Setting the table: This is the 8th part of our Road to the White House series.

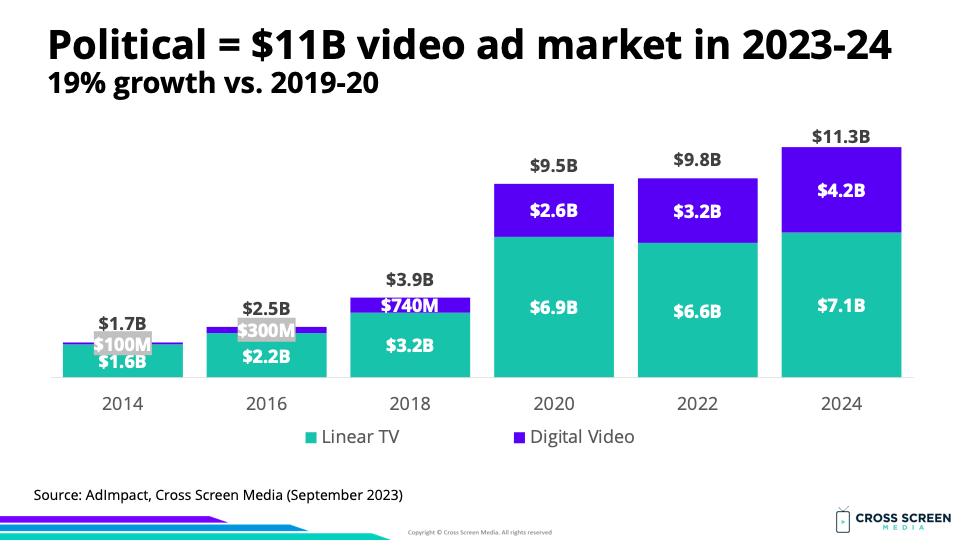

1) 11 Billion Reasons to Care About Political Video Ads

2) The Battle for Iowa (Part 1)

3) The Battle for Iowa (Part 2)

4) The Battle For New Hampshire

5) Is Biden Reaching Enough Swing Voters?

6) Biden vs. Trump I

7) The GOP Convention

8) The Race to Define Kamala Harris

Six big questions re: the 2024 TV ad war:

1) Who is currently ahead in the polls?

2) Which states are the focus?

3) How do swing voters in battleground states watch TV?

4) How much money has been spent on TV ads?

5) How much did Team Biden spend on TV advertising before dropping out?

6) Who is winning the air war since President Biden dropped out?

