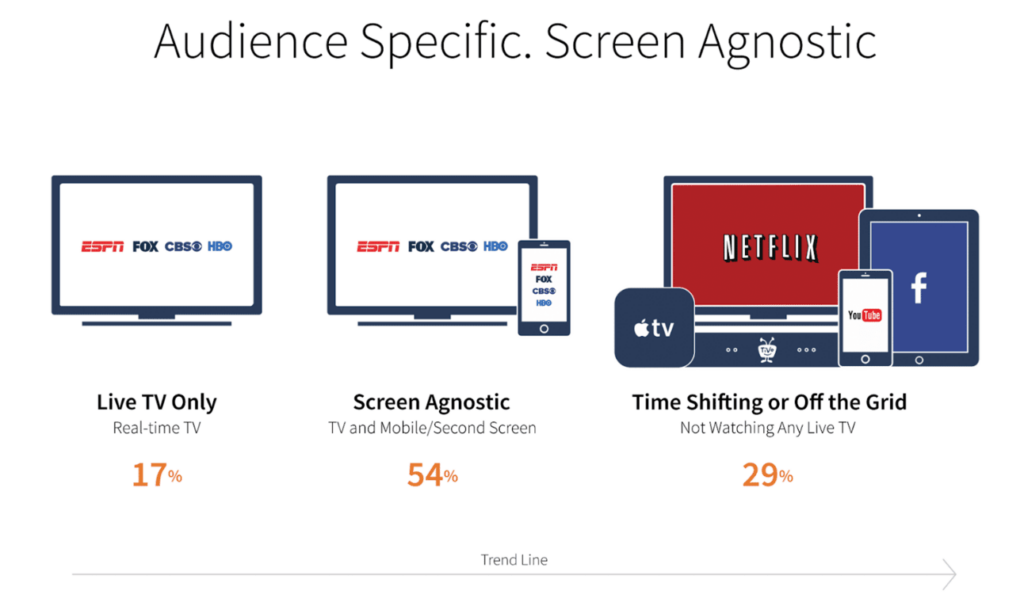

Mr. Screens Gets Nostalgic: 10 years ago, Zac Moffatt and I led a study that showed 29% of voters had moved away from all forms of live television besides sports. People thought we were crazy. Our only mistake was not thinking big enough.

Big time: My highlight was presenting our findings to the legendary Dan Balz from the Washington Post. Here was someone at the top of the political world, and he could see the change was coming.

Quote from Dan Balz – Chief Correspondent @ The Washington Post:

“If this is truly a tipping point — and everything suggests that the changes in viewing habits will accelerate — then campaign strategists will have to change their habits even more rapidly than they may think.”

Flashback #1: Voters Going Off The Grid 2014

Flashback #2: Voters Going Off the Grid 2012

Bottom line: Off the Grid provided an early warning to anyone willing to listen about how persuading voters would change in the next 10 years.

Special hat tip: Matt Rosenberg and the team at SAY Media were the originators of the Off the Grid concept and worked with us on an early version during the 2012 cycle. SAY Media was an incredible company with a distinct point of view and marketing that felt like amazing content rather than BS. They were way ahead of their time.

