Eight big questions re: cord-cutting:

1) How many homes subscribe to a pay-TV bundle?

2) What share of U.S. households subscribe to a pay-TV bundle?

3) Why is cord-cutting accelerating?

4) What share of pay-TV subscriptions are streaming?

5) Are streaming pay-TV services replacing the subscribers leaving traditional pay-TV?

6) How many homes currently subscribe to broadband?

7) What content takes up the most broadband bandwidth?

8) Is time spent with cable declining at the same rate as subscribers?

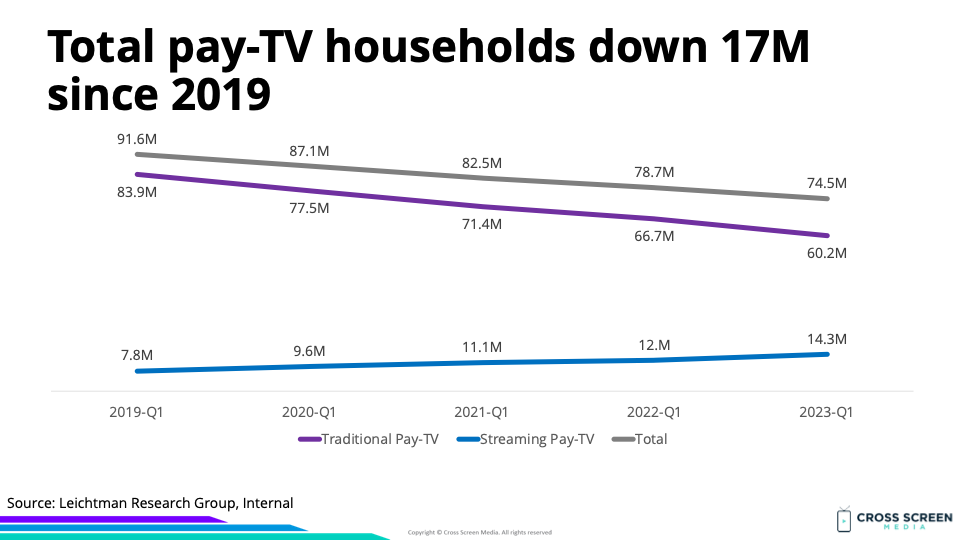

Big question #1: How many homes subscribe to a pay-TV bundle?

Quick answer: 75M

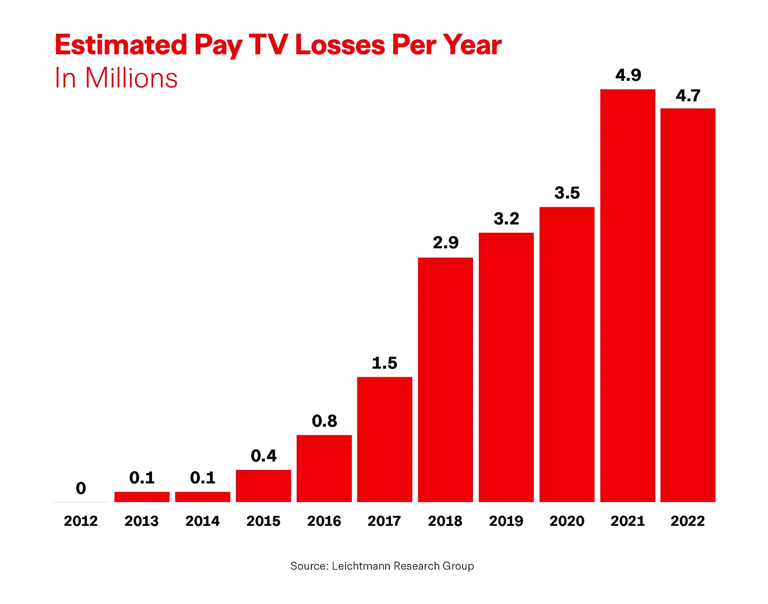

YoY change in pay-TV subscribers:

1) Traditional pay-TV – ↓ 6.5M

2) Streaming pay-TV – ↑ 2.3M

3) Total pay-TV – ↓ 4.3M

Total pay-TV subscriptions (YoY growth):

1) 2019-Q1 – 91.6M

2) 2020-Q1 – 87.1M (↓ 5%)

3) 2021-Q1 – 83.0M (↓ 5%)

4) 2022-Q1 – 78.7M (↓ 5%)

5) 2023-Q1 – 74.5M (↓ 5%)

Wow: It took a while for cord-cutting to pick up steam, but the % decline will accelerate due to higher losses (≈ 5M) against a lower subscriber base.

