Convergent TV Series

What is Roku?

Roku is rising, and media sellers and buyers alike should be paying attention. With 43 million active accounts (+41% YoY) and 14.6 billion streaming hours (+65% YoY) in Q2 2020 alone, Roku remains atop the Connected TV podium.

This article was originally published on Sept 4, 2020. Last updated Dec 23, 2020.

Roku, which gives consumers access to live television and streaming services in one centralized interface, drives revenue through two main business lines:

Advertising sales and subscription revenue through its platform (~69% of revenue)

Device Sales (~31% of revenue)

Like its closest competitor, Amazon Fire TV, Roku takes a cut when users subscribe to other streaming services through it. Roku also sells advertising inventory for ad-supported channels on its platform, as well as offering its own ad-supported channel that plays syndicated content. Roku has become increasingly appealing for advertisers with the launch of their OneView Ad Platform, which allows for centralized management of campaigns across OTT and linear TV.

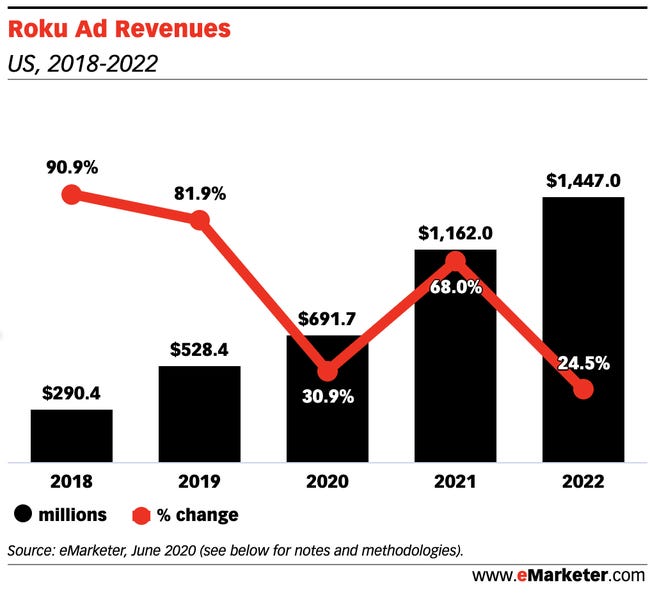

Selling Roku players to consumers used to be Roku’s main source of revenue. But in 2018, Roku revealed that revenue from its media and advertising business had eclipsed hardware sales, a strategic shift that the company has continued to pursue. As its platform business grows, Roku is shifting their consumer hardware footprint to focus adoption, including providing its operating system to TV manufacturers in “low- or no-economic deals”.

What does Roku’s strong growth mean for convergent TV advertising today?

Roku’s strong growth can be attributed partially to their positioning as a ‘neutral’ distribution platform. This positioning was called into question when for months after their launches, Roku did not carry either of the two new entrants to the ‘Streaming Wars’, HBO Max and NBCU’s Peacock. As Roku’s focus has shifted towards their ads business, they are looking to increase their share of the ad inventory for programs streamed through their platform. This split of ad inventory, and the split of subscriber revenue, were central issues in their negotiations, since NBCU’s new platform includes an ad-supported pricing tier and HBO Max will be introducing one in Spring 2021.

While AT&T and Comcast were reluctant to give up the revenue share that Roku was asking for, Roku’s significant distribution will be critical for hitting their ambitious subscriber growth goals.

Lightshed analyst Rich Greenfield framed it well: “This is an important and precedent-setting deal that will establish the power dynamics in a fairly nascent industry.”

As of December 2020, both HBO Max and Peacock were able to reach mutually beneficial deals with Roku and can be now be streamed to Roku’s massive audience.

What does Roku’s strong growth mean for convergent TV advertising in the future?

Cord-cutting will only accelerate, and that’s great news for Roku.

“We believe advertising dollars will flow to AVOD services as linear TV ad buyers look to extend TV’s reach, leverage data targeting capabilities and control CPM inflation in a brand safe, big-screen, ‘TV-like’ way,” writes MoffettNathanson analyst Michael Nathanson.

But powerful new entrants could threaten the company’s hold on the market. Most notable would be a direct incursion from Google parent company Alphabet, which already has many of the pieces in place to effectively compete.

Alphabet owns a sizable piece of the digital video pie through YouTube, which offers subscriptions to streaming service YouTube TV and to an ad-free version of YouTube. Additionally, Alphabet’s growing hardware business could help further support connected TV ambitions. Rumors have even circulated that Google might try to acquire Roku.

To maintain its lead, Roku must continue to offer differentiated value to advertisers. The company has a clear advantage as a unified convergent TV advertising platform that seamlessly gives advertisers access to streaming and linear TV audiences alike. The big question is whether Roku can maintain and communicate the unique reach and targeting power of its viewer data, even as it faces new competitors.

We’ll keep this page updated with new developments; check back for the latest on the rise of Roku.

Read the rest of our Convergent TV blog series here!