Six big questions re: video on social media:

1) How much time do we spend watching social video?

2) What share of social media time is with video?

3) Do more people watch linear TV or social video?

4) How large is the social video ad market?

5) What forms of video have the highest revenue per hour?

6) Which social platforms deliver the most time with video?

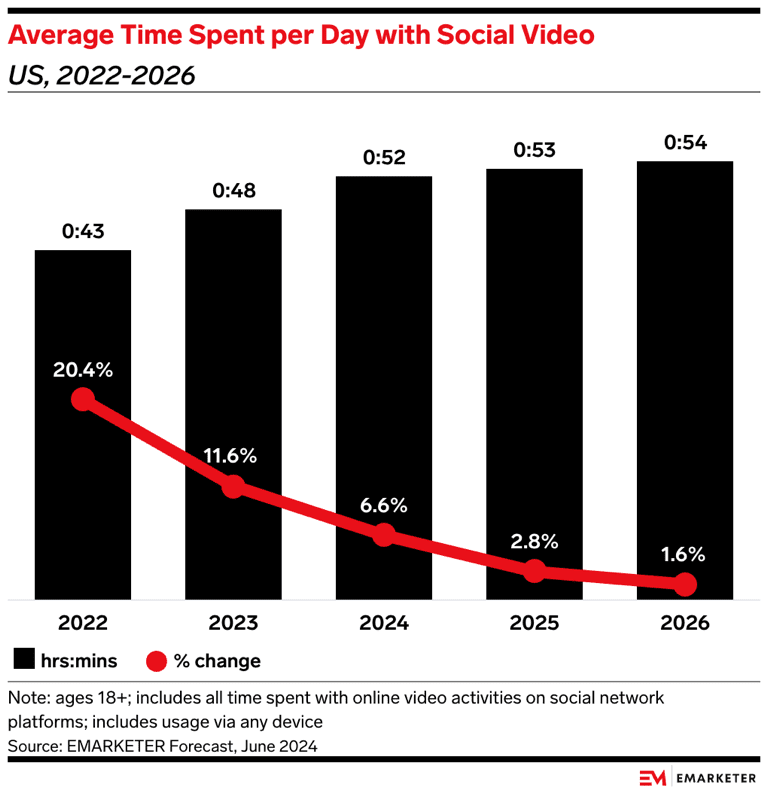

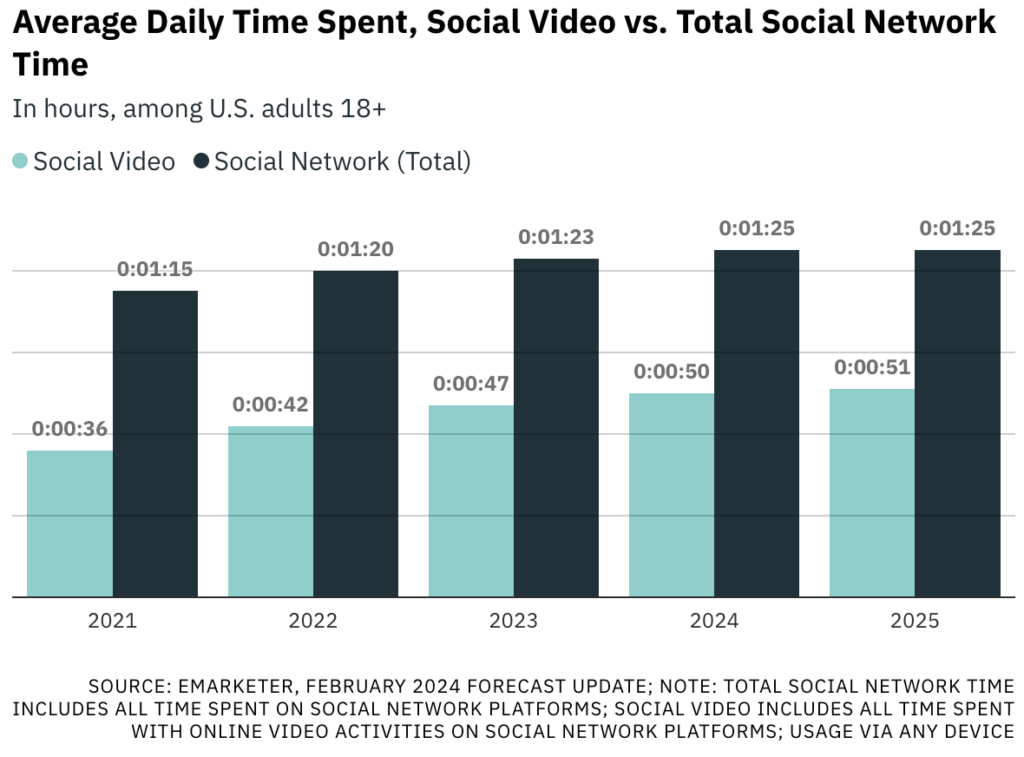

Big question #1: How much time do we spend watching social video?

Daily time spent in minutes with social video according to eMarketer:

1) 2017 – 13m

2) 2018 – 16m (↑ 23%)

3) 2019 – 20m (↑ 25%)

4) 2020 – 28m (↑ 40%)

5) 2021 – 36m (↑ 29%)

6) 2022 – 43m (↑ 19%)

7) 2023 – 48m (↑ 12%)

8) 2024P – 52m (↑ 8%)

9) 2025P – 53m (↑ 2%)

10) 2026P – 54m (↑ 2%)