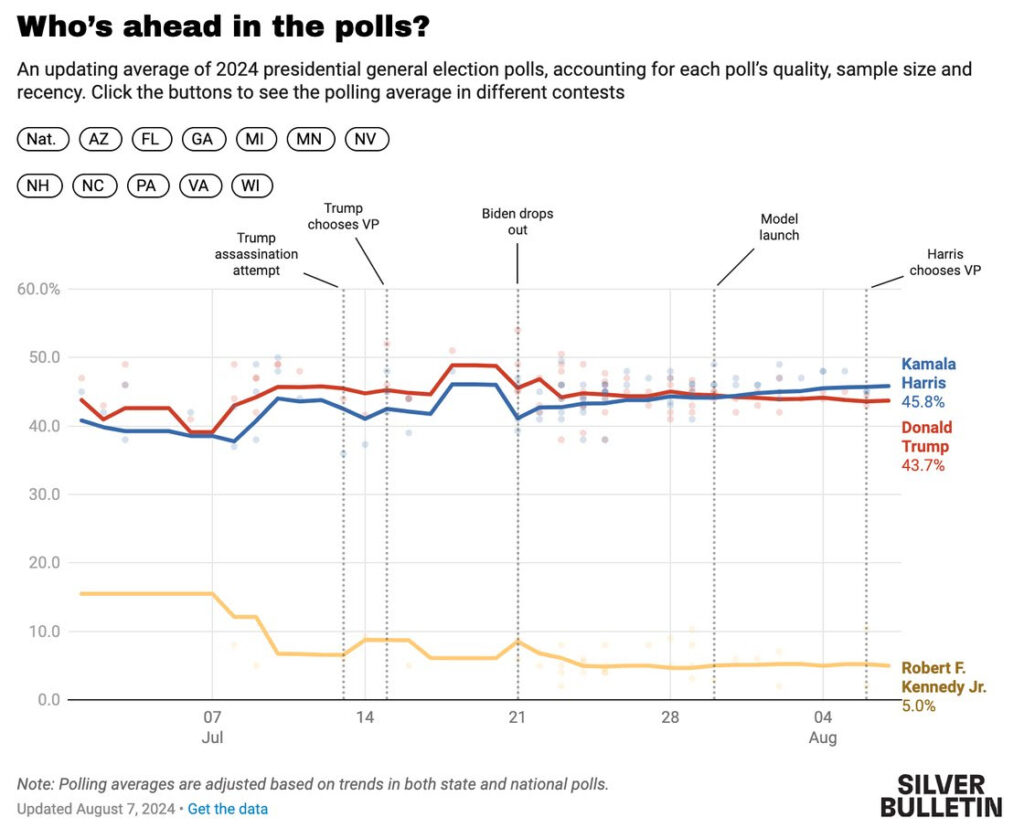

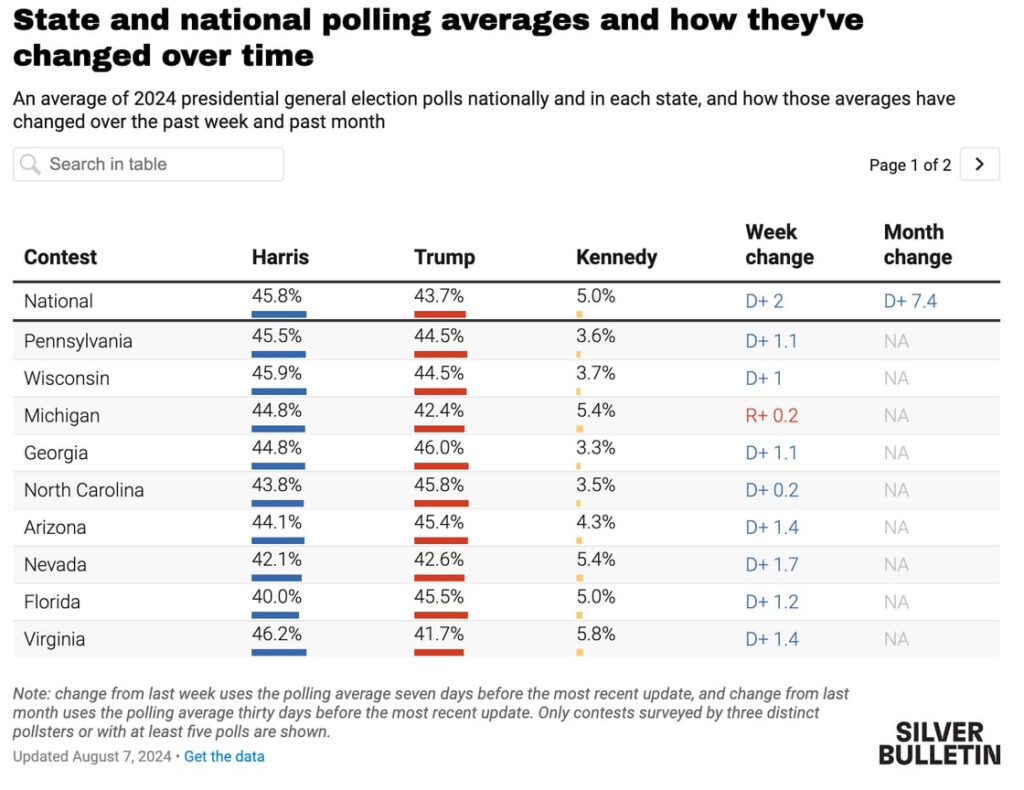

Big question #1: Who is currently ahead in the polls?