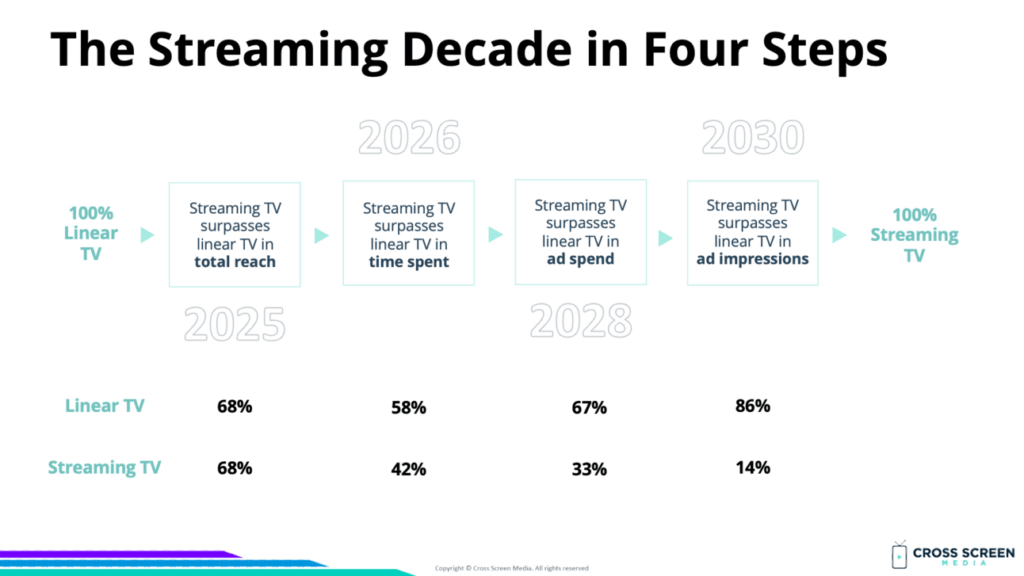

Setting the table: To fully understand our changing video habits, I will use the following metrics from my Streaming Decade in Four Steps framework:

1) Total reach

2) Time spent

3) Ad spend

4) Ad impressions

Five big questions re: Off the Grid:

1) How has TV viewing changed over the past decade?

2) How do swing voters watch TV in 2024?

3) How do swing voters compare to U.S. adults?

4) How has the political video ad market changed?

5) What will TV advertising look like in 2034?

