Four big questions re: cord-cutting:

1) How many homes subscribe to a pay-TV bundle?

2) Are streaming pay-TV services replacing all the subscribers leaving traditional pay-TV?

3) Where is the bottom for pay-TV subscriptions?

4) How will cord-cutting impact the 2024 election?

Big question #1: How many homes subscribe to a pay-TV bundle?

Quick answer: 74M (56% of all HH)

YoY change in pay-TV subscribers according to Leichtman Research Group:

1) Traditional pay-TV – ↓ 7.5M

2) Streaming pay-TV – ↑ 2.9M

3) Total pay-TV – ↓ 4.6M

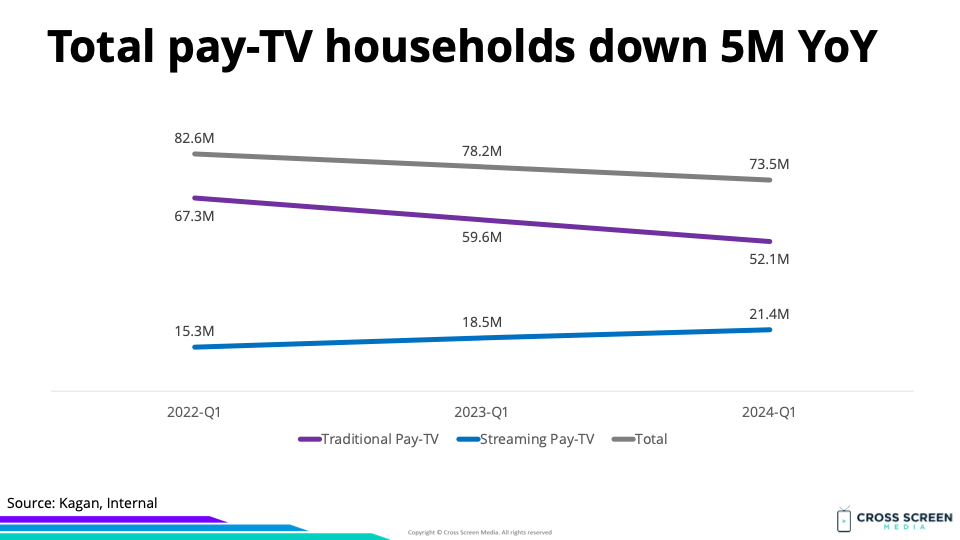

Total pay-TV subscriptions (YoY growth) according to Kagan:

1) 2022-Q1 – 82.6M

2) 2023-Q1 – 78.2M (↓ 5%)

3) 2023-Q1 – 73.5M (↓ 5%)

Bottom line: Q1 was the worst quarter ever for cord cutting.

Quote from Anthony Crupi – Sports Media Reporter @ Sportico:

“The state of the pay-TV business is a bit like the winding-down phase of one of those off-campus keggers that you maybe recall from school, the undergrad parties where you forked over five bucks to the grouch at the door in exchange for a red Solo® cup and a whole lot of adolescent noise. Maybe you got there late because the pregaming got a little out of hand, but it’s hard to shake the feeling that the fun part is over.

Sure, the party may grind on for a bit, but there’s no use in holding out for a second wind. The keg’s not killed, exactly, but it’s floating, and while there are still a bunch of people milling around the kitchen, they’re an older crowd: townies, the dutifully employed. And you don’t even want to know about the bathroom situation. If sheer inertia doesn’t snuff this thing out, the increasingly frazzled-looking hosts will. You don’t gotta go home, but you can’t stay here, etc…”

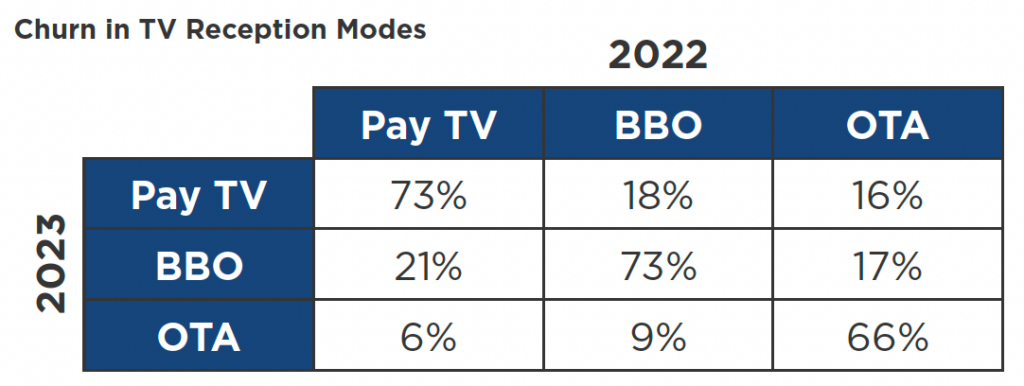

Interesting: Data from the Advertising Research Foundation shows movement to and from pay-TV. More consumers are leaving, but a small percentage go back.

