Six big questions re: cord cutting:

1) How many homes subscribe to a pay-TV bundle?

2) What share of pay-TV subscriptions are streaming?

3) How many homes currently subscribe to broadband?

4) Is broadband a better business than pay-TV?

5) Is time spent with cable declining at the same rate as subscribers?

6) What share of available channels do pay-TV subscribers watch?

Setting the table: The chart below shows the HH growth for broadcast, cable, and streaming since 1950.

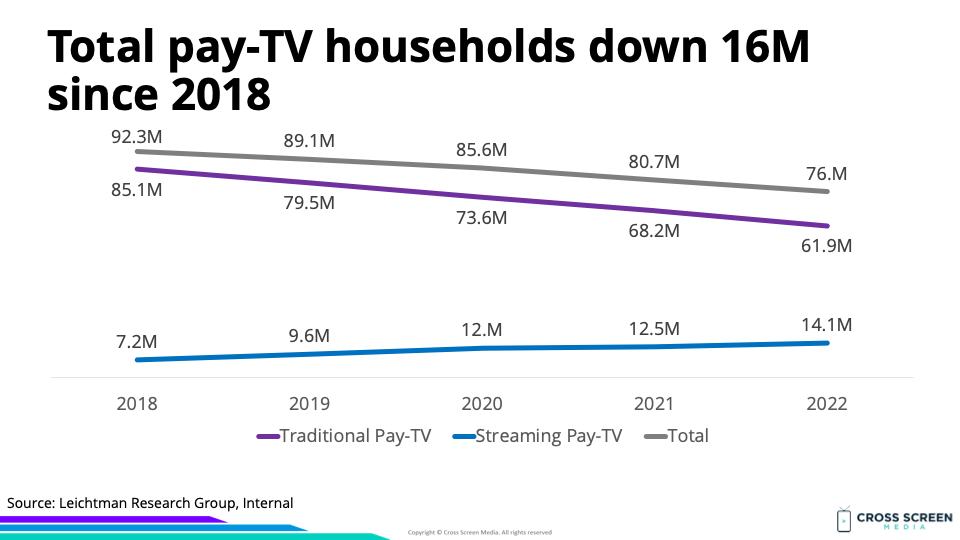

Big question #1: How many homes subscribe to a pay-TV bundle?

Quick answer: 76.0M

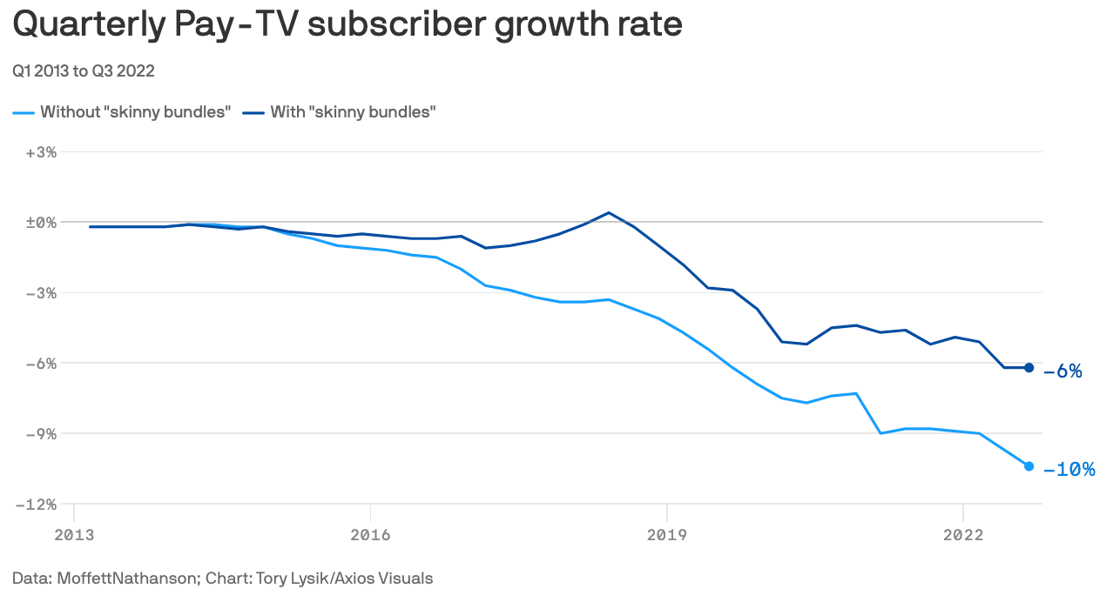

YoY change in pay-TV subscribers:

