Big news: Baseball is back after a 98-day lockout, the ninth work stoppage for Major League Baseball (MLB) since 1972.

Big question #1: Why was there a lockout?

Quick answer: The collective bargaining agreement from 2017 expired, and owners/players were at an impasse.

Big question #2: What was the primary disagreement between owners and players?

Quick answer: Players argue team revenue/profit is growing faster than salaries.

Player share of revenue by collective bargaining agreement:

1) 2007-11 – 51.6%

2) 2012-16 – 50.2%

3) 2017-21 – 49.3%

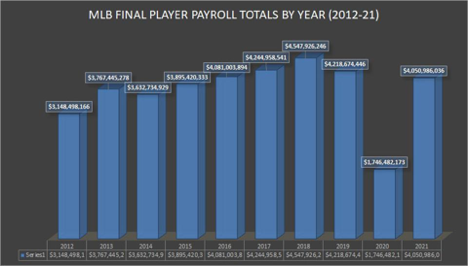

MLB total payroll (YoY growth) according to Forbes:

1) 2012 – $3.2B

2) 2013 – $3.8B (↑ 20%)

3) 2014 – $3.6B (↓ 4%)

4) 2015 – $3.9B (↑ 7%)

5) 2026 – $4.1B (↑ 5%)

6) 2017 – $4.2B (↑ 4%)

7) 2018 – $4.6B (↑ 7%)

8) 2019 – $4.2B (↓ 7%)

9) 2020 – $1.8B (↓ 59%)

10) 2021 – $4.1B (↑ 132%)

Interesting: If adjusted for inflation, the Oakland A’s payroll has declined 30% (↓ $19M) over the past 20 seasons, while franchise value has grown 349% (↑ $869M).

Oakland A’s payroll in 2022 dollars (% change):

1) 2002 – $63M

2) 2022 – $44M (↓ 30%)

Oakland A’s franchise value in 2022 dollars (% change):

1) 2002 – $249M

2) 2022 – $1.2B (↑ 349%)

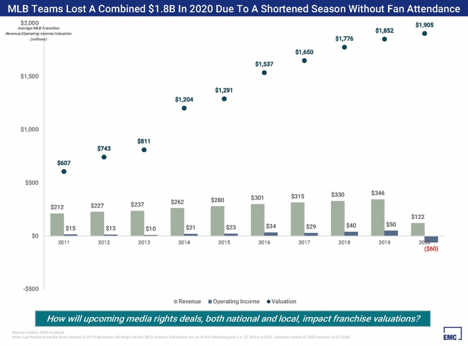

MLB franchise value (YoY growth) according to Forbes:

1) 2012 – $607M

2) 2013 – $743M (↑ 22%)

3) 2014 – $811M (↑ 9%)

4) 2015 – $1.20B (↑ 48%)

5) 2026 – $1.29B (↑ 7%)

6) 2017 – $1.54B (↑ 19%)

7) 2018 – $1.65B (↑ 7%)

8) 2019 – $1.78B (↑ 8%)

9) 2020 – $1.85B (↑ 4%)

10) 2021 – $1.90B (↑ 3%)

11) 2022 – $2.07B (↑ 9%)

Top five MLB franchises by value (YoY growth):

1) New York Yankees – $6.0B (↑ 14%)

2) Los Angeles Dodgers – $4.1B (↑ 14%)

3) Boston Red Sox – $3.9B (↑ 13%)

4) Chicago Cubs – $3.8B (↑ 13%)

5) San Francisco Giants – $3.5B (↑ 10%)

% increase between 2012-21:

1) Total payroll – ↑ 29%

2) Average franchise value – ↑ 241%

Big question #3: Did the lockout dampen national advertiser appetite for Major League Baseball?

Quick answer: No. Each of the three national networks is close to selling out for the entire season.

Quote from Mark Evans – EVP of Ad Sales @ Fox Sports:

“It’s hard to aggregate scale quickly in today’s bifurcated environment. If you’re trying to move product, launch a movie, get awareness for a new brand, live sports is the only place in town to do it quickly. It’s the only place to aggregate millions of Americans.”

Outstanding questions:

1) How will new TV rights deals (more $$$) play into the relationship between players and owners?

2) What happens with local (in-market) streaming rights? Will MLB go DTC with MLB.tv or allow local teams to strike deals (Bally Sports, Amazon, etc.)?