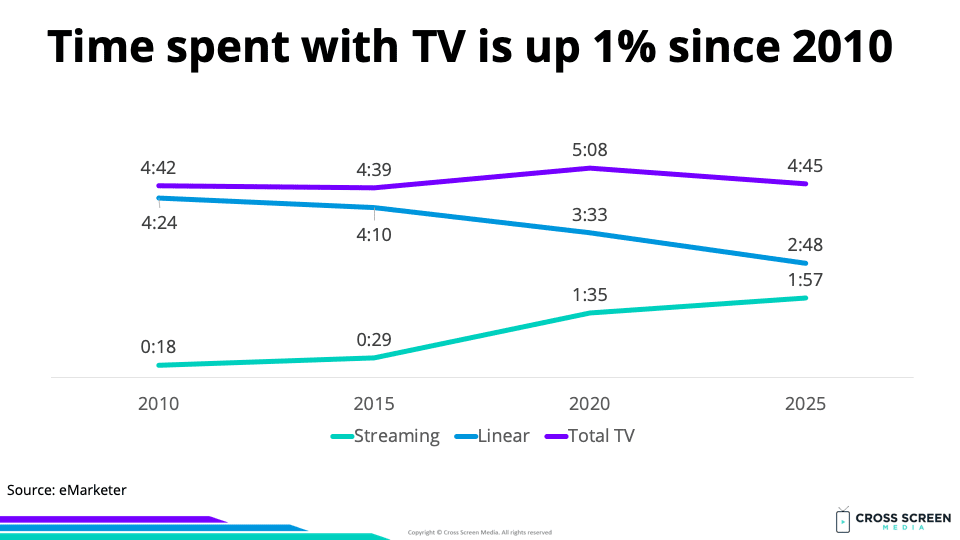

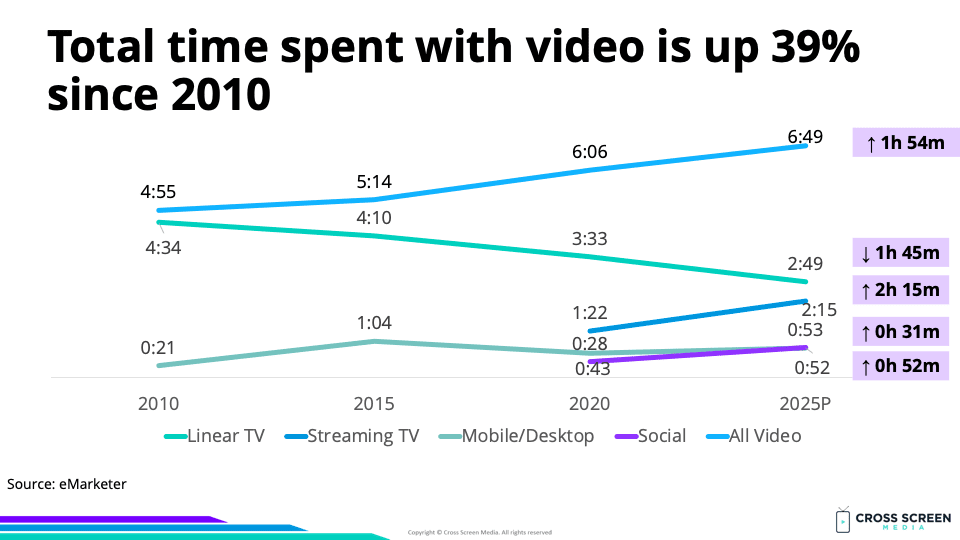

Why this matters #1: Time spent with total TV (linear and streaming) is only up 1% over the past 15 years. Streaming is taking time directly from linear TV rather than growing the pie.

Why this matters #2: Social video is growing the attention pie. Since 2010, the time we spend watching video has grown 39% (↑ 1h 54m). 97% of that growth has come from mobile/desktop and social video.

Big question #2: What share of social media time is with video?

Share of time spent with social that is video, according to eMarketer:

