Viacom18) – $3.05B

2) Linear TV (Disney) – $3.02B

3) Total – $6.07B

Why this matters #2: Streaming rights were valued higher than the linear TV rights.

Share of viewership from streaming:

1) Indian Premier League – 20%

2) 2022 NFL Super Bowl – 10%

IPL media rights per year comparison (% change):

1) Current (Disney/Hotstar) – $480M

2) Future (Disney/Viacom18) – $1.2B (↑ 153%)

Media rights value per game:

1) National Football League – $17M

2) Indian Premier League – $14M

3) English Premier League – $11M