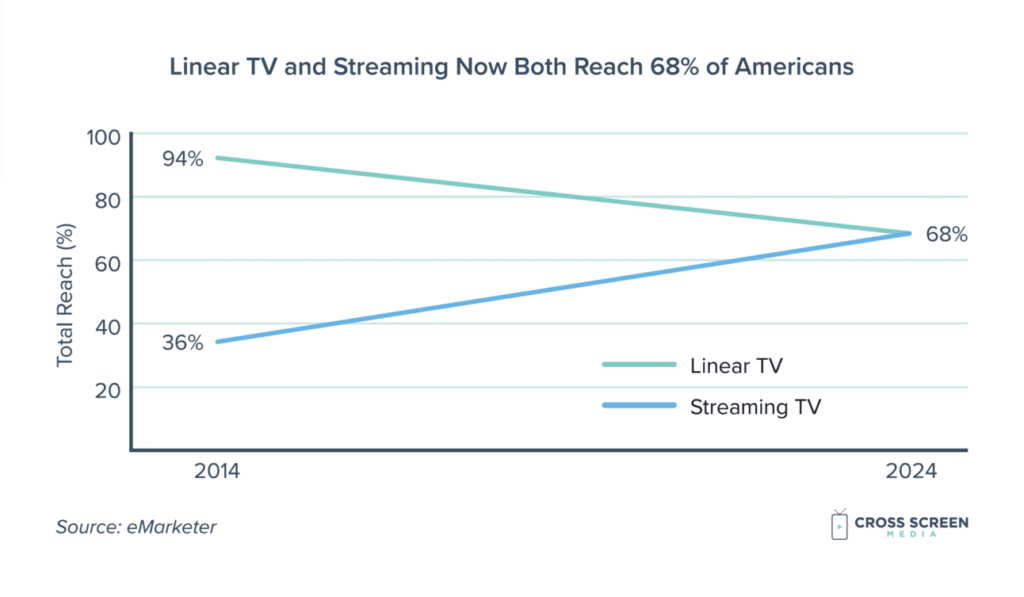

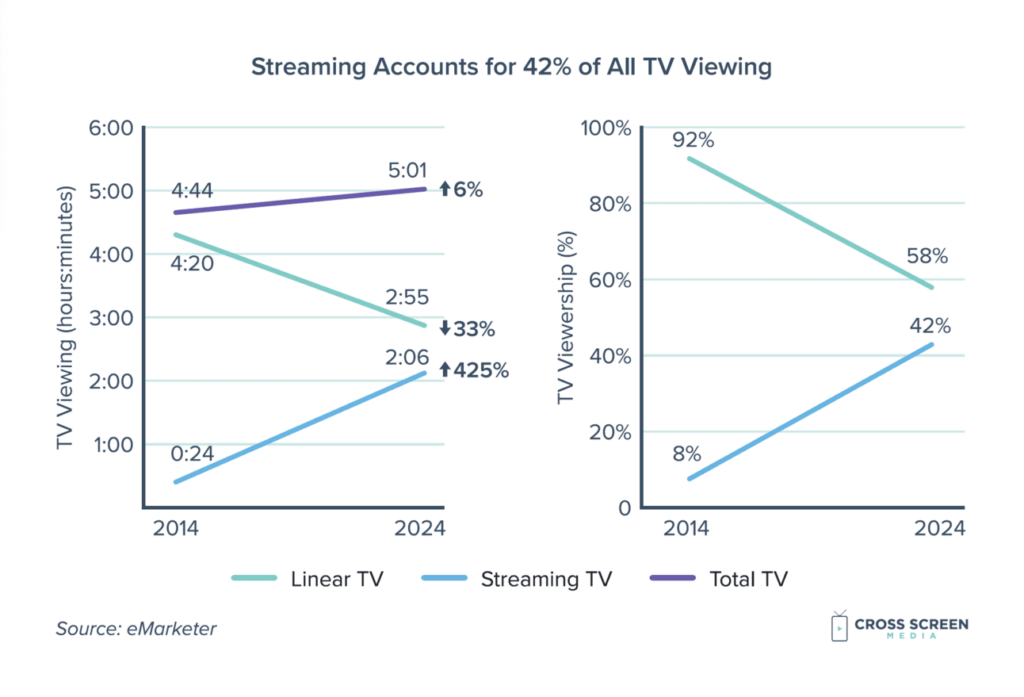

Big question #1: How has TV viewing changed over the past decade?

Change in reach between 2014-24, according to eMarketer:

1) Linear TV – 94% → 68% (↓ 28%)

2) Streaming TV – 36% → 68% (↑ 91%)

Change in time spent between 2014-24, according to eMarketer:

1) Linear TV – 92% → 58% (↓ 33%)

2) Streaming TV – 8% → 42% (↑ 425%)