Quick answer: The switcheroo has given Team Harris a momentum boost at both the national and state levels. The race has gone from sleeper to barnburner, setting up a wild 88-day sprint!

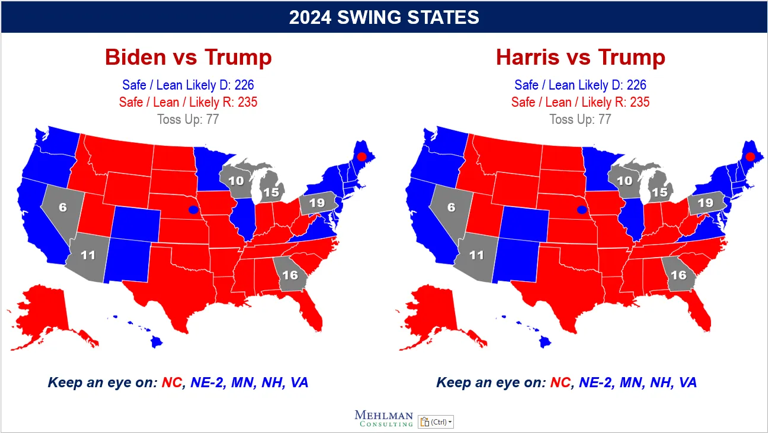

Big question #2: Which states are the focus?

Quick answer: 6 states are considered toss-ups.

Share of the U.S. population according to Wikipedia:

1) Pennsylvania – 4%

2) Georgia – 3%

3) Michigan – 3%

4) Arizona – 2%

5) Wisconsin – 2%

6) Nevada – 1%

7) Total – 15%

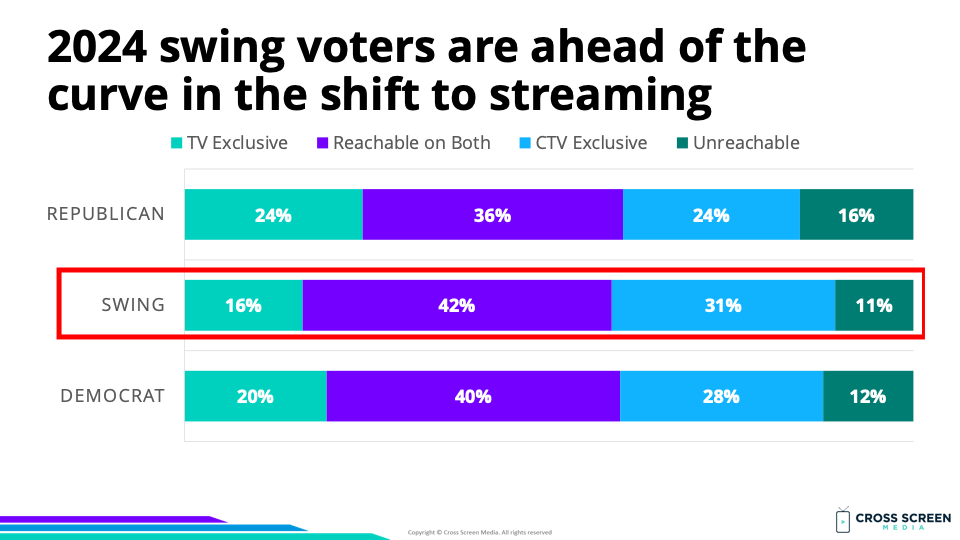

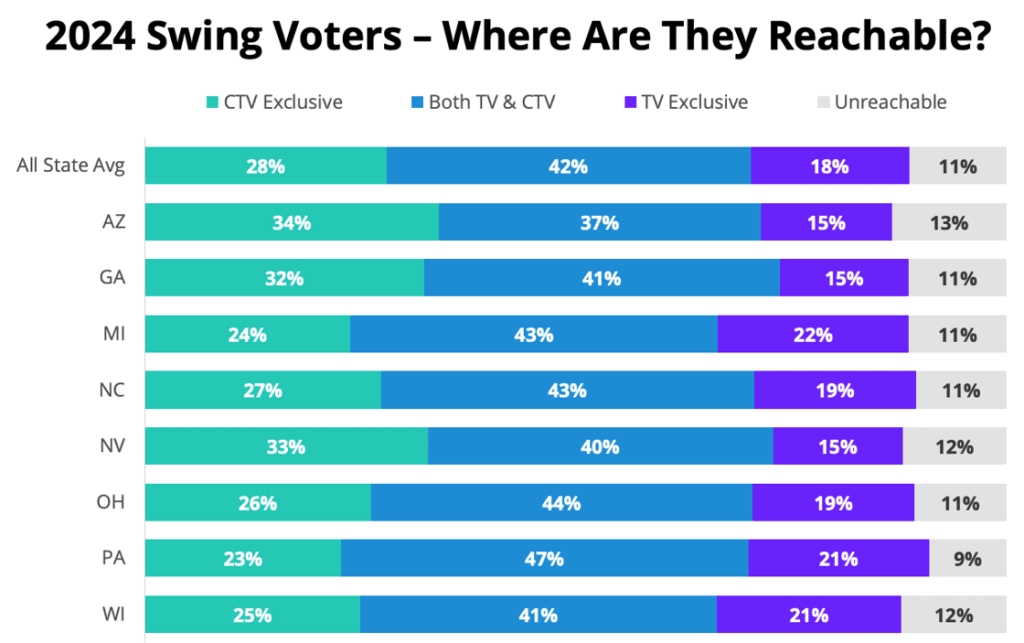

Big question #3: How do swing voters in battleground states watch TV?

Reachability for swing voters in battleground states according to Cross Screen Media:

1) 11% are not reachable with TV ads

2) 89% are reachable with TV ads

3) 58% are reachable with linear TV ads

4) 73% are reachable with streaming TV ads

5) 42% are reachable through both linear TV and streaming

6) 16% are reachable through linear TV only

7) 31% are reachable through streaming TV only

Battleground states with the largest share of swing voters who are streaming TV only:

1) Arizona – 34%

2) Nevada – 33%

3) Georgia – 32%

4) Michigan – 24%

5) Wisconsin – 25%

6) Pennsylvania – 23%

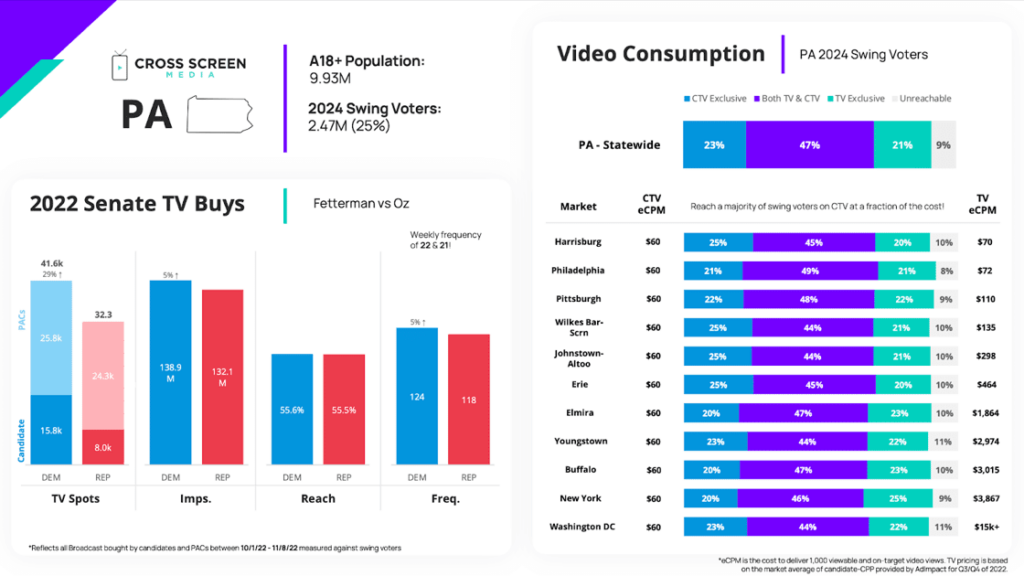

Big picture: Pennsylvania is ground zero.

