Seven big questions re: local convergent TV:

1) How large is the video ad market in the United States?

2) How large is the local video ad market in the United States?

3) Is growth in streaming ad spending keeping up with consumption?

4) How many local video ad buyers are in the United States?

5) Why is streaming advertising a great fit for local advertisers?

6) How is local moving toward convergent TV?

7) Will CPMs for streaming be higher than linear TV?

Setting the table: I was fortunate enough to present at the Borrell 2023 conference in Miami in March. Both the video and PDF presentation is available for a deeper dive. Below is a summary of a few key points.

Note: We have yet to release an updated local video ad spend model for this year. We are working on it 🙂

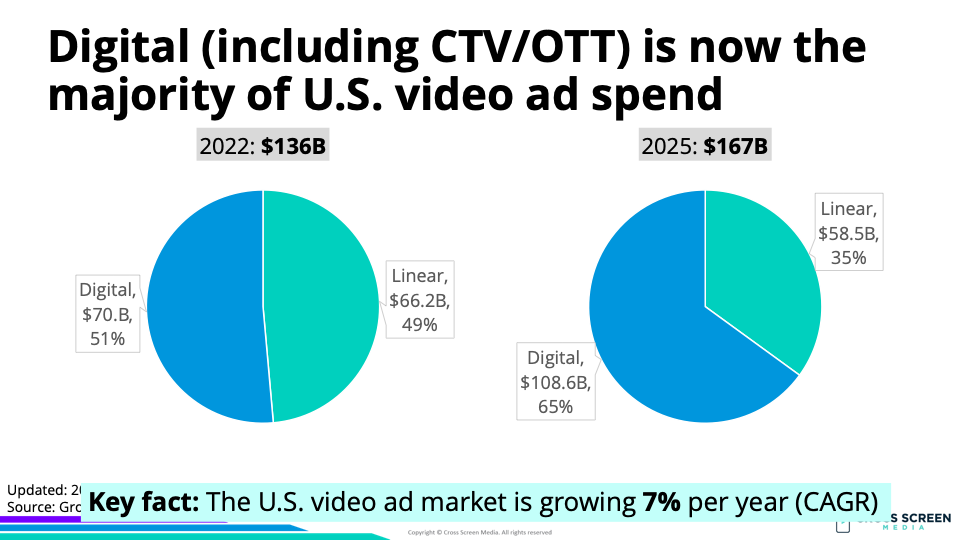

Big question #1: How large is the video ad market in the United States?

U.S. video ad market (% change):

1) 2022 – $136B

2) 2025 – $167B (↑ 23%)

Digital share of U.S video ad market:

1) 2022 – 51%

2) 2025 – 65%

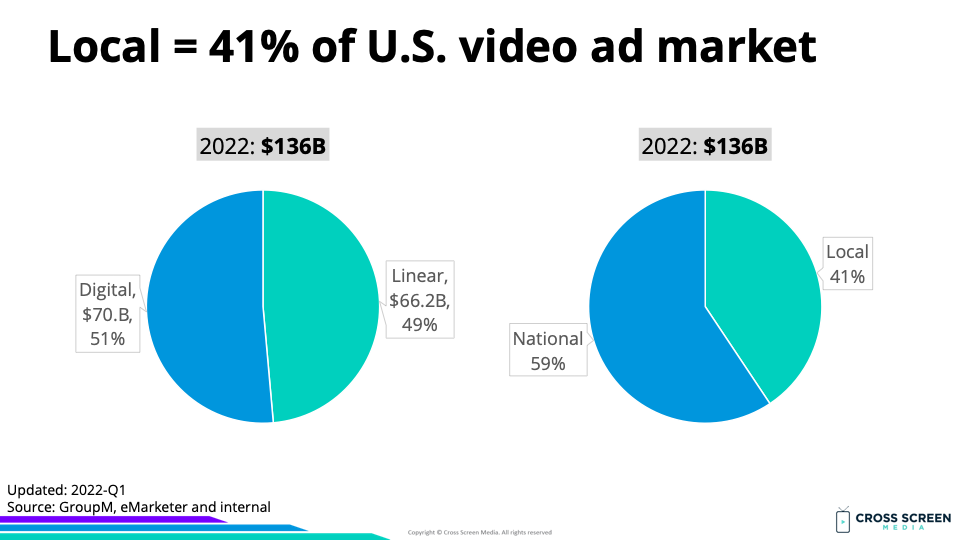

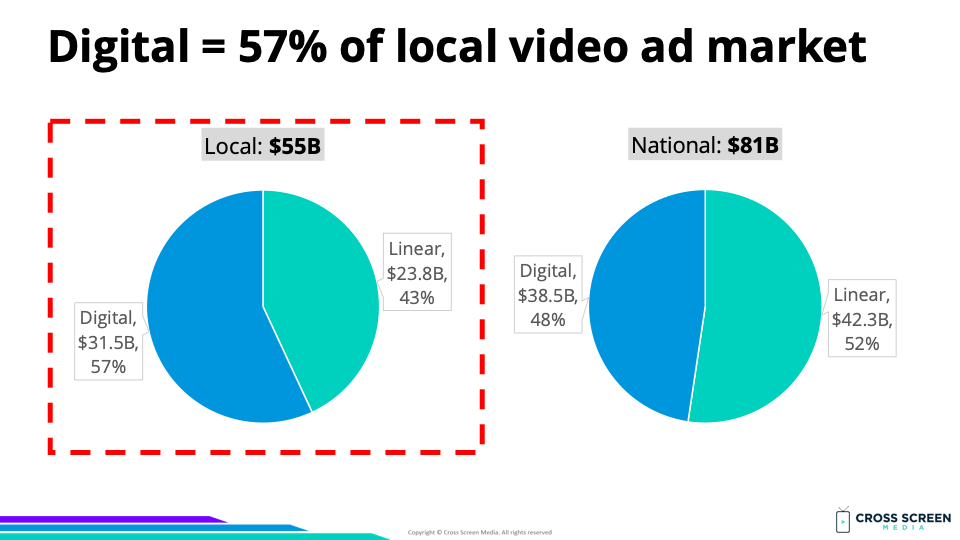

Big question #2: How large is the local video ad market in the United States?

U.S. video ad market (% of total) by geographic targeting:

1) National – $81B (59%)

2) Local – $55B (41%)

Why this matters: The local video ad market is larger ($55B) than most people understand. With 210 markets and 800X more advertisers, it is more fragmented than the national ad market.

Digital share of U.S. video ad market by geographic targeting:

1) Local – 57%

2) National – 48%

Flashback #1: 55 Billion Reasons to Care About Local Video Ads

Flashback #2: The Top Growing Local TV Markets for 2023

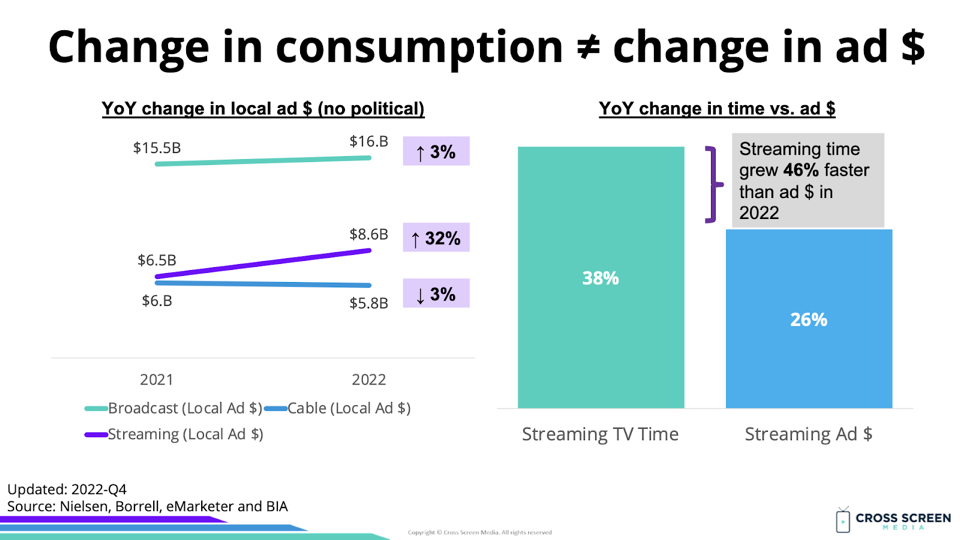

Big question #3: Is growth in streaming ad spending keeping up with consumption?

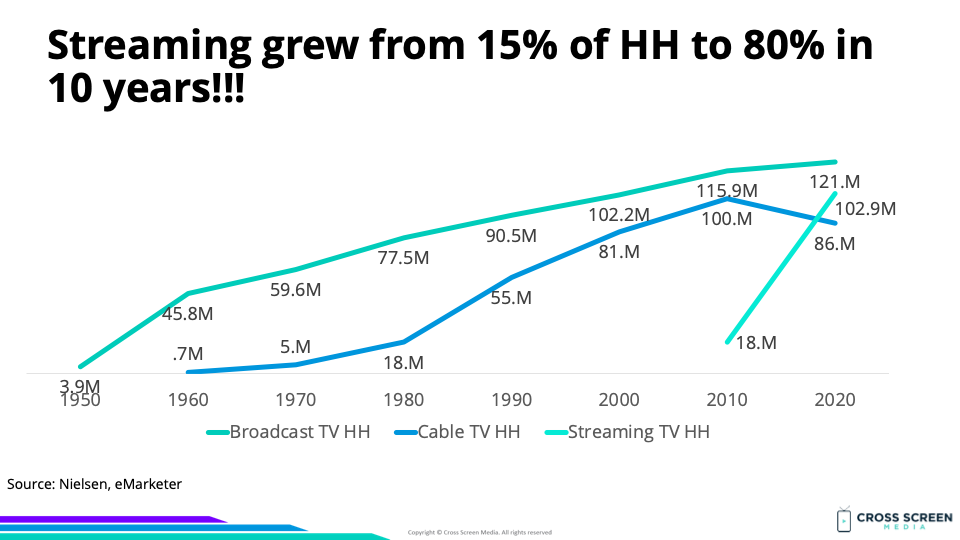

Quick answer: This shouldn’t be surprising considering how fast streaming HH growth has been over the past 10+ years.

YoY change between 2021-22:

1) Consumption – ↑ 38%

2) Advertising (local only) – ↑ 32%

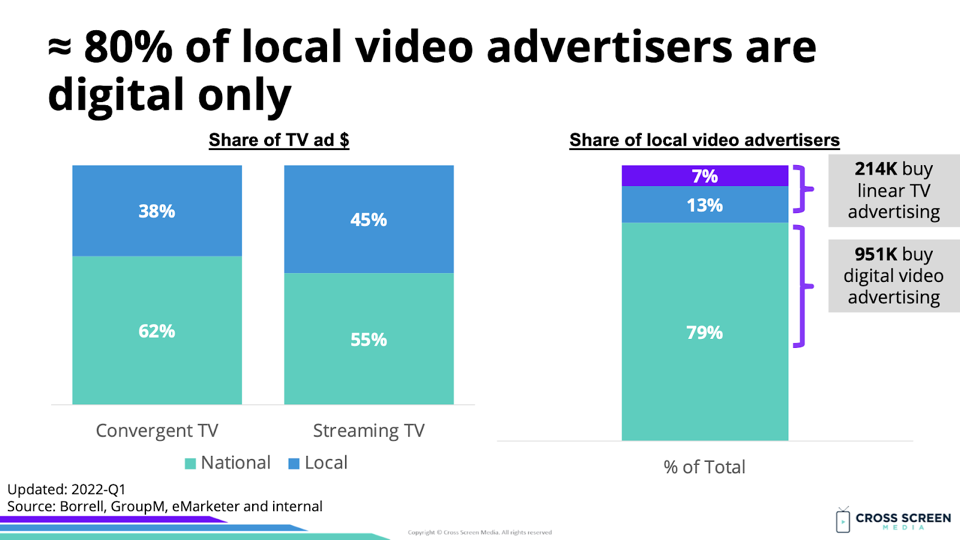

Big question #4: How many local video ad buyers are in the United States?

Quick answer: 1M+

Estimated number of local video ad buyers (% of total):

1) Digital only – 814K (79%)

2) All video – 137K (13%)

3) Linear only – 77K (8%)

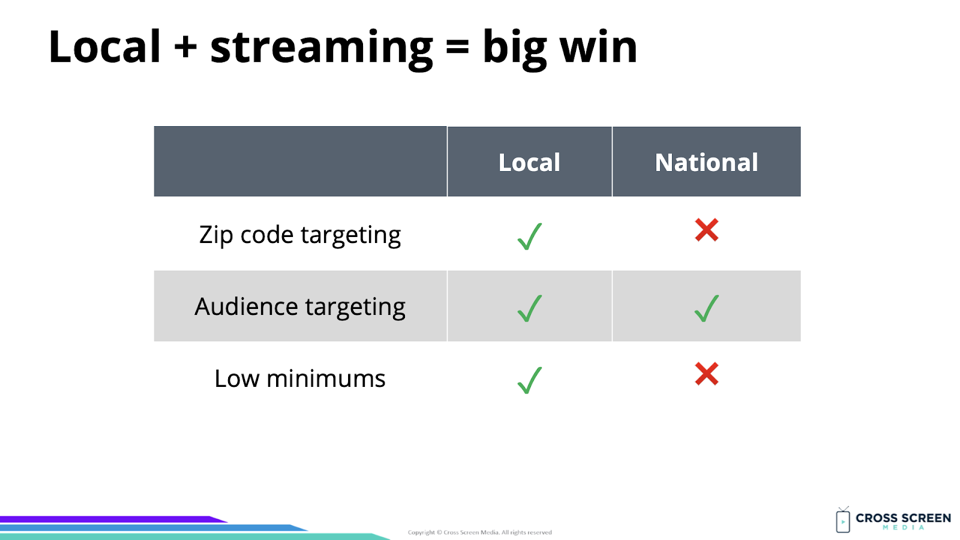

Big question #5: Why is streaming advertising a great fit for local advertisers?

Quick answer: The addition of lower budgets (test and learn) combined with zip code targeting make streaming a great fit for local.