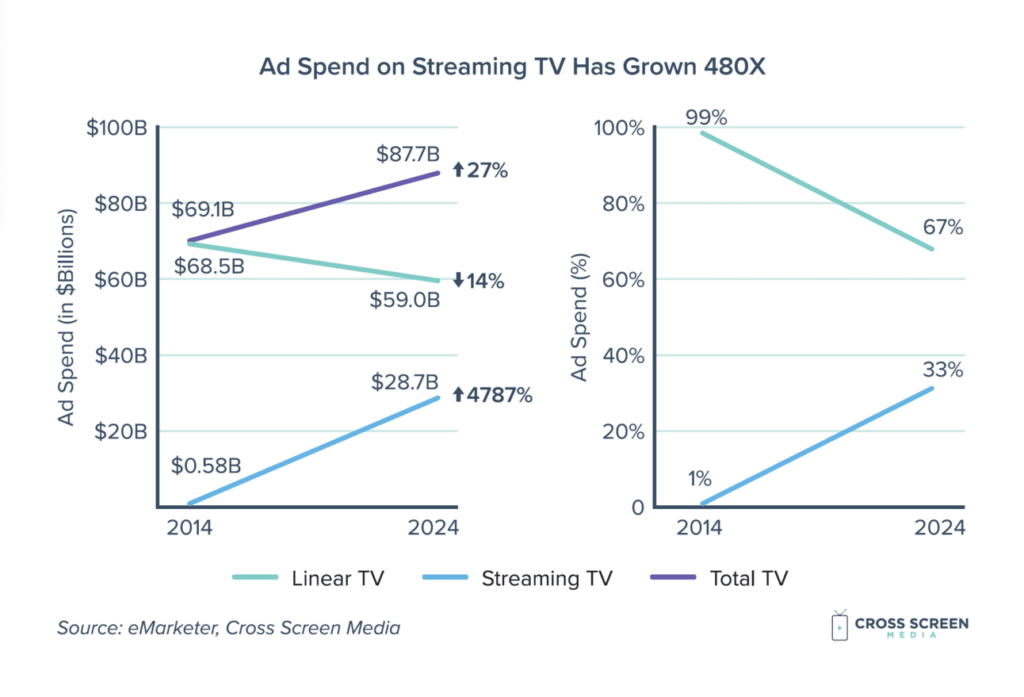

Change in ad spend between 2014-24, according to eMarketer / Cross Screen Media:

1) Linear TV – 99% → 67% (↓ 14%)

2) Streaming TV – 1% → 33% (↑ 4,787%)

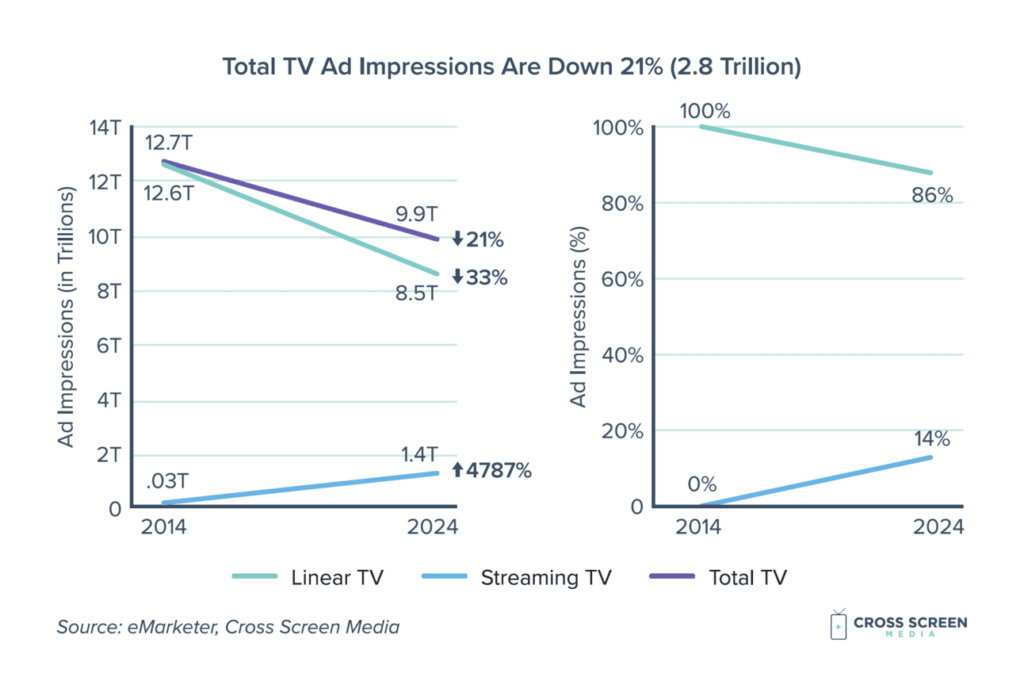

Change in ad impressions between 2014-24, according to iSpot / Cross Screen Media:

1) Linear TV – 100% → 86% (↓ 33%)

2) Streaming TV – 0% → 14% (↑ 4,787%)

