Eight big questions re: the Summer Olympics:

1) How many people watch the Olympics?

2) What share of viewership comes from streaming?

3) What share of Americans plan to watch the Olympics?

4) What are the most anticipated sports?

5) How much does NBCUniversal pay to air the Olympics?

6) How many hours of content will be generated during the Summer Olympics?

7) How much advertising revenue will NBCUniversal generate from the Olympics?

8) How much will TV ad spots cost?

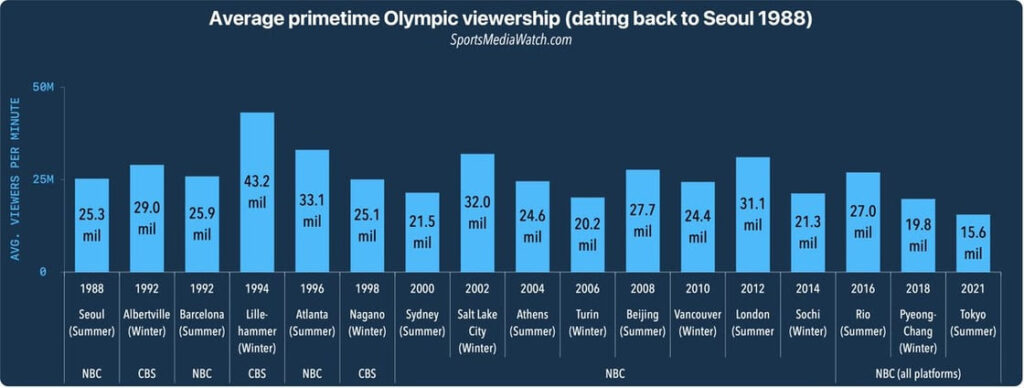

Big question #1: How many people watch the Olympics?

Summer Olympics (U.S. only) average primetime viewership (% change) according to Nielsen:

1) 1988 (Seoul) – 25.3M

2) 1992 (Barcelona) – 25.9M (↑ 2%)

3) 1996 (Atlanta) – 33.1M (↑ 28%)

4) 2000 (Sydney) – 21.5M (↓ 35%)

5) 2004 (Athens) – 24.6M (↑ 14%)

6) 2008 (Beijing) – 27.7M (↑ 13%)

7) 2012 (London) – 31.1M (↑ 12%)

8) 2016 (Rio) – 27.0M (↓ 13%)

9) 2020 (Tokyo) – 15.6M (↓ 42%)

Wow: 37% of the planet watched the 2020 Olympics!

Summer Olympics global viewers (% change) according to Front Office Sports:

1) 1988 (Seoul) – 3.5B

2) 1992 (Barcelona) – 3.5B (↑ 0%)

3) 1996 (Atlanta) – 3.2B (↓ 9%)

4) 2000 (Sydney) – 3.6B (↑ 13%)

5) 2004 (Athens) – 3.9B (↑ 8%)

6) 2008 (Beijing) – 4.7B (↑ 21%)

7) 2012 (London) – 3.6B (↓ 23%)

8) 2016 (Rio) – 3.2B (↓ 11%)

9) 2020 (Tokyo) – 3.1B (↓ 5%)

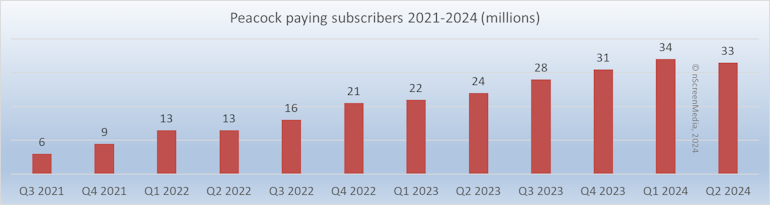

Big question #2: What share of viewership comes from streaming?

Streaming share of total viewership by year:

1) 2020 – 3%

2) 2024P – 20%

Why this matters: NBCUniversal is placing a massive bet on streaming. Every event will be available to stream through Peacock.

Bottom line: NBCUniversal is projecting a 567% increase in viewership share from streaming. Peacock’s subscriber base has grown 352% (+15M) since the Tokyo games.

Peacock subscribers (YoY growth):

1) 2020-Q2 – 1.4M

2) 2021-Q2 – 7.3M (↑ 421%)

3) 2022-Q2 – 13.0M (↑ 78%)

4) 2023-Q2 – 24.0M (↑ 85%)

5) 2024-Q2 – 33.0M (↑ 38%)

Big question #3: What share of Americans plan to watch the Olympics?

Quick answer: 66% of Americans are interested in the Olympics.