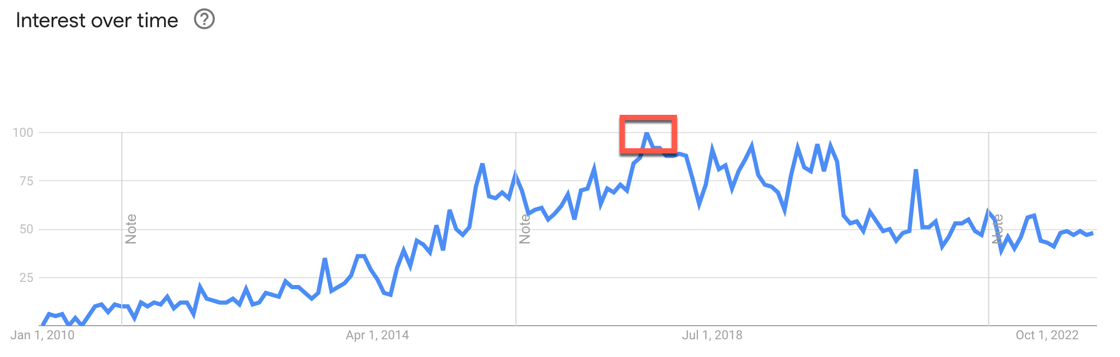

Interesting: The conversation around cord-cutting peaked in 2017. Yet, 87% of the “cord-cutting” occurred after.

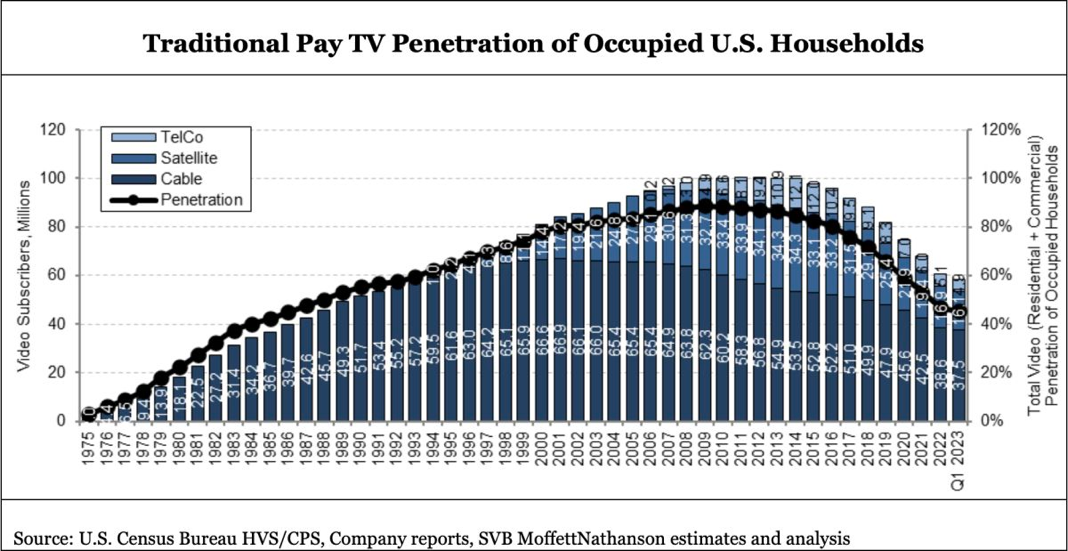

Big question #2: What share of U.S. households subscribe to a pay-TV bundle?

Quick answer: 57% of all HH or 60% of TV HH.

