Big news: NBC sold its last Super Bowl spot ten days before the game. The most expensive slot reportedly sold for $7.0M.

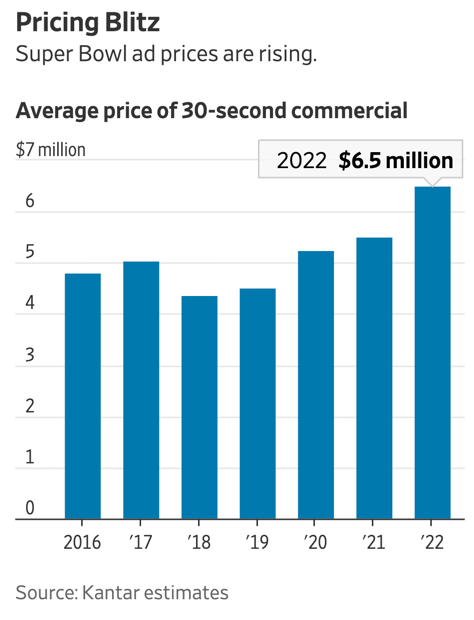

Estimated cost per 30s spot by year (YoY growth) according to Kantar:

1) 2012 – $3.5M (↑ 13%)

2) 2013 – $4.0M (↑ 14%)

3) 2014 – $4.2M (↑ 5%)

4) 2015 – $4.4M (↑ 5%)

5) 2016 – $4.8M (↑ 9%)

6) 2017 – $5.1M (↑ 5%)

7) 2018- $4.4M (↓ 13%)

8) 2019 – $4.5M (↑ 3%)

9) 2020 – $5.3M (↑ 16%)

10) 2021 – $5.5M (↑ 5%)

11) 2022P – ≈ $6.5M (↑ 18%)

Big question: Why are marketers willing to pay so much for Super Bowl ads?

Quote from Jeff Shell – CEO @ NBCUniversal:

“Reach is increasingly difficult to find in the market, and if you have reach, then you have a commodity that’s very valuable.”

Super Bowl vs. top primetime show (% difference) by total viewers for 2020-21 according to Variety:

1) Super Bowl 2021 (CBS) – 98.0M

2) NCIS (CBS) – 12.7M

Why this matters: Last year, the Super Bowl delivered 7X the audience for the most-viewed (non-sports) primetime show. In 2009 that ratio was 2X. The Super Bowl is down ≈ 15% from its high (115.8M in 2015), but everything on linear (outside of news and sports) has fallen off of a cliff (↓ 40%+ since 2015).

Super Bowl in-game ad spend by year (YoY growth) according to Kantar Media:

1) 2015 (NBC) – $322M

2) 2016 (CBS) – $376M (↑ 17%)

3) 2017 (FOX) – $430M (↑ 14%)

4) 2018 (NBC) – $341M (↓ 21%)

5) 2019 (CBS) – $339M (↓ 1%)

6) 2020 (FOX) – $449M (↑ 33%)

7) 2021 (CBS) – $435M (↓ 3%)

Minutes of ads per Super Bowl (YoY growth) according to Kantar Media:

1) 2013 – 51:40

2) 2014 – 47:15 (↓ 9%)

3) 2015 – 48:05 (↑ 2%)

4) 2016 – 49:30 (↑ 3%)

5) 2017 – 51:30 (↑ 4%)

6) 2018 – 51:20 (↓ 0%)

7) 2019 – 49:31 (↓ 4%)

8) 2020 – 51:15 (↑ 4%)

9) 2021 – 42:00 (↓ 18%)