1) Traditional pay-TV – ↓ 6.3M

2) Streaming pay-TV – ↑ 1.6M

3) Total pay-TV – ↓ 4.7M

Total pay-TV subscriptions (YoY growth):

1) 2018 – 92.3M

2) 2019 – 89.1M (↓ 4%)

3) 2020 – 85.6M (↓ 4%)

4) 2021 – 80.7M (↓ 6%)

5) 2022 – 76.0M (↓ 6%)

|

FYI: Household penetration for pay-TV has fallen to 1993’s level.

Big question #2: What share of pay-TV subscriptions are streaming?

Quick answer: 19%

Streaming pay-TV subscriptions (YoY growth):

1) 2018 – 7.2M

2) 2019 – 9.6M (↑ 33%)

3) 2020 – 12.0M (↑ 25%)

4) 2021 – 12.5M (↑ 4%)

5) 2022 – 14.1M (↑ 12%)

Streaming share of pay-TV subscribers:

1) 2018 – 8%

2) 2019 – 11%

3) 2020 – 14%

4) 2021 – 16%

5) 2022 – 19%

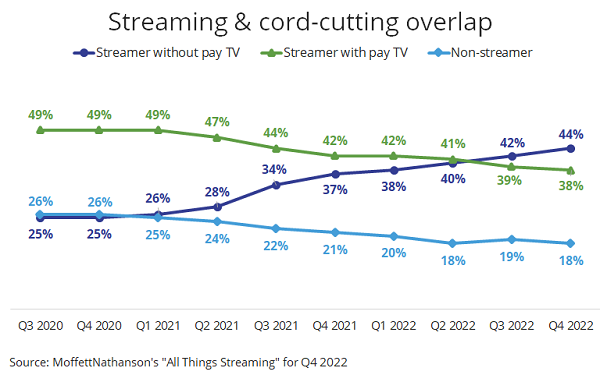

Share of U.S. TV households by source according to MoffettNathanson:

1) Streaming only – 44%

2) Streaming + Pay-TV – 38%

3) Non-streamer – 18%

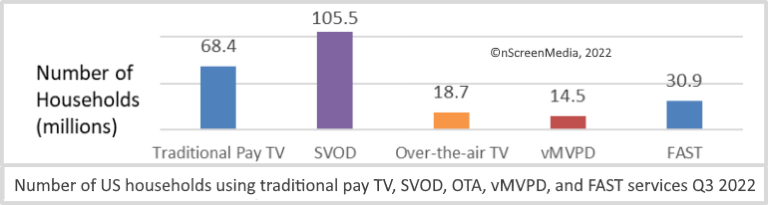

Interesting: Colin Dixon at nScreenMedia has a similar chart (includes duplication).

Total U.S. TV households by source according to nScreenMedia:

1) Streaming (subscription) – 106M

2) Traditional pay-TV – 68M

3) Streaming (ad-supported) – 31M

4) Over-the-air – 19M

5) Streaming pay-TV – 15M

|

Traditional pay-TV subscriptions (YoY growth):

1) 2018 – 85.1M

2) 2019 – 79.5M (↓ 7%)

3) 2020 – 73.6M (↓ 7%)

4) 2021 – 68.2M (↓ 7%)

5) 2022 – 61.9M (↓ 9%)