Pay-TV penetration amongst U.S. households:

1) 2019-Q1 – 71%

2) 2020-Q1 – 68%

3) 2021-Q1 – 63%

4) 2022-Q1 – 60%

5) 2023-Q1 – 57%

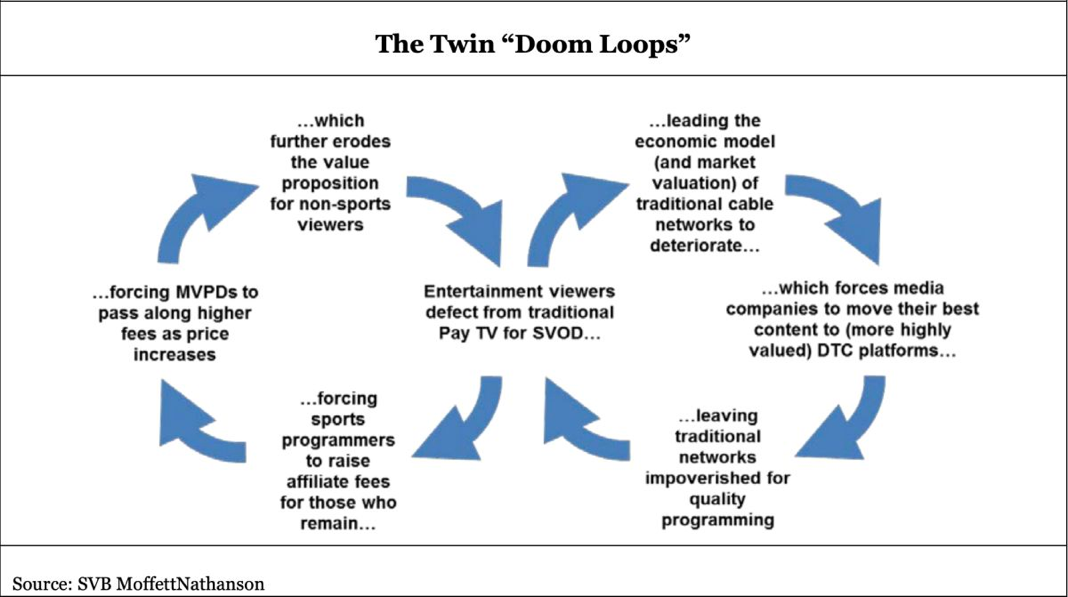

Big question #3: Why is cord-cutting accelerating?

Quick answer: Two primary reasons. First, sports drive monthly pay-TV bills up, leading people to cancel. Second, networks are putting their best content on streaming, leading people to cancel. Craig Moffett from MoffettNathanson describes this as “The Doom Loop.”

Big question #4: What share of pay-TV subscriptions are streaming?

Quick answer: 19%

Streaming pay-TV subscriptions (YoY growth):

1) 2019-Q1 – 7.8M

2) 2020-Q1 – 9.6M (↑ 23%)

3) 2021-Q1 – 11.1M (↑ 16%)

4) 2022-Q1 – 12.0M (↑ 8%)

5) 2023-Q1 – 14.3M (↑ 19%)