Shift between 2022-23:

1) Pay-TV to broadband-only (BBO) – 21% (11% of total HH)

2) Broadband-only (BBO) to pay-TV – 18% (6% of total HH)

3) Antenna (OTA) to pay-TV – 16% (2% of total HH)

4) Pay-TV to antenna (OTA) – 6% (3% of total HH)

Wow: 9% of broadband-only households (3% of total HH) dropped broadband and returned to rabbit ears.

Methodology note: Leichtman Research Group has stopped releasing pay-TV subscriber data, but we have switched to a combination of sources, including Kagan and MoffetNathanson. Past numbers may differ due to this.

Big question #2: Are streaming pay-TV services replacing all the subscribers leaving traditional pay-TV?

Quick answer: No. Traditional pay-TV shed nearly 3X as many subscribers as streaming pay-TV added YoY.

Streaming pay-TV subscriptions (YoY growth):

1) 2022-Q1 – 15.3M

2) 2023-Q1 – 118.5M (↑ 21%)

3) 2024-Q1 – 121.4M (↑ 16%)

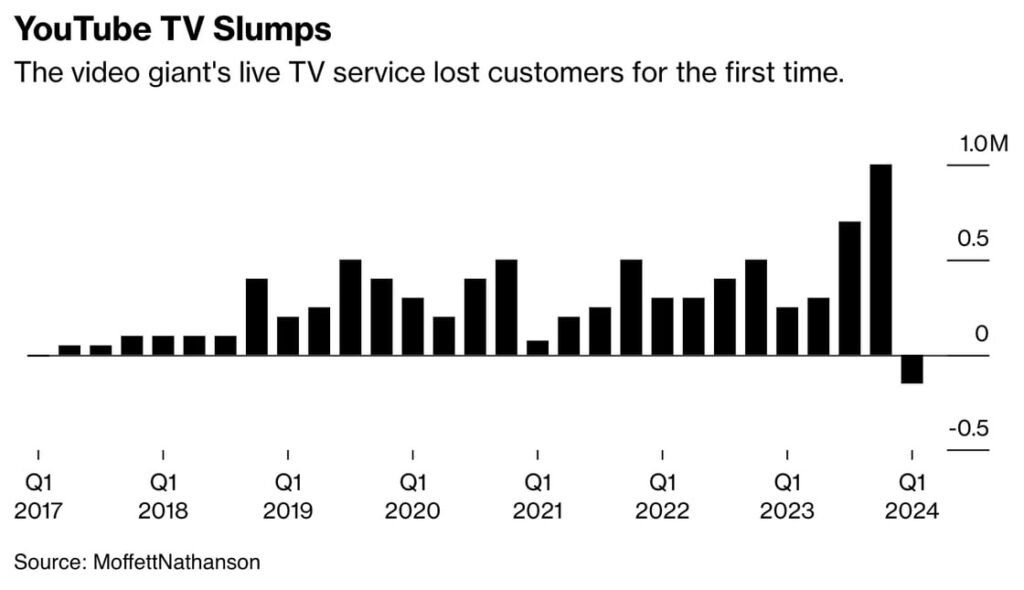

Ruh roh: YouTube TV lost subscribers for the first time!

Streaming share of pay-TV subscribers:

1) 2022-Q1 – 19%

2) 2023-Q1 – 24%

2) 2024-Q1 – 29%

Big question #3: Where is the bottom for pay-TV subscriptions?