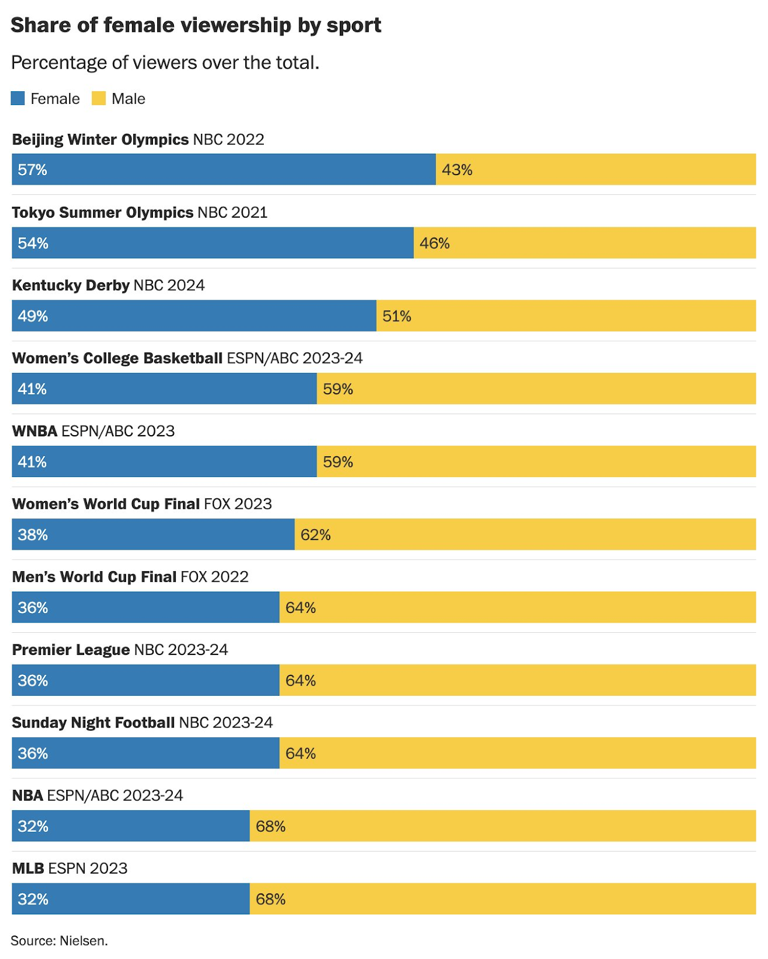

Summer Olympics viewers by gender according to Nielsen:

1) Female – 54%

2) Male – 46%

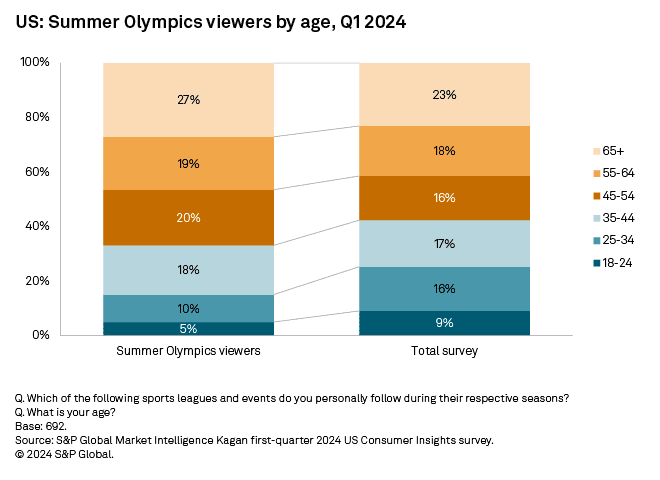

Summer Olympics viewers by age according to Kagan:

1) 65+ – 27%

2) 55-64 – 19%

3) 45-54 – 20%

4) 35-44 – 18%

5) 25-34 – 10%

6) 18-24 – 5%

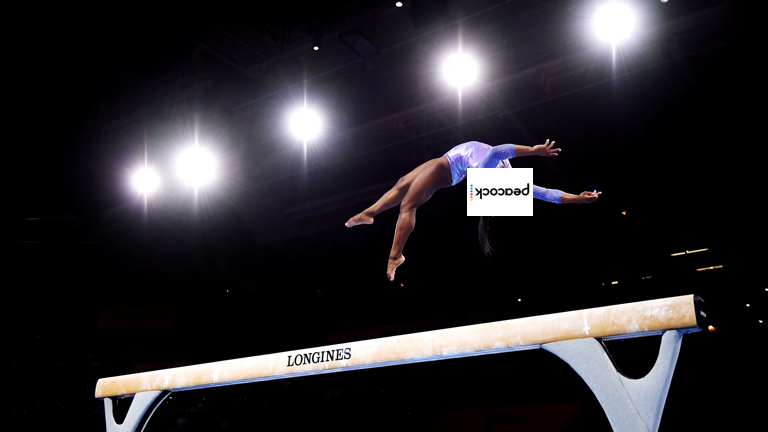

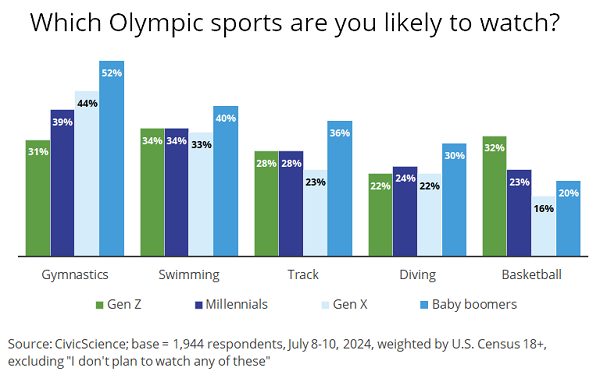

Big question #4: What are the most anticipated sports?

Quick answer: Gymnastics is the most popular with every generation outside of Gen Z (swimming).

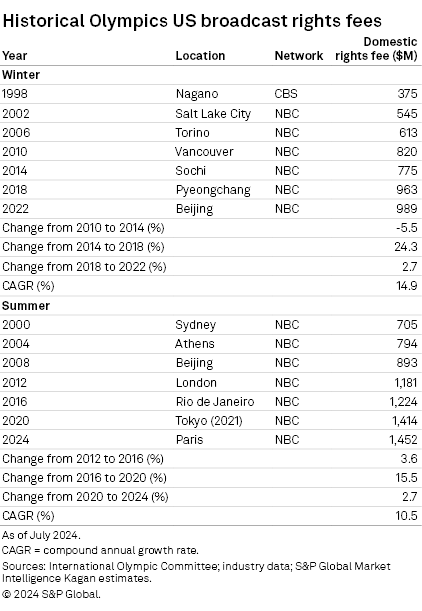

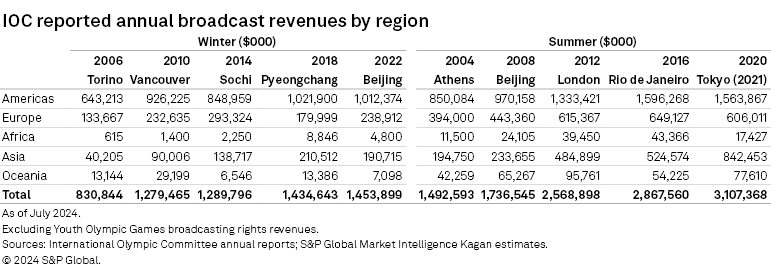

Big question #5: How much does NBCUniversal pay to air the Olympics?

Quick answer: $1.5B for the 2024 games.

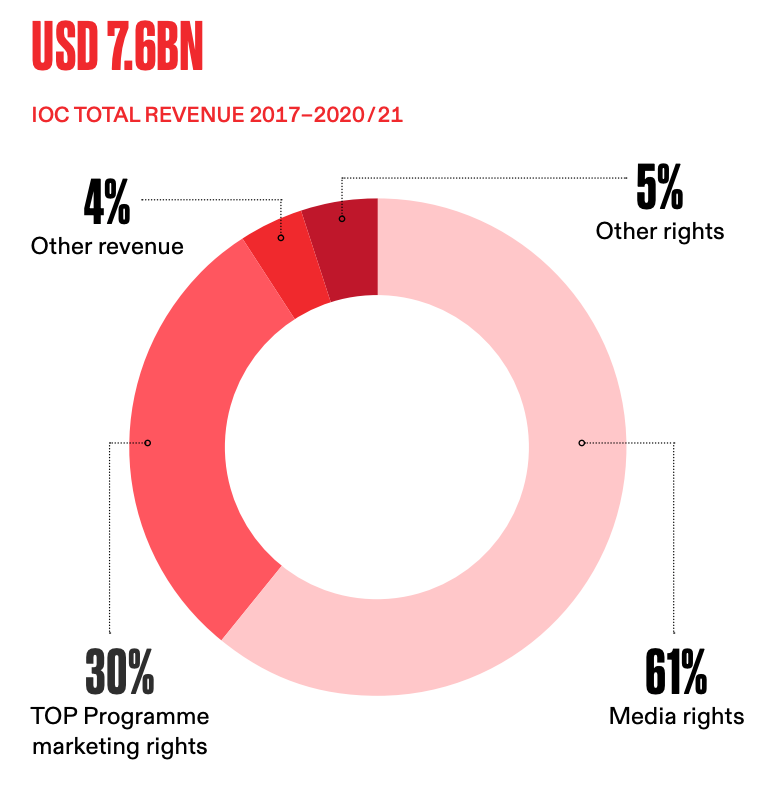

Wow: The U.S. accounts for 47% of global media rights despite only being 4% of global population!