1) 2017 – 24%

2) 2018 – 29%

3) 2019 – 34%

4) 2020 – 40%

5) 2021 – 48%

6) 2022 – 54%

7) 2023 – 57%

8) 2024P – 60%

9) 2025P – 61%

10) 2026P – 62%

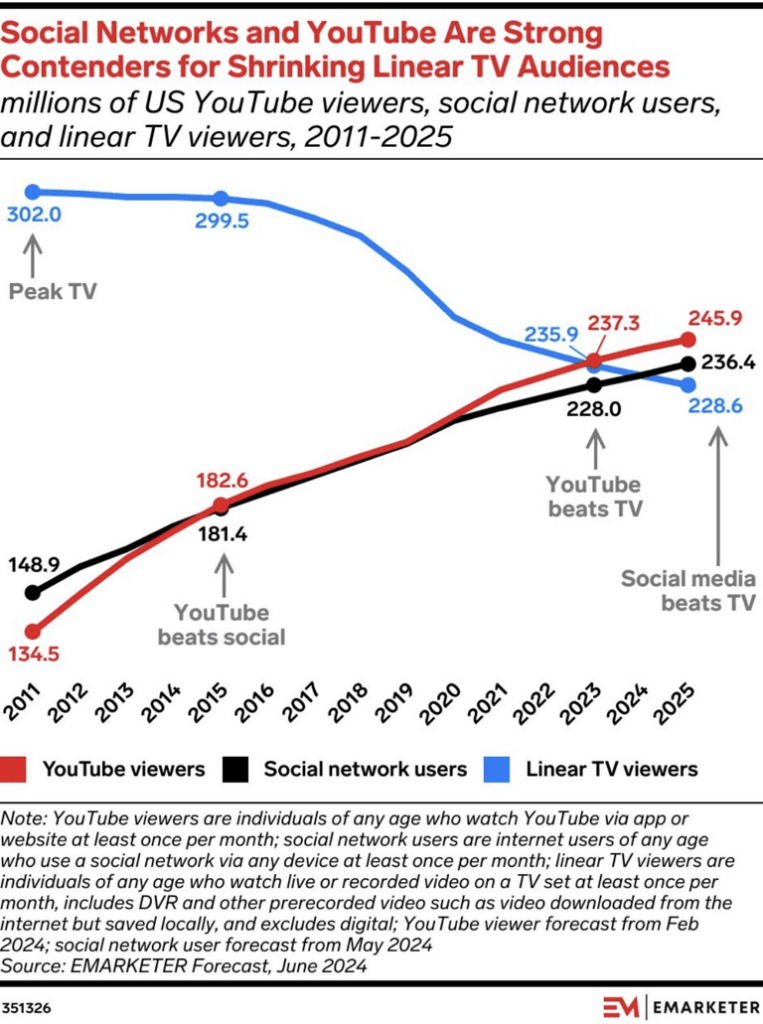

Big question #3: Do more people watch linear TV or social video?

Quick answer: For now, it’s linear TV, but eMarketer predicts that social video will surpass linear TV in terms of reach in 2025

Monthly reach in 2025, according to eMarketer:

1) YouTube – 246M

2) Social video – 236M

3) Linear TV – 229M

Big question #4: How large is the social video ad market?

Social video ad spending (YoY growth) according to eMarketer:

1) 2019 – $11.3B (↑ 33%)

2) 2020 – $15.3B (↑ 36%)

3) 2021 – $24.1B (↑ 58%)

