Convergent TV Series

What is HBO Max?

The power struggles of HBO’s Game of Thrones are nothing compared to the intrigue of the ongoing “Streaming Wars”. AT&T’s newly launched HBO Max joined the fray in May, backed by plenty of firepower; the direct-to-consumer streaming service combines HBO’s award-winning programming with hundreds of additional TV shows and movies from the extensive WarnerMedia catalog.

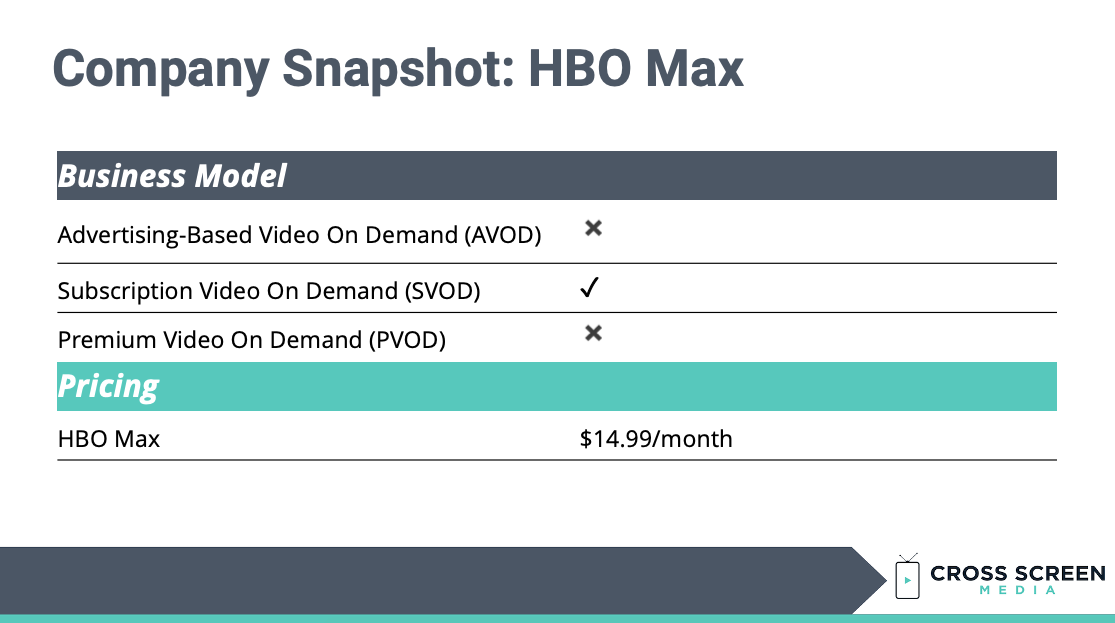

In addition to producing original content, they are also clawing back fan favorites from other streaming services to bolster their appeal (most notably, Friends will be moving exclusively to HBO Max after years as one of Netflix’ crown jewels). The service comes with a $14.99/month price tag, the highest among streaming competitors, although a lower-cost, ad-supported version is planned for 2021.

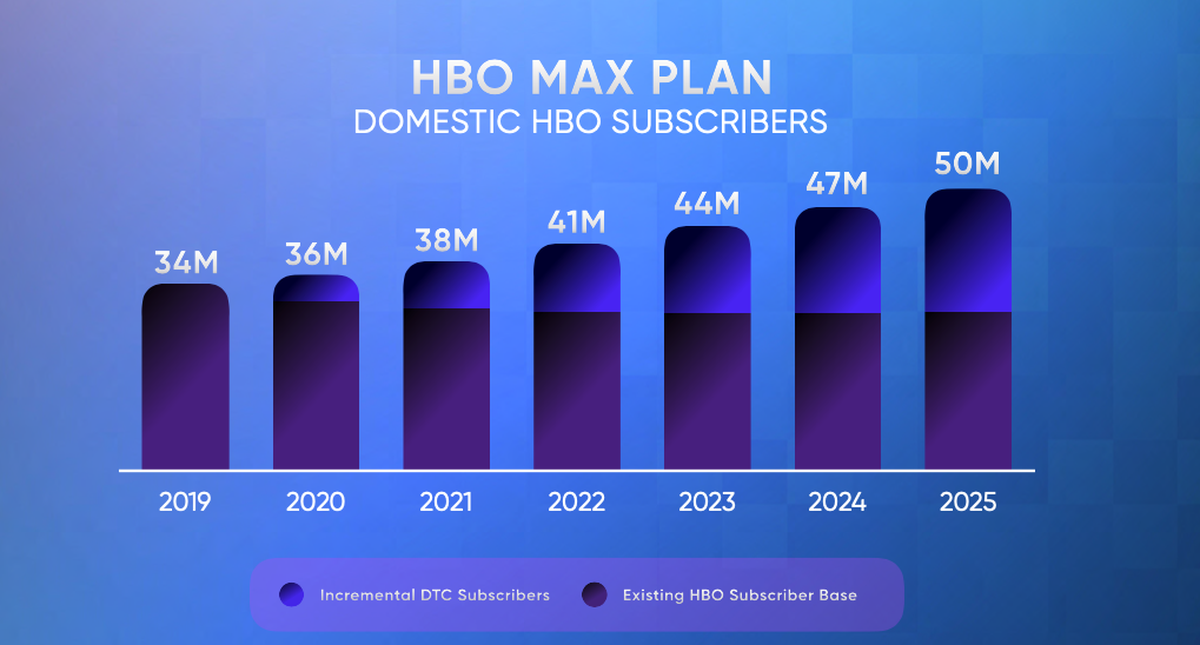

AT&T is doubling down on the importance of streaming content as their future, tapping Jason Kilar, Hulu’s co-founder and former CEO, to lead WarnerMedia (including HBO Max). AT&T is playing catch-up in a crowded streaming base, but benefits from a massive 44.2 million subscriber base of existing HBO viewers in the U.S.