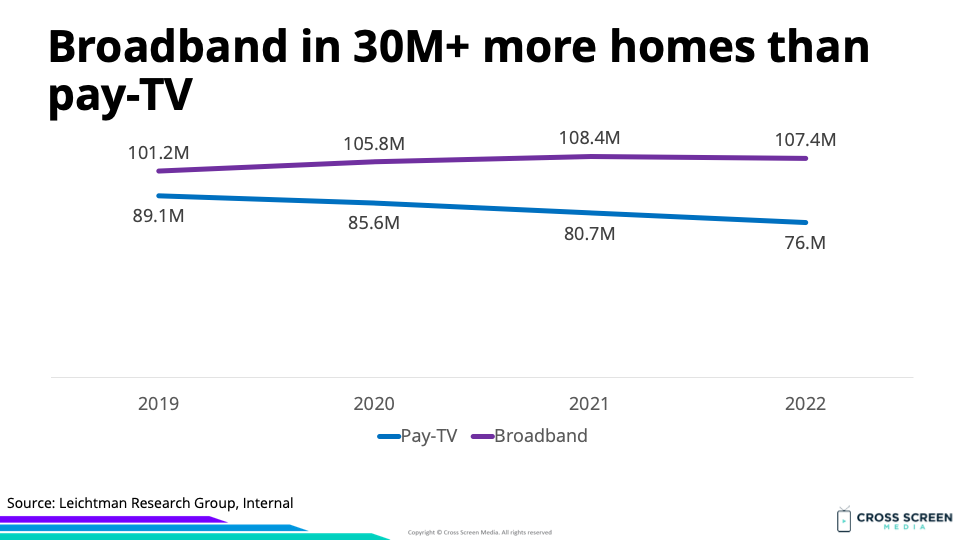

Big question #3: How many homes currently subscribe to broadband?

Total broadband subscriptions (YoY growth) according to Leichtman Research Group:

1) 2019 – 101.2M

2) 2020 – 105.8M (↑ 5%)

3) 2021 – 108.4M (↑ 2%)

4) 2022 – 107.4M (↓ 1%)

|

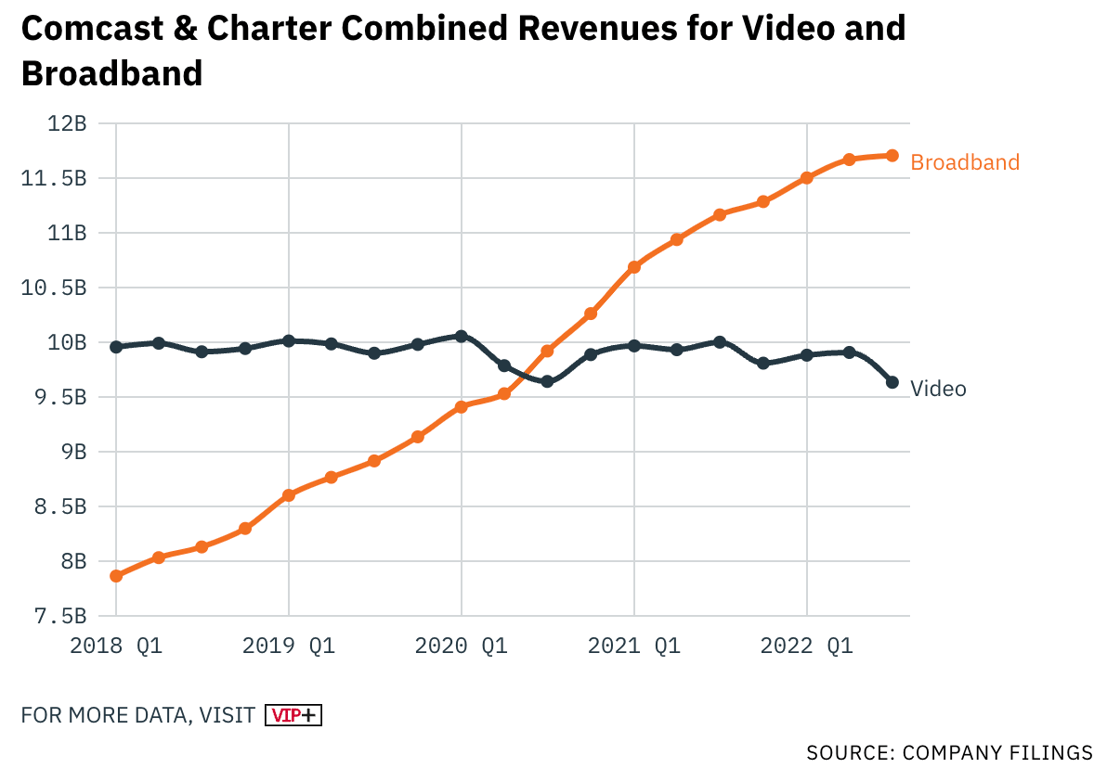

Big question #4: Is broadband a better business than pay-TV?

Quick answer: Yes. In 2022-Q3, Comcast/Charter generated $1.21 in broadband revenue for every $1.00 in pay-TV revenue.

