|

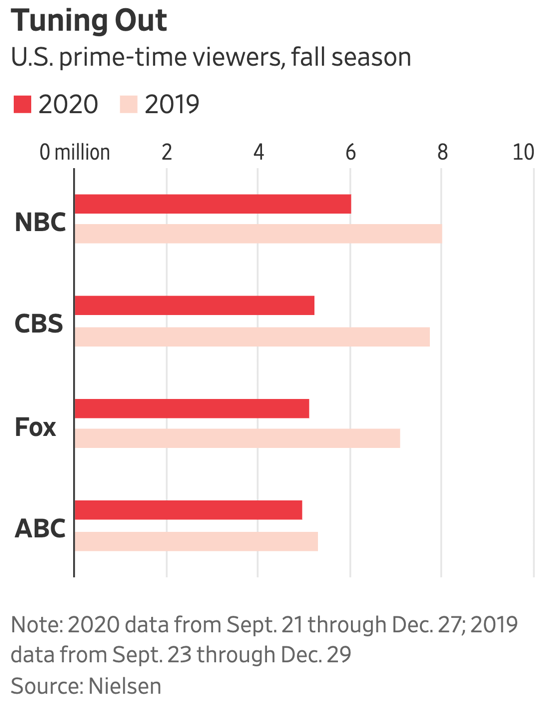

Big news: Prime-time viewership for the major broadcast networks was down between 7% and 32% during the fall season. YoY change in average prime-time viewers during fall season according to Nielsen: 1) ABC – ↓ 7% |

|

Interesting: COVID related protocols have added an estimated $300K in cost for every hour of production. Top 10 TV networks by prime-time viewership according to Nielsen: 1) CBS – 5.6M

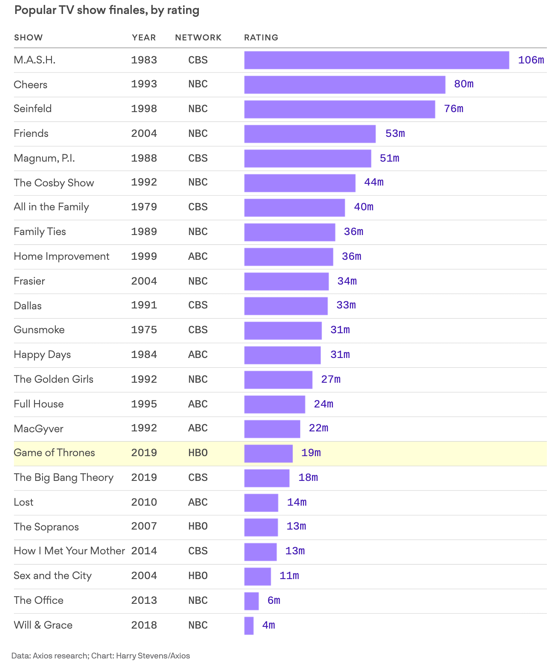

Flashback: Volatility Has Some TV Advertisers Seeing (And Paying) Double Why this matters: This reflects two big shifts that are just starting. Big shift #1: Time spent consuming video is at a record level, but consumers have access to more content than ever. The explosion of choice has led to fragmented viewership. A good example is the largest series finales of each decade. The largest finale of the 2010s (Game of Thrones) was watched by 82% fewer people than the record holder (M.A.S.H.). |

|

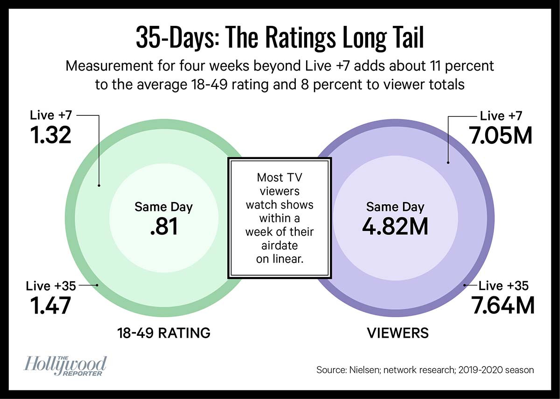

Big shift #2: Scripted programming is better suited for on-demand (streaming, etc.), which is why TV viewership for this type of content is dropping faster than live sports. % of total viewership within 35 days, according to Nielsen: 1) Same day – 63% |

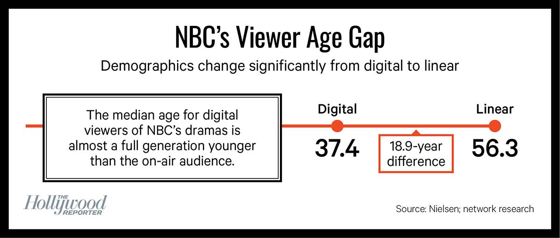

Media viewer age for NBC dramas according to Nielsen:1) Digital – 37.4 |