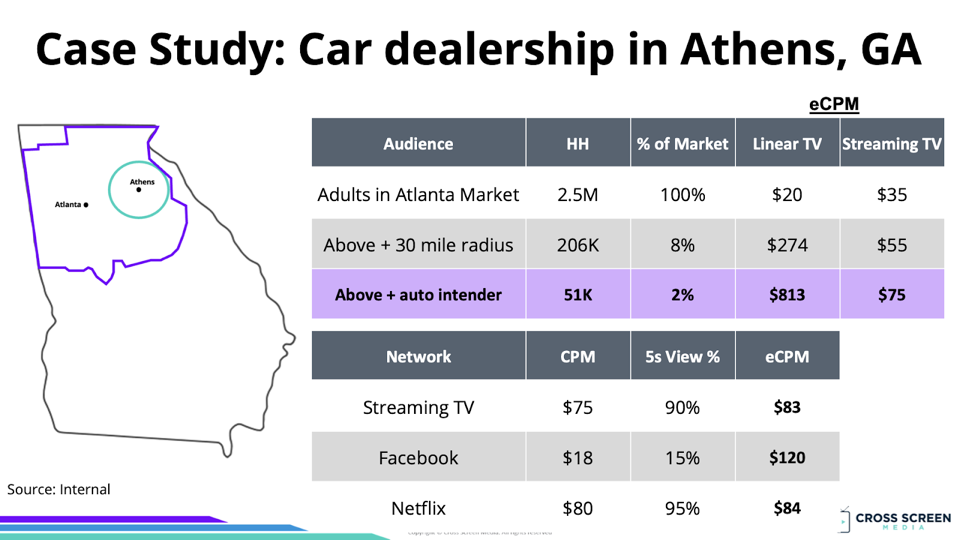

Bottom line: In the example below, adding geo-targeting (30-mile radius) would lower eCPMs by 91%.

Big question #6: How is local moving toward convergent TV?