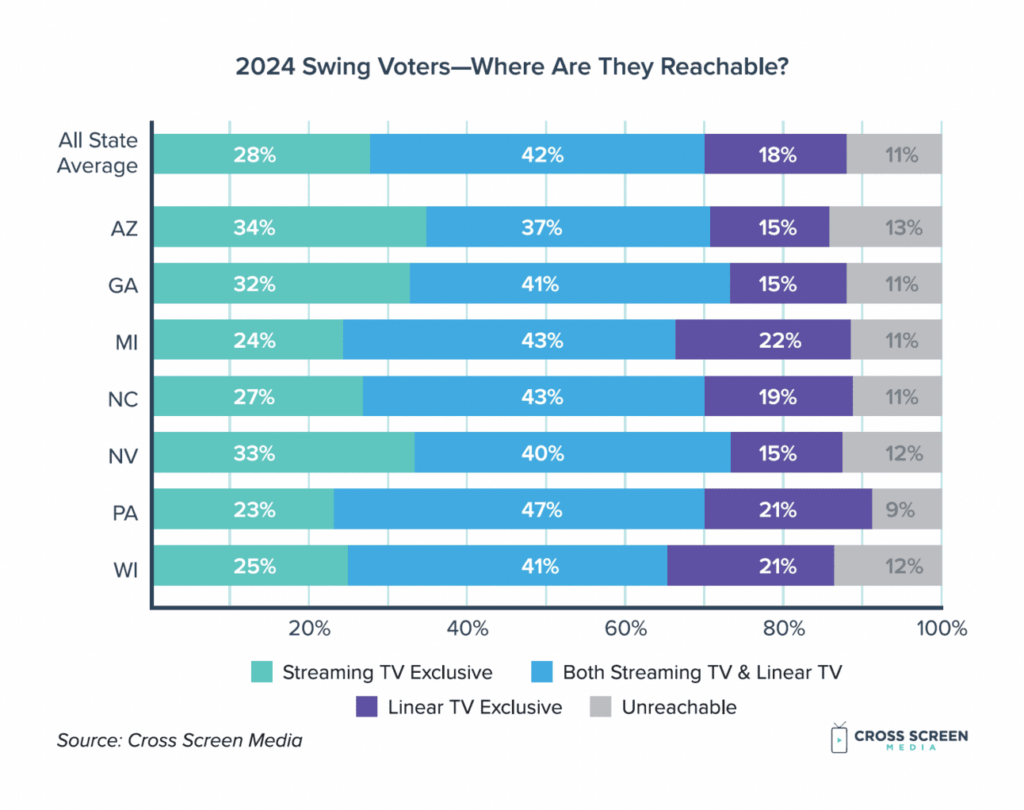

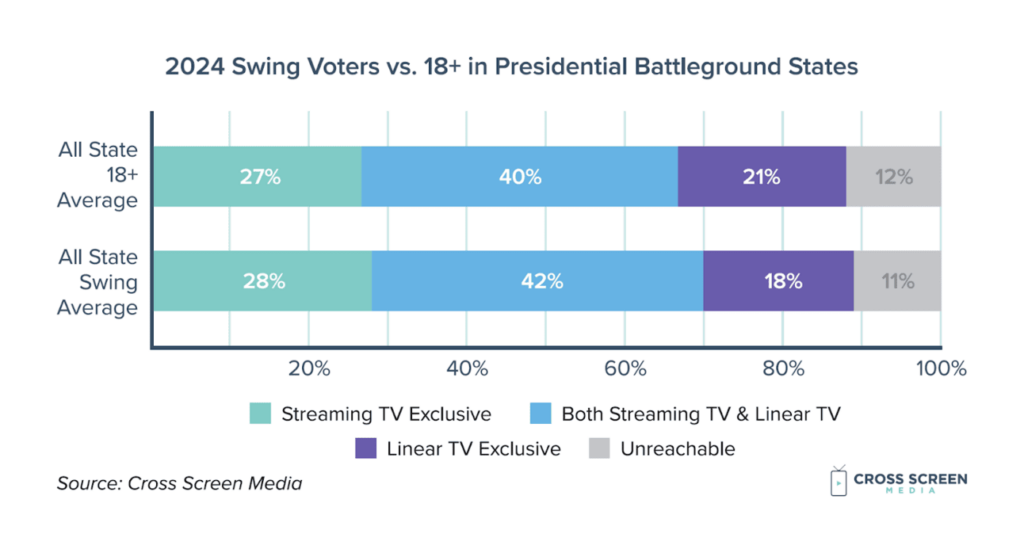

Big question #2: How do swing voters watch TV in 2024?