What does HBO Max’s launch mean for convergent TV advertising today?

HBO Max has opted to launch initially with only one tier: an ad-free SVOD model with all content included. Consumers may respond well to the simplicity of an all-inclusive, ad-free service, or conversely could be turned off by the relatively high cost. AT&T’s approach is in contrast to Disney, which primarily offers their services (Hulu, Disney+, ESPN+) as separate subscriptions.

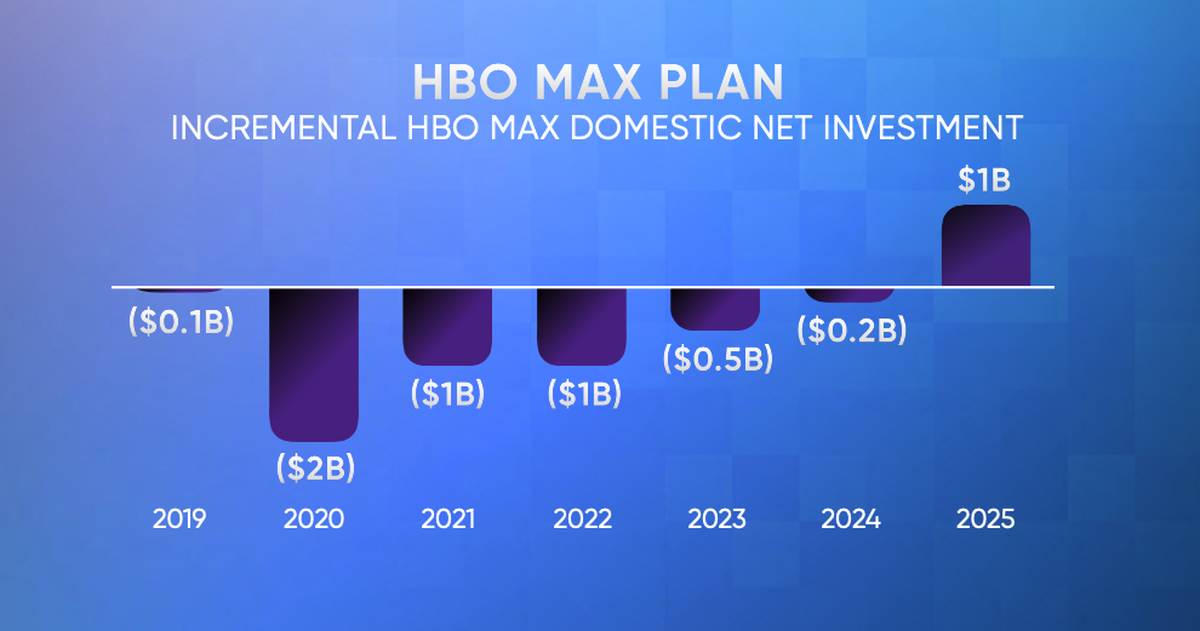

The decision to launch without ads means forgoing a significant revenue source at a time when AT&T plans to invest $4B+ over three years to launch the service. It also gives other OTT AVOD streaming competitors (e.g., Hulu) time to further extend their lead in the space. However, if AT&T can show strong subscriber numbers in 2020 it will likely drive up demand (and pricing leverage) for the eventual launch of their AVOD model.

What does HBO Max’s launch mean for convergent TV advertising in the future?

AT&T has ambitious goals for scaling HBO Max, and has already announced several noteworthy initiatives to achieve that scale. First, AT&T plans to release an ad-supported version of HBO Max in 2021 (price TBD). This offering will be the first major HBO-branded project to have commercials. Despite some concerns about HBO brand dilution, this is likely a necessary step to reach the HBO Max subscriber growth goals.

Equally notable, HBO Max plans to host content from other media companies and enable those organizations to sell ads.

“We fully expect that once the AVOD environment goes up, it’s not just going to be our content and our avails and inventory that’s in that environment. We very much would love this platform over time to receive content from others, as well as inventory from others to go with that content.” – John Stankey, CEO, AT&T

AT&T’s aggregated data assets collected across their mobile, internet, and TV business lines bring significant value for advertisers increasingly focused on precisely targeted ads. With the decision to allow other inventory from other media companies, AT&T will aim to scale ad revenue (via their advertising arm, Xandr) in parallel with subscriber growth.

We’ll keep this page updated with new developments; check back for the latest as AT&T pushes streaming to the Max.

Read the rest of our Convergent TV blog series here!