Quote from Mike Allen – Co-founder @ Axios:

“In 2000, it was Florida, Florida, Florida. In 2024, it’s Pennsylvania, Pennsylvania, Pennsylvania.”

Deep dive: Pennsylvania swing voters are more reachable on streaming (70%) than linear TV (68%) despite being slightly older (40.7) than the average American (38.8).

Pennsylvania media markets with the largest share of swing voters who are streaming TV only:

1) Harrisburg – 25%

2) Wilkes-Barre Scranton – 25%

3) Johnstown Altoona – 25%

4) Erie – 25%

5) Youngstown – 23%

6) Washington DC – 23%

7) Pittsburgh – 22%

8) Philadelphia – 21%

9) Elmira – 20%

10) Buffalo – 20%

11) New York – 20%

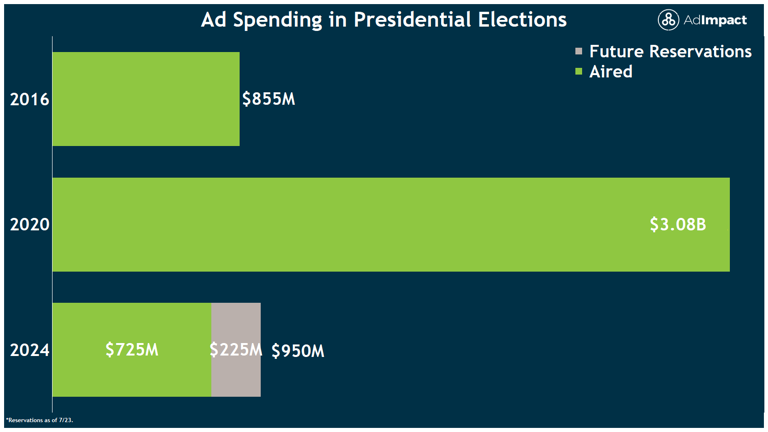

Big question #4: How much money has been spent on TV ads?

Quick answer: $725M+ has already been spent on the presidential campaign, which is 27% of our estimated total for the cycle ($2.7B).

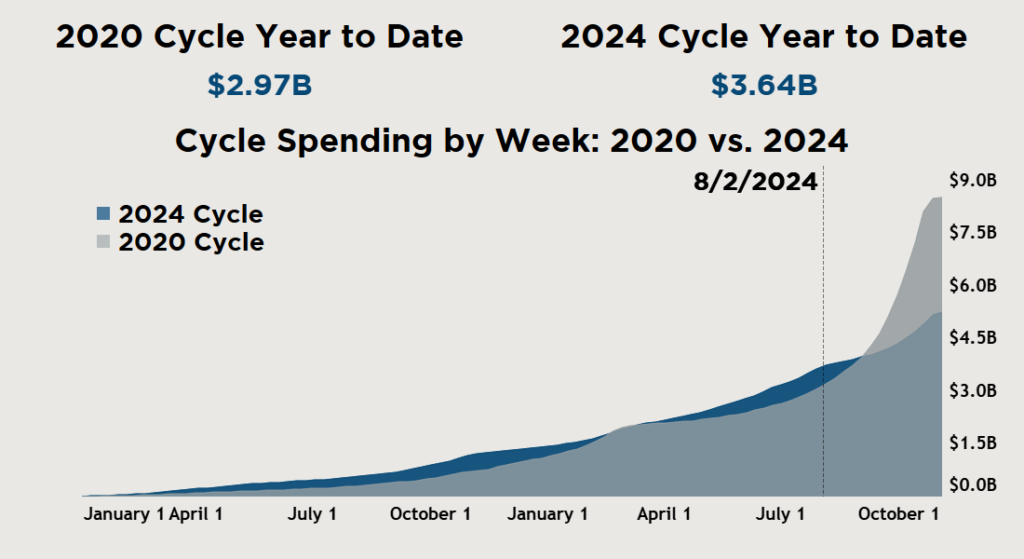

TV ad spending (% growth) as of August 2nd, according to AdImpact:

1) 2020 – $3.0B

2) 2024 – $3.6B (↑ 23%)

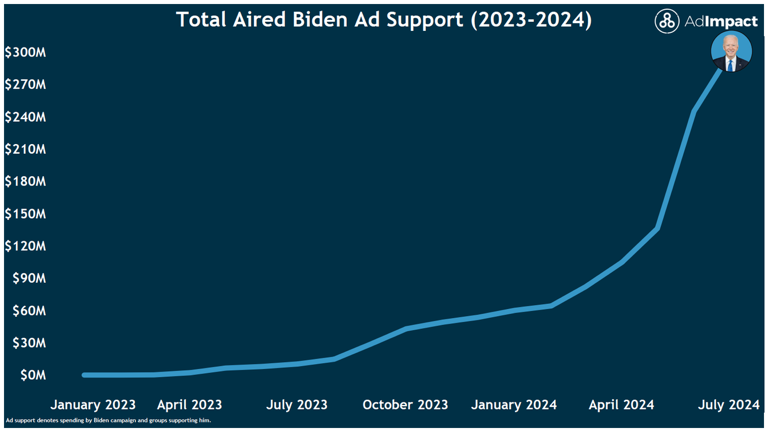

Big question #5: How much did Team Biden spend on TV advertising before dropping out?

Quick answer: Team Biden spent $301M on TV advertising before dropping out – roughly 2X the amount spent by Team Trump!

Wow: At the point Biden dropped out, 2024 TV ad spend had already reached 85% of the total amount for 2016!

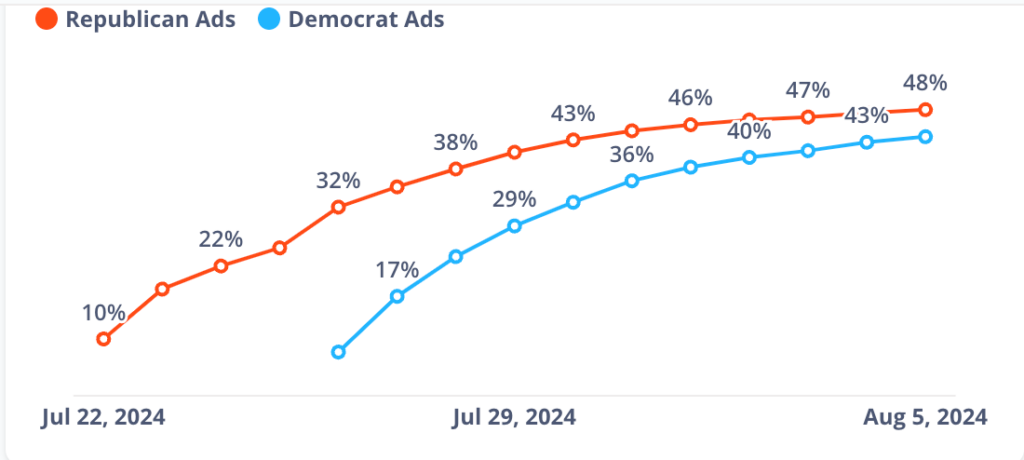

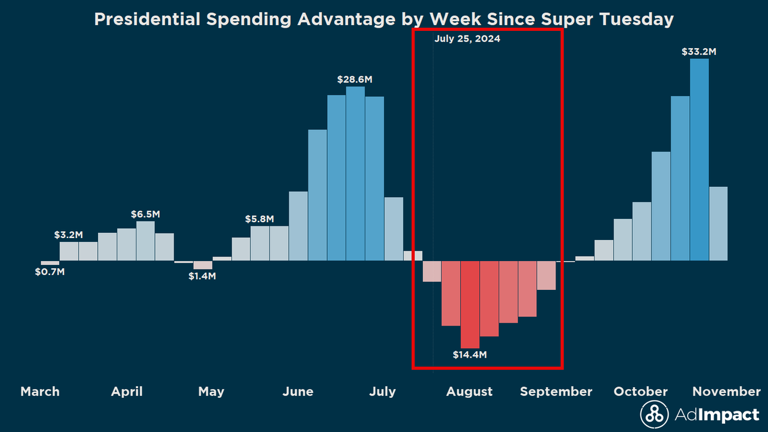

Big question #6: Who is winning the air war since President Biden dropped out?