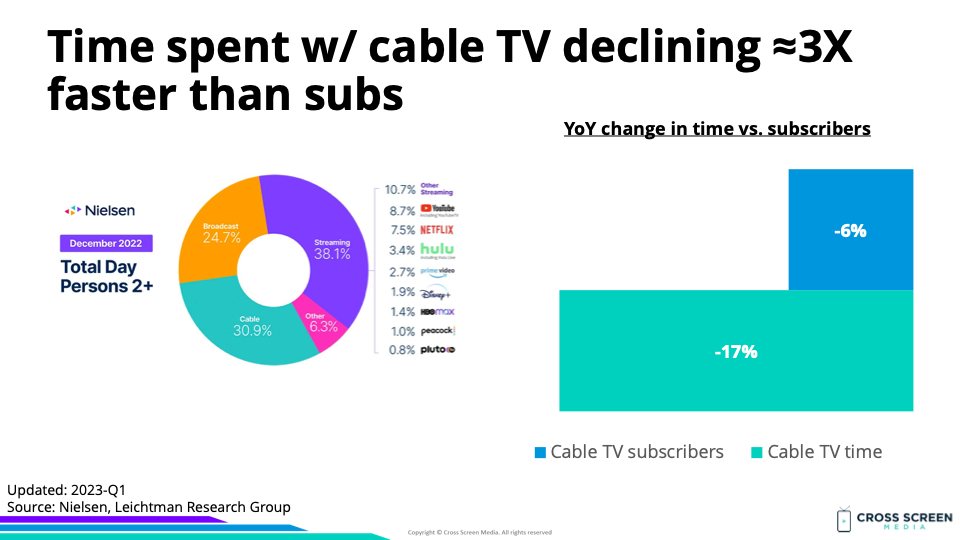

Big question #5: Is time spent with cable declining at the same rate as subscribers?

Quick answer: Yes. Time spent w/ cable TV declined ≈ 3X as fast as subscribers.

Why this matters: Consumers who watched low amounts of cable TV were obvious early targets for cord-cutting. Now consumers who watch an above-average amount of cable TV are cutting the cord.

|

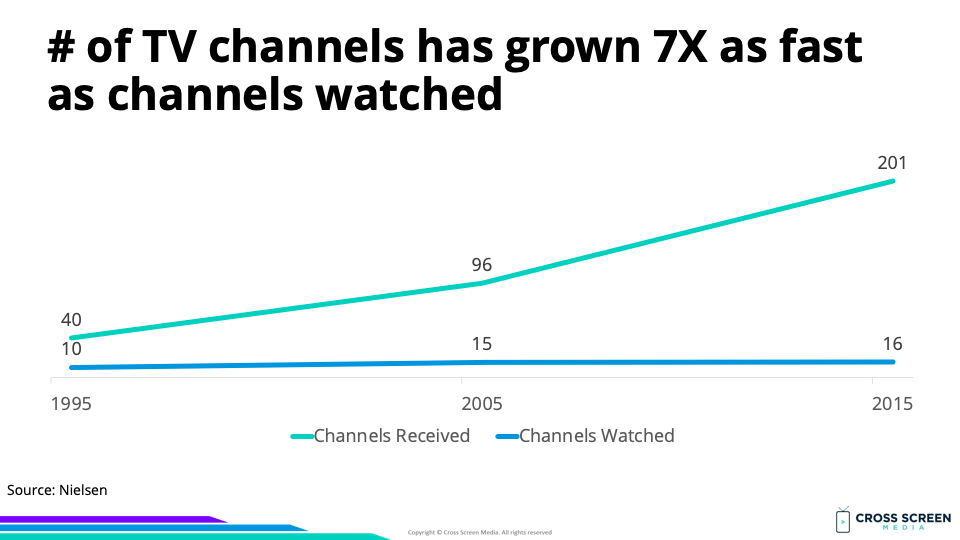

Why this matters: Pay-TV bundles become bloated with networks many people never watch but still pay for.

Three waves of disruption for the pay-TV ecosystem, according to Matthew Ball:

1) Wave #1 (2007 – 2015) – Pay-TV is getting better but too expensive. Better value substitutes emerge

2) Wave #2 (2015 – 2019) – Pay-TV is still getting better, plus cheaper. Better value substitutes are getting better

3) Wave #3 (2019 – Present) – Pay-TV is getting worse and more expensive. Suppliers focused on better value substitutes