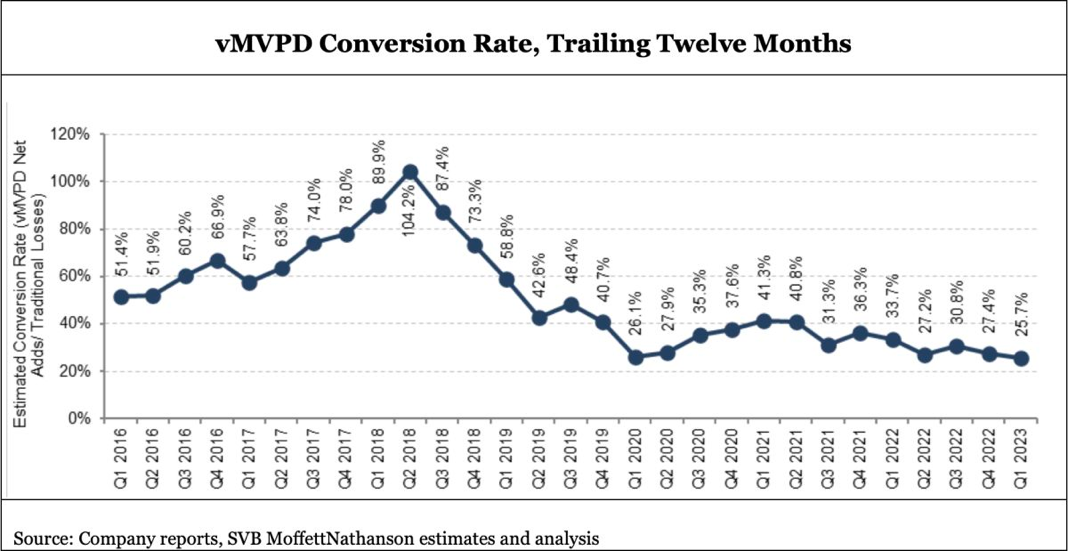

Big question #5: Are streaming pay-TV services replacing the subscribers leaving traditional pay-TV?

Quick answer: No. Streaming pay-TV has only added 28% of the subscriptions lost by traditional pay-TV since 2019.

Net change in pay-TV subscribers since 2019-Q1:

1) Traditional pay-TV – ↓ 23.7M

2) Streaming pay-TV – ↑ 6.5M

3) Total pay-TV – ↓ 17.2M

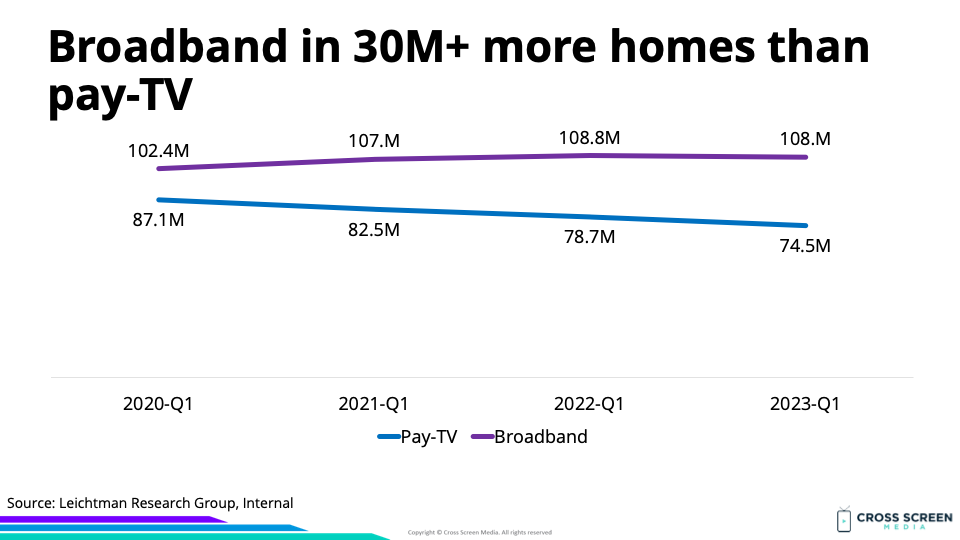

Big question #6: How many homes currently subscribe to broadband?

Total broadband subscriptions (YoY growth) according to Leichtman Research Group:

1) 2020-Q1 – 102.4M

2) 2021-Q1 – 107.0M (↑ 4%)

3) 2022-Q1 – 108.8M (↑ 2%)

4) 2023-Q1 – 108.0M (↓ 1%)

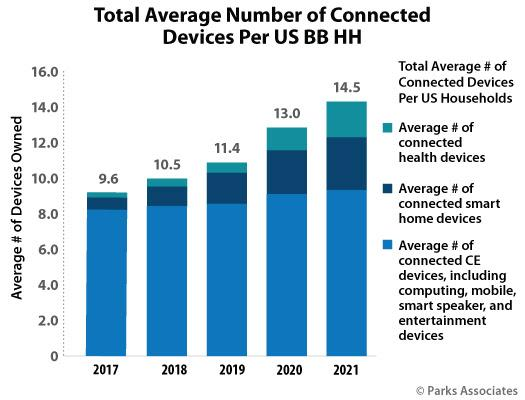

Average number of connected devices per broadband household (YoY growth) according to Parks Associates:

1) 2017 – 9.6

2) 2018 – 10.5 (↑ 9%)

3) 2019 – 11.4 (↑ 9%)

4) 2020 – 13.0 (↑ 14%)

5) 2021 – 14.5 (↑ 12%)

