Eight big questions re: a TradeDesk smart TV operating system:

1) Is TradeDesk (TTD) building a smart TV operating system (TVOS)?

2) Which TVOS has the largest footprint?

3) Why does the TVOS market need another offering?

4) What does TradeDesk gain by building a TVOS?

5) Why would TV manufacturers choose TradeDesk?

6) How many TVs are sold each year?

7) How do TV manufacturers make money?

8) How large is the TVOS market?

Big question #1: Is TradeDesk (TTD) building a smart TV operating system (TVOS)?

Quick answer: Janko Roettgers reports that it began development in 2019. Sonos is rumored to be its first hardware partner with an upcoming streaming media player.

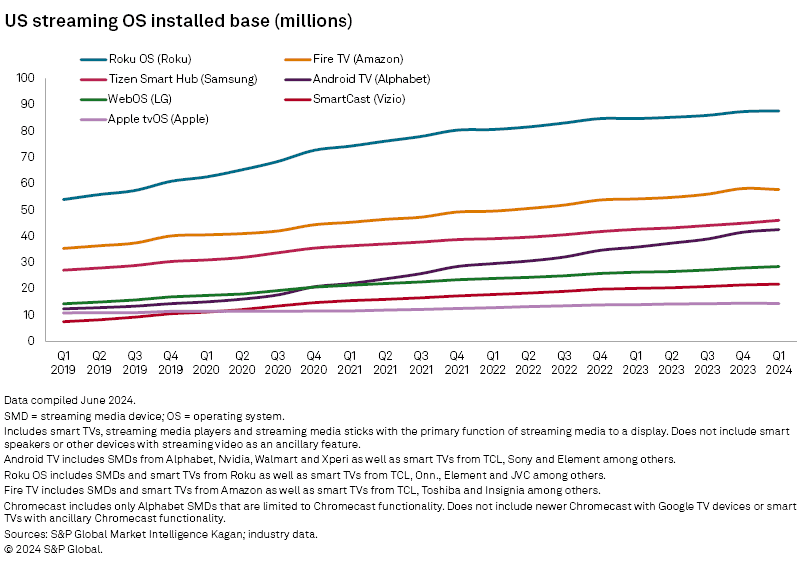

Big question #2: Which TVOS has the largest footprint?

Share of smart TV OS install base in the United States, according to Kagan:

1) Roku OS (Roku) – 26%

2) Fire TV (Amazon) – 17%

3) Tizen Smart Hub (Samsung) – 14%

4) Android TV (Alphabet) – 13%

5) WebOS (LG) – 9%

6) SmartCast (Vizio) – 7%

7) Apple TVOS (Apple) – 4%

8) Pre-Tizen Smart Hub (Samsung) – 2%

9) Chromecast (Alphabet) – 0%

10) Others – 8%

Big question #3: Why does the TVOS market need another offering?

Quick answer: This is the same question I asked when Comcast launched their line of smart TVs. For this to work, you need three things to happen:

1) TV manufacturers (OEMs) use your OS

2) Consumers purchase TVs with that OS

3) Consumers spend most of their streaming time on your OS vs. another device (Roku, etc.)

