|

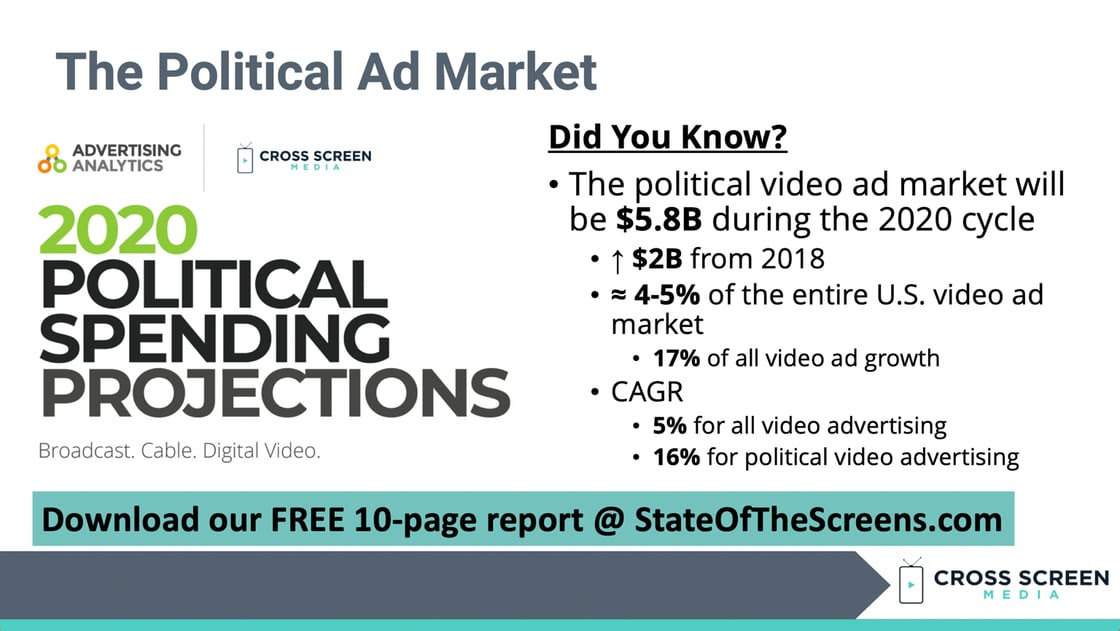

1) CTV will be the battleground for control of video advertising dollars – TV buyers are rebranding themselves as video investment teams, and digital buyers believe that CTV should fall under them. Control of the video ad budget is up for grabs, which will be key when linear TV falls below 50% of video spend in the next 4-6 years. Verdict: Streaming grew to 25% of video viewing time but only accounted for 8% of video ad dollars. Cross screen buying and selling is the present/future, and CTV will be the battleground for the next 5+ years. 2) Political will set the pace for cross screen video advertising – The 2020 political video ad market will be $5.8B, accounting for ≈ 4-5% of the entire U.S. market. Politics has consistently led the way with regards to audience targeting, and we believe that cross screen planning/buying will be added to the mix in 2020. Verdict: The final numbers are coming in, but we most likely missed this by guessing too low! Bloomberg/GASEN runoff added $1B+, which is 17% of our total estimate. Smart media sellers are already focused on 2022 and have much to be excited about after the 2018 cycle grew 141% over 2014 to $3.9B. |

|

|

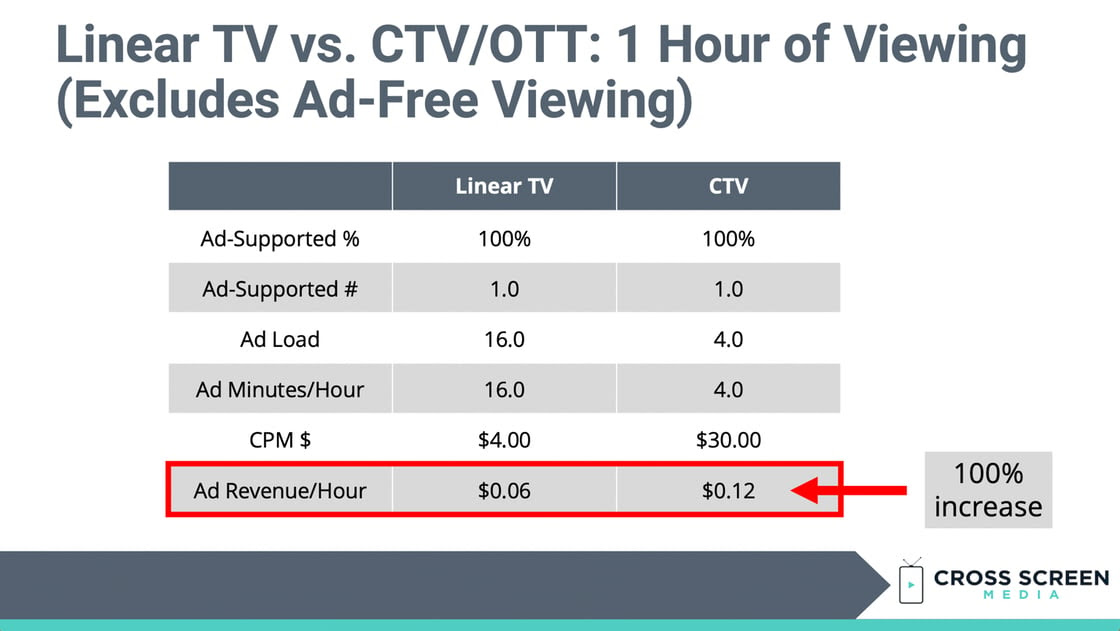

3) Ad-supported streaming will emerge as a sustainable business model – The success of platforms such as Tubi, Pluto TV, and the Roku Channel will continue in 2020 along with new entrants such as NBCUniversal’s Peacock. These platforms are popular with advertisers because they combine the reach/quality of linear TV with the targeting/measurement of digital. Ad-supported streaming will carry a lower ad load compared to linear TV, which will lead to an overall drop in TV ad impressions. Verdict: Tubi/Xumo were acquired, and Roku is one of the hottest tech stocks with an advertising driven business model. This trend is just getting started. |

|