|

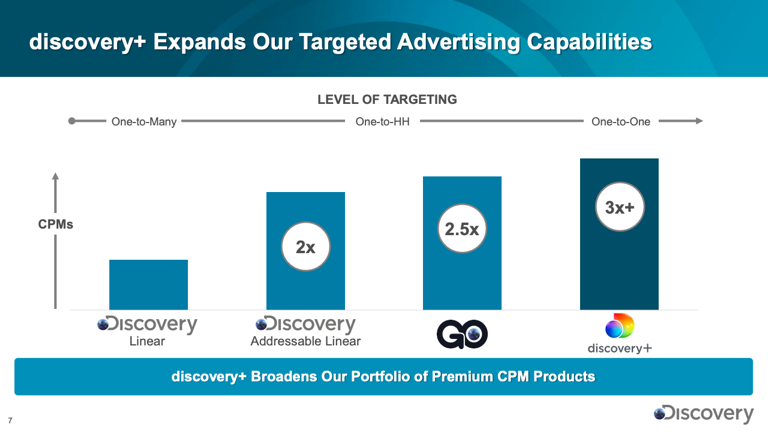

1) The Smart TV Wars get even hotter – Roku’s battles with HBO Max/Peacock along with Comcast’s rumored partnership with Walmart made clear the strategic importance of owning distribution in the streaming era. Look for other major players (Amazon, Samsung, Vizio, Google, etc.) to start throwing more elbows in these deals. 2) National addressable TV ads will drive up CTV/OTT CPMs – If national TV advertisers can purchase addressable inventory in 2021, it is our assumption CPMs will be 3X+ higher than normal linear TV. This will cause CTV/OTT advertisers to re-evaluate (increase) what they are willing to spend for an addressable ad in with a lower ad load. This is something we discussed at the Rosenblatt Securities 3rd Annual OTT/CTV Virtual Fireside and was also reflected in the Discovery+ investor presentation. |

|

|

3) Monthly revenue per user (ARPU) grows faster for ad-supported subscribers than ad-free – Any streaming service that launches with both an ad-free as well as an ad-supported offering should see ARPU growth for both in 2021. The ad-supported cohort will grow faster due to increased demand for ad-supported streaming and higher CPMs (see above).

A few other annual predictions that are worth your time: 1) PARQOR’s Learnings from OTT streaming in 2020, Predictions for 2021 2) The Year in Stocks: 2020 Tossed in the Streaming Cyclone 3) How the future of TV was reshaped by 2020 4) The prognosticator is at it again: Here’s what to expect in sports media |