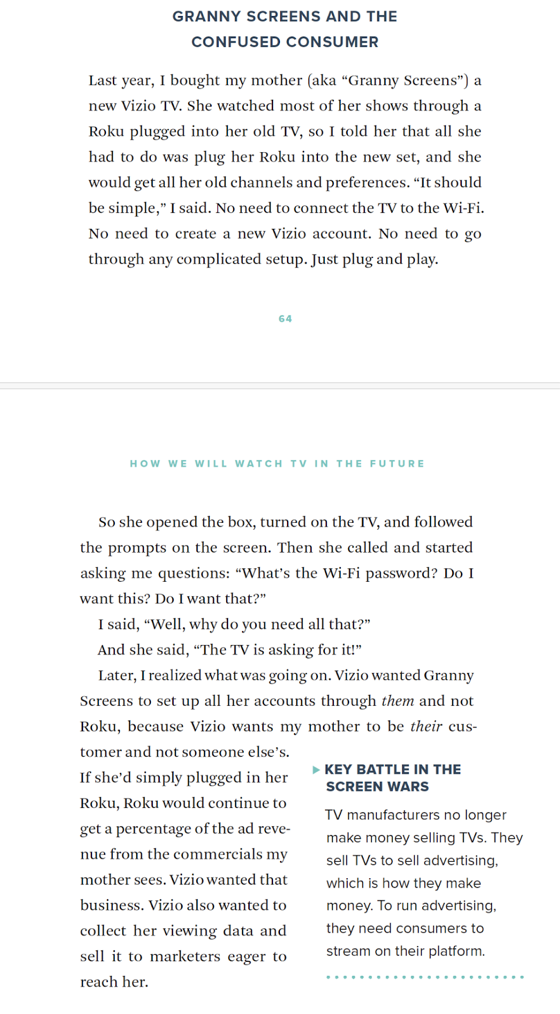

Tales from the Screens family: Getting consumers to use your OS for streaming is a harder problem than most think. We have 8 TVs in our household (6 Samsung + 2 Vizio), and all but one have a Roku we use to access linear/streaming content.

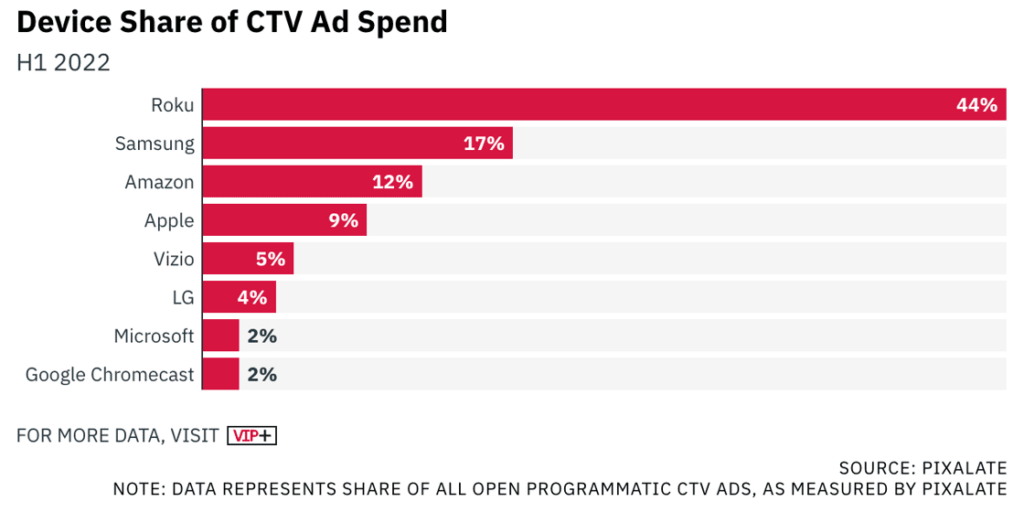

Why this matters: Our household would show Roku as 47% (7/15) of the installed devices but 100% of the ad impressions since it is how we watch TV.

U.S. share for Roku OS:

1) Ad spend – 44%

2) Install base – 26%

A word from our sponsor: In my book, Screen Wars: Win the Battle for Attention with Convergent TV, we tell the story of Granny Screens and her new Vizio TV.

Big question #4: What does TradeDesk gain by building a TVOS?

Priorities for TradeDesk launching a TVOS:

1) Leverage – Removes dependency on companies such as Roku that could shut them out of the smart TV ad space

2) Ad inventory – Owning TVOS creates additional inventory through distribution deals with streaming apps

3) Data – Getting closer to the glass (ACR) allows TTD to offer better targeting and measurement

Quote from Ari Paparo – CEO @ Marketecture Media:

“TTD is betting its future on its ability to become the primary buying system for the future of TV. There’s no way to get to that $50 billion valuation unless you assume that a big portion of the roughly $60 billion TV market starts flowing through TTD’s pipes.”

Big question #5: Why would TV manufacturers choose TradeDesk?

Quick answer: A possible benefit would be better terms/rates on ads sold through the TradeDesk platform.