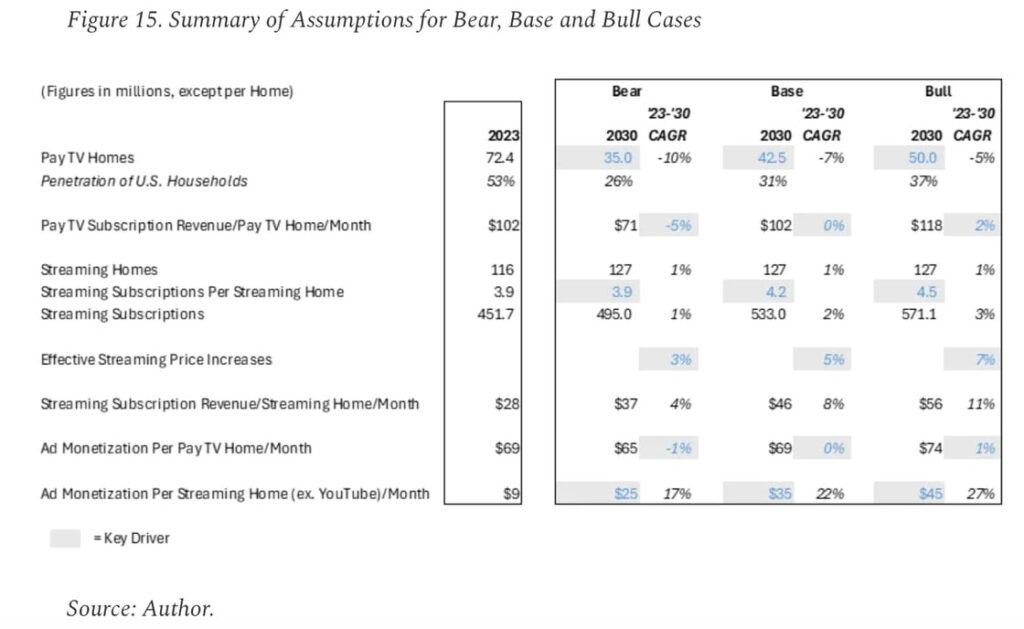

Quick answer: This vibe has completely changed over the past year. Not too long ago, the number Doug Shapiro used for his bull case (50M subs) was a bear case for many.

Projected pay-TV subscriber number by 2030 (% of U.S. HH) according to Doug Shapiro:

1) Bull case – 50M (37%)

2) Base case – 43M (31%)

3) Bear case 35M (26%)

Big question #4: How will cord-cutting impact the 2024 election?

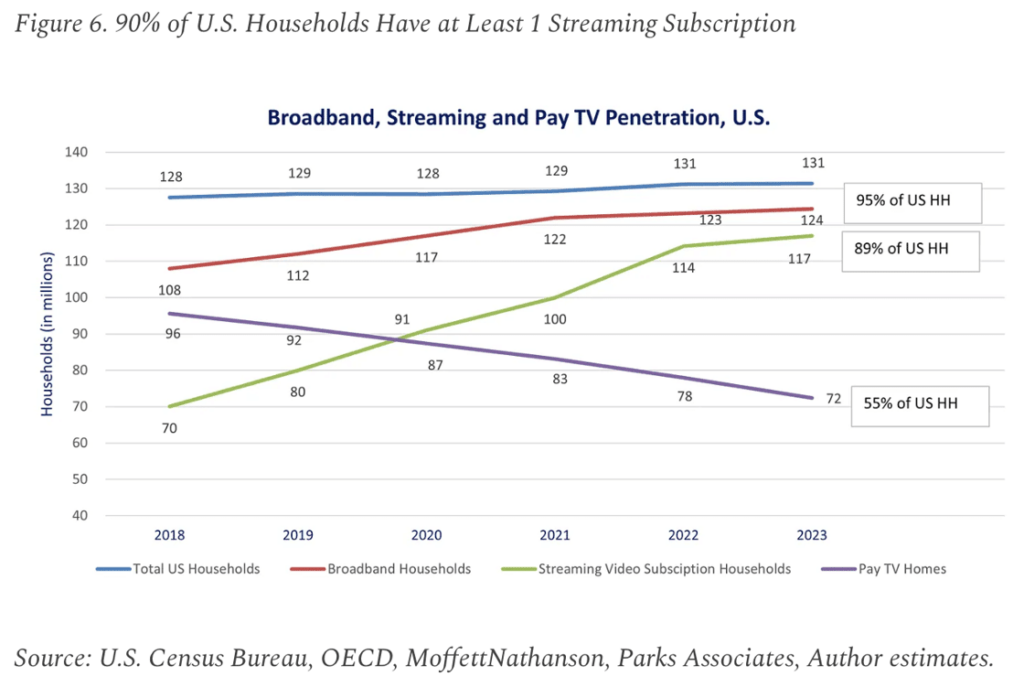

Quick answer: In 2020, more American households watched streaming TV than subscribed to pay TV for the first time. For 2024, streaming will reach 63% more HH (117M vs. 72M) and play a major role in the political ad wars.

Growth between 2019-23:

1) Streaming TV – 80M → 117M (↑ 46%)

2) Pay-TV – 92M → 72M (↓ 22%)