Reachability for swing voters in battleground states:

1) 11% are not reachable with TV ads

2) 89% are reachable with TV ads

3) 60% are reachable with linear TV ads

4) 70% are reachable with streaming TV ads

5) 42% are reachable through both linear TV and streaming

6) 18% are reachable through linear TV only

7) 28% are reachable through streaming TV only

Big question #3: How do swing voters compare to U.S. adults?

Share who are reachable through streaming TV:

1) Swing voters – 70%

2) 18+ – 67%

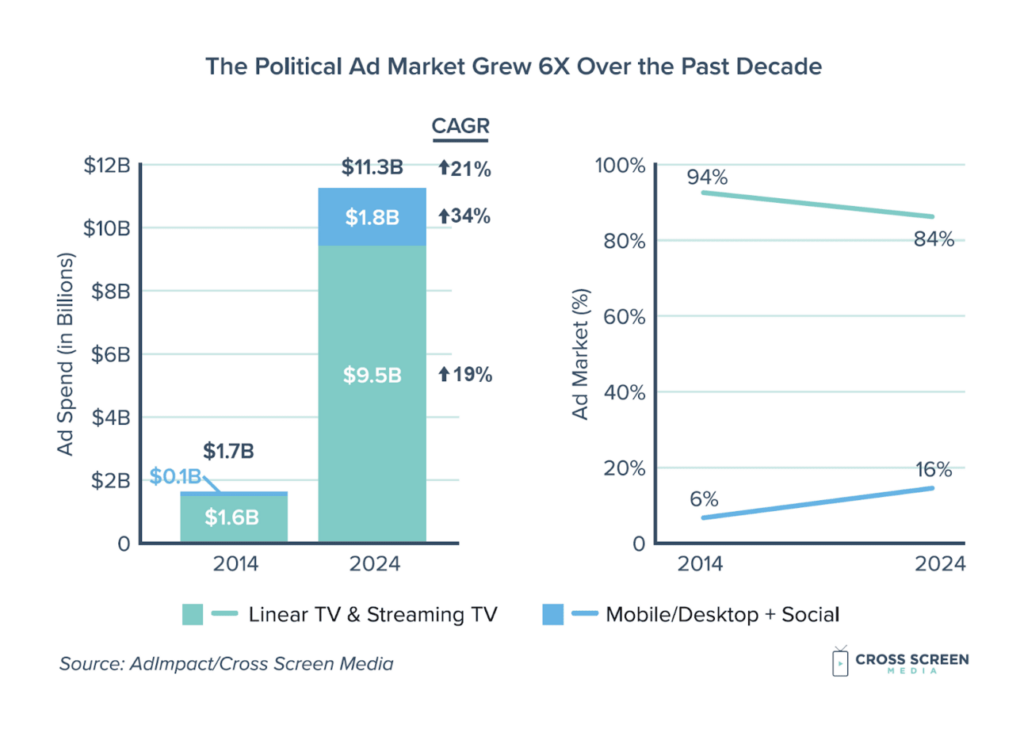

Big question #4: How has the political video ad market changed?

Quick answer: Video ad spending in politics has exploded over the past decade with a compound annual growth rate (CAGR) of 21%.

The compound annual growth rate between 2014-24:

1) Political video ad market – ↑ 21%

2) US ad market – ↑ 8%

Wow: If the political video ad market had grown at the same rate as the overall US ad market, it would be a $3.8B market (↓ 66%) in 2024 vs. the $11.3B we are projecting.

Big question #5: What will TV advertising look like in 2034?

Mr. Screens’ Crystal Ball: By 2034, streaming TV will dominate nearly 100% of all TV viewing/advertising. With streaming’s reach surpassing linear TV, even live sports (NFL, etc.) will move to streaming.

The streaming decade in four steps:

1) 2025 – Streaming TV surpasses linear TV in total reach ← YOU ARE HERE

2) 2026 – Streaming TV surpasses linear TV in time spent

3) 2028 – Streaming TV surpasses linear TV in ad spend

4) 2030 – Streaming TV surpasses linear TV in ad impressions