4) 2022 – $31.1B (↑ 29%)

5) 2023 – $39.2B (↑ 26%)

6) 2024P – $48.9B (↑ 25%)

7) 2025P – $56.6B (↑ 16%)

8) 2026P – $64.3B (↑ 14%)

9) 2027P – $73.0B (↑ 13%)

10) 2028P – $82.7B (↑ 13%)

Video ad spend by platform (% of total):

1) Linear TV – $59B (35%)

2) Social – $49B (29%)

3) Mobile/Desktop – $31B (18%)

4) Streaming TV – $29B (17%)

5) Total video – $168B

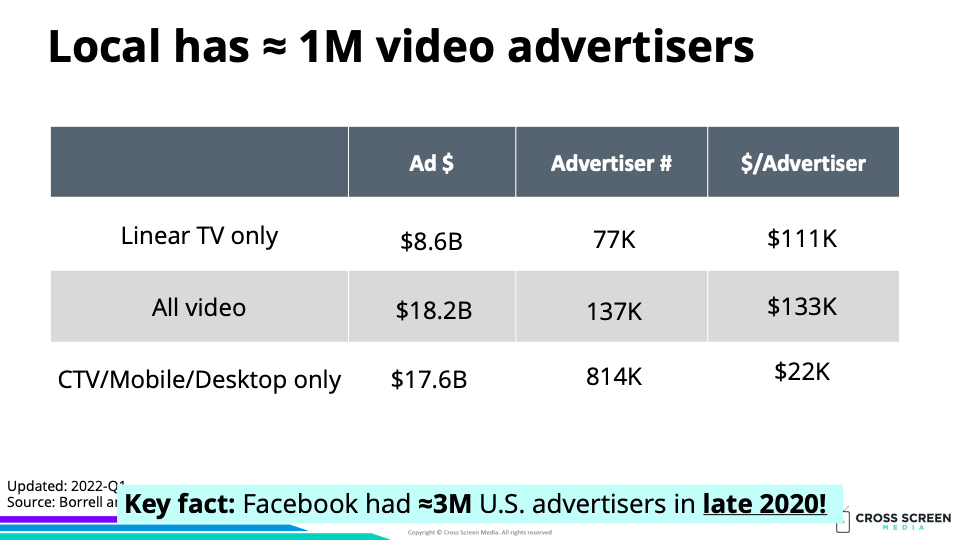

Bottom line: Getting the mix right between all video ad types is hard. Looking at a weighted average above is more confusing when you factor in that the majority of advertisers who buy social video (29% of all video) buy $0 of TV advertising. Less than 1% of all video advertisers in the U.S. buy TV advertising.