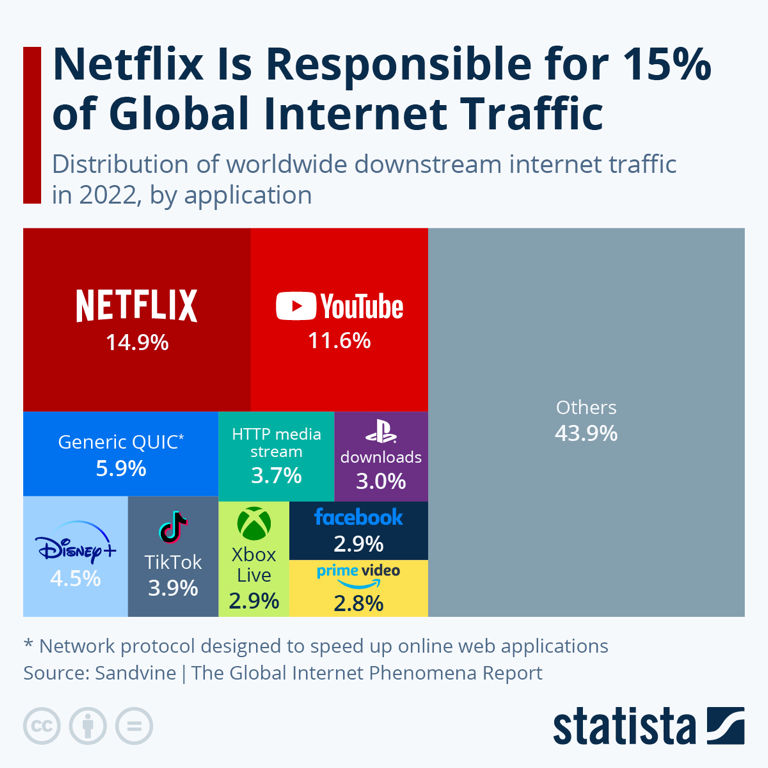

Big question #7: What content takes up the most broadband bandwidth?

Quick answer: Netflix and YouTube account for 27% of all global internet traffic.

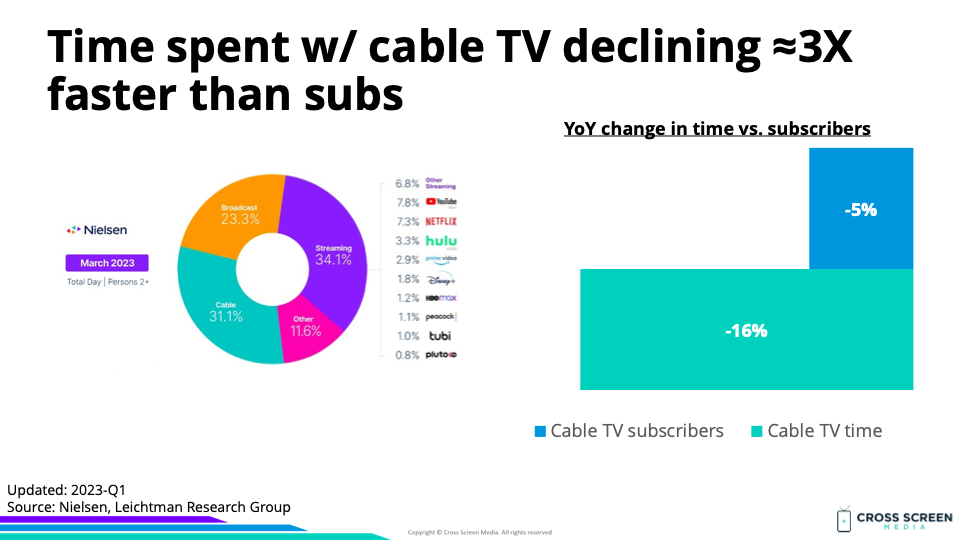

Big question #8: Is time spent with cable declining at the same rate as subscribers?

Quick answer: No. Time spent is declining 3X as fast as subscribers.

Outstanding questions:

1) What is the floor for total pay-TV subscriptions (50M, 60M, etc.)?

2) How does the floor change when sports (ESPN, etc.) become available outside the bundle?