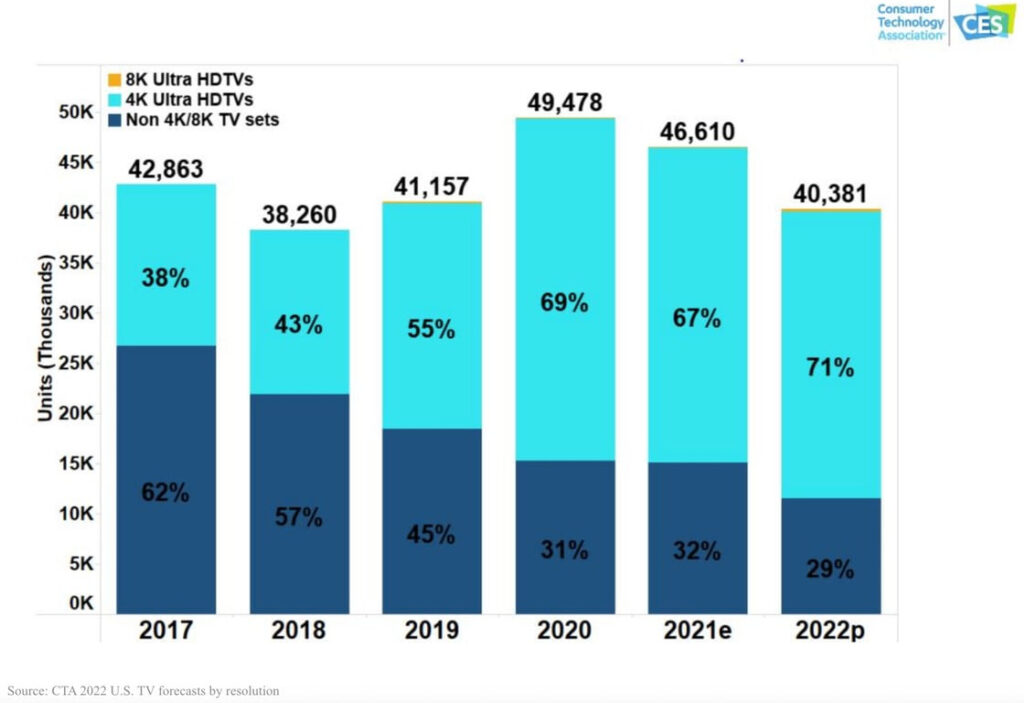

Big question #6: How many TVs are sold each year?

Quick answer: 40M TVs are sold in the U.S. (250M globally). The average TV is replaced every 7 years.

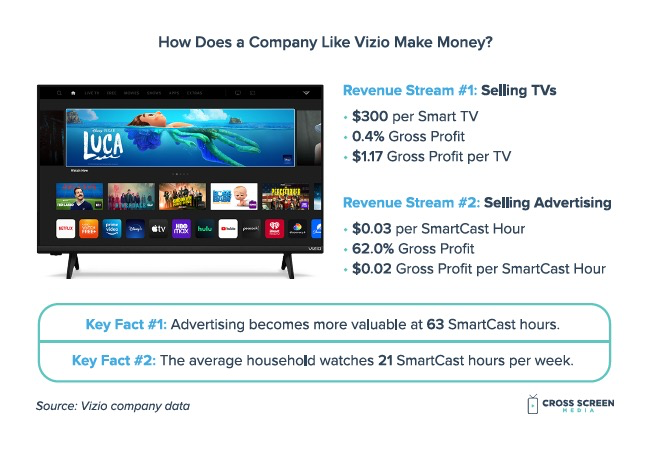

Big question #7: How do TV manufacturers make money?

Quick answer: Advertising. Vizio is a great example of a company that generates ≈ 100% of its profit from advertising vs. selling TVs.

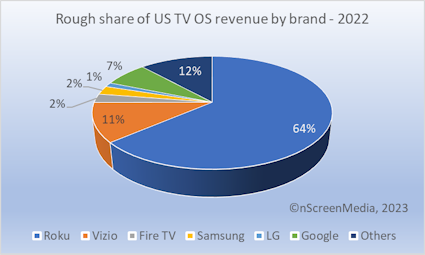

Big question #8: How large is the TVOS market?

Quick answer: ≈ $4B

TV operating system revenue (% of total) according to nScreenMedia:

1) Roku – $2.7B (65%)

2) Vizio – $478M (11%)

3) Google – $250M (6%)

4) Samsung – $100M (2%)

5) Amazon – $100M (2%)

6) LG – $50M (1%)

7) Other – $500M (12%)