Convergent TV Series

What is NBCUniversal’s Peacock?

NBCUniversal may have ruffled some feathers in the increasingly crowded OTT space when it launched Peacock, its new video streaming service, on July 15th.

This article was originally published on Aug 16th, 2020. Last updated Sept 21, 2020.

Peacock includes thousands of hours of shows from NBCUniversal’s broadcast and cable networks, films from Universal Pictures, Dreamworks Animation, and Focus Features, as well as original content.

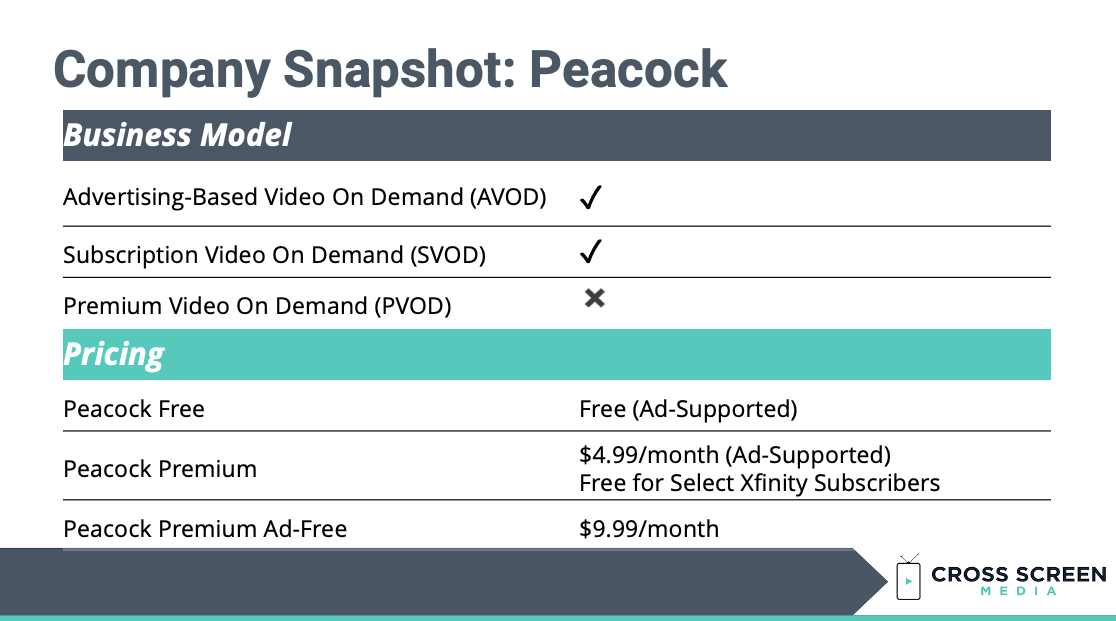

Comcast (NBCU’s parent company) is reportedly spending $2 billion over the first two years, betting on the combination of original shows, pulling fan favorites from other services (e.g., Netflix will lose The Office, it’s #1 show), and their freemium model to entice viewers. Peacock is also touting a customer-friendly ad load, with a cap of 5 minutes per hour compared to ~8 min/hr for mobile/desktop video and up to 20 min/hr for linear TV.

Peacock’s launch only includes customers in the U.S. for now, but they have their eye on international expansion through Comcast’s 24 million Sky subscribers in Europe. Additionally, after months of negotiations, Peacock struck a deal to stream on Roku devices. The new agreement reportedly brings Peacock’s household reach up to an estimated 100 million.  What does Peacock’s launch mean for convergent TV advertising today?

What does Peacock’s launch mean for convergent TV advertising today?

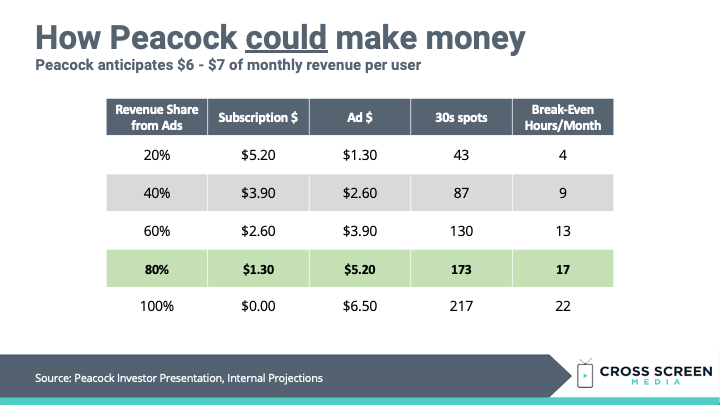

NBC will sell ads for the streaming service alongside its linear and on-demand content, and has already lined up marquee launch sponsors including Verizon, Capital One, L’Oreal, and Molson Coors. Their uniquely low ad load is worth

watching, and comes as a double-edged sword. Fewer ads, paired with a freemium model, may successfully pull viewers from other subscription services and could put pressure on AVOD services (Hulu most prominently) that run more ads. Conversely, the economics of fewer ad minutes means that the margin is thin for balancing rates with profitability.

Brands that advertise with NBC will benefit from the brand-safe content they are used to, but enhanced with better audience targeting from the range of Peacock’s digital distribution channels.

Finally, Peacock will be a boon for Comcast to expand their first party data within their ecosystem, an increasingly critical asset that other networks need to emulate to better compete with the digital ad giants. What will Peacock’s launch mean for convergent TV advertising in the future?

What will Peacock’s launch mean for convergent TV advertising in the future?

Cord-cutting cannot be stopped, but that doesn’t mean it impacts all networks equally. By offering Peacock Premium at no cost to select Xfinity subscribers, Comcast makes their pay-TV bundles all the more attractive to existing customers. This strategy will be of particular interest for other multi-channel networks looking to grow their digital offerings while maintaining as much possible share in the $70B U.S. linear ad market.

Peacock’s entrance means an even more fragmented streaming market for consumers to navigate, especially in light of other recent launches such as HBO Max, Disney+, and Apple TV+. Consumers presumably have an upper limit of how many subscriptions they are willing to sign up for. As more options like Peacock enter the market, it raises the stakes for each provider to offer value continually over time or risk attrition to newer players in the space. New content usually means a hefty price tag, and the future of streaming will depend on which players can find the balance of value vs cost.

We’ll keep this page updated with new developments; check back for the latest as Peacock takes flight!

We’ll keep this page updated with new developments; check back for the latest as Peacock takes flight!

Read the rest of our Convergent TV blog series here!