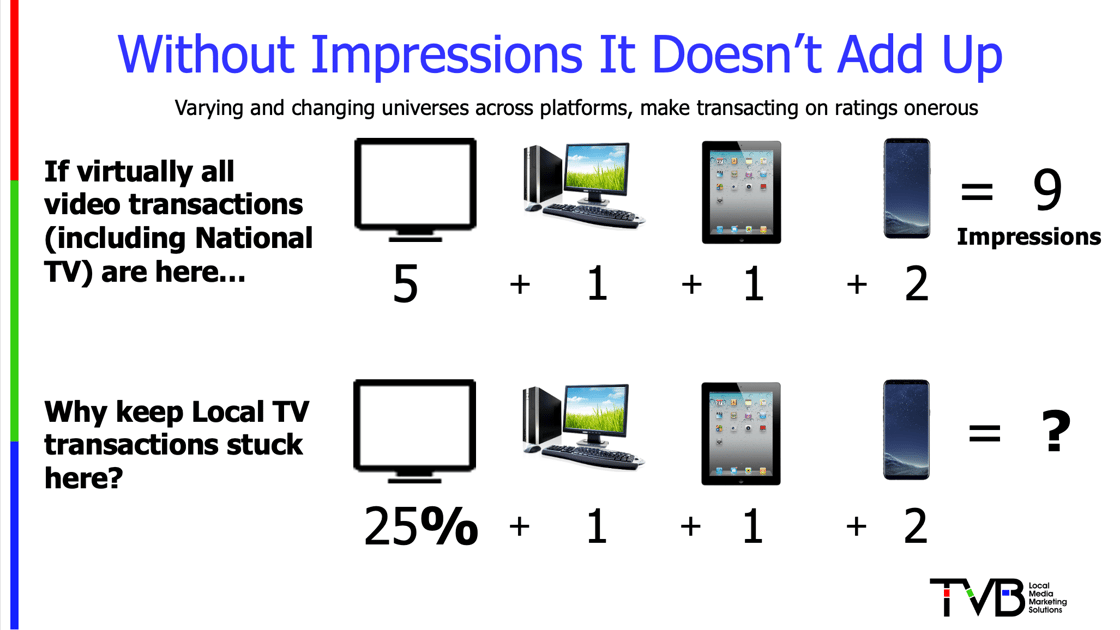

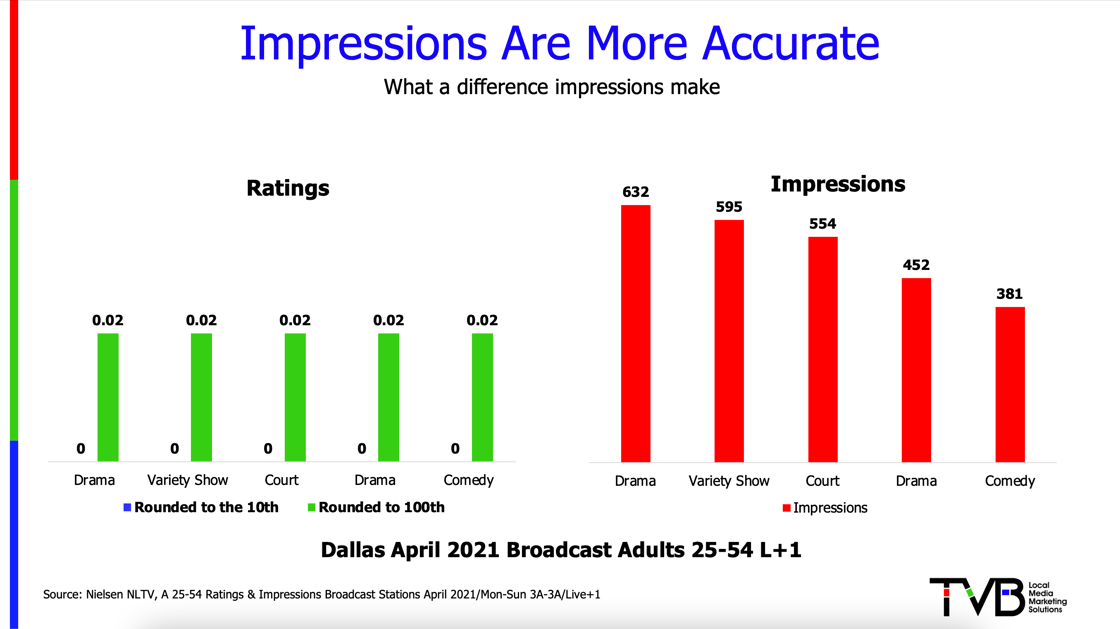

Quick answer: A big shift is local TV (finally) adopting impressions. This will make it easier to plan alongside streaming. Increasing demand from digital video-only advertisers (79% of total) is another potential benefit.

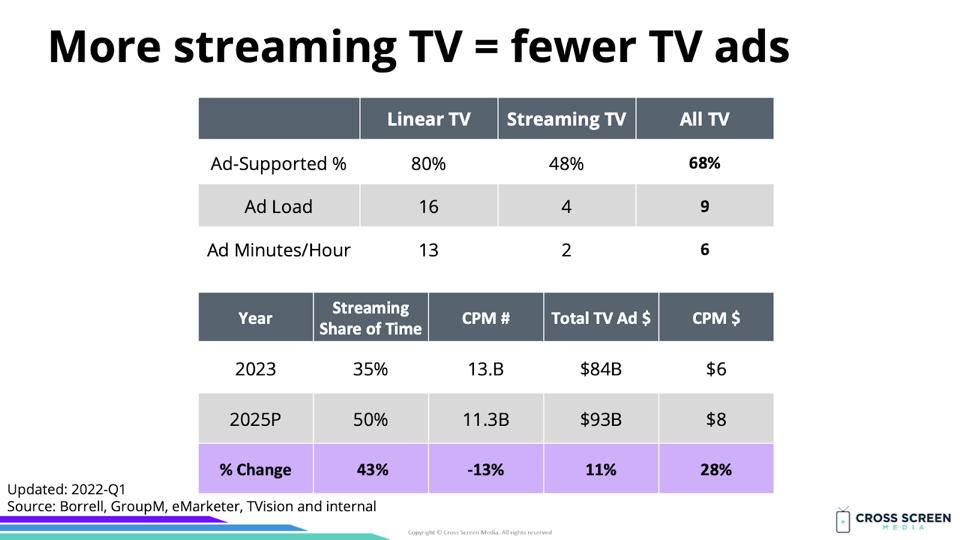

Big question #7: Will CPMs for streaming be higher than linear TV?

Quick answer: Yes. More ad spend chasing fewer impressions leads to higher CPMs.

% change between 2023-25:

1) Ad impressions – ↓ 13%

2) Video ad spend – ↑ 11%

3) CPM $ – ↑ 28%

Bottom line: Every 10% shift in consumption from linear TV to streaming reduces total ad impressions by ≈ 8%.