Bottom line: Media rights make up 61% of total revenue for the Olympics.

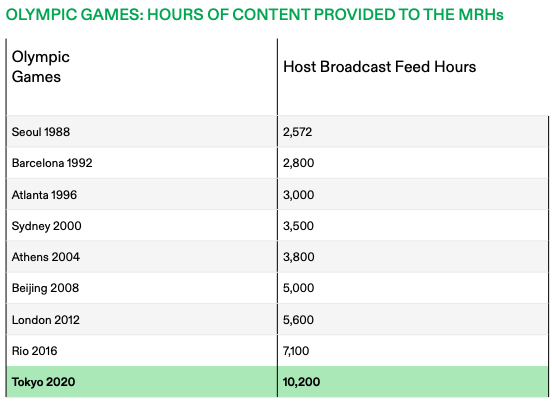

Big question #6: How many hours of content will be generated during the Summer Olympics?

Summer Olympics hours of content (% change) according to the International Olympic Committee:

1) 1988 (Seoul) – 2,572

2) 1992 (Barcelona) – 2,800 (↑ 9%)

3) 1996 (Atlanta) – 3,000 (↑ 7%)

4) 2000 (Sydney) – 3,500 (↑ 17%)

5) 2004 (Athens) – 3,800 (↑ 9%)

6) 2008 (Beijing) – 5,000 (↑ 32%)

7) 2012 (London) – 5,600 (↑ 12%)

8) 2016 (Rio) – 7,100 (↑ 27%)

9) 2020 (Tokyo) – 10,200 (↑ 44%)

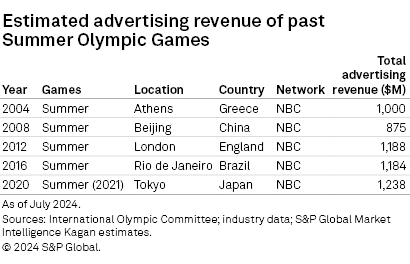

Big question #7: How much advertising revenue will NBCUniversal generate from the Olympics?

Summer Olympics ad spend by year (% growth) according to Kagan:

1) 2004 (Athens) – $1.0B

2) 2008 (Beijing) – $875M (↓ 13%)

3) 2012 (London) – $1.2B (↑ 36%)

4) 2016 (Rio) – $1.2B (↑ 0%)

5) 2020 (Tokyo) – $1.2B (↑ 5%)

6) 2024P (Paris) – $1.4B (↑ 13%)

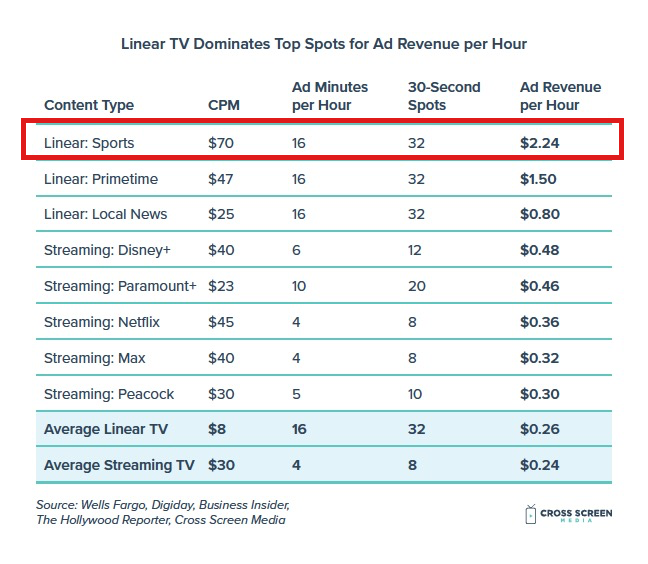

Big question #8: How much will TV ad spots cost?

Quick answer: Each 30s spot will cost $750K – $850K at roughly a $60 CPM.

A word from our sponsor: In my book Screen Wars: Win the Battle for Attention with Convergent TV, I discuss advertisers’ willingness to pay a premium for live sports.