Big question #5: What forms of video have the highest revenue per hour?

Ad revenue per viewing hour by platform:

1) Social media – $0.62

2) Linear TV – $0.26

3) Streaming TV – $0.24

Wow: Social media generates 2X more advertising revenue per hour than either linear TV or streaming despite having $0 in content costs.

Ad revenue per viewing hour by content type:

1) NFL regular season (2021) – $2.95

2) Broadcast primetime (2021) – $2.46

3) Facebook – $1.04

4) Instagram – $0.95

5) Peacock – $0.42

6) WarnerBros Discovery- $0.36

7) Hulu – $0.31

8) Disney+ – $0.28

9) Netflix – $0.27

10) TikTok – $0.17

Flashback: Who Has the Best Economics in Convergent TV?

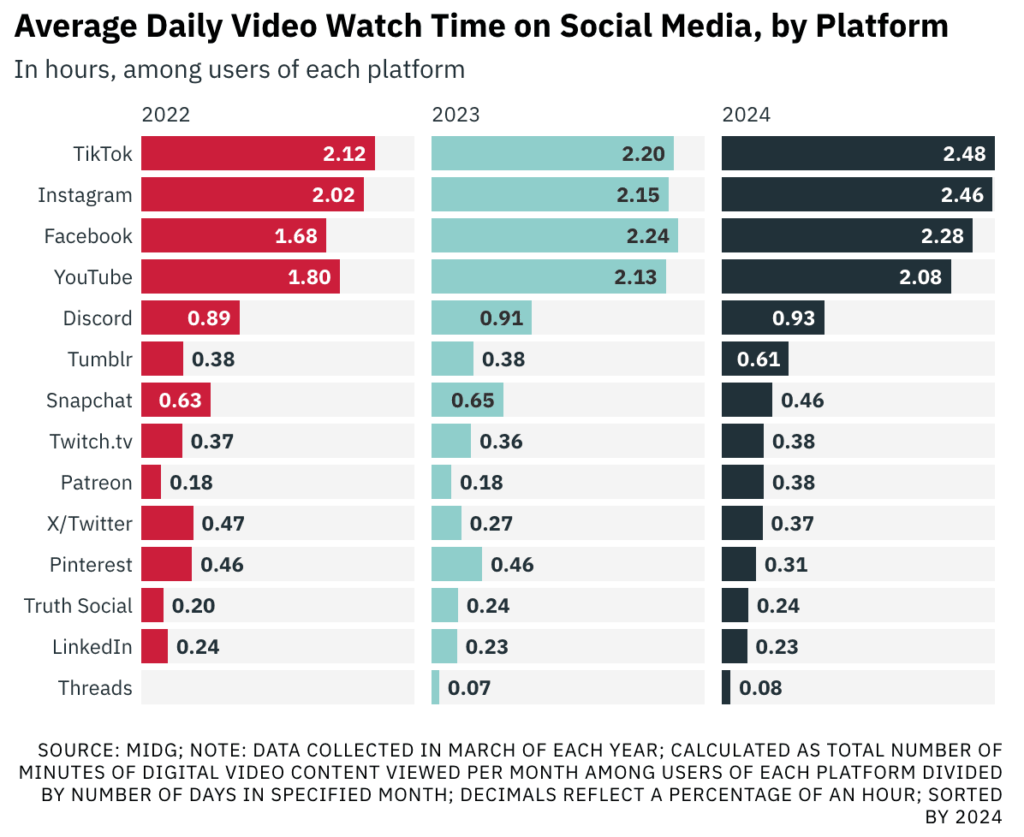

Big question #6: Which social platforms deliver the most time with video?

Daily time spent per user with video according to MIDG:

1) TikTok – 2.5 hours

2) Instagram – 2.5

3) Facebook – 2.3

4) YouTube 2.1

5) Discord – 0.9