TV ad spending between 07/22 – 08/11 (% of total) according to AdImpact:

1) Team Harris – $112M (61%)

2) Team Trump – $70M (39%)

Future TV ad reservations between 08/12 – 11/05 (% of total):

1) Team Harris – $172M (71%)

2) Team Trump – $72M (29%)

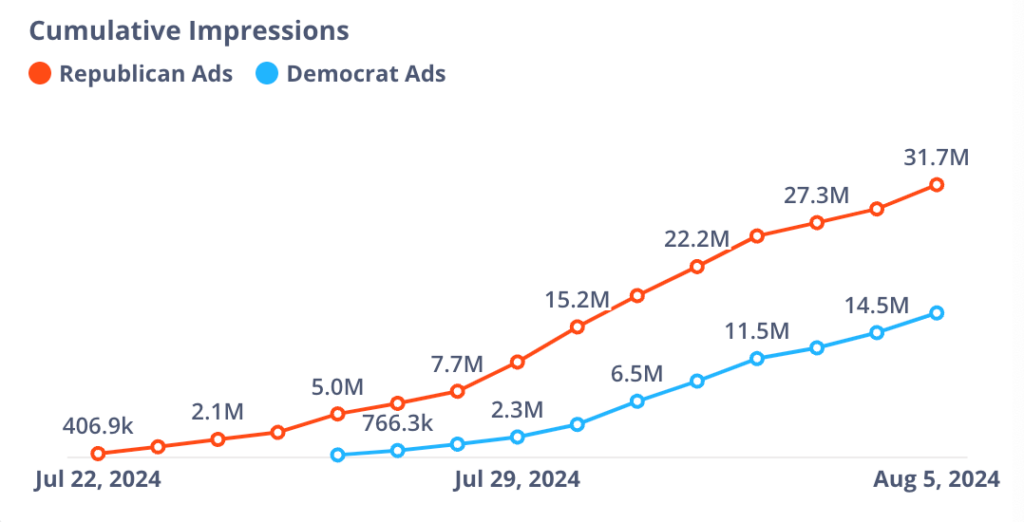

Cumulative reach since July 22nd to Pennsylvania swing voters according to Cross Screen Media:

1) Team Trump – 48%

2) Team Harris – 44%

Cumulative impressions since July 22nd to Pennsylvania swing voters (% of total):

1) Team Trump – 32M (65%)

2) Team Harris – 17M (35%)

Wow: Team Trump hammered Team Harris during the first week, accounting for 69% of all TV spots.

Quote from Politico Playbook:

“But the delay is a real issue inside the campaign, and it’s related to the uncertain role of chief strategist MIKE DONILON, Biden’s longtime close adviser who controlled the Biden-Harris campaign’s ad-making operation.

Yesterday, on their podcast, DAVID AXELROD and MIKE MURPHY discussed how they were concerned about the lack of Harris ads airing to respond to the MAGA attacks.

Axelrod explained his understanding of the problem: “Mike Donilon — the way the ads worked before — the president’s guy, Mike Donilon, would work with one producer, tell him his ideas, the guy would produce stuff and Mike would pick an ad and they put it on the air. They don’t — Mike’s not there, I don’t think, anymore. And you know, they’ve got to very quickly build an operation to do this.”

Donilon is still there, but his new role isn’t defined yet.

A person familiar with the Harris campaign’s ad-making process confirmed to Playbook that this unusual setup described by Axelrod is indeed the situation that the new Harris team inherited and the cause of the delay.”

Check out the rest of our Road to the White House series!